- After decades of subdued inflation, rising prices in commodities and consumer goods have prompted many investors to revisit their portfolios’ ability to withstand a rise in inflation.

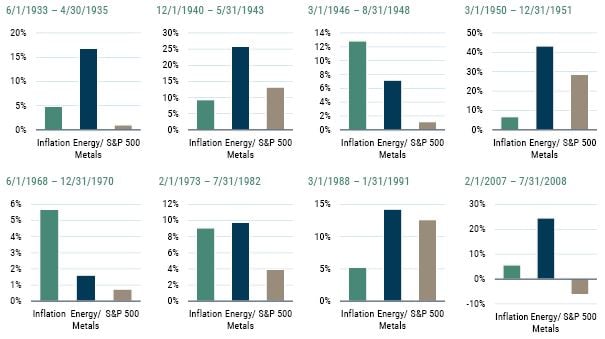

- Historically, resource equities have not only protected against inflation, but have actually dramatically increased purchasing power during inflationary periods. In the U.S., we’ve identified eight periods of time where inflation, as measured by CPI, was more than 5% per year for a period of one year or longer. In those inflationary periods, a basket of energy and metals companies kept up with or beat inflation six out of eight times, and in all eight periods the commodity producers outperformed the S&P 500. In fact, the commodity producers delivered real returns of more than 6% per year on average during these inflationary periods, as compared to a destruction of purchasing power of around 1.6% per year for the S&P 500.

During Inflationary Periods, Resource Equities Have Grown Purchasing Power

Annualized returns during inflationary periods

Inflation and Energy/Metals are industry classifications. Inflationary periods have been identified as periods where inflation, as measured by CPI, was greater than 5% per annum for a period longer than 1 year.

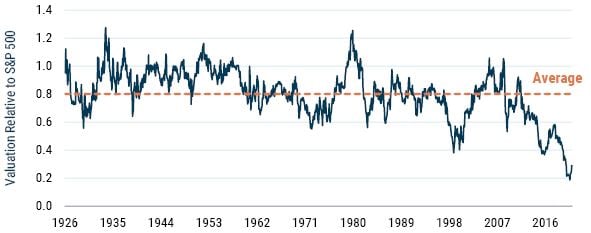

- Whether this year’s price rises are merely transitory or something longer lasting, the opportunity in energy and metals companies looks very appealing from a historical perspective. Energy and metals companies are trading at a discount of over 70% to the S&P 500 Index, the biggest discount we have ever seen with the exception of other points in the last year or so. In fact, energy companies are trading at the cheapest levels in absolute terms that we had ever seen prior to Covid.

VALUATION OF ENERGY/METALS COMPANIES RELATIVE TO THE S&P 500

As of 3/31/21 | Source: S&P, MSCI, Moodys, GMO. Valuation metric is a combination of P/E (Normalized Historical Earnings), Price to Book Value, and Dividend Yield.

- With prices rising, one might expect to pay a premium for inflation protection, but resource equities provide protection at a steep discount while also providing impressive diversification, the ability to capitalize on an inefficient sector of the market, and exposure to an asset class that has outperformed over the long-term.

Download article here.