Overview

We welcome you to kick off the new year with a brief update on opportunities in the Value universe and how these opportunities might impact your portfolio allocations in 2023. In the webcast, Ben Inker, Michelle Morphew, and Catherine LeGraw cover forecasts for Value outperformance, compelling dislocations in U.S. Deep Value and Value/Growth spreads globally, and strategies for capturing the opportunity.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

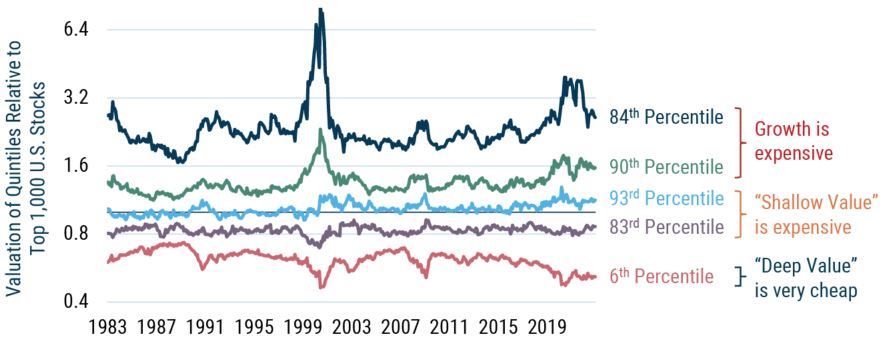

- Value continues to look attractive globally relative to Growth. In the U.S., there is a special opportunity in Deep Value stocks.

- Globally, Value is priced to outperform Growth significantly if valuations return to median.

- Within the U.S., we believe the most attractive group of stocks is one that most portfolios may not have much exposure to – the cheapest quintile or “Deep” Value. After the longest cycle in which Growth massively outperformed Value, many portfolios dropped their underperforming Value managers, and those that hung on leaned a bit less on Value to survive.

- The GMO Asset Allocation team uses the Equity Dislocation and U.S. Opportunistic Value Strategies across their portfolios to gain targeted exposure to these attractive investment opportunities.

Within the U.S., “Deep Value” segment (cheapest 20%) is truly dislocated

Quintiles of Valuation in Top 1,000 U.S. Stocks

Preliminary as of 12/31/2022 | Source: GMO

Composite valuation measure is composed of Price/Sales, Prices/Gross Profit, Price/Book, and Price/Economic Book. Quintiles of value and market are weighted by 4th root of market cap.

Download event highlight here.