Overview

After a strong rally in Japanese stocks year to date, investors are asking whether this really is the turning point for Japanese equities that has been decades in the making. GMO believes the answer is a strong yes, due to a combination of factors which extend beyond valuations alone. In this webcast, Ben Inker, co-head of GMO Asset Allocation, considers the durability of improvements in Japanese company fundamentals and where continued dislocations in valuations make the opportunity ahead compelling. Drew Edwards, Head of GMO Usonian Japan Equity, explores the significant shift in corporate reforms and how engagement is a particularly effective tool to unlock shareholder value in Japan.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- The Japanese equity market is reflecting the results of improving fundamentals due to years of effort to make local companies more competitive, profitable, and shareholder-focused.

- Our bullishness on the opportunity in Japanese equities stems from a combination of factors including:

- The economy’s exit from deflation, healthy fundamental growth, and improving EPS and shareholder distributions.

- Attractive valuations, particularly for small and value leaning equities, which are trading at steeper than normal discounts relative to history.

- The potential for currency appreciation and/or better relative fundamental growth due to the near historic cheapness of the yen.

- Committed policymakers who have launched multi-dimensional reforms to address shortcomings in corporate governance, growth, and capital efficiency. Two recent initiatives are (and will be) particularly impactful:

- The announcement of the Tokyo Stock Exchange’s less than 1.0x price-to-book initiative.

- The Ministry of Economy, Trade, and Industry (METI)’s Fair Merger & Acquisition Guidelines, designed to drive consolidation and a more active market for corporate control.

- A rich set of companies with which to engage and unlock shareholder value by increasing distributions from overcapitalized balance sheets.

- GMO’s Usonian Japan Equity team has a long history of finding and investing in undervalued Japanese companies, working directly with management teams to help expedite improvements in profitability and shareholder returns.

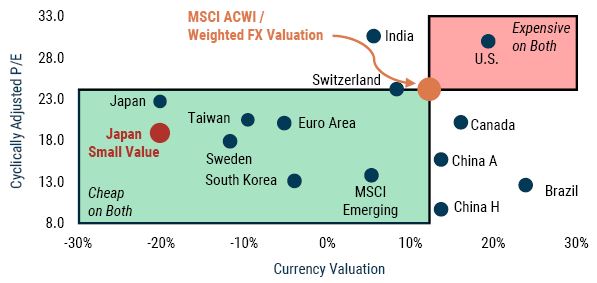

Equity Market Valuation and Currency Valuation

As of 6/30/2023 | Source: GMO

Currency valuations are measured relative to MSCI ACWI ex-U.S.

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.

Download event highlight here.