To make an allocation to any asset class, it’s essential to understand not just the return potential but also the underlying riskiness. In hard currency emerging debt, the primary risk is sovereign default. Our view has always been that the credit spread received to compensate for default has been generous. In other words, we believe hard currency sovereign credit portfolios are less risky than they seem, often warranting a long-term strategic allocation to the asset class. The past five years have provided a test of this thesis and, indeed, emerging countries have generally passed.

Resilience in the Face of Shocks

The first few years of the 2020s were extremely challenging for emerging countries. A rapid succession of shocks—Covid-19 (primarily a global demand shock), Russia’s invasion of Ukraine (primarily an inflation shock), and the steep hiking cycle undertaken by the Federal Reserve (primarily a cost-of-financing shock)—represented a massive stress test for the emerging world.

Though some emerging countries defaulted, the vast majority found a way to muddle through without default, preserving repayment reputations and capital market access. Countries used all the tools at their disposal to remain current on obligations. Macroeconomic policies generally involved initial monetary and fiscal policy easing (lower policy rates and higher fiscal deficits), which were followed, at the right time, by monetary and fiscal policy tightening. The larger short-term deficits were financed by diversified sources, including their own local markets, multilateral development banks (which often fill financing gaps when private markets temporarily close), and friendly government bilateral creditors.

Importantly, for most countries, exchange rates were allowed to act as shock absorbers as well. By allowing some exchange rate depreciation, countries preserved their foreign reserve buffers, even if it was at the cost of a spike in inflation. The benefit was that, coming out of the shock period, exchange rates were largely undervalued relative to the dollar.

0 Defaults in the Last 2 Years

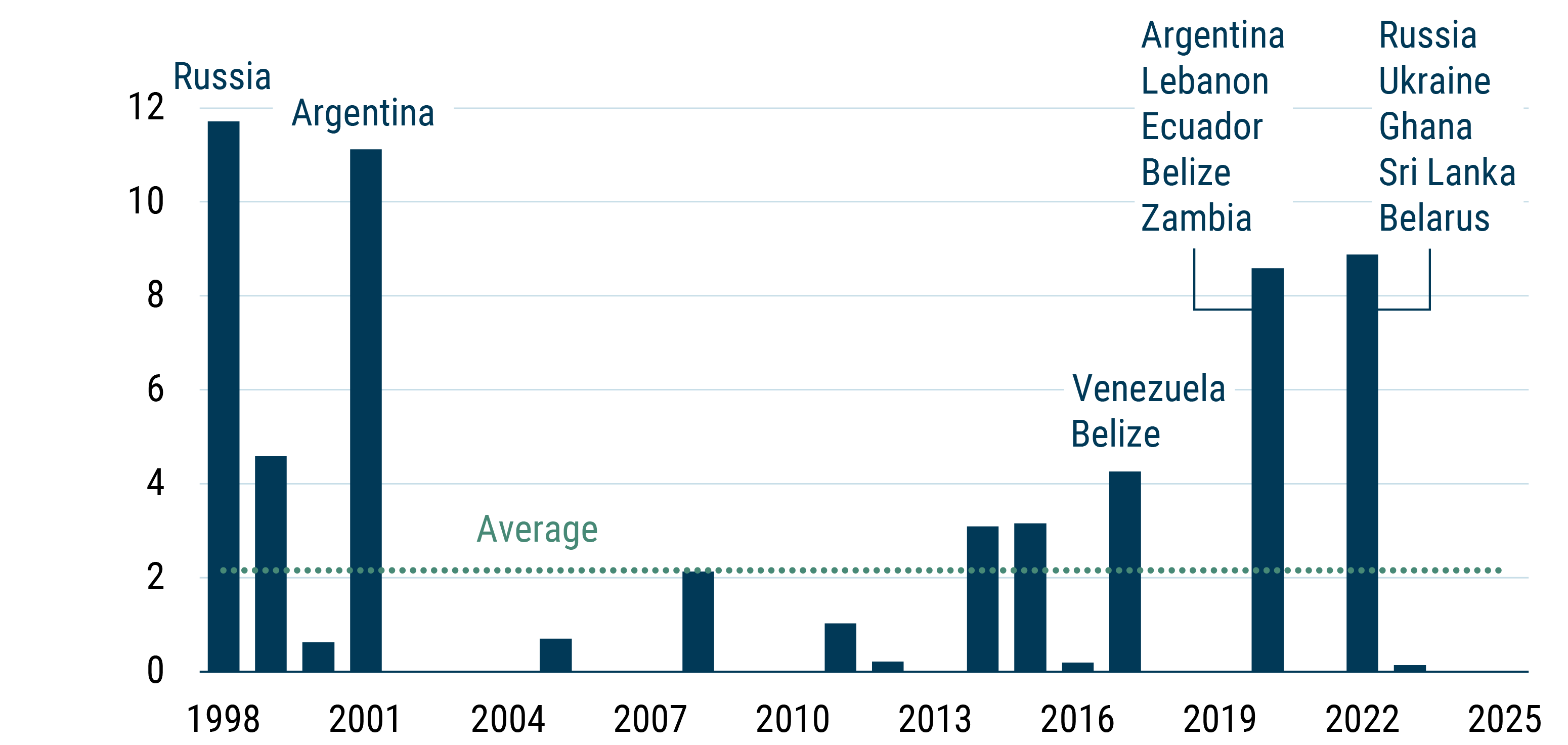

We believe that we are on the “other side” of the default cycle in this market and will likely return to the historical norm of about one sovereign default per year—out of 69 countries currently in the benchmark. Indeed, we have not had a sovereign default in 2024 or 2025.

Exhibit 1: Collective EMBIG-D Weight of Defaulted Countries by Year (%)

As of 9/30/2025 | Sources: Bank of America, GMO

Constructive Restructurings

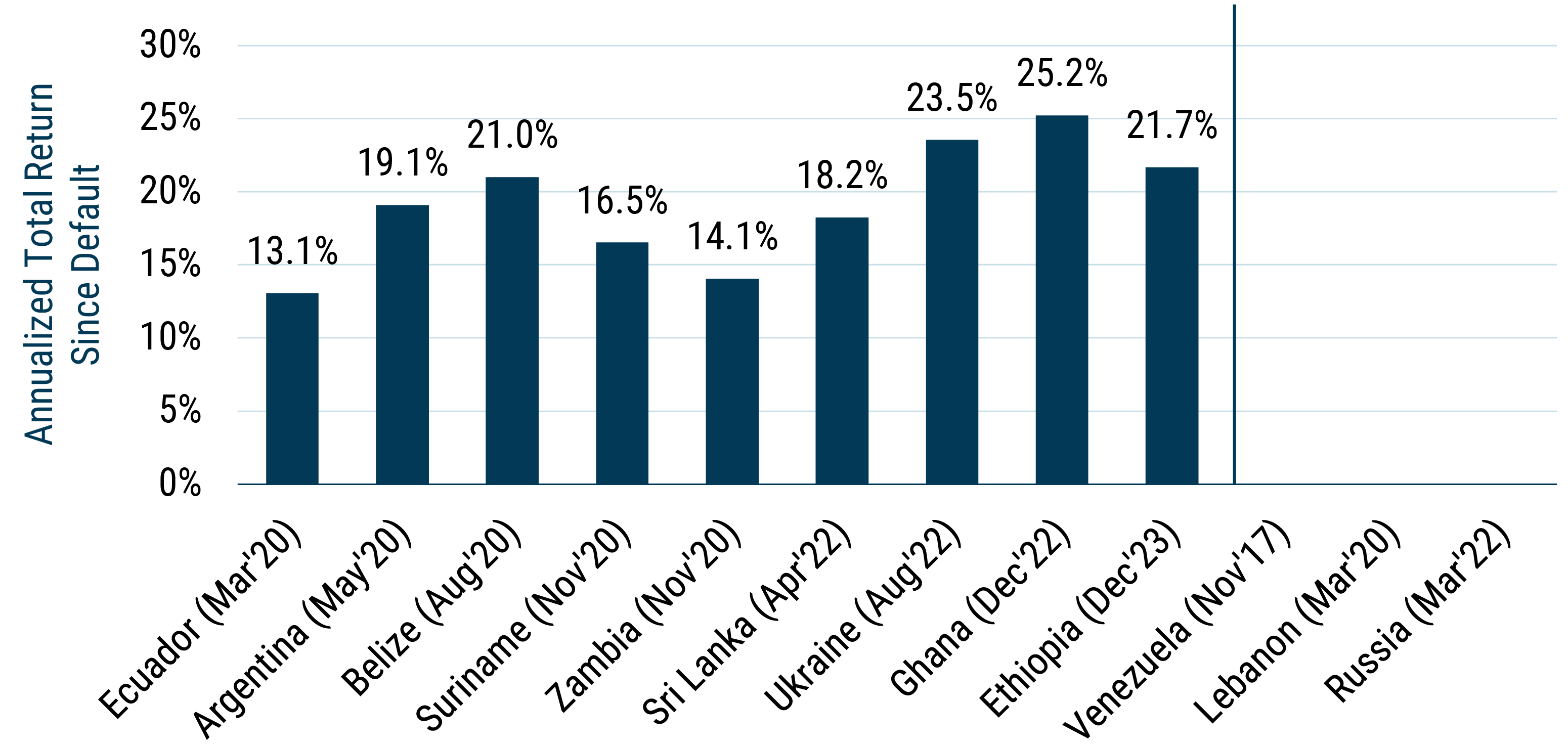

Pre-2024, non-sanction-related defaults, including Ecuador, Argentina, Suriname, Zambia, Ghana, and Sri Lanka, had been restructured on reasonable terms for bondholders. Ultimate recoveries in all these cases have been above (sometimes well above) 50 cents of par, which is consistent with the historical experience. Ukraine remains a special case, and conditions may be forming for Lebanon to finally begin its recovery out of financial distress.

Exhibit 2: Bondholders Have Recouped Considerable Value in Bond Restructurings

…And recent history is no exception

As of 5/31/2025 | Source: Moody’s, GMO

Emerging Debt: Worth the Spread

In a remarkable recent study, 1 researchers analyzed the history of sovereign bond lending over a 200-year period since 1815. What they found closely matches our recent experience:

- Holders (mainly U.S. and UK investors, due to the time period) of foreign sovereign bonds earned an excess return of 3-4% above their own government bonds, after accounting for default losses.

- Full repudiation of sovereign bond debt is extremely rare, and recoveries in default are above 50%.

These results match intuition. Whereas companies can be liquidated and essentially cease to exist, countries live on and generally recognize the need for future access to markets.

All of this supports the case that the credit spread for hard currency emerging market debt has generally overcompensated investors for actual riskiness, warranting, in our opinion, the consideration of an “always on” strategic allocation.

Moreover, that strategic allocation can be augmented currently by the relative attractiveness of EM currencies, especially relative to the U.S. dollar. As we have written elsewhere, 2 we believe the case for tactical overweight positions of local currency debt in blended EM debt portfolios and for outright long EM local debt strategies is particularly strong at the moment. 3

Meyer, Josefin, Carmen M. Reinhart, and Christoph Trebesch. “Sovereign Bonds Since Waterloo.” NBER Working Paper No. 25543. National Bureau of Economic Research, February 2019; revised January 2022.

See Still a Once-in-a-Generation Opportunity: Emerging Markets Local Debt by Victoria Courmes (July 2025).

For more details and our latest valuation assessment, please see our Quarterly Valuation Update.

Disclaimer: The views expressed are the views of the GMO Emerging Country Debt team through the period ending October 2025 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

Meyer, Josefin, Carmen M. Reinhart, and Christoph Trebesch. “Sovereign Bonds Since Waterloo.” NBER Working Paper No. 25543. National Bureau of Economic Research, February 2019; revised January 2022.

See Still a Once-in-a-Generation Opportunity: Emerging Markets Local Debt by Victoria Courmes (July 2025).

For more details and our latest valuation assessment, please see our Quarterly Valuation Update.