Executive Summary

Rising rates hurt investors; claims on profits in the future are simply worth less if you discount them at a higher rate. As growth stocks deliver their cash flows deeper in the future, their worth is hit harder than the average stock. In this note, though, we conclude that this effect is much less strong than one might think, as the growth rates of even the growthiest of growth stocks tend to decelerate over time. As a result, this year has presented an opportunity for value investors to take a fresh look at growth companies, especially Quality growth companies.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

-- attributed to Mark Twain

Jeremy Grantham likes to cite the aphorism above for good reason, and it applies particularly well to stock market investing. Everyone knows that rising rates are bad for asset prices and stock markets tend to react to changes in the discount rate – indeed, aggregate stock market movement arguably is the change in the discount rate for equity investors. However, the impact of a changing discount rate on growth stocks seems to us to be almost universally overstated. This is especially true in our area of focus, growing Quality companies, which have an extra layer of protection in rising rate environments because they are less reliant on capital markets. Speculative growth companies, on the other hand, tend not to be cash generative and must rely on external funding; therefore, their cost of capital is much more sensitive to rising rates.

Of course cash flows in the distant future are worth a lot less if you discount them at a higher rate. $100 in 30 years is worth $30.83 discounted at 4% and $5.73 discounted at 10%, a full 80% less at the higher rate. But there is no company we know for which we would project growth rates 30 years in the future with a straight face. We are skeptical that anyone owns a crystal ball that clear; assumptions of perpetual growth rates are doomed to disappoint.

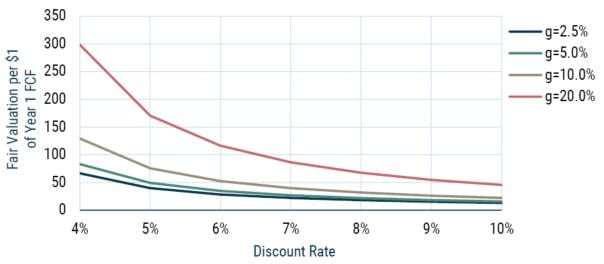

A more realistic approach is to value companies using a decade-long growth forecast. In Exhibit 1 below we examine the impact of different discount rates on the fair value of four theoretical companies that will grow their free cash flows at rates between 0% and 20% per annum over the following ten years (after which they each become uniformly unexceptional, growing at 2.5%, in line with GDP). 1 The fair values are expressed here in terms of multiple of next year’s free cash flow. We can immediately see why investors fear rising rates. The falls in fair value are precipitous as the discount rate increases from 4% on the left to 10% on the right, and the 20% grower looks particularly worrisome with fair value dropping by 80%! 2

Exhibit 1: Fair Multiple

10 Years of Growth at "g," Terminal Growth at 2.5%

Source: GMO

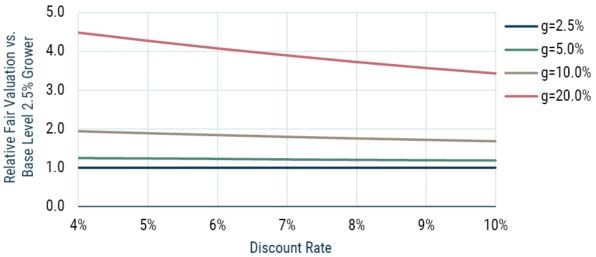

However, if we recast the same set of fair values in relative terms, comparing to an unexceptional company that grows at 2.5% in Act 1 as well as Act 2, a different story starts to take shape (see Exhibit 2). The relative loss in valuation as we move from 4% on the left to 10% on the right of the same 20% grower is 26%, and for a 10% grower around 9%. That might sound like a lot, but bear in mind that in the tough six months from end November 2021, growth stocks underperformed the market by 12.5% for a measly 1.2 points jump in the U.S. 30-year rate. Equity investors took rising rates seriously! Or perhaps it was more important that many growth stocks were no bargain in late 2021; they had run up immensely as rates had trended down over the previous decade.

Exhibit 2: Fair Multiple vs. 2.5% Grower

10 Years of Growth at "g," Terminal Growth at 2.5%

Source: GMO

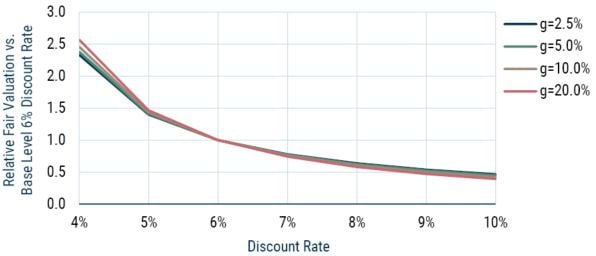

Exhibit 3 shows the final cut of our thought experiment. This time we show the impact on fair value on each of our four companies as the discount rate moves away from 6%. The highest growth company still gets bumped the hardest as rates rise, but in the scenario where rates rise sharply, investors probably have bigger concerns than the relatively modest divergence between high and low growers at that point.

Exhibit 3: Fair Multiple vs. 6.0% Discount Rate

10 Years of Growth at "g," Terminal Growth at 2.5%

Source: GMO

What do we think this means? While rates have a big impact on equity valuations, we argue that the difference in theoretical impact on growth stocks versus the market has been exceeded by actual moves in 2022. This year’s gyrations in growth stocks have created an interesting opportunity for our Quality Strategy in which we have been able to acquire shares in high-quality growth companies at prices that have seemed to us to overplay the role of rates in determining investment results. Of course, many factors have been at play this year. Nevertheless, we expect our results to be driven in the main by the ability of these Quality companies to allocate capital successfully over time (though we are happy to take revaluation gains when they present themselves too). We suspect that this year, investors leaned a bit too hard on something that “just ain’t so.”

Download article here.

It is also worth stressing just how hard it is for a company to grow cash flows at a 20% rate for a decade. On average, just 3.7% of the S&P 500 by weight has grown EPS at that rate (averaging across each ten-year period since 1990). Among the top 50 stocks in the S&P at the start of 2012, only Amazon, Alphabet, and a couple of cyclicals coming off a depressed base achieved this threshold.

The range of values for growth and discount rates is chosen to make sense in real more than nominal terms, but the analysis applies regardless.

Disclaimer: The views expressed are the views of the GMO Focused Equity team through the period ending October 2022 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2022 by GMO LLC. All rights reserved.

It is also worth stressing just how hard it is for a company to grow cash flows at a 20% rate for a decade. On average, just 3.7% of the S&P 500 by weight has grown EPS at that rate (averaging across each ten-year period since 1990). Among the top 50 stocks in the S&P at the start of 2012, only Amazon, Alphabet, and a couple of cyclicals coming off a depressed base achieved this threshold.

The range of values for growth and discount rates is chosen to make sense in real more than nominal terms, but the analysis applies regardless.