Presenters |

|

Anna Chetoukhina |

|

Michelle Morphew |

|

George Sakoulis |

|

Riti Samanta |

|

Serginio Sylvian |

Overview

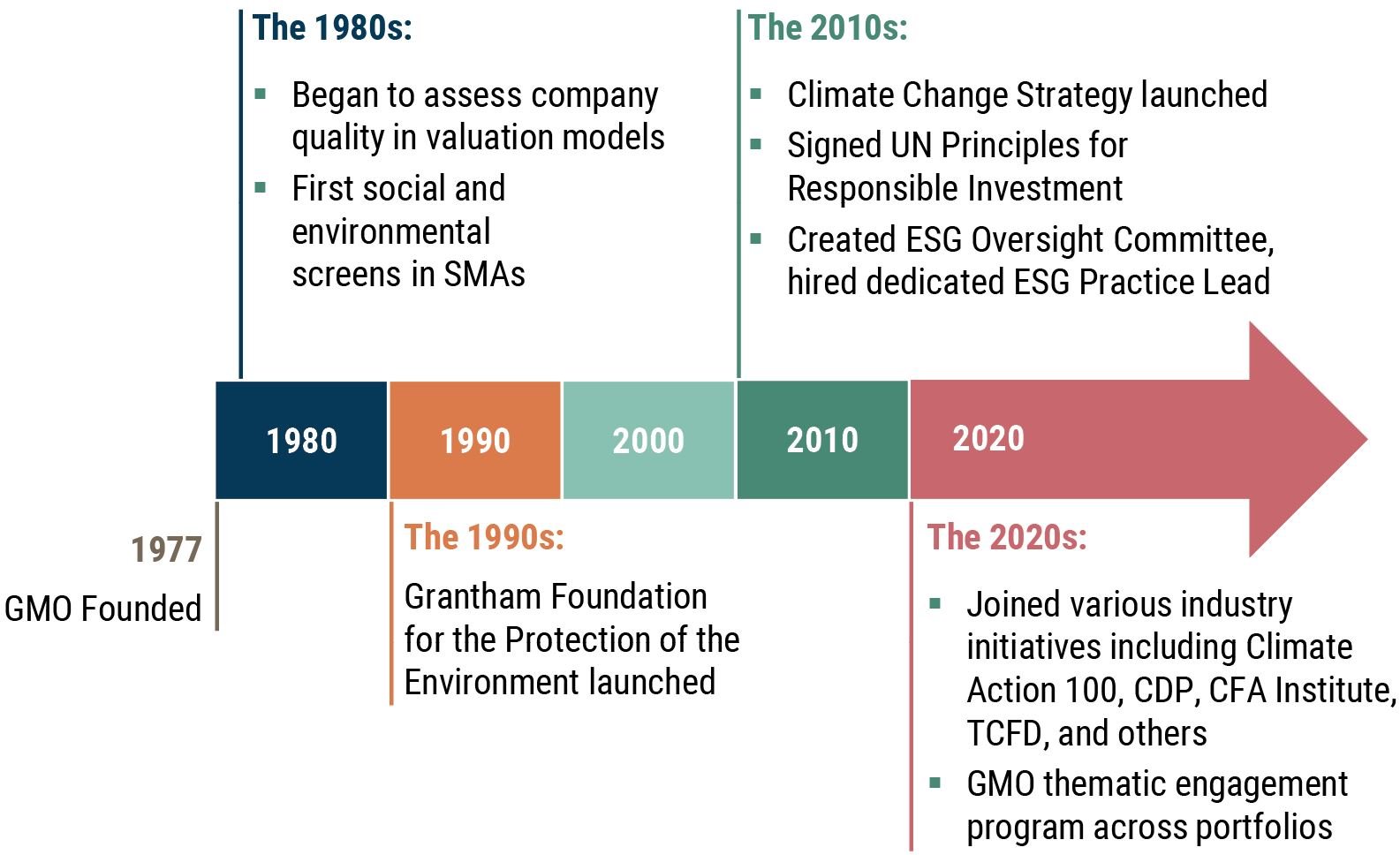

GMO panelists discussed our ESG integration journey from Asset Allocation, Fixed Income, and Equity perspectives. In our early days, GMO started by working with clients to reflect their social and environmental values in separately managed accounts. Over time our approach to ESG integration has evolved, and in recent years our investment teams have launched both top-down and bottom-up approaches to ESG integration. More recently, firm-wide efforts have also included building a proprietary GMO ESG Score and enhancing GMO’s approach to engagement.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

We built our investment thesis around quality, a theme GMO is very well known for. Material ESG issues represent dimensions of the quality of a company and will be a driver of future financial performance, as they have the potential to affect future profitability along multiple channels. Accounting for material ESG issues amounts to the evolution of our definition of quality.

George Sakoulis (2021 Fall Conference)

Key Points

- Jeremy Grantham’s years of work on climate change led to the launch of the GMO Climate Change Strategy in 2017.

- In recent years we have seen the development of a top-down country ESG model used by both our Emerging Markets Equity and Emerging Country Debt teams, bottom-up approaches attuned to various teams’ distinct investment processes, and in 2021 the introduction of our own GMO ESG Score aligned with our belief that ESG integration should be fundamentally driven and proprietary to the firm.

- With our GMO ESG Score, we developed an ESG investment thesis that is consistent with GMO’s philosophy. Our process captures the possibility of expected returns and mitigates investment risks on a forward-looking basis.

- ESG integration in fixed income spans a wide range, from systematically integrating GMO’s proprietary ESG Scores in our credit strategies to fundamentally restating the materiality map for emerging market debt.

- Fixed income ESG integration also requires the consideration of non-standard materiality, reflecting that ESG issues may differ in their materiality depending on the fixed income sector being considered.

- GMO’s Asset Allocation team has taken steps to incorporate the proprietary GMO ESG Scores into our top-down 7-Year Asset Class Forecasts for equity groups, allowing Asset Allocation strategies to benefit from integration at the allocation level in addition to getting pass-through ESG integration from the underlying GMO strategies in which Asset Allocation invests.

- Engagement is approached differently by each investment team. For example, certain teams, like the Focused Equity and Usonian Japan Equity teams, have long histories of incorporating engagement in their investment process, while the Global Equity team is in the early stages of enhancing their quantitative process with engagement efforts.

Related Strategies

Please click on the links below to access strategies related to this event.

- GMO Benchmark-Free Allocation Strategy

- GMO Climate Change Strategy

- GMO Emerging Country Debt Strategy

- GMO Emerging Markets Strategy

- GMO International Equity Strategy

- GMO Multi-Sector Fixed Income Strategy

Related Research

Please click on the links below to access additional research related to this event.