As the world grapples with increasing destruction caused by climate change, its impact on investment portfolios is only growing.

Urgency to adapt our economy is presenting long-term investment opportunities like never before in clean energy and resource equities. Companies and countries that proactively manage ESG-related risks will stand out above their peers in both developed and, especially, emerging markets.

Explore our content below and Contact Us or your GMO representative for more information. Intended for accredited investors.

Featured Session:

Energy Transition Opportunities: Clean, Green, and Obscene

Extreme weather has become the norm in 2022 – we saw the worst European drought in 500 years, record heat waves across Europe, China, and India, two-thirds of Pakistan flooded and underwater, and at least eight 1,000-year rain events in the U.S. since late July. Adding to that, Russia’s invasion of Ukraine has caused an energy crisis around the globe, particularly in Europe, with energy prices rocketing up from already high levels before the invasion.

There are silver linings, though. The U.S. Inflation Reduction Act is a more impactful step forward in combating climate change than many realize, and renewable energy and battery costs continue to drop.

Lucas White, lead Portfolio Manager of GMO’s Climate Change and Resources strategies, outlined what he believes are misunderstandings by the market about continued secular growth in both resources and climate equities. The energy transition is already creating long-term investment opportunities in these sectors, which currently trade at attractive discounts to the market.

Read the 1Q GMO Quarterly Letter

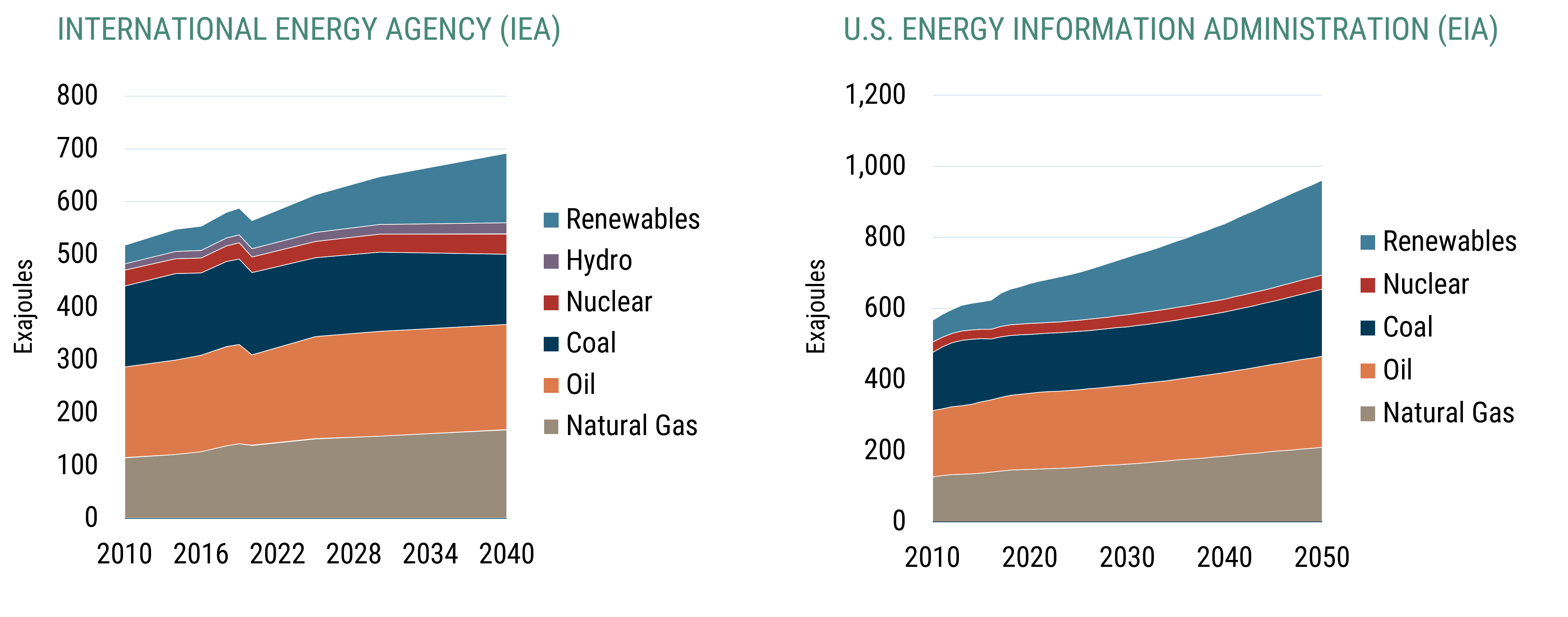

Growth will be in renewables, but fossil fuels will be around for decades to come

Global energy consumption

As of 2021 | Source: IEA, EIA

Exajoule is a standard unit of energy defined as the work required to produce 1018 watts of power for one second.

Climate Risk: Hype, Hope, and Headway

Deborah Ng and Chris Heelan, from GMO’s ESG team, explained why financed emissions must be reduced across the entire value chain to mitigate climate change, not just with a focus on Scope 1 and 2 emissions. GMO has made significant progress in quantifying and managing portfolio carbon risk and generating real world emission reductions through our net zero strategy.

Learn about GMO's Net Zero targets.

Emerging Markets: Quality, Growth, and Sustainability

ESG is particularly relevant in emerging markets investing, given the outsized impact climate change is already having – and stands to have in the future – on these countries. Warren Chiang and Binu George introduced the next evolution of GMO’s Emerging Markets Select Equity Strategy, which focuses on finding high-quality companies that can take advantage of important growth trends in emerging markets and utilizes a climate change-oriented approach to ESG and sustainability integrated at the country, sector, and company selection levels.

Japan: An Active Manager’s Treasure Trove – Using Engagement to Unlock Shareholder Value

Japanese equities look attractive through both top-down and bottom-up lenses. Rick Friedman identified some of the secular and cyclical reasons why GMO likes Japanese Value equities today, while Colin Bekemeyer described the various ways GMO’s Usonian Japan Equity team generates alpha through company engagement.

ESG Integration in Emerging Debt Markets – The Challenges and Rewards

The GMO Emerging Country Debt team has integrated ESG factors into both its sovereign and quasi-sovereign/corporate credit research and analysis processes. Members of the team explained how this incorporation has impacted our emerging debt portfolios and results.