Executive Summary

- Inflationary pressures will likely be higher going forward than they’ve been over the past two decades. Higher real interest rates are necessary in such an environment to keep inflation at target.

- Higher real interest rates put pressure on both expensive and leveraged assets. The combination of these two – which is not hard to find in the LBO market – looks particularly fragile.

- Investors should prepare for a recession not by owning less risk, but by owning risk where they are well-compensated for it. Leverage is generally not compensated, especially in private equity and private credit.

- Tax changes that occurred in 2017 make leverage more expensive (by capping interest tax deductibility) and bankruptcy more likely. Valuations suggest that these changes are not fully priced.

- The combination of high quality and cheap assets materially improves companies’ resilience in recessions and return perspective outside of them.

Foreword

The immediate assumption most people make about the macroeconomic research done by asset allocators is that our primary goal is to predict GDP prints and recessions and position portfolios accordingly. At first blush, this makes some sense. After all, the thing that makes risk assets risk assets is the fact that they are vulnerable to impairment in economic downturns. 1 If an asset allocator could accurately predict recessions, in principle they’d be able to sidestep many of the most damaging downturns in risk assets. If they were particularly adroit at it and moved their portfolios from risk assets into long-duration government bonds at the right time, they could turn those painful drawdowns into capital gains.

And yet, predicting recessions is not the primary goal of the macroeconomic research we do in the asset allocation team. Not only is predicting recessions a harder task than it usually seems in retrospect, but also as an allocator, the times when it is most useful is when your (correct) forecast of a recession is most at odds with the market consensus for continued growth. Market consensus is far from infallible, but it is usually not crazy either. In order to have the confidence to move your portfolio on the basis of your recession forecast, you would really want to not only understand why you should have faith in your forecast, but why the consensus view of the economy is much more flawed than usual. That isn’t an impossibly high bar.

In 2007-8, we believed strongly that extremely poor credit allocation and insufficient capital in the financial sector meant a credit crisis was inevitable. Consensus was much more sanguine, taking comfort in assumptions about how diverse that collection of borrowers was and that a national or international collapse in housing prices was impossible because there weren't any in their historical datasets. Such situations are fairly rare, however, and particularly difficult to try to fully model. The temptation is to shortcut the process and just move your portfolio when you believe the chances of recession are high. This urge caught out some investors this spring. Economists were already predicting a reasonable likelihood of recession in 2023, and after the collapse of Silicon Valley Bank, around 80% of economists believed a recession would occur this year. If you had moved money out of stocks and into government bonds based on that high confidence call, it would have cost you, as global stocks are up 12.7% and Treasuries are down 2.6% since then. 2 Building your portfolio based on economic forecasts isn’t necessarily a horrible idea, but there is plenty that can go wrong and it can be quite dangerous to have too much confidence in your economic forecasts.

As a result, our macroeconomic work tends to have a different focus. Rather than focusing on building a model about how the economy works on average, we are most interested in what is different in a particular cycle, what impact those differences may have on the nature of future recessions, and the vulnerability of assets when they occur. In building our portfolios, we need to make a further estimation of how much of that vulnerability is already in the price. To steal a little of the thunder from the Quarterly Letter, which follows, today there are a few key issues that will make this cycle different –notably, the sharp increase in interest rates, the likely persistence of inflation, and a corporate tax change in the U.S. that seems to have gotten less notice than we believe it deserves. Those factors make us believe that a recession, when it occurs, will be harder to cushion and that highly levered corporations will fare worse in a recession than investors might assume from past cycles.

On the other hand, not all equities look particularly vulnerable to a recession and plenty of assets are trading at prices that suggest decent medium-term returns even if a recession occurs. While we are avoiding assets that are either particularly expensive versus history (growth stocks) or not offering enough return for the higher-than-normal risks they embody today (the debt and equity of junky and highly levered companies – particularly those in the U.S. where tax law has become more unfriendly), we can find a number of assets around the world that offer very appealing expected returns for their risks. In fact, after facing an investment desert as recently as the end of 2021 – when neither stocks nor bonds nor cash looked appealing – investors are spoiled for choice. Deep value globally and Japanese small cap value in particular are very cheap. Bond yields once again promise positive expected returns after inflation, with the 5-year TIPS offering a yield well above 2% real, the highest we’ve seen since well before the Global Financial Crisis. 3 And with cash yields the highest we’ve seen in the U.S. since 2000, liquid alternatives and other short-duration assets offer the best prospective returns of this century. While risks certainly exist in the macroeconomic landscape, the prospective returns to a sensibly allocated multi-asset portfolio look better than any we have seen in a long time.

Introduction

There are two fundamental questions investors – no matter their style or horizon – should always ask of themselves:

- What are the risks that I am taking?

- Am I being paid enough to take them?

The substantial shift we have just experienced in interest rates – both nominal and real – should prompt us to revisit these questions. A large increase in rates changes the allocation of risks in an economy, affecting the growth and default prospects of different economic agents. Companies and countries with large exposure to floating-rate debt suddenly find themselves in a very different market to the one they experienced two years ago, while their cash-heavy counterparts suddenly look prescient. The opportunity cost of investment, literally zero two years ago, has also climbed higher, and the price of risk should adjust accordingly.

In some corners of the market, it has: cyclical quality companies are now significantly cheaper than they were in 2021. Deep value companies are priced to deliver exceptional real returns globally. Portions of the nominal and inflation-linked bond markets are offering returns last seen more than a decade ago. Yet many assets have not adjusted. The simultaneous disinflation and strong economic growth of the past five months has caused concerns over a recession to dissipate. Risk assets have recovered from their depths, with some pockets of the U.S. equity market marking new highs and credit spreads returning to levels inconsistent with the forward-looking picture for defaults. Post Silicon Valley Bank’s collapse this spring, assessing the risks as one-sided and betting hard on recession by de-risking and buying bonds would have cost an investor both in lost opportunity and in actual loss. Arguably, pricing today is likewise lopsided, with the growth and levered segments of the market largely betting that inflation is gone, the Federal Reserve will consequently reduce interest rates, and the economy will remain strong.

We believe that the starting assumption behind this logic is wrong. Recent disinflation has indeed been surprisingly fast, but it has come from one-off supply-side healing more so than a rates-led deceleration in demand. The global move toward protectionism and the increase of income indexation in the U.S. make it probable that inflation will be higher going forward than it has been in the past three decades, meaning that nominal cash rates are highly unlikely to go back to zero. Leverage will be available only at much higher cost, and sectors of the market whose existence is premised on leverage, such as private equity, are now vulnerable to decisions made and habits created during a different economic reality. Valuations across asset classes will have to contend with a higher risk-free hurdle.

A recession, moreover, should still be on investors’ minds. Though it is hard to predict exactly when a recession will happen, it is possible to understand what a recession may bring. We expect companies which employ high levels of leverage – operational and financial both – are the most vulnerable; investors who are eager to buy into private credit and private equity should keep this in mind. We believe that a recession will see less policy intervention, a greater number of bankruptcies, and a slower recovery. Consequently, it will weigh on expensive risk assets. This doesn’t guide us to be conservative in our positioning – there are plenty of assets in the world which pay us enough to bear recession risk – but it does help focus the mind on what to own and what to avoid.

The economy evolved consistently over the past three decades: inflation was kept close to the Federal Reserve’s 2% target, with globalization providing a consistent disinflationary tailwind, and real growth fluctuated gently as policymakers became ever more aware of how to manage the economy. Financial assets, in a world of decreasing macroeconomic volatility and plunging real interest rates, exploded upward. The past two years have made us increasingly confident that we are not returning to these trends, with the simultaneous pickup in demand and decay in the growth rate of supply positioning us for a new set of economic and financial patterns.

Higher inflation, higher taxes

Inflation, for one, is likely to be higher and to exhibit more upside volatility over the next decade. This has two clear consequences: it lowers the real value of nominal cashflows, and it acts as a tax on net worth. The former means nominal assets that bake in the expectation of falling inflation are poised to disappoint in absence of a recession. The latter is pernicious for all assets. Because taxes are levied upon nominal asset returns, a gain in asset value solely from inflation translates to a loss in purchasing power. This is clear for taxable investors: if you pay capital gains on nominal asset price increases and those increases reflect nothing but inflation, you will simultaneously experience a bump in your nominal wealth and a decrease in how much you can consume with it.

Tax-exempt investors are also hurt because taxes that occur at the asset-level – such as income tax for businesses – destroy shareholder value at the source. This is especially clear for debt-light, capital-heavy corporates. For such businesses, we need only pay attention to what happens to asset values. These are either immediately reappraised (if they are invested) or held on the balance sheet at cost. In the first case, inflationary gains are booked on the income statement and taxed. 4 In the second case, gains are still taxed, though in a rather roundabout way. Higher inflation leads to a lower proportion of maintenance capex being covered by depreciation (which flows through at cost). This higher capital expenditure bill causes an overstatement of earnings and a consequent increase in tax. 5 When we put it all together, asset values increase by less than inflation, and real wealth has been transferred from corporations to the government. This loss is often misconstrued in the short term since the increase in capital expenditures can lead to an artificial boost to profit margins, bringing opportunity to the more attentive investor.

The Terrible, Horrible, No Good, Very Bad Accounting DetailThe simplest way to think about capitalization is as a deferred accounting expense; you have some outflow in the present (perhaps R&D for a large project that has a useful life of several years), but you only book it in the future. This deferral creates accounting income today: without the expense slashing your revenues, you look more profitable than you otherwise would. The problem is that you owe taxes – cash taxes – on that accounting gain. You are not nominally paying more tax than you would have to overall – the expense will still be booked in a different fiscal year – but you are paying tax earlier than you would have to. When money today is worth more than money tomorrow, that’s not ideal.As inflation surges, the same amount of nominal dollars is indeed worth more at present than it is in the future. Deferring $1,000 of taxes by a year if inflation is 10% per annum means that you are effectively only paying $909 of taxes in present dollars. When taxes are not counted in the thousands, but in the billions, savings can be a non-trivial amount of money. This is why a business that gets to expense its investments is generally in a better position than a counterpart who doesn’t, especially as inflation picks up. |

The main opportunity for equity investors is to look at the well-priced market segments that suffer the least from higher inflation: capital-light corporates with fixed rate, long-term debt. These companies – which are prevalent in the high-quality universe 6 – normally expense their investments as opposed to capitalizing them, 7 thus avoiding a lot of the depreciation-led tax pain described above. They benefit from inflation eroding their debt load without any increase to their interest cost, leading their interest expenses to dwindle as a percentage of income as inflation hums along. Add to this the pricing resilience that often characterizes the high-quality universe, and investing in the cheap subset of this market can be quite additive.

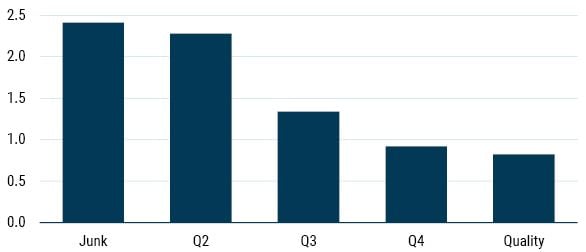

Exhibit 1: Inflation Tax (% of Earnings)

As of 7/31/2023 | Source: GMO, Moodys, S&P, Worldscope, Compustat, MSCI

The outlook for inflation

It is useful, then, to understand the reasons for which we believe inflation will be higher. In a simple model of the world, prices increase for four reasons: a decrease in competition, an increase in marginal costs, a reduction of the price-elasticity of demand, and unexpected demand. The positive supply shock we have just experienced is, in some reduced form, a consequence of both an increase in competition (say, in trucking), and a decrease in marginal costs (say, in airfares). 8 The post-pandemic demand shock was mostly a consequence of unexpected demand due to stimulative fiscal policy and a reduction of the price-elasticity of demand due to pent-up spending.

We believe all four of these levers will play a role in sustaining inflation at higher levels going forward. The trend to more protectionist policies, whether due to geopolitical tensions or nativism, will simultaneously decrease competition and increase the marginal costs of production across swaths of goods and services. Because this process of retrenchment is slow and iterative, it will probably manifest itself as a continued push on prices as opposed to a one-off shock. It is already visible in certain industries – such as anything reliant on semiconductors – and won’t get better in the face of increasing isolationism.

An aging population is also going to contribute to higher inflation. This isn’t solely due to a dwindling workforce, a factor that should change the relative price of labor-intensive goods and services more so than the absolute price level, but because social security is tied to the Consumer Price Index (CPI). 9 The indexation of retiree spending to inflation means that a growing share of the population will have a direct pass-through of inflation into their incomes. This will lower price sensitivity given that incomes are only eroded temporarily by price rises, leading to greater inflationary inertia. 10

Inflation is further likely to be buoyed by greater government reliance on fiscal policy. Considering the growing demands on public spend – from defense and supply chain resilience at a time of geopolitical tension to climate change amid mounting evidence of its toll – it is hard to see how the fiscal spigot can be turned off. Unexpected demand from an injection of money into the system is of course inflationary. Add in potentially higher marginal costs of production as industrial policy reallocates resources to lower-productivity sectors and, whether it is essential or not, policy is set to add to the inflationary backdrop.

Higher rates, different risks

A world of higher inflation is almost certain to become a world of higher real interest rates. Though there is nothing inherently destabilizing about higher rates, the transition from one economic regime to the other will – as is wont to be the case – cause a certain amount of disruption. The multi-decade drop in interest costs, alongside the expectation that low rates would persist, led to an increase across asset prices – lowering the yields on bonds, equities, and housing. It boosted the optimal amount of leverage for corporations and countries, causing debt to become a larger fraction of the liabilities of almost all market participants. And it fueled industries that benefit from both of these effects, with the leveraged buyout subset of private equity a special beneficiary.

The increase in asset prices is most obvious – and most problematic – with bonds. When long-term securities are issued with a guarantee of low nominal returns, the combination of higher inflation and higher interest rates is painful. While inflation eats away at the extra consumption the dollar compensation from the bonds was supposed to afford, rising rates devour the present nominal value of these securities. The latter phenomenon can strain market participants that took on a great deal of fixed rate exposure to reach for yield. In the U.S., where individuals and corporations levered up on long-lived fixed rate debt, the pain was felt by bondholders. Regional banks provide a case in point of what bond risk really means: the more solvent ones are now illiquid, and the rest no longer exist.

In risk assets, a change in the perception of where real interest rates will end up is also a substantial risk for expensive (read: “growthy”) pockets of the global equity market. Any asset which is priced on the back of eternally negative real interest rates will suffer a significant repricing if this turns out to be wrong. Growth companies the world over, but particularly in the United States, are acting as if we are going to be in such a regime. We would wager that they will be wrong both in absolute terms, as discount rates for all companies adjust to a reality of non-negative real rates, and in relative terms, as cheap companies outperform their expensive peers.

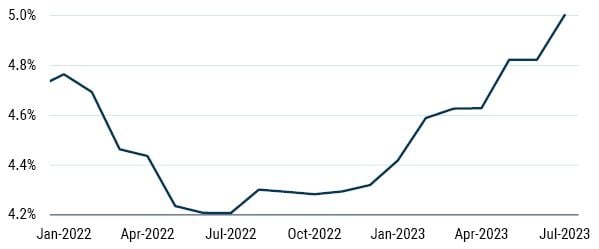

Highly levered entities that didn’t term out their debt are also in trouble. If a market participant has floating rate exposure, the rapid increase in interest rates can immediately translate into a cashflow problem. This is one lever that Central Banks outside the U.S. are using to slow their economies, seeing that household mortgage rates are not held fixed for a long period of time. U.S. households are mostly exempt from this, but non-financial corporates are less so. While only 12% of debt issued over the past ten years has had a floating rate – and many debtors therefore benefited from increasing inflation reducing their liabilities – interest costs are on the way up as old debt matures and refinancing becomes necessary. This is a salient concern for small caps that have already started experiencing an increase in their effective interest rates.

Exhibit 2: S&P600 Interest Rate (%)

As of 7/31/2023 | Source: GMO, S&P, Worldscope, Compustat, MSCI

Now imagine what should happen to entities whose business model is to make small public companies more operationally efficient by taking them private, saddling them with the debt used for their purchase, then selling them. When interest rates are falling and valuations are rising, these entities simultaneously benefit from debt costs coming in below expectations and exit multiples rising to unexpectedly high levels. In other words, returns are magnificent. When interest rates rise, however, both tailwinds go into reverse: debt-loads that would have been manageable at low rates can unexpectedly eat up free cashflow, and lower valuations lead to mediocre returns for even the best-run of businesses if purchased at a premium.

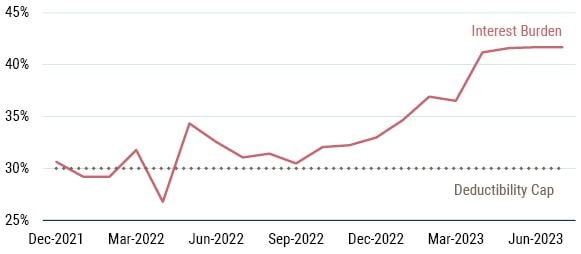

This is the reality for private equity today. Though the sector has large cash piles which can be deployed into new investments, it is of little relevance to the existing book of business. A lot of ink has already been spilled on how specific LBO-led investments are not doing well, but the situation is unlikely to get better. We can proxy the leveraged buyout industry’s financials by looking at those of highly levered small value companies. When we do this, we see that interest costs have risen over the past two years to become an enormous fraction of EBIT. If we are correct in suggesting that real interest rates will remain high, the situation is bound to get worse as old debt matures and refinancing needs become more widespread and more acute.

Exhibit 3: LBO Proxy Interest Burden (% of EBIT)

As of 7/31/2023 | Source: GMO, S&P, Worldscope, Compustat, MSCI

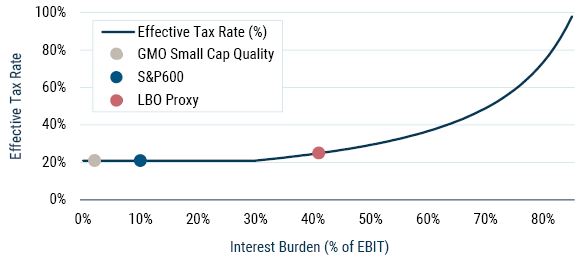

A Greek gift in the tax cuts of 2017

There is another source of pain for levered businesses which has scarcely been discussed: a shift in interest tax deductibility – capped at 30% of earnings before interest and tax 11 – that was introduced by the Tax Cuts and Jobs Act of 2017 but only came into full effect in 2022. Many corporations that see their interest expense creeping up alongside interest rates, either due to floating rate debt or because they must refinance, will therefore experience a concomitant increase to their tax bill. 12 In practice, this new clause in the tax code means that leveraged entities can see their effective tax rate climb from 21% to infinity depending on the fraction of EBIT eaten up by interest. 13 Exhibit 4 depicts this relationship, showing that while GMO Small Cap Quality companies are unconcerned about this tax change, the LBO-like subset of small caps has already begun to see its tax rate creep upward as interest costs have climbed.

Exhibit 4: Interest Burden vs. Effective Tax Rate (%)

As of 7/31/2023 | Source: GMO, S&P, Worldscope, Compustat, MSCI

Excluding financials, real estate and utilities, given industry-level exemptions from the deductibility cap.

To put this tax increase into perspective, consider a business whose interest burden is half of EBIT; it would now have an effective tax rate of 30%. A fundamental analyst who – all else equal – raised their tax assumption on a DCF model from the statutory rate of 21% to the now-applicable 30% would see the present value of the company cut by over 10%. Of course, all else would not be equal – a business with a higher tax bill would have less money to invest, and its present value loss would be higher than what taxes alone suggest.

For businesses that are unprofitable because their interest expense is high, this tax change is an even greater issue, since it creates tax claims against the business despite net income turning negative. This is bad news for private equity investors when equities come last in the line of seniority during a bankruptcy. It is also a problem for creditors, who come second to the tax authorities in the repayment of liabilities. Anyone with a heightened predisposition to invest in private credit – the favorite lender for distressed businesses – should take this into account. No matter your seniority, your recovery rates will be lower if taxes are owed.

We should mention that we are not the only party worried about private credit. In June, Moody’s issued a note discussing the worsening outlook for borrowers in that market, due both to increasing interest burdens and a dry-up in liquidity. Beyond the pandemic-era deals looking notably horrible for private creditors – the easy money of the times means terms were not in lenders’ favor – new credit vintages come with non-trivial bankruptcy risk attached to them, as we can see by analyzing the financials of listed Business Development Corporations (BDCs). These companies have the goal of funding (generally through credit or equity) small and distressed businesses, and their financial statements reveal a marked increase in the interest burden of their portfolio holdings. For instance, Ares Capital Corporation (ARES) – the largest listed BDC – has seen its portfolio’s interest increase from below 30% of EBITDA in Q2 of 2021 to over 60% in Q2 of 2023. 14 The yields available from lending to that portfolio might be exciting, but that excitement seems a bit too large considering the concentrated bet that defaults are not around the corner.

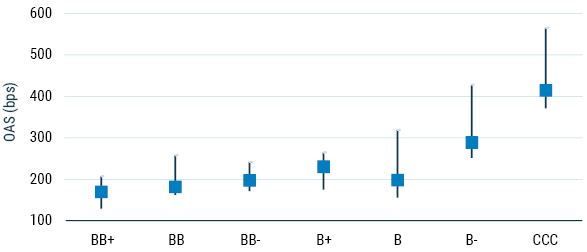

Problematically, a second tax change from 2017 makes defaults more likely. Prior to 2017, companies that experienced a loss could ask for a tax carryback; the government would refund unprofitable companies for taxes paid in the past. This cashflow injection at a time when a business was cashflow constrained was an important way to stave off bankruptcy, especially since carrybacks had a lookback of multiple years. As of 2018, 15 carrybacks have been replaced by carryforwards. Businesses that are profitable can net out taxes owed with past losses, but they can no longer get cash injections when going through periods of distress. The same business conditions should then lead to a greater number of bankruptcies today, and both equity valuations and credit spreads – which are somehow offering south of 500 bps for over half of the most speculative of issuers within the S&P 1500 – need to reflect this.

Exhibit 5: S&P1500 Spread IQR by Issuer Credit Rating (bps)

As of 7/31/2023 | Source: GMO, S&P, Worldscope, Compustat, MSCI

We aggregate all CCC-rated bonds into a single category.

Navigating the next recession

An investor who is certain that recession is nigh will generally be positioned defensively, owning safe-haven bonds (such as Treasuries and JGBs) and avoiding risk assets. There are two problems with this recipe, with the main one being certainty. It’s worth remembering that 2023 was supposed to include the most well-telegraphed recession of all time; over 80% of economists thought we were in for two quarters of negative GDP growth in March of this year. As we write, 2023 real growth is now forecast to be in the top quartile of growth for the last decade. Predicting an event that only comes about every eight years on average is hard (our probabilities should always be informed by the base rate of events) and costly. Investors who lightened up on equities and loaded up on bonds in March have had the compound joy of missed opportunity and loss.

The second problem is being overly reliant on the recipe of yestercessions. Bonds were an amazing risk hedge during 2008 and Covid, but they did poorly during the inflationary recessions of the early 80s and were not the boon to performance that one would expect in the Savings & Loan crisis of the early 90s. If we continue to be in an environment of fiscal largesse, bond supply will increase during the next crisis. At the same time, the odds of experiencing a new bout of quantitative easing are remote, thus taking away the largest inelastic buyer of bonds from the table. Though duration should still rally as interest rates come down to fight an economic slowdown, the supply-demand mismatch and the return of an interest term premium make us believe that the overall performance of nominal bonds will disappoint expectations.

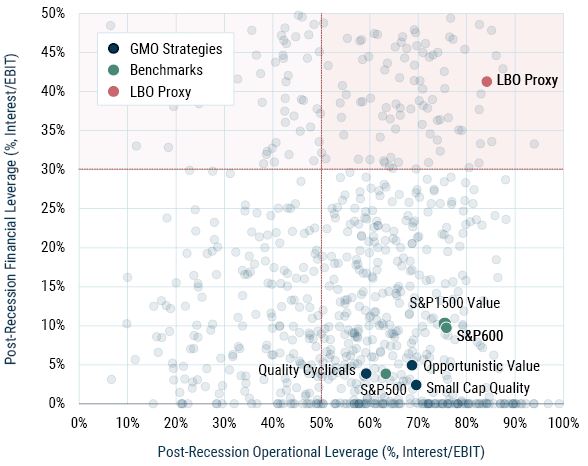

For investors worried about recession, we would instead argue for the attractiveness of owning stocks in (cheap) high quality companies. We find that within value, large caps, small caps and cyclicals, high quality looks poised to both do well in good times and protect in relative terms should the business cycle turn. A recession will – as usual – strain the companies that are the most operationally levered. While high-quality companies have somewhat high fixed costs, their low interest burdens make them quite resilient to recession when compared to either the broad universe of stocks or other indices. We can see in Exhibit 6 that while certain portions of the markets such as small cap growth and LBO-like corporates look ill-positioned for a negative shock, investors can build robust portfolios today with an attractive return profile in various subsets of the equity universe.

Exhibit 6: S&P1500 Recession Vulnerability

As of 7/31/2023 | Source: GMO, S&P, Worldscope, Compustat, MSCI

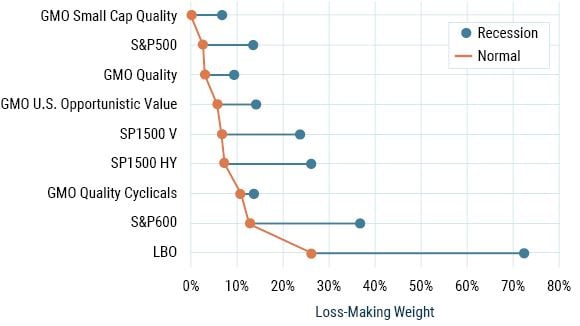

To understand the extent to which strategies would suffer during a recession, we have gone further than looking at aggregates and modeled the income statement of individual companies during a production shortfall. We estimate fixed costs assuming they remain unchanged in different economic environments, and then project a hit to production which affects both revenues and variable costs proportionally. This hit is estimated to be larger for cyclical industries and smaller businesses. After shocking revenues and variable costs, we flow through interest costs (taking into consideration the new interest rate cap) and taxes to estimate net income. The percentage weight each portfolio has in loss-making businesses currently and potentially during a business cycle downturn is displayed in Exhibit 7. 16

Exhibit 7: Portfolio Weight in Loss-Making Companies (%)

As of 7/31/2023 | Source: GMO, S&P, Worldscope, Compustat, MSCI

The operationally levered cohorts we identified previously suffer the most, with corporates in the high yield and leveraged buyout baskets seeing their portfolio weight in negative-earning businesses increasing by the greatest amount. Despite our assumption that small caps should suffer almost twice as much of a production loss as their large cap peers, the GMO Small Cap Quality Strategy – which has an exceptionally low weight in loss-making companies to begin with – sees a tiny increase in its exposure to unprofitable businesses (+7%), especially when contrasted with the overall small cap universe (+25%). High quality businesses in cyclical sectors as well as GMO’s deep value universe (which emphasizes quality when identifying cheap securities) likewise look resilient to a business cycle downturn.

The previous two recession-led corrections in markets, while sharp, were also very rapid. The limited space for policy to be accommodative, with above-target inflation and extraordinary fiscal deficits, should stop investors from assuming that a new recession will be similarly short lived. If an economic slowdown comes about in this new economic regime, it is likely that the government response will be softer than what we have seen since the Global Financial Crisis. Capital may well be scarce for longer than companies have become accustomed to, with limited private appetite for cheap lending or new equity issuance. To us, this means negative cashflows pose a very real threat of bankruptcy, especially with the 2017 tax changes making the economy more procyclical. Leverage should only be held at prices that justify its risks, and expensive companies should have meaningful growth tailwinds. Neither case holds for the majority of levered or expensive assets today.

Conclusion

Two fundamental investment risks should always be front and center for investors: inflation and recession. The former diminishes the purchasing power of your wealth, while the latter can wreck the cashflows that underpin your investments. Understanding the balance of these risks, and what various assets are priced to return when they do and do not materialize, is key to building a successful portfolio. The new economic regime has materially increased the probability that inflation will be an ongoing risk, and this in turn has shifted the assets most likely to do well and poorly during a continued expansion and a recession.

In an expansion, real interest rates will probably not fall meaningfully. Highly priced, long-duration assets therefore require yields competitive with cash. Nominal and inflation-linked 10-year bonds are priced to deliver decent returns going forward, but pockets of the equity markets – particularly growth and private equity-backed companies in the U.S. – are not. Sustained high interest rates will also build on the interest burden of companies as old debt is refinanced at higher interest rates, an issue that is particularly salient for privately traded assets. We therefore warn investors excited to get into the levered buyout subsector of the private equity market, especially in the face of recent tax changes which cap interest deductibility, to take a step back before allocating. The risk associated with high leverage should be compensated with very high returns, and the latter seems quite unlikely at the high valuations the asset class still demands today. Investors that are interested in earning a high return by taking equity risk should instead look to deep value – a part of the market that seems to trade everywhere at very low relative valuations versus its own history – and the cheaper subsets of high quality. Both of these equity subsectors can be allocated to without taking substantial interest rate risk, and both can offer more compelling returns than growth or private equity.

In a recession, we expect high quality and deep value to pose little risk of permanent impairment to capital, with the former likely outperforming the broad market. On the flipside, we think privately traded assets look poised to experience a pickup in bankruptcies as cashflows turn negative and external funding dries up. Junky high yield credit is on similarly fragile footing, considering that the securities involved do not offer sufficient compensation for the default rates and low recoveries that would likely come to fruition in a recession. The precise timing of recession – and when the market will react to it – is hard to divine, but its consequences are clearly severe. We therefore advise investors to focus less on timing their risk exposure and more on taking risk where they are well-compensated for doing so.

Download article here.

Admittedly, it is also a term of art in banking that may include assets whose value may change for any reason. But for most investment purposes, people think of risk assets as those whose cash flows are at risk in a recession or depression—equities, high yield credit, real estate etc. These are also the assets which give the highest long-term returns, since impairment in bad economic times is a characteristic that investors deserve to get paid for being willing to take.

MSCI ACWI and Bloomberg U.S. Government Bond indices, respectively.

That’s a bit of an oversimplification. There were actually a few days just after Lehman Brothers collapsed that TIPS yields got quite high, as Lehman had used TIPS as collateral on derivatives contracts. When Lehman failed, there was a rush to sell those securities. The fact that Lehman was a major market maker in that market did not help liquidity as those sales were occurring and yields briefly moved materially higher. Other than those days, you’d need to go back to the summer of 2007 to find a time you could get paid as much as you can today.

This, of course, assumes assets (eventually) re-rate with inflation.

Accelerated depreciation passed within the TCJA has been a boon to many capital-heavy businesses in the U.S. As accelerated depreciation moves from 100% to 0% (from 2023 to 2027), capital-intensive businesses will become progressively more vulnerable to the inflationary tax described above.

The subset of the market with high and consistent profitability and low leverage.

In large part because their primary investment is in human capital.

Though this is a “partial equilibrium” treatment of the world, we believe it is sufficiently accurate.

CPI-W as opposed to CPI-U, given that the latter didn’t exist when the COLA adjustment law passed.

It bears mention that social security income can never go down, and this inertia is therefore one-sided.

More precisely, Adjusted Taxable Income. EBIT is a reasonable proxy for this measure.

Carve-outs exist for a portion of businesses in the Real Estate and Utilities sectors.

Our resident tax expert, my colleague John Nasrah, pointed out that the additional tax burden incurred due to the deductibility cap can be carried forward in future years – providing future respite to companies that eventually reduce their interest costs.

See page 14 of their most recent earnings disclosure at https://ir.arescapitalcorp.com/.

The CARES act allowed carrybacks for 2018, 2019 and 2020 net operating losses during the Covid Emergency.

We exclude extraordinary items from current and projected return on sales.

Disclaimer: The views expressed are the views of Ben Inker and John Pease through the period ending September 2023, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2023 by GMO LLC. All rights reserved.

Admittedly, it is also a term of art in banking that may include assets whose value may change for any reason. But for most investment purposes, people think of risk assets as those whose cash flows are at risk in a recession or depression—equities, high yield credit, real estate etc. These are also the assets which give the highest long-term returns, since impairment in bad economic times is a characteristic that investors deserve to get paid for being willing to take.

MSCI ACWI and Bloomberg U.S. Government Bond indices, respectively.

That’s a bit of an oversimplification. There were actually a few days just after Lehman Brothers collapsed that TIPS yields got quite high, as Lehman had used TIPS as collateral on derivatives contracts. When Lehman failed, there was a rush to sell those securities. The fact that Lehman was a major market maker in that market did not help liquidity as those sales were occurring and yields briefly moved materially higher. Other than those days, you’d need to go back to the summer of 2007 to find a time you could get paid as much as you can today.

This, of course, assumes assets (eventually) re-rate with inflation.

Accelerated depreciation passed within the TCJA has been a boon to many capital-heavy businesses in the U.S. As accelerated depreciation moves from 100% to 0% (from 2023 to 2027), capital-intensive businesses will become progressively more vulnerable to the inflationary tax described above.

The subset of the market with high and consistent profitability and low leverage.

In large part because their primary investment is in human capital.

Though this is a “partial equilibrium” treatment of the world, we believe it is sufficiently accurate.

CPI-W as opposed to CPI-U, given that the latter didn’t exist when the COLA adjustment law passed.

It bears mention that social security income can never go down, and this inertia is therefore one-sided.

More precisely, Adjusted Taxable Income. EBIT is a reasonable proxy for this measure.

Carve-outs exist for a portion of businesses in the Real Estate and Utilities sectors.

Our resident tax expert, my colleague John Nasrah, pointed out that the additional tax burden incurred due to the deductibility cap can be carried forward in future years – providing future respite to companies that eventually reduce their interest costs.

See page 14 of their most recent earnings disclosure at https://ir.arescapitalcorp.com/.

The CARES act allowed carrybacks for 2018, 2019 and 2020 net operating losses during the Covid Emergency.

We exclude extraordinary items from current and projected return on sales.