In markets, short-term underperformance can often set the stage for a compelling long-term opportunity. Although healthcare was the S&P 500’s worst-performing sector over the past year (from 9/30/24 to 9/30/25), innovation remains strong, demographic trends are supportive, and valuations have fallen to attractive levels. In our opinion, areas within the sector present fertile ground for quality-focused investors.

Sector Underperformance Presents Short-Term Pain, But Long-Term Promise

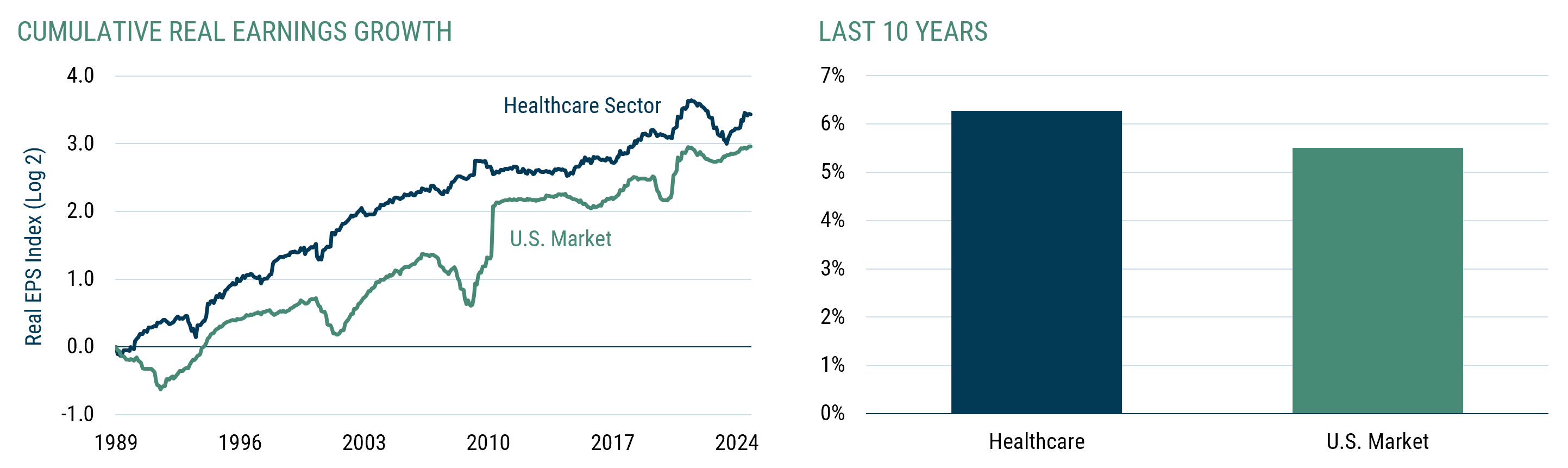

Despite recent results, healthcare has been one of the most compelling sectors over the past decade, consistently outpacing earnings growth in both the U.S. and across developed markets.

Exhibit 1: The Healthcare SECTOR HAS DELIVERED CONSISTENT GROWTH

As of 9/30/2025 | Source: Worldscope, GMO

Innovation remains the sector’s primary engine, with over half of healthcare’s growth in recent years being attributed to advances in oncology, GLP-1 therapies, and vaccines. Demographics, too, are destiny, as aging populations and expanding access in emerging markets continue to underpin demand.

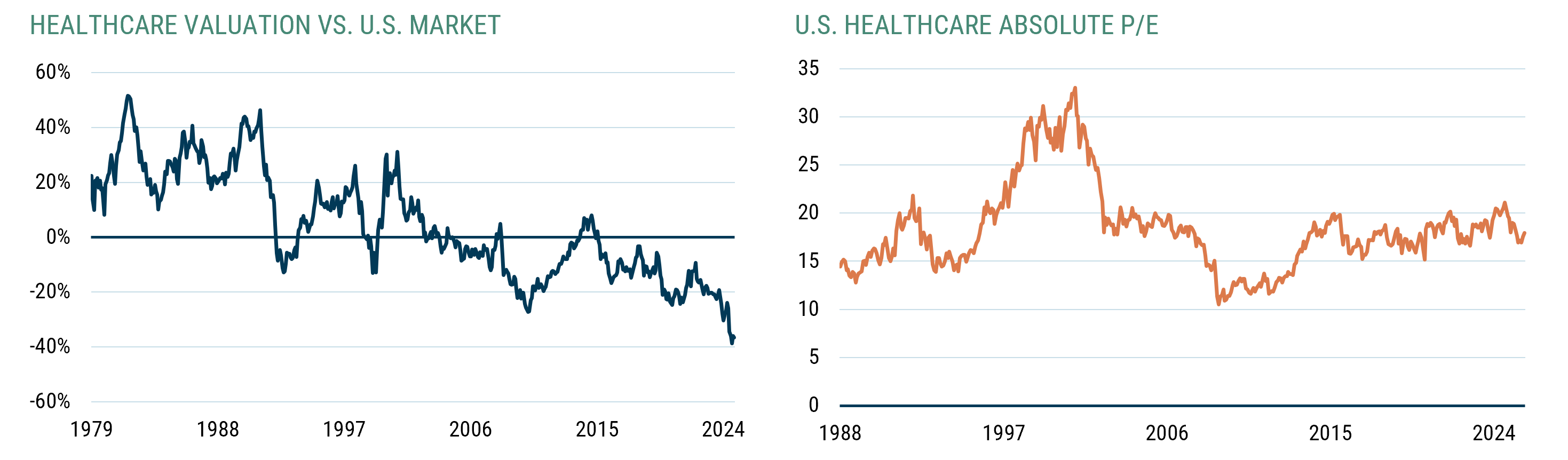

Yet, despite robust fundamentals and strong secular trends, the market has grown increasingly skeptical. Valuations have compressed, and forward P/E ratios now sit at attractive levels relative to the market. In our experience, such disconnects between fundamentals and sentiment have historically rewarded patient investors.

Exhibit 2: Healthcare valuations have compressed relative to the market

U.S. healthcare sector

As of 9/30/2025 | Source: Worldscope, IBES, GMO

Relative valuation is based on a composite metric of P/E (TTM), P/E (NTM), Price/Normalized Earnings, P/Sales, P/Cash Flow, and Dividend Yield.

Enduring Growth Drivers

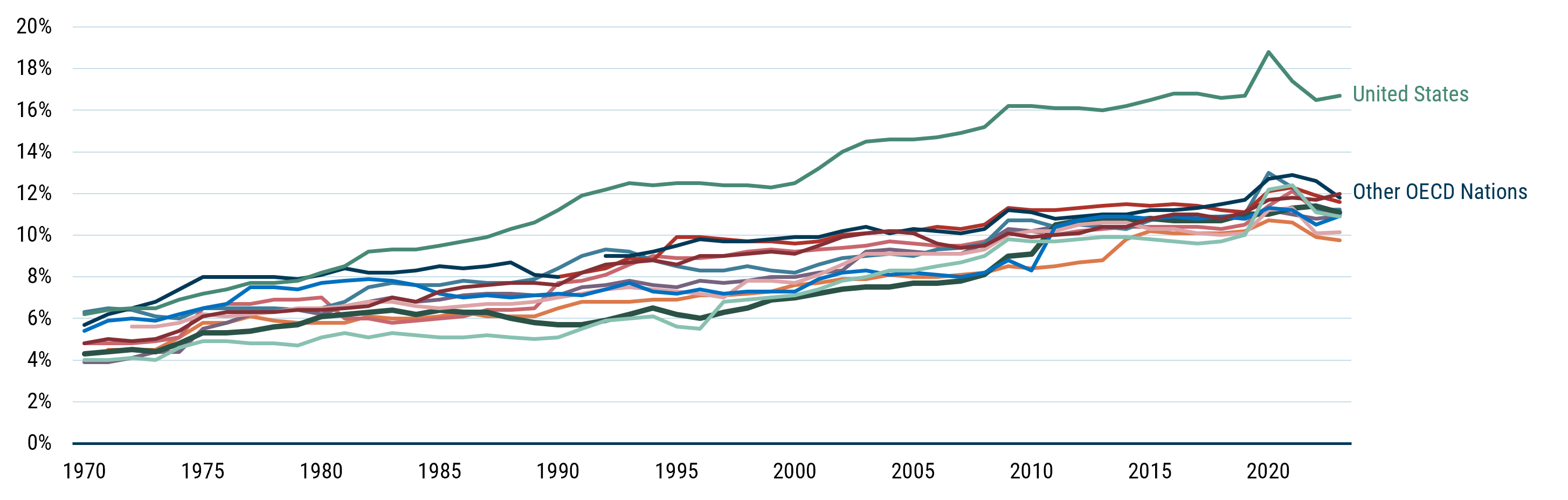

The story for this sector remains positive: long-term trends, including innovation, favorable demographics, and global growth, continue to drive healthcare spending as a percentage of GDP in the U.S. (up from 6% to 16% over the past 50 years) and other developed markets within the OECD (roughly doubling over the same timeframe).

Exhibit 3: THE BASIC TRENDS ARE STILL STRONG

Healthcare spending as a fraction of GDP

As of 2023 | Source: Peterson-KFF Health System Tracker

For large pharmaceutical companies, GLP-1 drugs (mainly produced by Eli Lilly and Novo Nordisk) represent a significant opportunity, with a market potentially exceeding $100-$150 billion, driven by treatments for diabetes and obesity.

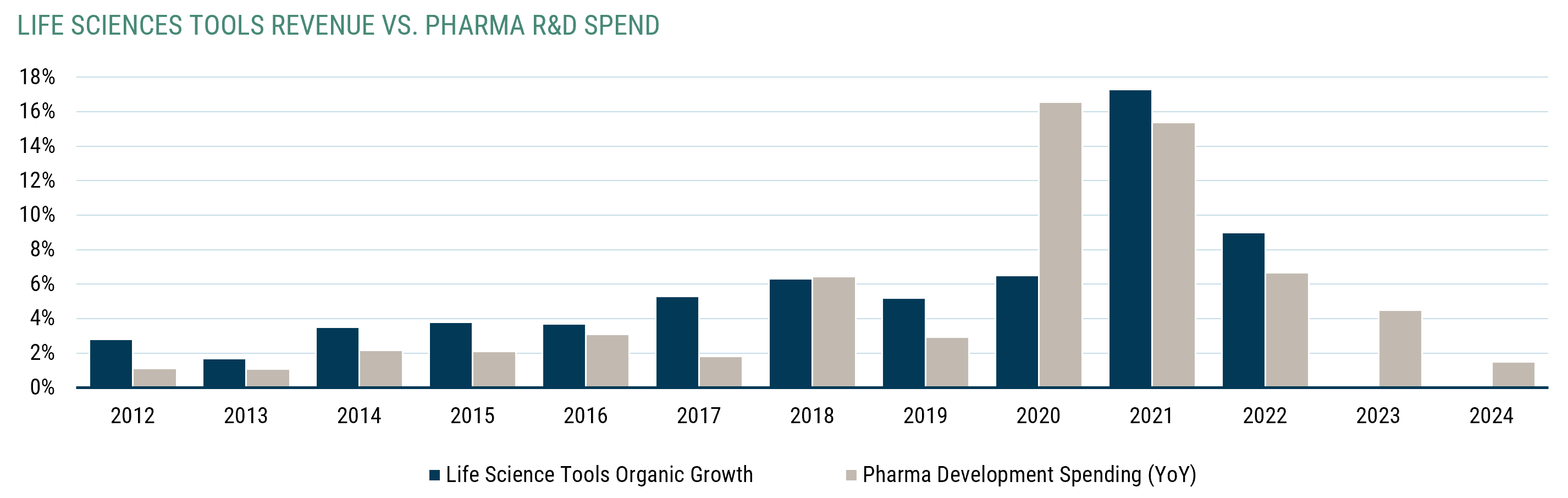

Companies that support large pharmaceuticals, such as life science tools, contract research (CROs), and bioprocessing, are also secular growth areas, benefiting from rising R&D spending and the shift to biologics.

The COVID-driven boom and subsequent normalization in R&D spending led to inventory buildups and pipeline concerns, culminating in what appears to be a cyclical trough. While timing such inflections is always fraught, we believe the current environment offers the opportunity to acquire solid companies at cyclical lows.

Exhibit 4: Life science tools: R&D Winners at cyclical lows

A boom/bust cycle, in part driven by Covid, has slowed a secularly winning industry

As of 9/30/2025 | Source: IQVIA filings, Bloomberg, GMO

As innovation increases, the need for spending to be managed highlights the role of managed care organizations (MCOs), which sit at the center of the system. This increase in importance, along with demographic drivers, has been reflected in the companies’ strong fundamental performance. While MCOs and pharmacy benefit managers (PBMs) are navigating profitability and regulatory scrutiny against a backdrop of public criticism (see Don’t Blame the Middleman for our recent insights on this issue), fundamentals remain strong for leading players.

Finally, healthcare is poised to benefit from AI, particularly in claims processing, diagnostics, and drug discovery, which could drive efficiency and innovation.

Policy and Patent Risks: More Bark Than Bite

Policy risk, particularly around drug pricing and manufacturing, has weighed on sentiment, with recent volatility reflecting both political rhetoric and regulatory uncertainty. The late-September agreement between the administration and Pfizer has helped to stabilize the sector.

Concerns about patent cliffs have also increased sector volatility as companies like Merck and Johnson & Johnson face major patent expirations (Keytruda, Stelara). However, these companies have strategies in place to replenish their pipelines through new drug development and acquisitions, suggesting that the revenue decline may be less severe than initially expected. Additionally, the low multiples at which they are trading offer some protection against downside risk.

Conclusion

In sum, while concerns around drug pricing, tariffs, and government funding are unlikely to disappear, we believe they are more than reflected in current valuations. The sector’s long-term drivers of innovation, demographics, and the adoption of AI remain firmly in place.

Within GMO’s Quality Strategy, healthcare represents the second-largest allocation, and our approach emphasizes focusing on quality holdings with both defensive and growth characteristics. It can offer a compelling way for investors to enhance diversification while participating in the long-term upside as this opportunity plays out.

For more on this topic, watch our recent presentation from GMO’s 2025 Fall Conference.