Overview

In this webcast, GMO’s Tom Hancock, Ben Inker, Catherine LeGraw, John Thorndike, and Tina Vandersteel discussed their top market predictions for 2026 and ways investors can capitalize on these opportunities.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Market Predictions Highlights

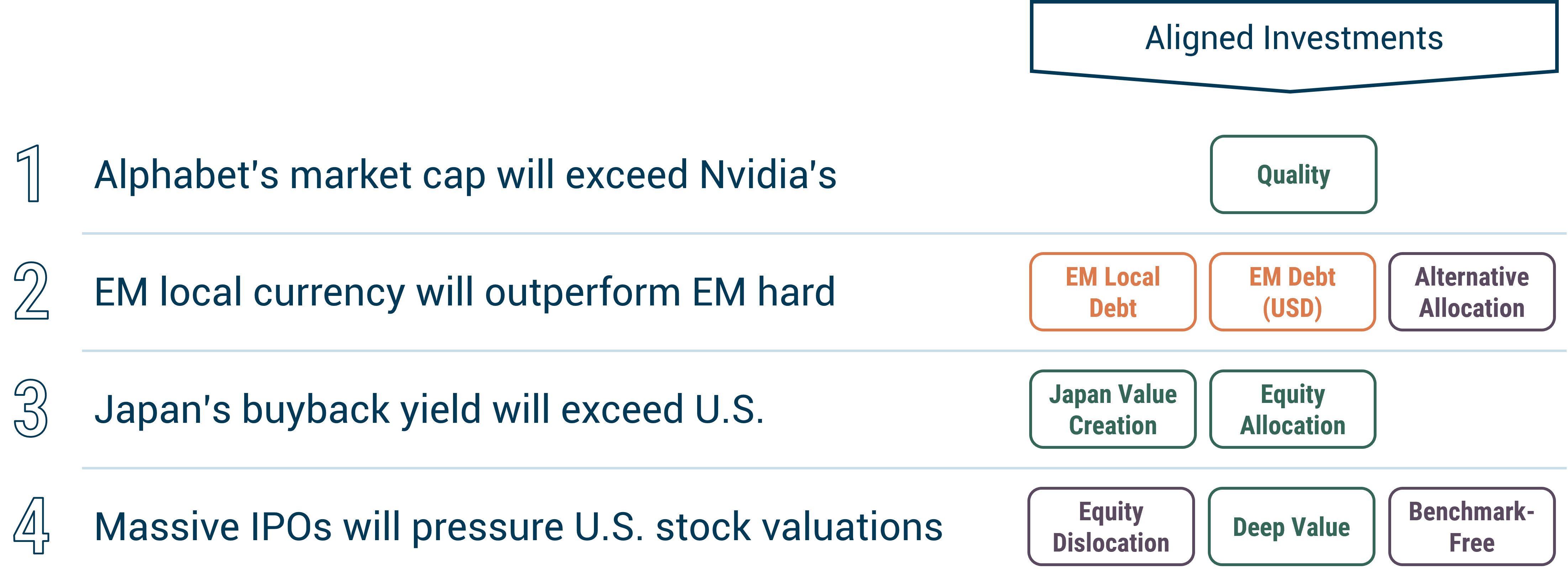

Tom, Ben, John, and Tina shared their market predictions for the year ahead

Tom Hancock: By the end of 2026, Alphabet’s market cap will exceed Nvidia’s

This prediction is about 20% out of the money, so this essentially predicts that the Q4 stock performance will continue for the year. Alphabet has the benefit of more proven AI use cases for itself and its customers, and of having customers (itself included) who are more committed to long-term investments in AI. Nvidia’s margins are very high and are unlikely to be sustainable without share loss. And if the wind were to come out of the AI sails, Alphabet has a much more diversified business with search, YouTube, etc., while Nvidia’s revenue comes 90% from data center AI.

Aligned investments: Today, the GMO Quality Strategy and GMO U.S. Quality ETF (QLTY) hold Alphabet, but not Nvidia.

Tina Vandersteel: EM local currency debt will outperform EM hard currency debt

Based on valuations, as seen in the GMO Quarterly Valuation Update, we believe that we are in the early innings of a U.S. dollar decline versus emerging market currencies and therefore, the local currency debt benchmark will again outperform the hard currency debt benchmark. Our hard currency strategy, which opportunistically invests in local currencies, will continue to get good alpha from local currency positions in a way that it hasn't since the last time EM currencies were this cheap about 20 years ago.

Aligned investments: The GMO Emerging Country Local Debt Strategy provides a direct play. EM local bonds are a material alpha source for both the GMO Emerging Country Debt Strategy and the GMO Alternative Allocation Strategy (a liquid alternatives portfolio), which incorporates an opportunistic EM Currency strategy.

John Thorndike: Japan’s buyback yield will exceed that of the U.S.

I predict that the buyback yield on Japanese stocks will exceed the buyback yield on U.S. stocks this year for the first time. Due to lower valuations, it's easier for Japanese management teams to buy back a larger fraction of market cap because it requires less of their cash flow. The AI capex build-out underway by U.S. mega caps limits the cash flow available for buybacks. Having long hoarded cash and tied up capital and cross shareholdings, Japanese management teams are showing an increased focus on returns on capital in Japan.

Aligned investments: The GMO Usonian Japan Value Creation Strategy provides direct exposure to Japan. All of GMO’s asset allocation strategies are significantly overweight Japan: GMO Benchmark-Free Allocation Strategy and GMO Global All Country Equity Allocation Strategy hold 5.8x and 2.9x MSCI ACWI’s Japan weight, respectively.

Ben Inker: Massive IPOs will put pressure on U.S. valuations

My prediction is that 2026 is going to see a level of IPO excitement that we haven't seen in a while. My guess is that at least two of the private giants (OpenAI, Anthropic, SpaceX) will go public, and this is likely to put pressure on the U.S. market later in the year. Historically, each 1% increase in market cap through IPOs eventually leads to approximately a 7.5% decrease in stock market price. Post IPOs, initially, maybe the market rises, but longer term as more stockholders are able to monetize, that will create a challenge for the U.S. market.

Aligned investments: The GMO Equity Dislocation Strategy is a market neutral strategy which is long cheap value stocks, and short the most expensive growth stocks, so this strategy is actually short most extended names. Deep Value portfolios such as GMO U.S. Opportunistic Value Strategy, GMO International Opportunistic Value Strategy, GMO U.S. Value ETF (GMOV), and GMO International Value ETF (GMOI) invest in the cheapest 20% cohort of stocks, avoiding the stocks most likely to reprice. The GMO Benchmark-Free Allocation Strategy and the GMO Dynamic Allocation ETF (GMOD) avoid froth and invest in attractively priced asset classes, offering diversification for many investors whose portfolios have become increasingly concentrated in U.S. stocks.

Q&A Highlights

Below are select participant questions answered live during the webcast. Please refer to the event replay for the full Q&A.

Q: What is your perspective on the recent U.S. actions in Venezuela, and what is the impact on GMO’s emerging country debt portfolios?

Tina: This was a law enforcement operation rather than a military operation; it was very surgical, and there weren't a lot of casualties. President Trump is working with the VP there, Delcy Rodriguez, who appears to be pragmatic. Given how smoothly the exercise went, it is possible that there were insiders in her administration and the military who were cooperating with the United States to make this go so well.

We've had a long-standing view that bond prices have overly discounted the actual economic fundamentals of Venezuela. Venezuela is not Cuba. Venezuela is a resource-rich nation. As the prices fell and fell, we accumulated more and more Venezuela. Prices last year rose from around 15 to 30 cents, so our position had been growing. Following the events of the weekend, the bond prices have gone from 30 to 40 cents. From a positioning perspective, this has been unambiguously good for GMO’s Emerging Debt portfolios.

Q: When will the significant capex investment in AI pay off and by how much? What will be the telltale signs that the AI promise is faltering?

Tom: If you go back a couple of years, that investment in AI has already been very profitable. Of course, there's a lot more investment now. I don't think the big payoffs will be this year, but I have confidence that they will come in the future. The market will break if AI investment dries up as people get impatient waiting. Many AI big spenders have long investment horizons. If the Mag 7 start to pull back on AI investment, or if Microsoft’s CFO, Amy Hood, starts expressing nuance in a conference call later this year, for example, that would be what would freak me out. As long as these top companies that generate their own cash flow are seeing the reward potential and investing behind it, you will probably be pretty happy investing too.

Q: How should investors rotate out of areas they've become overweight (e.g., large cap growth recently)? Should we reallocate to large cap value, fixed income, or elsewhere?

John: If you either want or need to remain invested significantly in the U.S., value stocks still look quite attractive. International stocks did very, very well last year, but they still look attractive. Particularly for investors who are focused on absolute return and absolute risk as opposed to just benchmark-relative, liquid alternatives are definitely worth considering as a source of both risk taking and diversification.

GMO recently launched the GMO Dynamic Allocation ETF (GMOD). One beautiful thing about the ETF structure is that you can engage in portfolio rotation without realizing capital gains. Taxable investors might rationally hesitate to sell their winners for fear of the tax bill.

Q: For investors concerned about a potential stock market drawdown due to high valuations or uncertainty about that growth coming through, what is a sensible way to maintain your equity exposure without completely exiting the market?

Tom: Many areas have been left behind, for example in software and healthcare, so I think there's a lot to do within an equity portfolio. Also, we have a long-short version of the Quality strategy, called Quality Spectrum. Quality Spectrum gives you the fundamental upside, but at the same time hedges out much of the associated risk-on beta.

Q: What are the potential catalysts for the normalization of the value growth spread, which has persisted for years?

Ben: There’s nuance now, as last year was an amazing year for value outside of the U.S., actually one of the best years in history. Value is trading at a wider-than-normal discount everywhere around the world, but it has started to shrink in Europe and Japan. In the U.S., the spread is still at the extreme, 4th percentile versus history. A significant driver of spread narrowing to date has been the normalization of interest rates. In a world of zero rates, certain stocks were viewed as longer duration.

In the U.S., if air comes out of the AI space, that would be good for value relative to growth. More generically, change usually accrues towards value and against growth. Growth companies trade at a big premium. If some growth companies are not beneficiaries of the change, that premium comes down. For example, Peloton, a COVID darling, experienced a price collapse when the world changed. The most obvious change that could be a catalyst in the near future would be if people fell out of love with AI.