classic signs of speculation

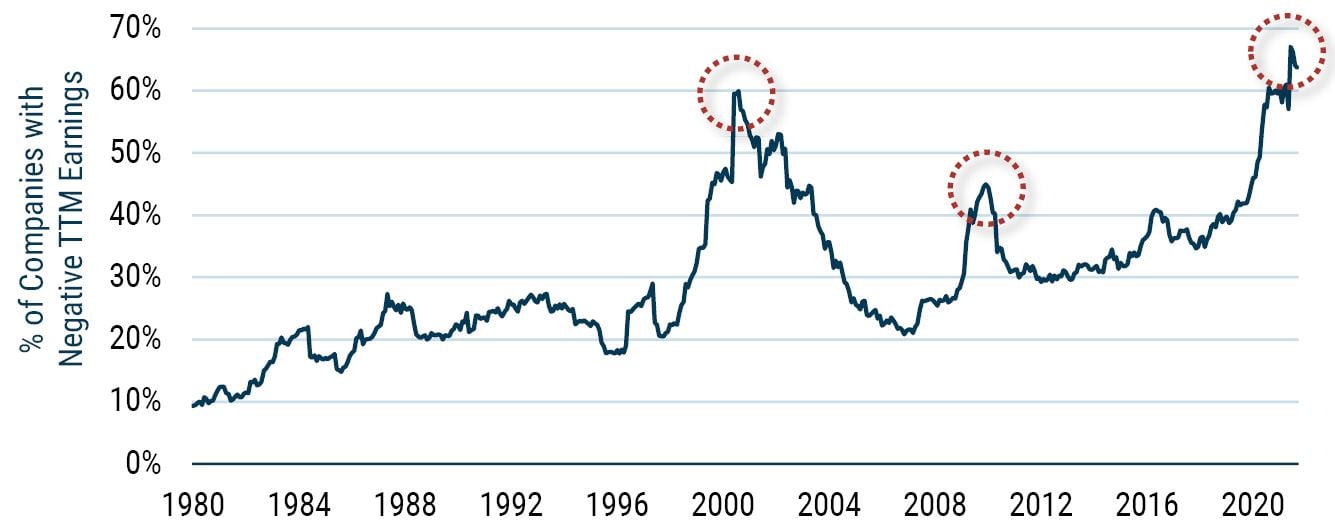

More than half of U.S. Growth stocks* have negative earnings, yet Growth stocks have dramatically outperformed in the past few years

MAKING MONEY ON COMPANIES THAT MAKE NO MONEY:

% of Russell 3000 Growth Stocks with Negative Earnings

Data through 9/30/2021 | Source: GMO

*The universe and rebalancing methodology is similar to that of the Russell 3000, but the definition of “Growth” is a proprietary GMO composite of metrics.

- Classic Signs of Speculation. Every bubble is unique. The economic environment is unique, the players are unique, the industries and companies caught up in the frenzy may be unique. All true. But classic common threads also run through bubbles because they are born of human nature: the fear of missing out, watching with envy as others get rich around you, career risk and (for investment professionals) keeping up with peer groups and benchmarks, the willing suspension of healthy disbelief, and the dissolution of discipline.

- Making Money on Companies That Make No Money. Bidding up the prices of money-losing enterprises is a classic bubble sign. It has shown its face in the SPAC phenomenon, certainly. But in the chart above, we see the same phenomenon in established companies. Today, 60% of the Growth stocks in the Russell 3000 Index make no money, and this was true even before the COVID-induced recession. Yet these very companies have been generating huge returns in price movement over the past few years, dramatically outperforming their Value counterparts. The Russell 3000 Growth Index was up 84% cumulatively over the last two years through August (more than double the return of its Value counterpart). So investors are making money on companies that make no money – never a good sign when it is done this pervasively and at these valuations. And while not common, it is also not unique. We all witnessed the same speculative behavior in the late 1990s and in the 2008 speculative bubble.

Download article here.

Disclaimer: The views expressed are the views of the GMO Asset Allocation team through the period ending October 2021 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2021 by GMO LLC. All rights reserved.