With inflation spiking as the world adjusts to the post-Covid regime, investors are naturally interested in how their portfolios might perform in an inflationary world. In this piece, we investigate the performance of high-quality equities during prior bouts of inflation. We note that quality stocks have tended to fare well compared to the broader markets in times of rising prices, and that paying attention to valuation alongside quality delivered even better results. We conclude that the fundamental characteristics of our Quality Strategy’s holdings today further underpin the ability of our investments to withstand a possible inflationary episode.

Several years ago, we extended our database of company accounts all the way back to the 1920s. This was hard labor, or as hard as clerical labor gets. We waded through thousands of pages of dusty Moody’s Manuals, processing and entering revenue and leverage data for hundreds of American companies by hand. The objective was to be able to run our quality and valuation proxies back almost a century so that we could investigate the attributes of quality stocks under different environments. As a result, we are well placed today to investigate how quality businesses performed when inflation struck in the past.

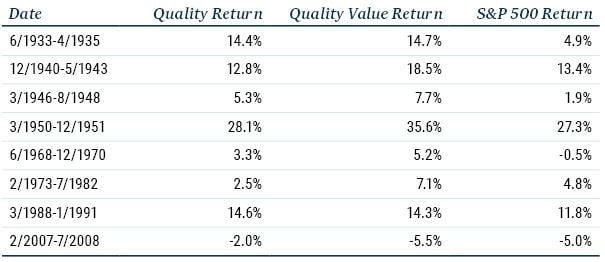

We identified eight periods in which U.S. CPI remained above 5% for a period of one year or longer and tracked the returns of the highest-quality stocks, the cheaper high-quality stocks, and the S&P 500.1 The annualized returns laid out in the table are striking.

Source: GMO

In historic bouts of inflation, we see that:

- High-quality stocks beat the S&P 500 in six of the eight inflationary periods.

- Cheaper high-quality stocks beat the S&P 500 in seven of the eight inflationary periods.

High-quality won in most inflationary periods, and one can make the case that the only serious miss, in the early 1970s, was unrepresentative. This period saw the peak of the Nifty Fifty bubble in which many quality businesses were pushed up to unreasonable prices. Considering valuation alongside quality yielded much better, market-beating results in that period and is also a better proxy for our investment process today.

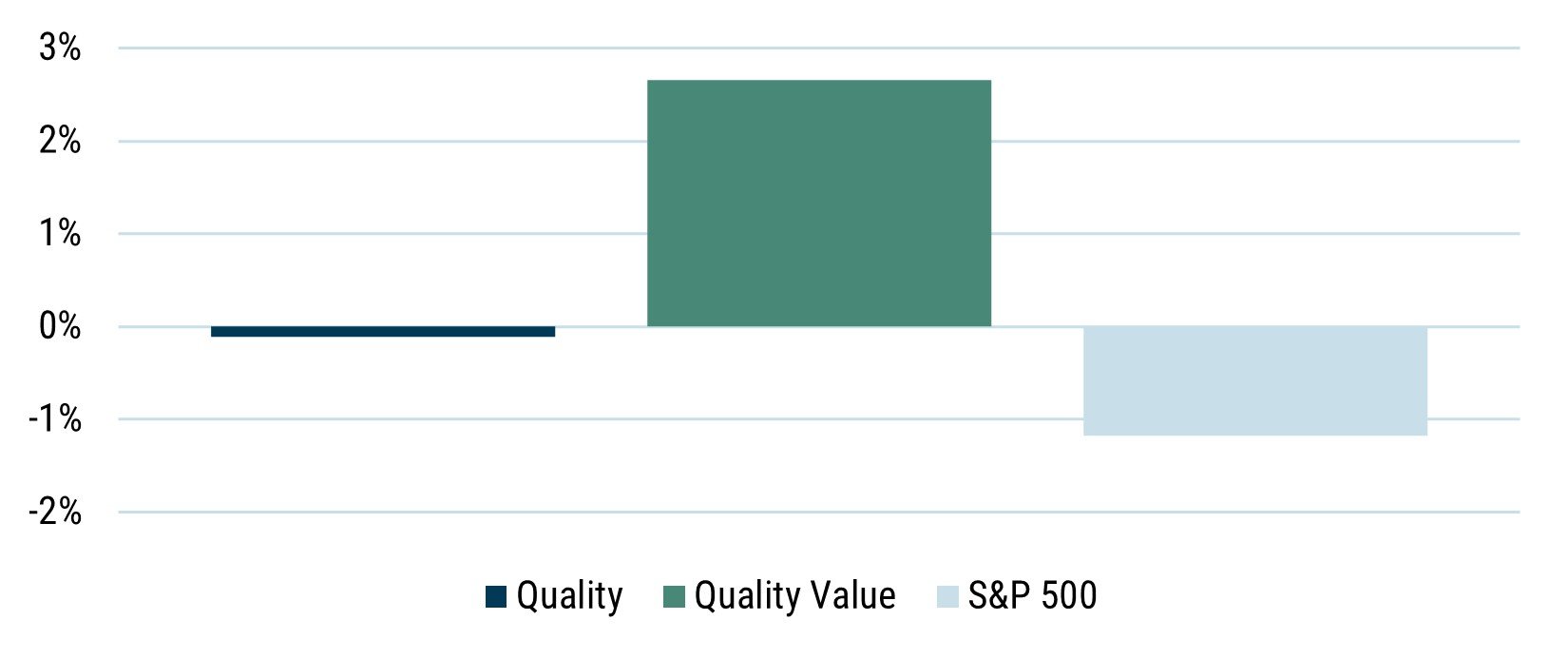

We see in the exhibit how the three equity portfolios fared compared to CPI across the data set. Reassuringly, the better proxy – cheaper high-quality stocks – generated inflation-beating returns while the S&P 500 lagged prices.

Average Real Returns During Inflationary Periods

Source: GMO

We believe that the GMO Quality Strategy is similarly well positioned for an inflationary environment today based on the fundamental characteristics of the holdings in the portfolio. First, we typically invest in relatively high margin businesses. This means that the companies’ exposure to cost inflation is lower per unit of revenues than for the market. If we assume that, like death and taxes, cost increases are more reliable than revenue increases, then quality companies’ margins are less at risk than the average. The reality, however, might be even better, as we would expect the majority of the businesses in which we invest to be able to raise their own sales prices given their entrenched advantages (e.g., in networks, intellectual property).

Second, our portfolio companies are typically relatively asset light, meaning that maintenance capex is lower than for the market. The maintenance of physical assets implies exposure to commodity prices one way or another, whereas previously established intangible assets are less immediately exposed. While most intangible assets do require reinvestment, that maintenance investment is largely intangible via technology, IP, and brand equity investments. These are disproportionately delivered via highly qualified and, frankly, relatively expensive personnel, especially in technology and healthcare, meaning that employees are not at the sharp end of household inflation and that any wage/inflation link is less mechanical in nature.

To sum, by putting together a century of empirical data and applying some fundamental logic, we believe that the GMO Quality Strategy is well placed today should another bout of sustained inflation be lurking around the corner.

Download article here.