Key Takeaways

- The evolution of U.S. investment-grade credit (IG), 1 highlighted by both increased issuance and improved liquidity, has created what we believe to be a fertile environment for systematic strategies.

- Traditional credit investment approaches, which tend to rely on deep fundamental research into individual securities or issuers, have struggled to deliver differentiated return profiles in recent years.

- In our view, using quantitative methods in a transparent, repeatable way to extract alpha through diversified factor tilts offers a compelling alternative in this new IG environment.

An Evolved Market Structure Demands New Investing Tools

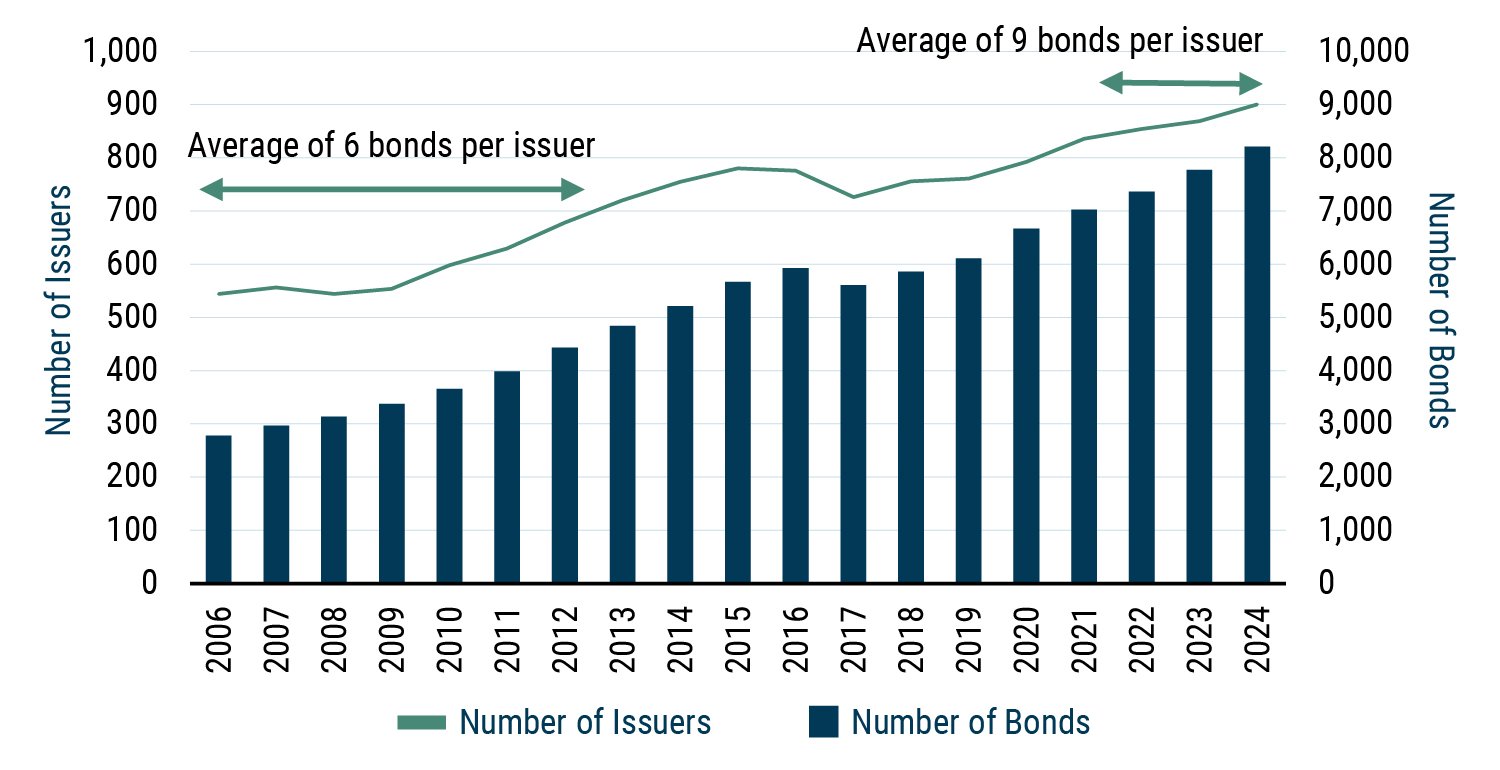

The debt outstanding in the IG market has more than doubled since the Global Financial Crisis (GFC). As the market size has expanded, so has the opportunity set within the asset class; there are now more than 8,300 distinct securities (an increase of 147% since 2009!) and over 900 debt issuers (a 65% increase). With a diverse set of sectors, ratings, and maturities, this boom in issuance has also meant a significant increase in the number of decision-making points when constructing an IG portfolio. Quantitative investment methods are ideal for such multi-dimensional investment opportunities.

Exhibit 1: Size of the U.S. Investment Grade Market

As of December 31, 2024 | Source: Bloomberg

The growth in market size has coincided with, or perhaps itself precipitated, significant improvements in market liquidity – another characteristic that supports a quantitative portfolio construction approach. The proliferation of electronic trading platforms and their steadily increasing share of trading volumes, the advent of portfolio trading, and the tremendous growth of fixed income ETFs have all contributed to create a deep, liquid trading environment with real price transparency.

Moreover, not only do the current market size and structure create a ripe opportunity for systematic investing, so too does the very nature of the market's evolution over the last two decades. Quantitative research relies heavily on data, and the surfeit of investment-grade issuance has created a rich dataset today that has enabled us to test the robustness of our process and the efficacy of our signals over multiple credit and economic cycles. We believe GMO’s long history and deep experience in quantitative investing adds to our advantage, and we can lean on this expertise to apply insights confidently across the breadth of opportunities available in IG.

Mind the Gap for Potential Opportunities

By its very nature, a systematic approach aims to harvest alpha differently versus a fundamentally constructed portfolio.

- Where a fundamental manager relies on depth of analysis on and knowledge about an individual issuer or sector, a quantitative process leverages the full breadth of information available.

- The ability to quantify both the value offered and the risk posed by almost every security in the IG universe allows us to construct a diversified portfolio that resembles the market in its broad, aggregate risk metrics – be that spread, duration, or sector exposure.

- The alpha potential in such a systematic strategy comes from the factor tilts each position represents. The factor models that drive security selection are designed to take advantage of valuation dispersions that fundamental credit analysis may not capture. The ultimate goal is to exploit several dislocations across a broad swathe of the market.

- A diversified, systematic portfolio ensures minimal idiosyncratic risk, and a construction process drawing from varied cohorts of sectors and maturity buckets avoids unintended macro exposure.

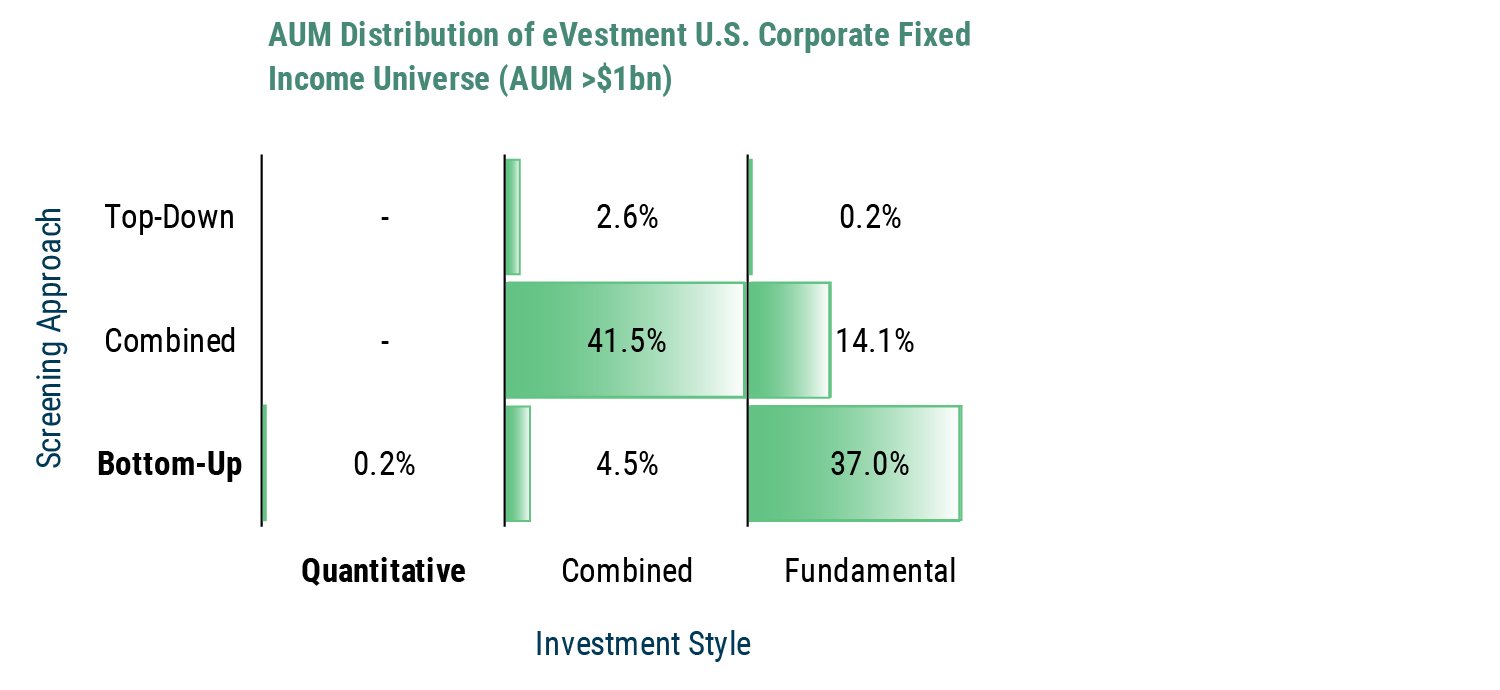

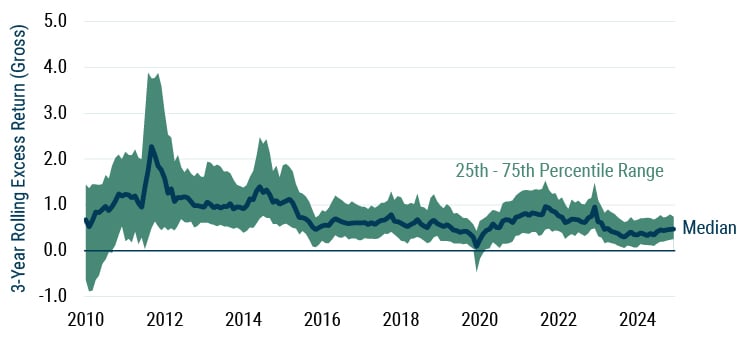

Despite the evolution of the IG market and these advantages of systematic approaches, evidence suggests that most managers still rely on fundamental analysis (Exhibit 2) and that IG managers overall have struggled to differentiate themselves in recent years (Exhibit 3). We posit that scalability may be a contributing factor, as analysts may have crowded into consensus trades led by “tried and true” traditional methods. We believe a systematic investment approach employing quantitative signals can exploit the gaps in fundamental coverage and harvest alpha from overlooked opportunities.

Exhibit 2: Most Managers Still Rely on Fundamental Analysis

As of March 2025 | Source: eVestment

Exhibit 3: Dispersion between the Top and Bottom Managers Has Narrowed

U.S. Corporate Fixed Income vs. Preferred Benchmark

As of March 31, 2025 | Source: eVestment

Data comprises products in the eVestment U.S. Corporate Fixed Income universe, a universe of managers who invest primarily in corporate debt securities issued by U.S. companies. Universe includes terminated strategies. The Preferred Benchmark refers to the specific index or benchmark chosen by U.S. Corporate Fixed Income universe constituents to track the performance of their investment strategy, typically the Bloomberg U.S. Corporate Investment-Grade Index or the Bloomberg U.S. Credit Index.

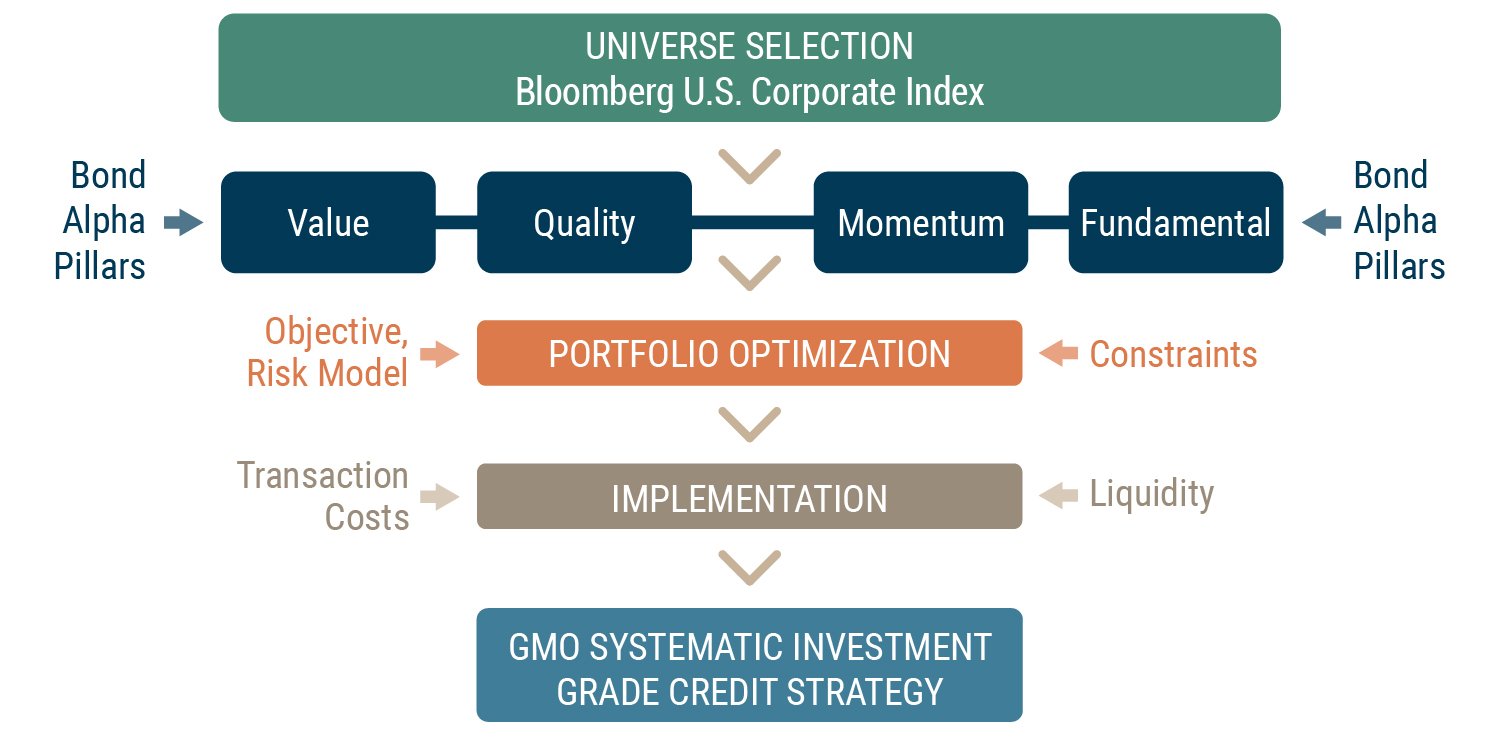

Introducing GMO’s Systematic Approach to IG

GMO’s Developed Fixed Income team has constructed a Systematic Investment Grade Credit strategy that seeks to take advantage of the opportunities discussed here. Designed to be transparent, repeatable, and highly scalable, our approach is grounded in robust economic and theoretical research foundations, with a flexible design allowing for constant evaluation and incorporation of new ideas. By combining a suite of diversifying signals, we aim to deliver differentiated return profiles for our clients.

- The process begins by evaluating issuers and securities within the U.S. IG universe across four primary dimensions – Valuation, Momentum, Quality, and Company Fundamentals.

- Valuation models estimate a bond’s fair credit spread by accounting for issuer credit and bond-specific risks.

- Momentum indicators capture cross-asset trends, drawing from public equity market returns to inform positioning.

- Quality metrics assess an issuer’s creditworthiness and incorporate information from the equity options market.

- Company Fundamentals utilize measures derived from public financials data, benefiting from proprietary enhancements built over 40+ years of quantitative equity investing at GMO.

- Signals are integrated into a composite alpha score for each bond in the IG universe (showcasing the advantage of the broad evaluation capabilities of a quantitative process). The diversifying nature of our signals adds robustness to the evaluation framework. Using TRACE 2 data and bond-level characteristics, we also apply liquidity filters to trim the universe down to what we believe to be investible.

- Portfolio optimization techniques are leveraged to combine security alphas with portfolio-level constraints, and a proprietary risk model helps balance the trade-off between ex-ante opportunity and tracking error. Constraints are applied to the strategy to ensure the resulting portfolio closely resembles the index, as we manage typical risks associated with IG bonds, including duration, issuer and sector concentration, ratings, and country of domicile.

- Lastly, proprietary tools empower portfolio managers and traders to construct portfolios and iterate portfolio optimizations as needed, seeking to ensure that the resulting portfolios are tradable and executable at a reasonable cost.

Exhibit 4: Transparent, Repeatable, Scalable Approach

As of May 2025 | Source: GMO

The Result – A New IG Option, Easily Accessible

Our strategy continues GMO’s long tradition of tailoring investment processes to access market opportunities on behalf of our clients however we think is most effective, even as other market participants may approach them differently. This certainly applies to IG, where shifts in market structure alongside improved liquidity and execution have provided an opportunity to apply quantitative techniques to an asset class traditionally dominated by fundamental investors. GMO’s strategy, now available via the GMO Systematic Investment Grade Credit ETF (INVG), aims to deliver an easily accessible, compelling alternative for clients to implement IG portfolio exposures.

Download article here.

Investment-grade credit refers to corporate bonds rated Baa3/BBB- or better.

Trade Reporting and Compliance Engine (TRACE) allows for the reporting of over-the-counter transactions pertaining to eligible fixed income securities.

Past performance is no guarantee of future results.

An investor should carefully consider the fund’s investment objectives, risks, charges and expenses before investing. This and other important information can be found in the fund’s prospectus. To obtain a prospectus please visit www.gmo.com. Read the prospectus carefully before investing. The GMO ETFs are distributed in the United States by Foreside Fund Services LLC. GMO and Foreside Fund Services LLC are not affiliated.

Risks associated with investing in the Fund may include: (1) Credit Risk: the risk that the issuer or guarantor of a fixed income investment or the obligor of an obligation underlying an asset-backed security will be unable or unwilling to satisfy its obligation to pay principal and interest or otherwise to honor its obligations in a timely manner; (2) Market Risk - Fixed Income Investments: the market price of a fixed income investment can decline due to a number of market-related factors, including rising interest rates and widening credit spreads or decreased liquidity stemming from the market's uncertainty about the value of a fixed income investment (or class of fixed income investments); and (3) Management and Operational Risk: the risk that GMO's investment techniques will fail to produce desired results, including annualized returns and annualized volatility. For a more complete discussion of these and other risks, please consult the Fund's Prospectus.

Disclosure: The views expressed are the views of James Donaldson, Rachna Ramachandran, and Mina Tomovska through the period ending June 4, 2025, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

Investment-grade credit refers to corporate bonds rated Baa3/BBB- or better.

Trade Reporting and Compliance Engine (TRACE) allows for the reporting of over-the-counter transactions pertaining to eligible fixed income securities.