Executive Summary

Inversiones Latin América Power (ILAP), a privately-owned Chilean electricity generator, defaulted on its bonds in July 2023 and concluded its restructuring by October 2024. Despite private ownership, the company meets our definition of a “quasi-sovereign” credit due to its indirect ties to the state through contracts and regulations.

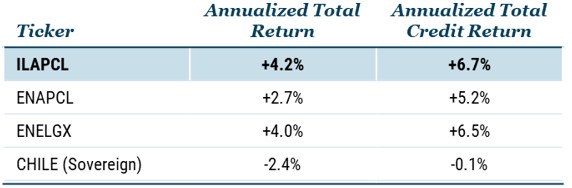

Such idiosyncratic credit events (defaults independent of the sovereign), while rare, are significant in the context of our strategy and warrant a check-in with our meta thesis. 1 The last similar case we examined, International Bank of Azerbaijan, was in 2017. 2 Once again, the outcome is favorable: with an 83-cent recovery, our ILAP position delivered a positive total return and outperformed our other Chilean portfolio holdings over the same period (Exhibit 1).

Exhibit 1: GMO ECD STRATEGY UNWEIGHTED TICKER-LEVEL RETURNS

As of 10/1/2024 | Source: GMO

Total returns calculated for the period from 6/9/2021 to 10/1/2024, the same period we held ILAP bonds in the GMO Emerging Country Debt Strategy. Credit spread returns are approximated by subtracting the total return of the Bloomberg U.S. Treasury: 7-10 Year TR Index (Bloomberg ID: LT09TRUU).

We were able to influence the outcome in our favor through a combination of:

- Focusing on quality assets: Being selective about the types of borrowers and structures we underwrite has given us extra downside protection in distressed situations.

- Process discipline: Our deep understanding of the asset's intrinsic value enabled us to accurately estimate recovery and capitalize on distressed market prices.

- Recovery value enhancement: Our restructuring expertise allowed us to enhance the recovery value through active creditor committee participation.

And what have we learned from this particular credit event?

We cite two very important lessons:

- Conflicting debt and equity interests: Incentives between creditors and private shareholders can become misaligned, even for quasi-sovereign entities.

- Aggressive energy transition poses systemic risks: Countries with high shares of renewable power generation without adequate backup capacity face grid stability issues.

Download full article here.

The Mystery of SOE Debt: A Unique and Growing Opportunity (Sobolev and Ulukan 2020).

The International Bank of Azerbaijan (Ulukan 2017).

Disclaimer: The views expressed are the views of Sergey Sobolev and the Emerging Country Debt team through the period ending November 2024 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Past performance is no guarantee of future results.

Copyright © 2024 by GMO LLC. All rights reserved.

The Mystery of SOE Debt: A Unique and Growing Opportunity (Sobolev and Ulukan 2020).

The International Bank of Azerbaijan (Ulukan 2017).