Executive Summary

The U.S. dollar has been on a tear in recent months, bringing it to its highest valuation versus other major developed currencies in more than 35 years. While higher interest rates in the U.S. make shorting the U.S. dollar in currency forward markets a potentially tricky proposition, that interest rate differential is not an issue for holders of equities. An overvalued currency is a negative influence on the performance of equities in that country. By contrast, a cheap currency is a strong equity tailwind in the developed world, leaving developed markets like the Euro area and Japan poised to benefit from their undervalued currencies. To date, the effects of the expensive dollar have not been that noticeable for the U.S., but the impact has been quickly felt in other countries. The strong dollar and high commodity prices have pushed some less developed countries into distress. While a cheap currency seems to be an unalloyed good in the developed world, things are somewhat more nuanced in the emerging world where the benefits of an undervalued currency can be undermined by poor policy choices. Still, the valuation of currencies in the emerging world today are attractive enough that even allowing for some poor decision making, they should still be a source of equity market support over the next few years. Today’s combination of cheaper stocks and cheaper currencies outside the U.S. seems a promising backdrop for a reversal of the U.S. equity dominance of the last decade.

One of the most famous sentences ever uttered by a U.S. Treasury Secretary was John Connally’s November 1971 G-10 meeting quote that “The dollar is our currency, but your problem.” It’s a wonderful line, and the sentiment certainly resonated with European governments that were seriously annoyed with the fact that the Nixon administration had just ended the U.S. dollar’s (USD) convertibility into gold, thus unilaterally ushering the world into the age of purely fiat currencies. But despite the lasting fame of his quip, what Connally said was wrong, or at least its implicit message was wrong. In November 1971 the USD was most assuredly a problem for the United States, as a half-decade of rising inflation and a fixed conversion rate to gold had left the dollar massively overvalued versus its peers. It was a simpler world back then, though, and the act of moving off the gold standard started a major devaluation of the dollar, relieving the pressure on the U.S. economy. Today, the USD again is looking strikingly overvalued on many measures, and the impact is rippling around the world. The questions that equity investors need to be asking themselves today are whose problem that overvalued dollar is and how, if at all, should they be adjusting their equity portfolios in light of today’s currency environment?

Measuring Currency Valuation

Most versions of currency valuation models are some riff on “The Law of One Price,” which says that goods and services should cost the same irrespective of the currency in which they are priced. As the Economist’s famed model suggests, a Big Mac in Tokyo should cost the same as one in New York, or New Delhi. 1 As a quick glance at the Big Mac index would show, that “law” fails materially almost everywhere at any given point in time, and it does so particularly strikingly for countries whose development levels are meaningfully different. But despite this problem, currency valuation models are reasonably predictive and – given the lack of many better alternatives – widely in use in finance. According to the Bank of International Settlements’ Real Effective Exchange Rate model, 2 the dollar looks more expensive than in all but two events in the last 51 years – the levels in 1971 that signified the end of the Bretton Woods Agreement and the mid-1980’s dollar bubble that led to the Plaza Accord. 3 We can see all three periods clearly in Exhibit 1.

EXHIBIT 1: U.S. Dollar Real Effective Exchange Rate

Data from August 1971 to June 2022 | Source: Bank of International Settlements

Exactly why the USD has gotten so strong lately is not entirely clear, but one can point to a couple of different drivers. The USD tends to be a safe-haven currency – it rises in tough times for risk assets and falls in boom times. That can help explain the most recent upward jag, but not really the move from 2012-20 that got us from some of the lowest levels in history to quite elevated. Another recent driver seems to be carry. The Federal Reserve has been more aggressive in raising rates than other developed central banks and currency speculators do like betting on carry, as my colleagues in GMO’s Systematic Global Macro team discuss – and caution against – in their recent paper “Let’s Not Get Carried Away.”

The two prior peaks in the USD occasioned active policy measures by the U.S. and other governments to push it back down. Today’s levels aren’t quite as high. It would take another 5% move higher to get us to about where the dollar peaked in 1985, and we aren’t hearing talk of any repeat of the Plaza Accord. Certainly, the impact of the strong dollar doesn’t feel quite as big as it did then. Europe is not overrun with American tourists buying everything in sight, 4 and while a number of U.S. corporations have somewhat ruefully complained about the impact the rising dollar has had on their earnings, they are not screaming the way the likes of Caterpillar and Boeing did back then. Perhaps this means that currency valuation doesn’t matter as much as it did in the 1980s. Or perhaps the impact of a strong USD these days is less about the impact it has on the U.S. and more about what it does in other parts of the world. Given the answers to those questions might well be different in developed and emerging countries, I’m going to look at each separately.

Developed Currencies

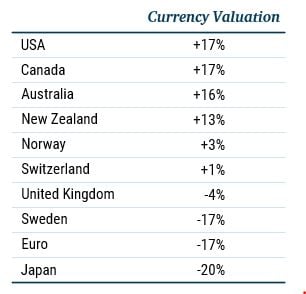

Because currencies can only really be valued in relationship to other currencies, the USD being overvalued mechanically implies that some other currencies must be undervalued. Table 1 shows valuations as of June 2022 across the G-10 currencies, 5 using a currency valuation model used by GMO’s Asset Allocation team. 6

Table 1: CURRENT G-10 CURRENCY VALUATIONS

Data as of 8/31/2022 | Source: GMO

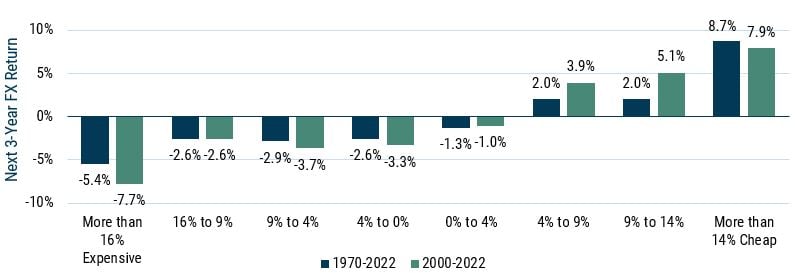

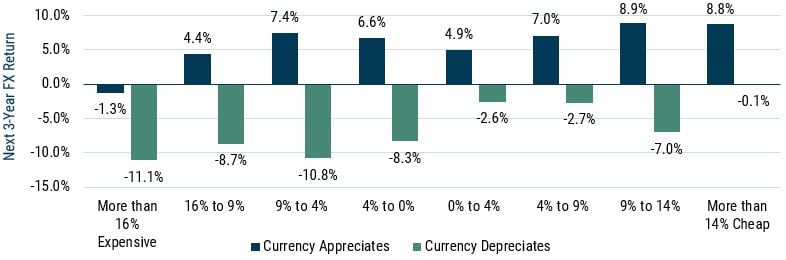

There are a few countries whose currencies look around as expensive as the USD (oddly, it is every G-10 currency with “dollar” in the name) and at the other end of the spectrum the euro and yen are pretty strikingly cheap. There is good reason to believe these differences should matter, both for the future returns of the currencies themselves and for future equity returns. Exhibit 2 shows the returns over the next three years for currencies sorted by starting valuations.

EXHIBIT 2: 3-Year Currency Returns by Starting Valuation

Data from December 1970 to June 2022 | Source: GMO

Ranges for bars were chosen to have roughly similar events in each in both the 1970-2022 and 2000-2022 periods.

The blue bars in the chart show returns over the entire period of floating currencies in the developed world and the green bars show returns since the turn of the millennium. This second set of bars helps us check whether the effects of currency valuations are still as impactful as they were in the past. While the detailed shape of the two sets of bars is slightly different, there is no indication that the power of currency valuations to predict future currency returns has deteriorated.

Of course, this would be of little interest to equity investors if local equity markets anticipated currency moves and accounted for them. But that is definitely not the case, as we can see in Exhibit 3.

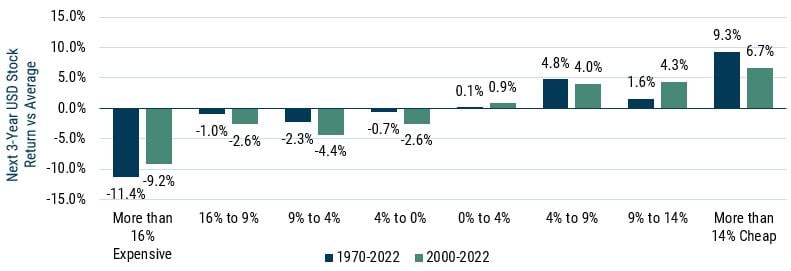

EXHIBIT 3: 3-Year Relative USD Country Returns by Starting Currency Valuation

Data from December 1970 to June 2022 | Source: GMO, MSCI

Ranges for bars were chosen to have roughly similar events in each in both 1970-2022 and 2000-2022 periods.

Countries with substantially overvalued currencies see their equity markets underperform sharply, and countries with cheap currencies outperform substantially. This has remained true over the last two decades.

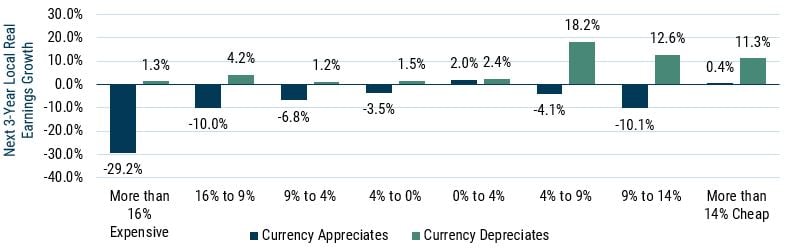

It may seem as if equity market moves are basically just driven by the currency moves we saw in Exhibit 1. "Buy equity markets with cheap currencies and you’ll see a nice windfall as the currency appreciates,” one might surmise. But under the surface there is something pretty interesting that that narrative glosses over. Having a cheap currency is a very good thing for the competitiveness of companies whose costs are based in that country, whereas an expensive currency makes local companies uncompetitive. If the currency moves promptly back to fair value, the competitiveness impact might not be a lasting one, but if the currency stays misvalued, it could be significant. So, let’s look at what happens to the underlying fundamentals of stock markets where the currency stays misvalued versus when it reverts back to fair value. Exhibit 4 shows the real local earnings growth for countries sorted by starting currency valuation. I’ve segregated the data into two groups – those countries whose currencies rose over the next three years and those whose currencies fell. 7

EXHIBIT 4: 3-Year local real earnings growth vs Starting Currency Valuation

Data from 1990-2022 | Source: GMO, MSCI

This is a bit of a messy chart, so it’s worth explaining what seems to be going on. In blue we have all countries whose currencies appreciated over the following three years, sorted by their starting currency valuations. In general, countries with rising currencies experienced weak contemporaneous local earnings growth – about 7% worse than the average country over the last 30 years. But those countries whose currencies started substantially overvalued and then appreciated saw disastrous real earnings growth, whereas those countries whose currencies were not overvalued to begin with saw a significantly less bad earnings impact from their currency strength. By contrast, countries whose currencies depreciate over a three-year period experience pretty good contemporaneous earnings growth – a mirror impact of +7% impact versus average. But those countries whose currencies started out cheap to begin with experienced double-digit earnings outperformance, while those whose currencies were not undervalued performed in line with the average country.

What this tells us is that equity investors in countries with overvalued currencies have two ways to lose and those with undervalued currencies have two ways to win. On one path, the currency moves back to fair value. If that is true, earnings growth is likely to be about average and the currency move will generate a corresponding equity move on a common currency basis. If the currency does not move back toward fair value, the earnings growth for expensive currency countries will be well below average and growth for cheap currency countries will be far better than average. Countries whose currencies appreciate over the next three years generate better total returns than those whose currencies depreciate, but in either case you’d be much better off in the countries whose currencies were cheap to start with, as we can see in Exhibit 5.

Exhibit 5: 3-Year Relative USD Returns vs Starting Currency Valuation

Data from 1990-2022 | Source: GMO, MSCI

The average country with an appreciating currency outperforms by about 6%, but those countries with the most overvalued currencies to start with managed to buck that trend and mildly underperform. Countries with depreciating currencies, on the other hand, almost always underperform, and the only countries to avoid substantial underperformance were those where the currency started out cheap to begin with.

So what does this all suggest for investors in developed markets today? The USD and other “dollar” currencies are just on the verge of a level of overvaluation that augurs lousy returns for equity investors over the next three years. The Euro area and Japan, by contrast, have currencies that are sufficiently cheap that it should be a real help to their markets. The simplest way for that to play out would be for the cheap currencies to appreciate and the overvalued ones to fall over the next few years. But even if that doesn’t happen, Europe and Japan look poised for stronger earnings growth than the dollar group.

Emerging Currencies

Not every currency is part of the G10, and in the emerging world an expensive USD might be as much a problem as a help. The most obvious reason for the difference is the fact that many emerging countries borrow in USD. As the USD rises relative to their home currency, such debt becomes a heavier burden to manage. Beyond that, the fact that many traded goods are priced in USD means that for many emerging countries a weak currency can lead to a balance of payments problem as well as higher inflation. A combination of rising inflation, a weakening economy and difficulty servicing external debt is an impressively nasty combination, and we see it in a number of countries in the emerging world today. The economies of Sri Lanka and Lebanon are in chaos after they recently defaulted on their external sovereign debts, and other nations such as Ukraine, El Salvador, Pakistan, Argentina, Ghana, Kenya, and Tunisia are priced as if default is a high likelihood in the next few years. But from a practical perspective for most investors, the travails of these countries are simply not all that important. None of them is in the MSCI Emerging Market Equity index and their weights in the J.P. Morgan emerging debt indices in total is less than 5%. 8 Furthermore, as my colleagues Carl Ross and Eamon Aghdasi wrote recently in “Emerging Countries Are More Resilient Than They Get Credit For,” the pricing of these distressed countries already assumes quite low recoveries relative to the history of emerging sovereign defaults, suggesting there may not really be much downside left even in default. As a result, the issues across the less developed world caused by the strong dollar may be more humanitarian and geopolitical in nature than issues that will meaningfully impact investment portfolios.

Beyond the question as to whether a cheap currency is a good or bad thing, let’s first ask the question as to whether we can even measure currency valuation in the emerging world. The law of one price certainly does not hold between countries at very different development levels – no one would expect a haircut in Alexandria, Egypt to cost the same as in Alexandria, Virginia. But that substantial relative pricing effect – empirically known as the Penn effect and theoretically as the Balassa-Samuelson effect 9 – can be adjusted for, and the models we use at GMO attempt to do just that. Of course, even assuming our models can succeed in that adjustment, there are other potential issues. In general, political and economic institutions in emerging countries are weaker than they are in developed economies. For countries with a chronic problem controlling inflation and/or where the currency has suffered repeated large falls, the economy may become effectively “dollarized.” In that situation, households lose faith in their own currency and prices wind up explicitly or implicitly indexed into the USD or other external currency. For a substantially dollarized country, a currency fall would not really change competitiveness, but rather herald a later spurt of inflation that would undo whatever competitiveness looked to be created when the currency fell. 10 So, findings in the developed world might fail to translate into the emerging world. On the other hand, they may hold up, so let’s look at what the models show.

Table 2 shows the current valuations of major emerging market currencies relative to the USD today.

TABLE 2: CURRENT EMERGING CURRENCY VALUATIONS VS USD

Data as of 8/31/2022 | Source: GMO

Looking at the expensive end of the list, Russia is clearly a special case given the strange nature of the sanctions-constrained Russian economy, although the Indonesia rupiah looks even more overvalued and has no such excuse. At the other end of the valuation spectrum, Turkey provides a different kind of problem that is harder to shrug off. The Turkish lira has fallen by 90% relative to the USD over the past decade. While Turkey has had much higher inflation than the U.S. over that period – 16.9%/year versus 2.6% for the U.S. – on the face of it the lira looks to be extremely undervalued. But the manipulation of the Turkish economy by the administration of President Erdogan almost certainly renders CPI a misleading (and possibly falsified) measure of the true prices that prevail in Turkey today. Beyond that, the economic policies adopted by Turkey in response to its currency problems have been sufficiently wrong-headed by conventional standards that it is hard to imagine that Turkish corporates have benefitted from the increased competitiveness we saw in the developed economy example.

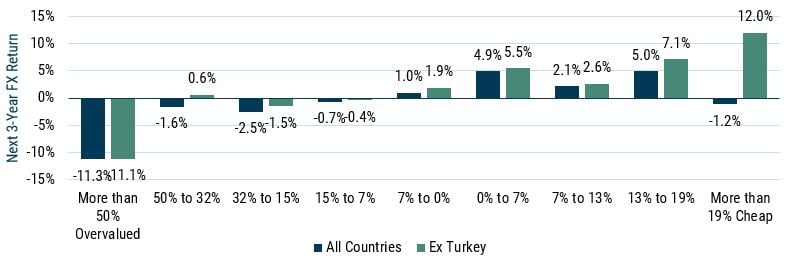

Let’s see whether the Turkish example has rendered currency valuations a less valuable signal than we found in the developed world. Exhibit 6 shows the 3-year currency relative to currency returns sorted by starting valuations in the emerging world.

EXHIBIT 6: 3-Year FX Return vs Starting Currency Valuation in Emerging Markets

Data is from 2000-2022 | Source: GMO

Very expensive currencies have clearly done quite badly over time, and cheap ones have done better, although the cheapest cohort has not done that well. As it turns out, that is entirely due to Turkey, as we see in the green bars that exclude that country. Honestly, though, it’s not entirely clear whether the direct currency returns matter as much here as in the developed world, because not all of these currencies are deliverable and hedging costs can deviate importantly from inflation and interest rate differentials. But currency valuations also have a meaningful effect on equity returns in USD, as we can see in Exhibit 7.

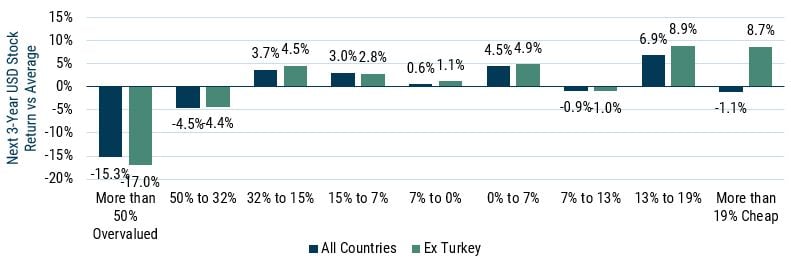

EXHIBIT 7: 3-Year USD Relative Equity Returns vs Starting Currency Valuation

Source: GMO

In blue, we can see that countries with substantially overvalued currencies have meaningfully underperformed, although the very cheap currency countries have not done correspondingly well. 11 Once again Turkey seems to be the culprit, as the green bars that exclude that country are much better behaved at the cheap end. Beyond Turkey, though, our sample also may suffer biases because we chose the countries that were decently liquid when we started to build this model about 15 years ago. Perhaps if we had built the model a decade prior to that we would have included countries like Argentina and Venezuela where equity investors would have been even less well served buying when the currency flashed very cheap.

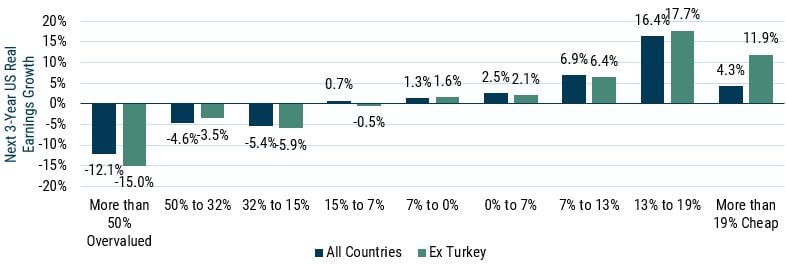

As for why the countries with expensive currencies do poorly, the story looks quite similar to the developed world. Earnings growth is much better in those countries with cheap currencies, as we can see in Exhibit 8.

EXHIBIT 8: 3-Year Real USD Earnings Growth vs Starting Currency Valuation in Emerging Markets

Source: GMO

The earnings impact of currency valuations is arguably even stronger than in the developed world, and largely survives the Turkey problem even if the numbers look substantially better excluding it. Once again, this is not simply about cheap currencies leading to currency appreciation. 12 The underlying fundamentals for corporations in countries with cheap currencies outperform those with expensive currencies. The good news today for emerging equity investors is that only one relevant country is even approaching a dangerous looking level of overvaluation – Indonesia. Beyond that, China is trading slightly above fair value and all the other major currencies are cheap. And when we look at the countries screening very cheap aside from Turkey, none of them look like particular candidates for Turkey-esque damaging policy making. 13

So, what does all this mean for equity investors?

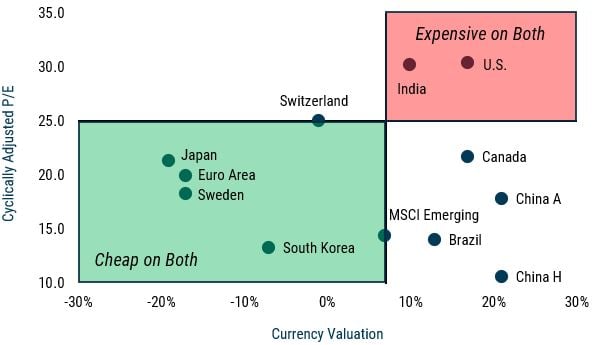

Today’s strong USD looks, in the end, to be our currency and our problem. The USD, alongside the other “dollars” in the developed world, looks to be overvalued enough to be a significant headwind for companies in those countries and it seems likely to weigh on those stock markets over the next few years. The Euro area and Japan look likely to be the biggest beneficiaries, as they are the developed market currencies that are sufficiently undervalued to suggest both strong local earnings and strengthening currencies over the next several years. Exhibit 9 shows a scatter chart of major countries with their equity market valuations on the vertical axis and currency valuations on the horizontal axis. The origin is set as the MSCI All Country World index average.

EXHIBIT 9: Equity Market Valuation and Currency Valuation

Source: GMO

The U.S. and India are the two countries with the dubious distinction of being notably expensive in both equity market and currency terms, whereas Japan, Korea, Sweden, and the Euro Area all have the alluring combination of being cheap on both. Emerging as a region is far and away the cheapest on equity valuations and its aggregate currency valuation is exactly average – cheap from a USD perspective but not particularly from that of the “average” currency. (Not everything with emerging in the name is exactly the same. The emerging equity and emerging debt indices have meaningfully different country compositions, and the J.P. Morgan GBI Emerging Bond index has a materially cheaper currency basket than the MSCI Emerging Market Equity index. Because it’s not an equity index I don’t have a place to put it vertically on the scatterplot, but it would score as about 10% cheaper on currency valuation than its equity counterpart, midway between MSCI Emerging and South Korea. 14 )

I’ll admit to being enough of a believer in the power of buying undervalued equities to find the appeal of the cheaper equities in emerging markets outweighs the draw of the cheaper currencies in Europe and Japan in my ranking of favorite regions. But I can certainly respect anyone who concludes that the charm of getting into extremely undervalued currencies is worth paying up a bit in equity valuation terms. But whichever you prefer – the cheapest currencies or cheapest stocks – the U.S. (and India) seems the least appealing of the bunch.

In terms of practical takeaways for USD-based investors, I’d suggest the following:

Equity Investing

- Favor European and Japanese equities over U.S. due to their cheaper currencies and relatively cheap equity valuations – equity investors in countries with overvalued currencies have two ways to lose and those with undervalued currencies have two ways to win; the equity markets are cheap enough to make it clear no one is pricing in that benefit.

- Favor emerging countries over U.S. due to cheaper currencies and much cheaper equity valuations – do keep an eye out for dangerously destructive economic policies, but don’t use that as an excuse to avoid the asset class entirely.

Hedging

- If you do not currently hedge non-USD equities, don’t start now.

- If you do hedge non-USD equities and are considering relaxing your policy, this would be a good time to do so. The yen and euro are at their cheapest levels in decades and hedging emerging market equities would be an expensive proposition even if the currencies weren’t generally cheap versus the USD.

Register for full access to GMO's Research

Strictly speaking, MacDonalds doesn’t sell a Big Mac in India, but the Economist is far too resourceful to let that stand in the way. It seems to have switched to using one version or another of the “Maharaja Mac,” which substitutes lamb or chicken for the beef.

Real Effective Exchange Rate is a measure of a currency’s value against a weighted average of foreign currencies divided by a price deflator. In this case it is the “narrow” version of the index, which covers a subset of global currencies but goes back far enough to show the 1971 and 1986 USD peaks.

The Plaza Accord was an agreement reached in the fall of 1985 for coordinated intervention by leading economies to push the USD down. It succeeded spectacularly well, enough so that only two years later the countries had to reach another agreement – the Louvre Accord – to get the dollar to stop falling.

Easy for me to say as an American who made only a brief foray to the U.K. this summer. But while travel has clearly been a mess in Europe this summer, neither my European friends nor the press seem to be particularly blaming American tourists for the problem. On the other hand, my colleague Drew Edwards was quite giddy about the prospects of upgrading his pre-Covid wardrobe on his recent trip to Tokyo. In contrast to decades of experience, everything is on sale in Japan for holders of the mighty USD.

For reasons that presumably make sense to currency traders, the G-10 currencies are not the currencies of the Group of Ten economies, but rather the most liquid 10 developed currencies. Given that several members of the actual Group of Ten are members of the euro, I guess something had to give somewhere.

This model uses the basic purchasing power parity methodology but makes adjustments for different income levels across countries and different levels of income inequality.

The data here is from 1990-2022. I needed to use a longer time period than just the last 20 years in order to get sufficient population of countries in all of the groups.

4.9% in the J.P. Morgan Emerging Markets Global Diversified index, and lower weights in Emerging Markets Global and Emerging Markets indices.

More specifically, the Penn effect was a result found as early as the 1950s that income ratios in high- and low-income countries were exaggerated when GDP was converted at market exchange rates. The Balassa-Samuelson effect is a mechanism by which this effect would be expected to occur.

Argentina is a pretty good example of such a country. The 2001-2002 devaluation when the peso fell by about two-thirds versus the dollar ushered in a huge burst of inflation, pushing prices up by a similar magnitude over the next several years. When the currency again fell by two-thirds from 2013-2016, the local price level similarly tripled. In neither case did the currency fall lead to any lasting benefit in the country’s competitiveness.

The ranges of the currency valuations are a lot wider in the emerging world than the developed world. Once again, I tried to build the groups so they had fairly similar numbers of countries over time. It shouldn’t be a huge surprise that currency valuations get further from fair value on this type of model. Not only is it the case that emerging currencies tend to be significantly more volatile than developed currencies, but the scope for a PPP-based model to be biased for a particular country is a lot bigger as well.

There is a notable difference between the behavior of emerging and developed countries, however, that made the analysis of emerging countries simpler. On a contemporaneous basis, emerging market currencies and country earnings have a decided positive correlation – think of it as emerging currencies tending to strengthen when their economies are doing well, which is not a notable pattern in the developed world. Therefore, there was no need to separate the chart into the sub-categories of appreciating currencies and depreciating currencies.

To be a little more specific here, none of the four other countries that are more than 20% undervalued today (South Korea, Chile, Hungary, and Poland) have any recent history of currency instability or implicit dollarization. And while populist governments are certainly capable of poor economic decision-making – all four countries could probably be accused of having populist leaders of one stripe or another – none has yet suggested any measures that look likely to meaningfully interfere with the benefits that would otherwise accrue from having an undervalued currency.

Obviously, that leaves emerging local debt looking pretty cheap versus USD, but not particularly close to as cheap as euro- or yen-denominated debt. But as the yields on emerging local debt are hugely higher than they are in those markets, it still seems the better buy.