At GMO, we are valuation-sensitive investors — not reflexive “value” investors. That distinction often gets overlooked.

Value Can Be Expensive

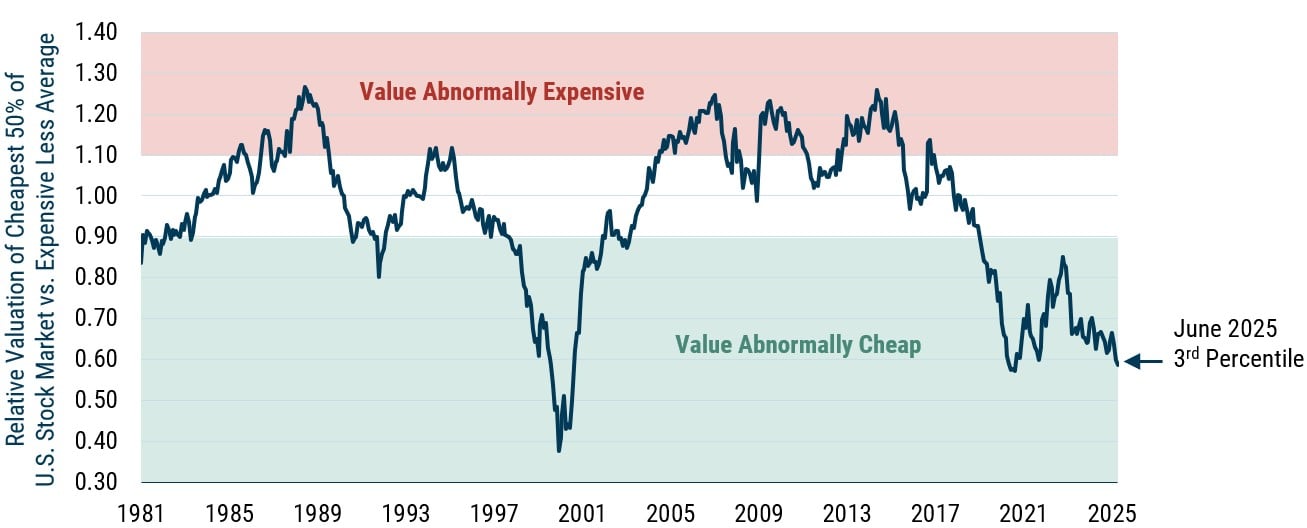

Like all asset classes, the attractiveness of value varies through time. The display below, which shows the cheap half of the U.S. market relative to the expensive half, indicates that variability in value’s discount:

Value Is Extremely Cheap

Preliminary as of 6/30/2025 | Source: GMO

Stock valuations are calculated on a blend of Price/Sales, Price/Gross Profit, and Price/Economic Book.

Since our founding in 1977, we’ve never been afraid to say when value looked unattractive. In fact, 20 years ago this month, Ben Inker (Co-Head of GMO Asset Allocation) published The Trouble with Value, 1 warning that value was poised to underperform given the group was trading at an abnormally narrow discount following its greatest run on record. Back then, Ben noted:

“If history is to be our guide…we shouldn’t expect any outperformance by value over the next few years, and it may very well underperform.”

By 2008, we held no value equities in our Benchmark-Free Allocation Strategy, preferring the safety and relative cheapness of quality stocks. That call was correct — value did lag for much of the subsequent cycle. But fast-forward to today and the setup is strikingly different.

Value Is Currently Extremely Cheap

As of June 2025, the relative valuation of the cheapest 50% of the U.S. stock market compared to the expensive half is at the 3rd percentile in our 40+ years of data. Value trades at similar discounts outside the U.S. with even more attractive overall valuations.

This is not a blanket endorsement of all things labeled “value.” But the deep value cohort — the cheapest 20% of stocks — looks particularly compelling today, both in the U.S. and internationally.

We believe deep value represents one of the most compelling valuation dislocations we've seen in decades. Across our portfolios, we are expressing this view via our U.S. and International Opportunistic Value strategies, which trade significantly cheaper than broad value benchmarks and do so with better quality as indicated by lower debt to equity and equal or higher return on equity metrics.

We Value Discipline

We don’t always favor value — we favor valuation discipline. That discipline kept us cautious in the late 1990s/early 2000s, defensive coming into the GFC, and skeptical of exuberant U.S. growth stocks more recently.

Today, it points us clearly toward value — especially deep value — as a rich source of return in a world where U.S. equity exposures look stretched. As in 1999 and 2020, we believe the opportunity for valuation-aware investors to look different (and benefit from doing so) is unusually strong right now.

To access this article, please contact your GMO representative.

Disclaimer: The views expressed are the views of the Asset Allocation team through the period ending July 2025 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

To access this article, please contact your GMO representative.