Speculation and Investment

Why today’s highfliers are so likely to fall back to Earth

Executive Summary

The signs of speculative excess in the stock market today are obvious. Speculative booms provide both entertainment and outsized profits while they are happening, but they do generally burst painfully. This is particularly true in equity markets, where the demand growth is ordinarily met with increased supply from savvy capitalists. Maintaining excess demand in the face of growing supply becomes ever more difficult and eventually proves impossible. In this cycle, the supply growth is particularly impressive in both its scale and the flexibility it has to migrate wherever speculation is most rampant. That does not seem like a good sign for an extended continuation of this boom. Whether the end means a fall for just the more speculative end of the market or the market as a whole is harder to predict at this point, although even if the rest of the market holds up for now it will require a difficult economic balancing act to keep it aloft indefinitely.

Something odd happened to me the other night. My cellphone rang at 2 AM, from a number I didn’t recognize. I let it go to voicemail, because there was no one I knew in Washington state that had a good reason to speak to me at that hour. I was not put out that the phone had rung in the middle of the night – I had to get up anyway so I could take our new puppy1 out for her nighttime walk. When I woke up the next morning, I was somewhat surprised to see that the caller left a voicemail, which I of course listened to. To be honest, it consisted mostly of expletives, but as near as I could tell the caller is quite angry with me for having suggested that retail investors would be left holding the bag when the market falls. I will admit to feeling a bit honored to be considered consequential enough to be a focus of some random person’s wrath, even if I’m a little confused as to why he singled me out as I hadn’t meant to pick on retail in the way he implied. So, to clarify to whomever it is that I offended by implying that retail investors might be left holding the bag when a speculative bubble bursts, the reason I mentioned retail investors is not because they are uniquely likely to lose money in the bursting of a speculative bubble. Lots of people and entities lose money when speculative bubbles burst. I mentioned retail investors because they are generally the only people who lose money in the bursting of a speculative bubble who are deserving of much sympathy. As the Archegos saga showed a few weeks ago, both sophisticated institutional investors and sophisticated financial institutions are more than capable of losing large sums of money when their speculative bets go bad. It’s just extremely hard to feel bad for them when it happens. When it happens to small investors who lost money they were counting on, however, it is hard not to feel sympathy even if they were doing the exact same thing as the big guys.

As such, I think the call I received was probably unwarranted, but I do apologize if I made it seem as if it is only retail investors who will lose out in a correction. But the event did seem like a nice excuse for me to write a piece on the distinction between investment and speculation and why the stock market is probably a particularly dangerous place to tread when speculative activity starts to overwhelm investing activity. Plenty of books have been written on the topic of speculation, so I’m not going to pretend I will be plowing new ground in musing on the topic over the course of a few pages, but I do want to make a few points. First, while the lines between investment and speculation can be blurry at times, the two are quite distinct activities from a theoretical perspective. Second, speculation is frankly a much more entertaining activity than investing; unfortunately, when the financial markets are capturing the attention of the broader public it is generally a sign that either the market is crashing or that the attention is being grabbed by speculation, not investment. Third, speculative episodes tend to end badly because the goals of speculators are usually unsupportable by the underlying fundamentals of assets. And fourth, that bad end is particularly likely to occur in markets like the stock market, because enterprising capitalists are very good at creating the types of securities that speculators crave. Because maintaining a speculative bubble requires keeping demand perpetually in excess of supply, a growing supply of speculative assets makes the levitation act ever harder to maintain.

Investment and Speculation

Much investing activity contains an element of speculation, and it is hard to imagine the functioning of an equity market in which speculation was entirely absent. Despite that, speculation and investment are, to my mind, quite distinct activities economically. While there are a number of reasonable definitions one could give for these activities, over the years I have found it useful to think in terms of the following for them:

Investment: The deployment of capital to perform an economic service for which a rational counterparty should be willing to pay.2

Speculation: The deployment of capital to achieve an expected gain based on an investor’s prediction of how future prices will differ from the market’s expectations.

Investment as an activity allows for both parties to a transaction to be satisfied with the outcome, whereas speculation generally implies a winner and a loser. While that is a slight oversimplification,3 it’s a useful one in thinking about why speculation can be such an intoxicating activity, and why a market driven by speculative activity probably isn’t sustainable. The trouble with investing as an activity is that it is generally pretty boring. The expected returns that are consistent with your counterparty also being satisfied with the outcome are necessarily moderate unless your counterparty was in severe distress when you made the investment. You are unlikely to get rich quick from investment activities, even if your long-term results should be satisfactory. Speculation, on the other hand, offers the potential for large and/or quick gains if you predict things well. Furthermore, it offers the prospect of the psychological reward of both “winning” the transaction and having been proven right.

Speculation in Today’s Stock Market

Even in normal times, speculation is an inherent part of the functioning of the stock market. For example, almost all investors participating in an IPO are doing so in the speculative hope that the company will outperform the market in the future.4 They are also performing an investment service by supplying low-risk capital to the company going public, but they are hoping the company was “wrong” in pricing the IPO and that the stock will outperform because of it. What makes speculative bubbles distinct is that the investment side of the equation becomes an insignificant driver of transactions, with both the rationale for trades and participants’ expectations for returns from them driven overwhelmingly by speculation.

Determining whether a transaction is speculation or investment may seem to require reading the minds of market participants, but that is not always the case. There are some transactions that are obviously purely speculative because they provide no valuable economic service. At-the-money and out-of-the-money call options, for example, are not “investment” instruments.5 Given the buyer of a call option participates only in the upside of the price of the underlying asset, the seller of a call option has no reason to be willing to sell such an option at a price that gives the option an expected return above the risk-free rate. Rising open interest in call options is therefore almost certainly a sign of rising speculative activity in a market. Personally, I’d call out a further distinction in the tenor of options as well. A longer-dated call option is still a speculation, but it at least might be a “fundamental” speculation. An analyst who believes that the future fundamentals for a company are likely to be better than the market suspects might choose to buy an option on the stock instead of the underlying stock itself. It is certainly a speculation, as any gain comes from the analyst’s ability to outguess the market with regard to future fundamentals, but it is at least a kind of speculation that serves the broader function of the stock market in pushing prices closer to efficiency. It can be thought of as a pure form of active management, in the same way a market-neutral equity portfolio is pure active management without any “investment” attached.6 The expected return to pure active management in the absence of skill is negative after transaction costs, but the actions of active managers can at least help make prices in the financial markets more efficient. Very short-term call options, however, are a different matter. The buyer of a five-day option has no reasonable expectation that new fundamental information will come out about the company over that period unless it happens to coincide with an earnings announcement. And given the transaction costs, short-dated options are quite an expensive and inefficient way to express a belief that a stock is undervalued. Furthermore, if one thinks about the counterparty to such an option, it is more or less certain to be a market maker rather than a holder of the stock. While the market maker does not necessarily “care” about what happens to the stock price given that it has probably hedged its exposure, you can be confident that the buyer of the option is not providing some valuable service to the market maker such that both parties are happy to have the buyer walk away with a gain. The market maker is absolutely expecting to make money from its option-writing activity – it has no other earthly reason to participate.

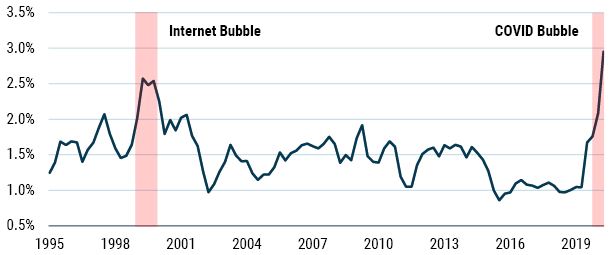

If, on the other hand, one is trying to speculate on the next few days of returns on an individual stock, short-dated options are an extremely efficient way to do so. And investors have leapt into these instruments like never before, as we can see in Exhibit 1.

EXHIBIT 1: Short-dated single stock options volume

Data as of 3/31/2021 | Source: Goldman Sachs

Recent volumes in the U.S. equity market are more than 8 times what they were from 2013-2016 and over 4 times the level prevailing just before the start of the pandemic.

I have trouble imagining any argument one could make that these options are “investments” in any real sense. That doesn’t necessarily imply that those who bought them were naïve or stupid. Short-dated options were an important part of the GameStop short squeeze and they seem to have been quite effective in putting upward pressure on the stock price, even if some of the participants probably had no real idea what they were doing other than joining in the fun.7

"The stock market has always been good at delivering what investors are craving, and there is nothing like a speculative bubble to get the issuance flowing...

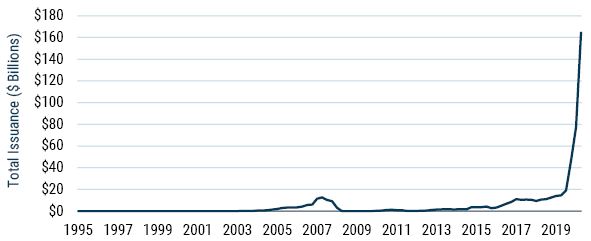

But as the extraordinary run GameStop and Tesla and others have enjoyed shows, speculative episodes can lead to extraordinary gains. Why not just go along for the ride? I’d argue that a big reason it is so dangerous is because the stock market is so good at giving speculators what they want. You say you like electric vehicle companies named after Nikola Tesla? Have another one! LIDAR8 companies strike your fancy? Here are five LIDAR start-ups all promising to be the future dominant provider for all those autonomous vehicles we’ve been hearing about for years! The stock market has always been good at delivering what investors are craving, and there is nothing like a speculative bubble to get the issuance flowing, as we can see in Exhibit 2.

EXHIBIT 2: U.S. EQUITY ISSUANCE AS PERCENT OF U.S. GDP

Data as of 3/31/2021 | Source: Goldman Sachs

Issuance doubled as a percent of U.S. GDP at the height of the internet bubble, but the recent burst has been even more impressive. Not only has the last year seen the highest level of issuance since the data I’m using began, it did so from what had been desultory levels over the previous half decade. The U.S. stock market of 2017-2019 may well have been quite expensive relative to history, but it didn’t show many of the other classic symptoms of a speculative bubble. That has now changed. As striking as this burst of issuance is, I’d argue that the form of the issuance this time is particularly laser-focused on giving speculators what they hunger for. SPACs, among their other interesting features, give their promoters the ability to create more of whatever type of stock is coveted in the market with impressive speed. And while it is easy to say that the burst in SPAC issuance in recent months is unprecedented, lots of things are unprecedented. Today’s activity surely deserves some grander term, as we can see in Exhibit 3.

EXHIBIT 3: 12-MONTH MOVING AVERAGE OF SPAC ISSUANCE

Data as of 3/31/2021 | Source: Goldman Sachs

The last 12 months have seen 2.5 times the total issuance of SPACS in all of history up until then. The first quarter of 2021 itself exceeded those 25 years by about 50%! While there is a fair bit to be concerned about when it comes to SPACs, the issue with them from the standpoint of the sustainability of today’s speculative frenzy is that they are both exceedingly agile and impressively large. EVs fall out of favor and artificially intelligent robotic personal assistants become the next passion for investors? No worries. As long as some companies somewhere are at work on that problem, enterprising SPAC managers can bring a perceived solution to investors. Whether those companies have actually succeeded in building a prototype or even figured out the use case for it is a relatively minor issue as long as the SPAC can get the deal to market before fashions change.

The Speculative Case for Supply Dooming a Speculative Bubble

The fact that issuance went up in the internet bubble certainly isn’t enough to prove that issuance is a problem in a speculative bubble. To even come close to proving that we’d need a case study where two or more equivalent speculative booms either had or did not have a burst of issuance occur. Comparing speculative booms across different periods (say, the 1920s versus the 1990s) is extremely difficult. In part this is because it’s hard to find comparable supply data in the relatively distant past. But even with perfect data availability, every speculative boom is different, and the bust might easily have been triggered by an external event that wasn’t relevant in another boom. Ideally, we’d want to find booms that occurred at the same time and with the same conditions, which suggests a cross-sectional comparison. But trying to look across contemporaneous stock markets has its own problems. First, stocks in different markets are fairly fungible – issuance in the U.S. might create a problem for a speculative boom in the U.K. even if there were no issuance in that country – and, second, the high correlation of equity markets means that even if there were not a direct problem in the U.K. caused by U.S. equity issuance, the very fact that if the U.S. equity market were to fall it would be quite likely to drag down the U.K. anyway.

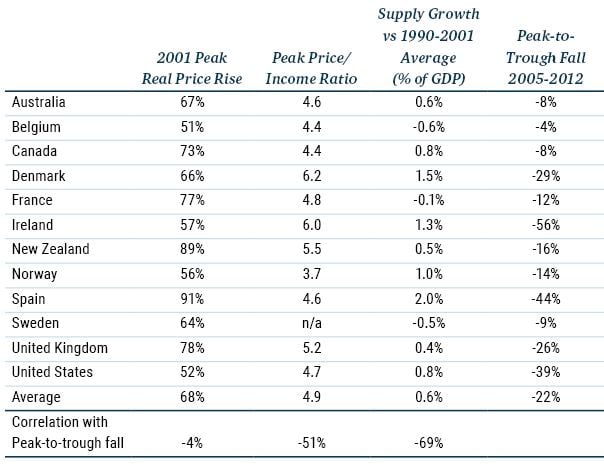

So I will admit my argument about issuance being a problem for a speculative bubble is mostly a theoretical one.9 But I was able to find one event that seemed like a reasonable test case, even if it wasn’t in the stock market. In the mid-2000s, house prices boomed in a number of different countries in the developed world. According to data from the BIS, 12 different countries in the developed world experienced house price increases of at least 50% in real terms between 2001 and their peak prior to the Global Financial Crisis (GFC) in 2008. As near as I can tell, this event was the only such global house price boom on record, as housing markets are much less globally correlated than stock markets. These housing booms differed in the scale of the national price increase, the valuation of house prices versus household incomes at their peaks, and the extent to which the price boom engendered a boom in the supply of houses as well. They also differed in the size of the price fall from the peak to the post-GFC low. Table 1 shows the data I could find from the period, as well as the correlation of each of the characteristics of the boom with the subsequent fall in house prices.10

Table 1: HOUSE PRICE DATA FOR MID-2000s HOUSING BUBBLE COUNTRIES

Source: BIS, OECD, Federal Reserve, Ryan Fox and Richard Finlay, “Dwelling Prices and Household Income,” Bulletin of the Reserve Bank of Australia, December 2012.

The scale of the housing boom was not a good predictor of the subsequent bust, with a correlation of only -4%. This is probably not too much of a surprise because different markets started at quite different valuations for housing in 2001. Peak housing “valuations” in the form of price/income levels did a much better job of predicting the subsequent falls, with a correlation of -51%.11 But the best predictor of the subsequent fall in prices was the increase in housing supply, with a correlation of -69%.12 Correlation, famously, does not prove causality, but the data for the 2000s’ housing boom is certainly consistent with increased supply eventually putting pressure on prices, with supply being as big a problem as valuations in a speculative boom.

But beyond the supply impact on demand imbalances, there is also a more direct way that the increase in capital raised can create problems for a highly priced stock market. Expensive stocks can wind up justifying their prices when the underlying companies can generate both strong growth and a high return on capital over time. But throwing more capital at an area creates more competition for a given niche, and more competitive industries almost invariably have lower returns on capital than highly concentrated ones. Let’s take the automotive LIDAR market as an example. Let’s assume for the moment that companies do crack the autonomous driving problem and that the solution requires LIDAR units. Let’s further assume that for whatever reason the established companies that are working on LIDAR units along with the rest of their businesses fail to capture the market and the LIDAR market is captured solely by the new players. The fact that there are now at least five well-funded LIDAR start-ups makes it more likely that they will wind up sharing the market and be forced to compete aggressively with each other for business, pushing down the profit margin on the business. Even if one of the start-ups winds up dominating the business and is able to charge monopoly prices for its units, investors in the other companies will have wound up losing out. The investment spree in the area might very likely wind up increasing the speed with which inexpensive automotive LIDAR is developed but throwing lots of capital at a problem is almost never a good recipe for generating a high return on the capital deployed.

Conclusion

While there is plenty of anecdotal evidence that significant parts of the stock market are being driven by speculation rather than investment, we don’t need to rely on anecdotes for a demonstration. The explosion in the use of derivatives that are purely speculative in nature shows a stark change in the motivations of a significant fraction of market participants. It is almost unquestionable that speculation is a much bigger driver in the stock market today than is normally the case. Speculative booms are not guaranteed to end badly, but they normally do and that seems to be particularly true in the stock market. I’d argue that an important cause of this eventuality is that the stock market is adept at giving speculators what they crave, and scarcity is necessary to keep prices above their fundamentals for an extended period. Today’s stock market is seeing the largest burst of issuance we’ve seen in over a generation. Furthermore, the form of much of that issuance – SPACs – seems tailor-made to deliver additional supply of capital to exactly those areas speculators are most in love with at the time. While that can lead to lovely outcomes for the managers of the SPACs, it is likely to both reduce the scarcity premium of the narratives that speculators are in love with and reduce the return on capital of the fundamental activities that the influx of capital will join.

This makes me believe that the timescale for the eventual deflation of the current speculative bubble is unlikely to be all that long. What form it will take is more difficult to say. The signs of speculation are obvious in the market today but determining how wide the mania has spread is trickier. While almost all the U.S. stock market is trading at very expensive levels relative to history, it is hard to determine whether a holder of, say, Microsoft or Johnson & Johnson is an investor who is content to earn 3% real in the long run from a high quality company in the context of low cash and bond yields, or a speculator who is betting the company will generate double-digit returns despite its high valuation. If the whole of the market is dominated by speculators with outsized expectations, it seems likely that deflation in the obviously speculative tier will take the overall market with it. If those speculators are coexisting with investors who recognize the impact that high valuations will have on potential returns but accept those lower returns, it may be that the losses will be more contained to today’s highest fliers, who have already started showing some signs of weakness even as the market continues making new highs. Even in that case, the viability of the rest of the market seems to be crucially dependent on the combination of economic growth solid enough to keep corporate profitability strong and not so strong as to reignite inflationary concerns. That is a tightrope that will be far from easy for the market to navigate indefinitely, but the timescale of the market’s fall from that narrow wire is harder to estimate.

What Can You Do to Protect Yourself?

If the bubble bursting takes the form of the speculative end of growth falling, the easy protection is not to own the speculative end of growth. It is not a coincidence that value today is close to as cheap as it has ever been relative to the market, but it is convenient nevertheless. You can protect your equity portfolios by choosing to bias them toward value and away from the most expensive end of growth. Doing so has the nice feature of being both risk-reducing13 and return-enhancing in today’s environment. If, as it did in 2000, the overall market is going to follow the expensive growth end down, a value bias will help but not necessarily make you money. For protection against a broader equity bubble bursting (or the market falling due to higher-than-expected inflation driving a repricing of long duration assets even if it wasn’t strictly a broad bubble to begin with), we would suggest liquid alternatives as a less risky way to get close to equity-like returns with lower correlation to the stock and bond markets. Of that class of strategies, our current favorite is the Equity Dislocation Strategy, which is explicitly short the highfliers and long cheaper stocks on the other side.14 It has had a good start to the year, but we believe there is still plenty of room for further gains, whether the market holds on and only the specs fall or if the overall market turns lower as well.

Download article here.