Executive Summary

- After a rough decade for commodities and commodity producers, we see resource companies trading at record low valuation levels relative to the broad equity market on some measures.

- Even if commodity prices were to stay flat, public resource equities would be well positioned to generate strong returns, either through a reversion in valuation or through the high dividend yields on offer.

- At these valuation levels, investors interested in the resources sector don’t need to be bullish about commodity prices, but there are reasons to be optimistic. In particular, the capital cycle supports commodity prices by reducing supply when prices are low.

- Most institutional investors will never go overweight the resources sector due to the perceived riskiness, but if you’re not going to go overweight resources now, when will you?

Introduction

In 2016, we wrote “An Investment Only a Mother Could Love: The Case for Natural Resource Equities,” a paper underscoring the strategic virtues of investing in the natural resources sector with only glancing comments on the tactical merits.1 We continue to believe that the strategic case for making a significant investment in resource equities is as compelling an investment case as you’re likely to come across. From a tactical perspective, resource equity valuations were hovering around historic lows relative to the broad equity market when we wrote that paper. As is often the case when dealing with out-of-favor asset classes, resource equities have gone from cheap to cheaper and now register at the cheapest levels ever recorded on some measures. We write this in the aftermath of oil prices falling below $20 per barrel and the front month West Texas Intermediate oil future actually going negative for the first time ever, reflecting storage challenges given the level of oversupply. In this paper, we shift our focus to the tactical case for investing in the resources sector.

The Past

First, let’s very briefly look back at what has happened over the last few decades in the resources sector. As commodity prices fell throughout the 1980s and 1990s, commodity producers cut back on investment, leaving commodity markets unprepared to meet the China-led boom in commodity demand that started in earnest in the early 2000s. As a result of supply shortages, commodity prices rocketed upwards over the course of the 2000s, eventually more than tripling.

High commodity prices in the 2000s had two notable consequences. First, the high prices helped the commodity producers generate strong returns in a down market. While resource companies move with equities in the short term, they move more with commodities over the longer term; the MSCI ACWI Commodity Producers Index, an index of upstream commodity companies, delivered almost 9% per annum in real terms in a decade in which the S&P 500 lost more than 3% per annum. Second, the extraordinary run in commodity prices spurred a tremendous increase in capital expenditure as producers rushed to profit from high prices.

As the increased investment came to fruition in the 2010s and new commodity supply flooded the market, commodities came back down to Earth, dropping approximately 18% in real terms.2 Oil, the biggest commodity of them all, fell around twice as much, down 35%. In almost a mirror image of returns from the decade before, the S&P 500 delivered over 11% per annum real while the ACWI Commodity Producers Index lost around 1% per annum, approximately the same spread as the previous decade, though obviously the winner and loser swapped positions.3 As 2019 came to a close, we believed the resources sector was very well positioned to rebound after a tough decade.

Then, we watched as Coronavirus swept the globe and shut down large swaths of the global economy in the first quarter of 2020. To make matters worse for the sector, in the midst of an unparalleled oil demand shock, Saudi Arabia and Russia were unable to agree to oil production cuts and instead ramped up production! Oil prices plummeted almost 70% in response.4 A very difficult quarter ended with the S&P 500 down around 20% and the ACWI Commodity Producers Index down almost twice as much.

Valuations

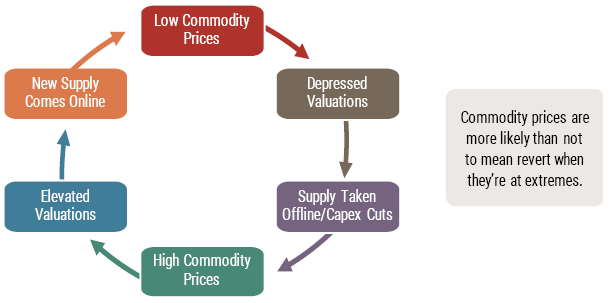

However, from the depths of despair sprout opportunities, and valuations in the resources sector have hit historic levels. As commodity prices fell over the course of the 2010s, negative sentiment helped push resource company share prices down even faster. This is classic double counting. Falling commodity prices have a negative impact on fundamentals, and the fear associated with tumbling commodities leads investors to assign a discounted multiple to the lower fundamentals (see Exhibit 1).

Exhibit 1: The Capital Cycle

Source: GMO

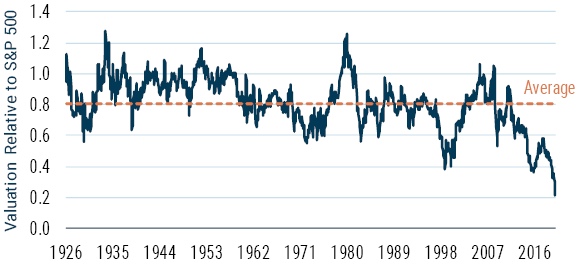

How much of a factor has valuation contraction been in explaining the poor performance in the resources sector? Energy and Metals companies entered 2010 trading at about a 28% discount to the S&P 500, not far from where they trade on average (see Exhibit 2). By the end of the decade, however, that discount had jumped to 66%, and after the rough Coronavirus-impacted first quarter in 2020, the discount stood at almost 80%.

Exhibit 2: Valuations are at historic lows

Valuation of Energy and Metals Companies Relative to the S&P 500

As of 3/31/20 | Source: S&P, MSCI, Moodys, GMO

Valuation metric is a combination of P/E (Normalized Historical Earnings), Price to Book Value, and Dividend Yield.

Over the last 100 years or so, we have never seen resource companies trading at anything close to these levels relative to the broad market. Furthermore, we can’t recall an asset class trading at such a large discount when investors can be fairly certain that the asset class will exist more or less in its current form 10 years hence, climate concerns notwithstanding (we will address them forthwith).5 While the prospects for individual commodities or companies will change over time, the global economy will continue to need the resources sector to function, as it always has.

The Impact of Climate Change, Stranded Asset Risk, and ESG on Valuations

Within the investment community, we have led the charge on the importance of climate change as an investment consideration and have long believed that investors must carefully consider the prospects for fossil fuels. Stranded asset risk is the risk that fossil fuel companies will be unable to produce all of their reserves due to climate change-related carbon pricing/regulation or technological disruption (e.g., electric vehicles displace internal combustion engine vehicles and drive down demand for oil). More generally, many ESG-oriented investors have qualms about commodity producers. Divesting from fossil fuels completely has gathered considerable momentum across the industry, and many huge pools of assets have either already divested or are in the process of doing so. Some institutional investors have taken it a step further and eschew extractive industries, including metal and fertilizer mining, altogether.

However, the global economy couldn’t function without extractive industries. Furthermore, the world can’t transition from fossil fuels to clean energy without the materials that clean energy relies upon (e.g., copper, lithium, nickel, vanadium, etc.). Regardless, ESG concerns have seemingly impacted the pricing of resource companies and are perhaps the most likely explanation for why Energy and Metals companies are trading at all-time lows relative to the market. For return-oriented investors interested in the resources sector, this lack of demand, driven to some extent by non-investment considerations, creates a unique opportunity and likely leads to higher expected returns.

With regards to stranded asset risk, we certainly consider the possibility of stranded assets in our analysis. Since the launch of our Resources Strategy in 2011, we have excluded coal, oil sands, heavy oil, and most fracking from our investable universe due to concerns about stranded assets. However, the vast majority of traditional oil and gas producers have significantly less than 15 years of reserves, and no matter how quickly the world transitions to clean energy, we will need oil and natural gas for the foreseeable future. It would be different if oil and gas companies had 30 or 40 years of reserves, but that’s not the reality that investors are confronted with. Furthermore, given the availability of high single-digit or even double-digit dividend yields in the resources sector, investors don’t need these companies to exist for 30 or 40 years to make them excellent investments in expectation.

To be clear, climate change, stranded asset, and ESG risks should be incorporated in decision making when assessing investments in the resources sector. However, to the extent that investors overreact or take non-economic approaches to these risks, opportunities will abound.

The Future

Where do we go from here? In the short run, who knows? In the long run, we believe this could prove to be an excellent entry point for investors. There are reasons to be optimistic about commodity prices.6 First and foremost, the capital cycle drives commodity prices. When commodity prices are relatively low, as has been and continues to be the case, capex is slashed and supply is taken offline, more or less guaranteeing future supply shortages. In this way, low commodity prices cure low commodity prices.

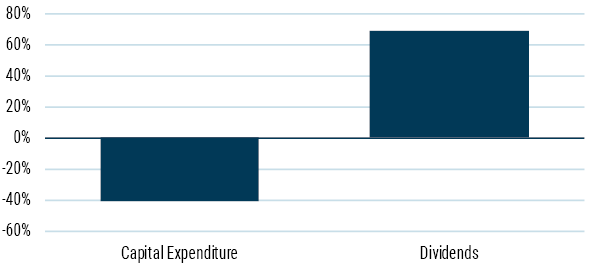

There’s evidence that the capital cycle had been playing out, even before the pandemic and oil crash last quarter. Despite production levels much higher than a decade earlier, Energy and Metals companies cut capex by around 40% over the course of the last decade (see Exhibit 3). Without vast amounts of maintenance and expansion capex, commodity producers inevitably see production decline. With the reduction on the supply side, not only do commodity prices rise, all else equal, but sentiment becomes much more positive and tends to push valuations up (once again, see Exhibit 1). The double counting, which helps to explain the big runs in the resources sector, becomes a positive.

Exhibit 3: signs of capital discipline

Energy and Metals Companies - Change over the Course of the Last Decade

As of 12/31/19 | Source: MSCI, WorldScope, S&P, GMO

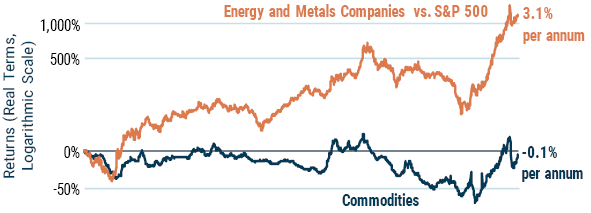

Yet, one does not need to be bullish about commodity prices to be bullish about returns for the resources sector. From 1926 through the beginning of the last decade, commodity prices were down slightly in real terms, yet Energy and Metals companies outperformed the S&P 500 by more than 3% per annum (see Exhibit 4). Resource companies typically traded at around a 20% discount throughout this period, nowhere near the current discount.

Exhibit 4: Resource companies can win without rising commodity prices

As of 12/31/09 | Source: S&P, MSCI, CRSP, GFD, GMO

Commodities represented by the GMO Commodity Index, an index of 34 commodities.

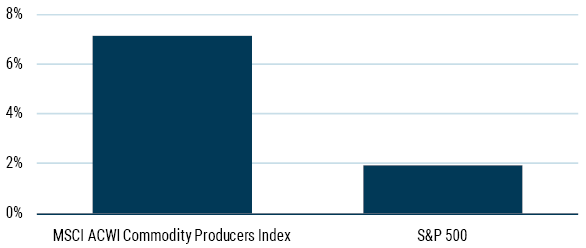

Given the size of the current discount, resource companies appear to be particularly well positioned to generate strong returns. As commodity prices fell last decade, median dividend payouts by Energy and Metals companies increased by 70% (see Exhibit 3).7 Increased dividend payouts and contracting valuations have combined to produce strong dividend yields in the resources sector, even without taking share repurchases into account. The dividend yield of the MSCI ACWI Commodity Producers Index stands at 7.1% compared to the S&P 500 at 1.9% (see Exhibit 5). While dividends will be vulnerable in the short term due to the evolving economic situation, the fact remains that the commodity producers are likely to deliver yields two to three times higher than the S&P 500, barring a significant re-rating of the sector.

Exhibit 5: Dividend Yields are very attractive

Dividend Yield

As of 3/31/20 | Source: MSCI, WorldScope, S&P, GMO

Investors in the resources sector are likely to be very successful if commodity prices rise substantively, and reasons for bullishness on that score include the functioning of the capital cycle and the underlying dynamics of resource scarcity. Yet, as discussed, commodity price rise is not a prerequisite for strong performance in the resources sector, and current valuations are compelling. Investors should not invest in the resources sector with the expectation that valuations will revert to more normal levels in the short term. If they do, of course, investors will likely experience very strong returns. However, even if valuations were to remain flat from here, the resources sector is well positioned to deliver strong performance due to the much higher yields on offer.

Inflation

The possibility of inflation provides another tactical motivation for investing in the resources sector. In recent years, the investment community seems to have all but brushed off inflation as a primary investment concern. The Economist recently put it nicely: “Inflation in the rich world resembles a fairy-tale beast. Older members of society frighten younger ones with stories of the creature’s foul deeds, but few serious people expect to see one and some doubt it ever existed.” Yet, inflation remains one of the two or three biggest risks to long-term investors and digging out of the current economic crisis could well lead to a bout of inflation, at least when recovery starts in earnest.

We’re going to see record amounts of fiscal stimulus as governments attempt to restart the global economy, and aggressive monetary stimulus has begun with widespread money printing and zero percent interest rates. Fiscal stimulus often includes resource-intensive infrastructure projects, particularly in China, which have a fairly direct impact on commodity markets. More generally, stimulus-driven demand may run up against a limited supply of goods and services, as global supply chains have been disrupted and tens of millions of people have lost their jobs. And while monetary stimulus didn’t lead to significant inflation in the wake of the Global Financial Crisis, it would be foolish to assume that widespread money printing isn’t without inflationary risk.

Inflation is notoriously difficult to predict, but the risk may be elevated as we try to extract ourselves from yet another once-in-a-lifetime crisis. Historically, the resources sector has performed very well during inflationary periods, either because commodity price appreciation was driving the inflation in the first place, or because currency devaluation led to commodity price appreciation.8 During the high inflation periods we’ve identified over the last 100 years, not only have Energy and Metals companies kept up with inflation, they’ve actually grown purchasing power by around 6% per annum compared to a loss of purchasing power of about 1.5% per annum for the S&P 500. While we can’t be sure about the future trajectory of inflation, we believe resource equities are as good a bet as any for growing purchasing power if and when inflation rears its head.

Conclusions

After a decade of falling commodity prices and contracting valuations, the resources sector measures cheaper than we’ve ever seen relative to the broad equity market. At these valuation levels, one doesn’t need heroic expectations for commodity prices. Yet, there are reasons to be optimistic about commodity prices, and hence sentiment in the sector, going forward. In the short term, commodity prices can go all over the place, but in the longer term, demand growth tends to be fairly stable, and the marginal cost of production limits how low or high prices can be.

As we’ve talked about resources with hundreds of institutional investors over the years, it’s struck us that investors are virtually always at their allocation target or below it. We suspect the vast majority of investors will never go overweight resources no matter how attractive the sector gets, because it’s perceived to be too risky. That’s all well and good – we all have careers to manage. However, if you have an asset class that investors will never go overweight, you almost definitionally end up with mispriced assets.

Resource companies have had a rough go of it in recent years, but at these valuations, investors have a large margin of safety even with very conservative assumptions. While the short-term prospects are uncertain, we believe this will likely end up being an excellent entry point for long-term investors. If you’re not going to go overweight resources now, will you ever?

Appendix A

What’s to Come for Oil?

In the first quarter of 2020, oil fell from $60 per barrel to $20. Typically, when there’s a sharp move in the pricing of a commodity, it’s due to a demand shock or a supply shock. In this case, we had both: dramatic demand destruction due to the Coronavirus-led global economic shutdown and unrestrained oil pumping as Saudi Arabia and Russia couldn’t come to an agreement. Given its prominence in commodity markets, oil has a huge impact on sentiment in the resources sector, and its fall has helped sour sentiment in the sector more broadly.

But where do oil prices go from here? The age-old question! In the short run, the answer isn’t very satisfying. We were going to write that oil could easily fall below $10 per barrel in the short term as we run out of storage and, in fact, was already changing hands in the physical market at such levels. Then, as we were writing, the front month West Texas Intermediate oil future dropped into negative territory for the first time in history, eventually reaching negative $40! Given unprecedented demand destruction and rapidly filling storage, oil prices could stay at very low levels in the short term. In the medium to long term though, oil prices more or less have to go up significantly from here.

While we expect fast growth in electric vehicle sales over time, the world will need oil for transportation, petrochemicals, etc., for many years into the future, and very few players in the oil market can make money at $20-30 oil. The few players who can (e.g., Saudi Arabia and Russia) can’t balance their budgets at these prices. Oil can stay low for a while, but sustainable oil prices are likely to be at least 100-200% higher than current levels.

Appendix B

Resource Scarcity Update

Jeremy’s research into resource scarcity from 2008 to 2011 inspired our work in the resources sector.9 Given a decade of falling commodity prices, let’s revisit scarcity. The thesis is that the long-term supply/demand dynamics for natural resources will favor generally rising prices in the decades to come. Demand will inexorably grow due largely to the industrialization, urbanization, and economic development of the emerging markets. On the supply side, we’ve chewed through the cheap, easy to access, easy to process resources for decades now and are being forced into lower quality, more expensive assets. Discoveries of new pockets of resources, with some exceptions, have more or less dried up in recent decades.

Has this thesis been playing out? Well, demand has continued its steady growth. Oil consumption grew by around 1.5% per annum over the last decade. Copper and iron ore demand both grew by between 3.5% and 4% per annum. The world has actively moved to transition from coal, but even coal consumption has grown globally over the last decade at around 1.3% per annum. On the supply side, shale has changed the game for oil and natural gas, at least in the short term, but metal ore grades continue to fall and new asset discoveries are few and far between. Supply of cheap resources is finite.

Scarcity’s impact on commodity prices is difficult to measure, but evidence will ultimately lie in the prices themselves. Even in the current Coronavirus-driven trough, iron ore prices are over 100% higher than they were 20 years ago in real terms. Copper is up over 60%, palladium up more than 200% on the same basis. Obviously, scarcity will play out at a different pace and in a different way for each commodity, but even after the demand destruction last quarter, commodity prices are still over 60% higher in real terms than they were entering the millennium.10

Resource scarcity started playing out the moment consumption began, but in commodity markets driven by short-term supply and demand, it can be difficult to see the bigger picture. Scarcity has been playing out underneath all the volatility of the resources sector over the last 20 years and will continue to put upward pressure on commodity prices going forward.

Download article here.