Executive Summary

Enthusiasm for Japanese equities picked up in 2023 as evidenced by the 28% rally in the TOPIX (local) index through November. Supportive headlines regarding shareholder-friendly policymaker initiatives along with earnings upsides from companies propelled stocks higher. Most active managers and investors, however, remain underweight and skeptical of Japanese equities. Perhaps the more pedestrian U.S.-dollar (and euro) returns due to yen depreciation have failed to excite them, but more likely many worry that improved company fundamentals will not persist.

We believe Japan is undergoing durable fundamental improvements and lasting change in attitudes toward shareholders. GMO’s 7-Year Asset Class Forecast framework sees Japan small value equities poised to deliver strong absolute returns of 12%, ranking them amongst our highest forecasts. Four “4s” make us particularly excited about small value equities in Japan right now:

- 4% Real Returns due to Fair Valuation: Japan broad equities look about fairly valued and priced to deliver 4% real returns.

- 4 New Initiatives: Four recent policymaker initiatives should provide support for company fundamentals and shareholder returns.

- 4% Alpha from Tilting to Small Value: Active managers who dial into cheap small value stocks stand to capture an additional 4% of returns.

- 4% Tailwind from Cheap Yen: If the yen reverts slowly back to fair value, USD-based investors stand to pick up a 4% tailwind.

This paper details the key observations regarding the opportunity in Japanese equities which we presented at GMO’s 2023 Conference in November. 1

4% Real Return Forecast Supported by Improving Fundamental Performance

Two key drivers underpin GMO’s forecasts: valuations and fundamental growth. After the recent run in Japanese equities, valuations look fairly valued for the broad universe. The interesting part of the story lies with fundamentals. While many believe recently strong fundamentals are a head fake and will revert to lower levels, evidence suggests otherwise.

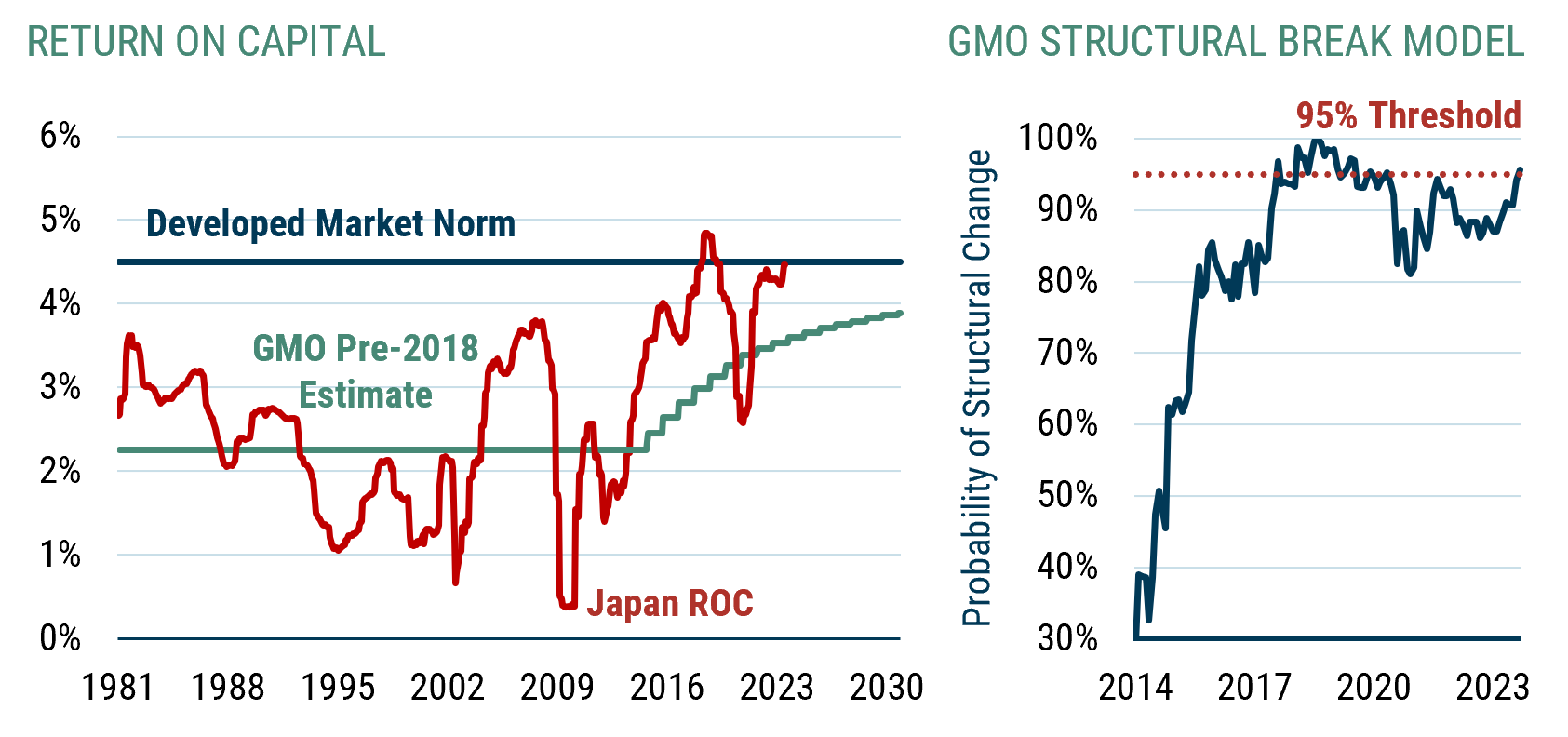

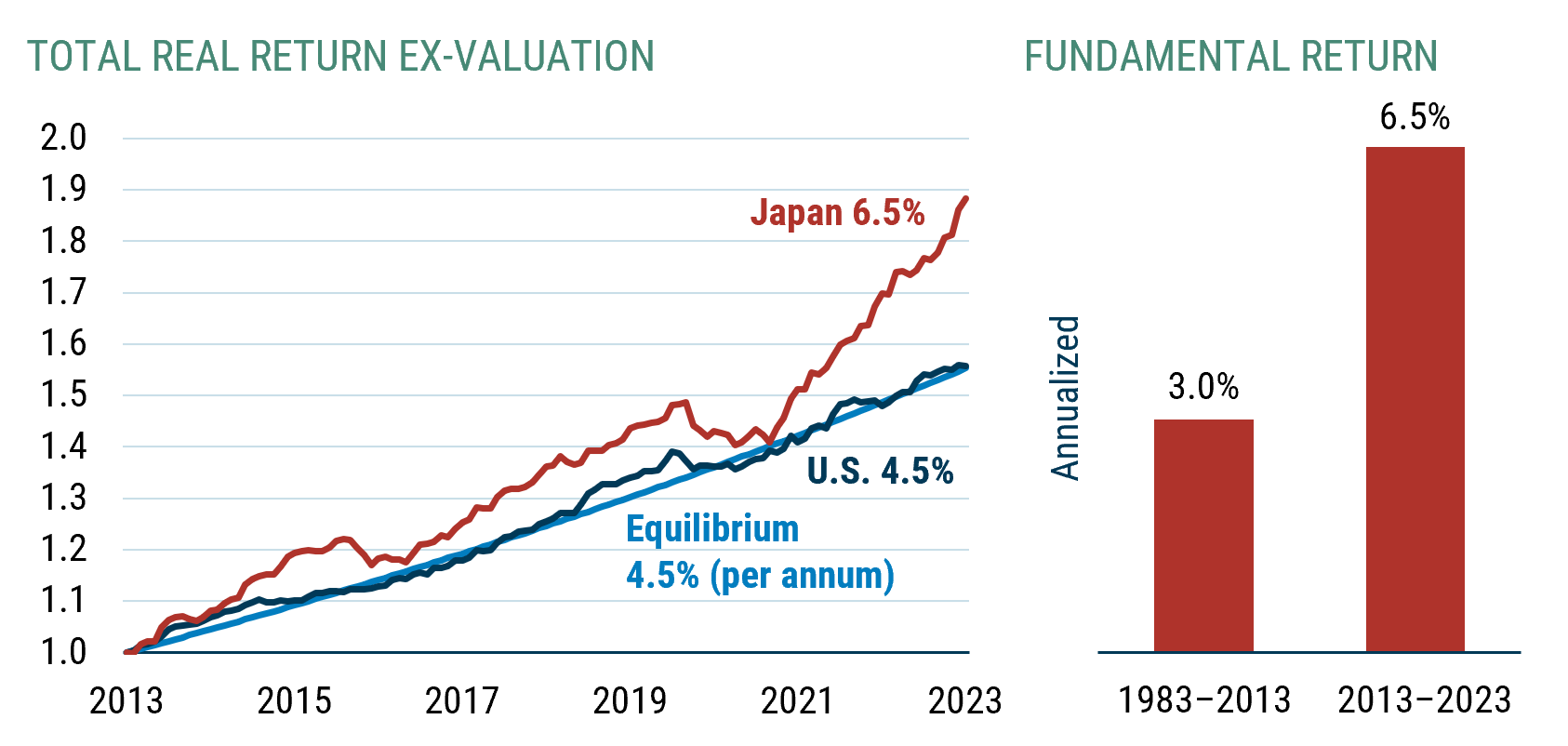

Most investors do not realize that Japan has been delivering superior fundamental growth for years. Exhibit 1 charts the returns shareholders earn from distributions and fundamental growth, ignoring the effects of valuation change. The smooth 4.5% annualized return line is consistent with what we expect stocks to earn in our “Low” base-case forecast scenario, and it’s roughly what we think equity markets should have delivered over the last 10 years.

Exhibit 1: Fundamental RETURN has been strong in Japan

As of 9/30/2023 | Source: GMO, Compustat, WorldScope, Shiller, MSCI

Data shows total return exclusive of valuation change. Valuation is a blend of price to sales, gross profits, book value, and smoothed earnings. Book value and smoothed earnings make use of GMO’s proprietary accounting values. Indexed to 9/30/2013.

Interestingly, it is almost exactly what U.S. companies earned over this period. Japanese companies, however, did much better delivering 6.5% fundamental performance. This might be surprising given the U.S. equity market outperformed the Japanese market when measured in dollars, but that is because valuation changes and currency movements more than offset the fundamental advantage Japan delivered. While investors did better owning U.S. equities over the last decade, underlying corporate performance was actually better in Japan.

Investor skepticism about the durability of Japan’s relatively strong fundamental performance makes sense given past experience. As the bars on the right of Exhibit 1 indicate, over the prior 30 years, corporate Japan earned a disappointing 3% real return. Thirty years of fundamental disappointment is a long time to forget.

The key question is what is more relevant going forward – the past 10 years or the 30 years before? Are we going back to the old normal of 3% real fundamental performance, or has Japan changed in an enduring way where we should expect something better? Understanding our estimates of return on capital (ROC) in Japan helps answer these questions. Afterall, it’s return on capital that generates the cash flow that can either be distributed to shareholders or reinvested for growth.

Exhibit 2: Returns on Capital are converging with global norms

As of 9/30/2023 | Source: GMO

Low forecast scenario.

Not surprisingly, Japan’s disappointing fundamental return in the eighties, nineties, and aughts corresponded to a period where returns on capital were disappointing. During those decades, Japan’s ROC, shown in red on the left of Exhibit 2, averaged only about half of what we estimate companies in developed markets should deliver (i.e., the blue line at 4.5%). Indeed, up until about 2018 our base case when forecasting Japanese market returns (the flat green line in the ROC chart) was to assume that ROCs would mean revert around this level of half of normal profitability. But by 2018 we had seen a change in ROC that was hard to ignore – ROCs had, for the first time on our data – exceeded what we assume to be normal. Further, after years of stronger returns on capital, we believed Japan had reached a permanent inflection point.

The chart on the right of Exhibit 2 represents a structural break model which asks how likely is it that ROCs were no longer mean reverting around the flat green line. By 2018, the model had put the odds of a structural break as a near certainty. We therefore changed our forecast model by assuming that profitability in Japan was slowly transitioning toward developed market norms (the stairstep section of the green line on the left.) In our view, Japan’s ROC improvement was not a head fake and would continue to converge toward the developed market norm, not fall back toward the old flat line.

Over the last five years since we made the change, ROC has remained high, except during the depths of Covid, and is very close to the developed market norm today. If we roll our structural break model forward, it still sees roughly a 95% chance that ROC is not reverting around that old historical norm. If profitability slowly continues to improve toward global norms, fundamental performance should be better in Japan going forward than it was before Abe’s reforms.

What does that mean for our forecasts? Today Japan trades right around what we would consider fair value, so our forecast from valuation change is immaterial. Essentially all the return that we expect comes from fundamentals, which we model to deliver 4.2%. Combining these effects, Japanese equities should deliver 3.9% in real terms (as of 10/31/23). Not particularly exciting, but not bad, either. 2

4 Policy Initiatives Should Support ROC Improvement

The recent rise in ROCs has been propelled by policymaker initiatives and reforms striving to augment Japan’s corporate governance. We believe four recent policy initiatives will continue the progress seen to date.

We have written previously about how the aggregate impact of policies implemented following the burst of Japan’s bubble in the 1990s intensified with the re-election of Abe in 2012 and changed the Japanese corporate mindset and results for shareholders. 3 In many ways, Japanese policymakers, who have long studied the economic and market systems of the United States and Western Europe, are emulating the shareholder-friendly evolution that occurred in the United States which began in the 1970s and culminated with the “Reaganomics” era of the 1980s. We believe four new and pending initiatives could positively impact Japan’s corporate ecosystem and equity markets and may very well accelerate adoption of shareholder-friendly corporate behaviors. They include:

- Kishida’s “Asset Management Nation” Initiative

- Labor Market Reforms

- Consolidation & Market for Corporate Control

- TSE’s 1x Price to Book Initiative

An “Asset Management Nation”

Prime Minister Kishida recently announced the goal to turn Japan into an “asset management nation” to improve capital allocation and capital efficiency. In essence, Japan is embarking upon reforms like those that sparked the shareholder revolution in United States with the passing of ERISA and the introduction of 401(k)s in the 1970s. Japanese leaders’ first aim is to unlock the $14 trillion of household financial assets tied up in cash deposits through a revised “NISA” program offering tax benefits and portability similar to the U.S. 401(k) program. The new NISA would make the program permanent and the tax-exempt holding period unlimited while tripling the annual investment limit and raising the tax-exempt limit. Goldman Sachs estimates that the launch of the new NISA program in January 2024 could lead to individual investors buying ¥5–9 trillion in Japanese stocks over five years. 4

Secondly, the government seeks to double down on a tailwind that has been in place for some time – pushing institutional investors to focus more on their fiduciary duties. Just as institutional investor representation of U.S. equity ownership grew from about 10% in the late 1960s to over 50% following the passage of ERISA and 401(k) regulations in the U.S., the ratio of proxy-voting-institutional investor ownership in Japan has increased to a critical threshold. Rather than passively approving management proposals, more investors are voting their proxies as responsible fiduciaries, as this year’s high-profile Canon case illustrates. Canon’s revered CEO Mr. Mitarai survived a vote to remain on the company’s board by a mere 60 bps because Canon’s board failed to meet institutional investor proxy voting requirements. The impact of this near miss for such a widely admired and followed leader has been palpable. Every CEO knows about Mr. Mitarai’s close call and is saying “if it could happen to Mitarai-san, it could happen to me!”

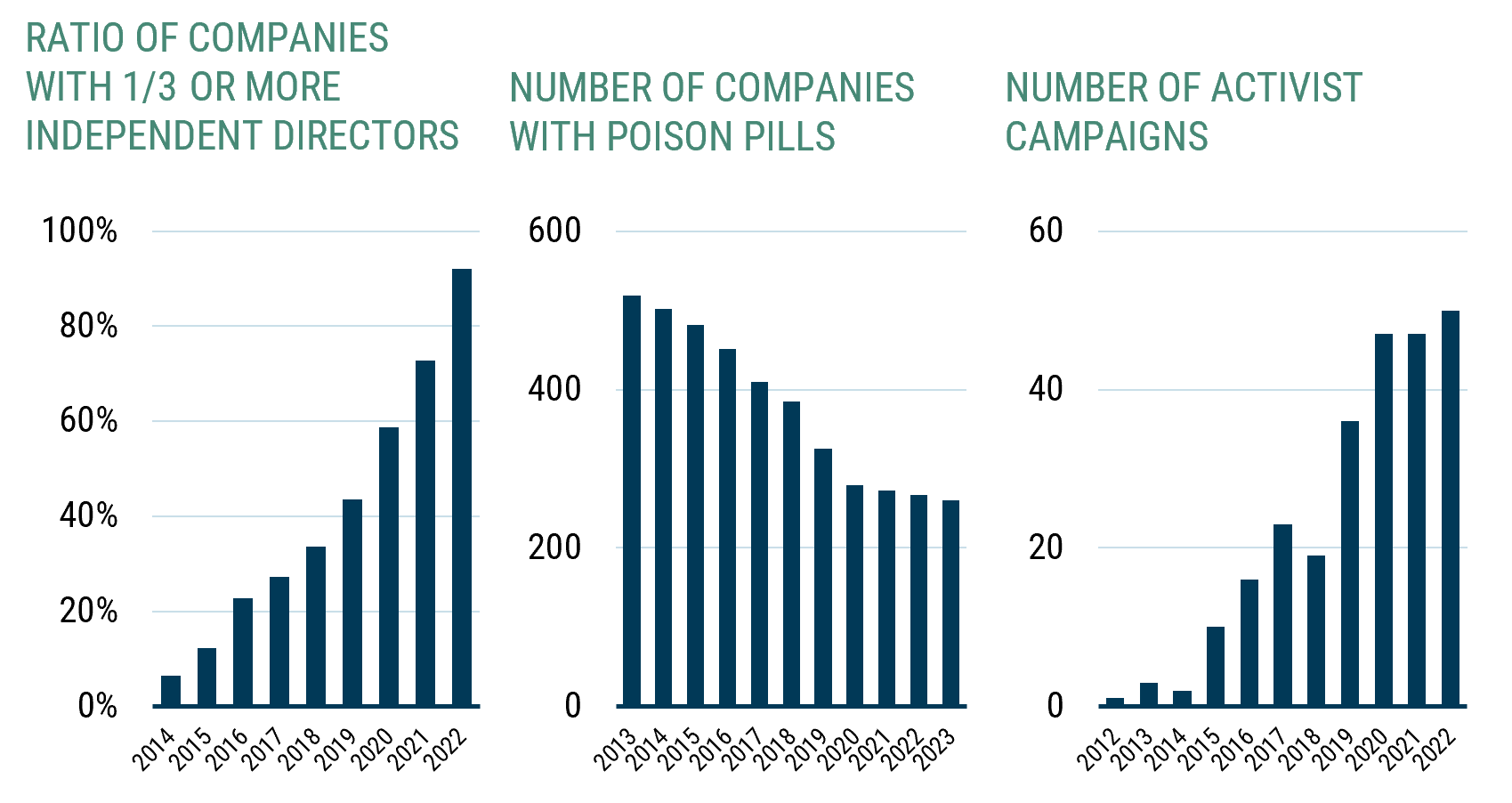

Like in the U.S. following changes in the 1970s, investors in Japanese equities are becoming more vocal and pushing for stronger corporate governance. Until recently, Japanese company boards were insular and unrepresentative of shareholders, just like those in the U.S. before the advent of ERISA. But similar to the U.S., companies are responding to pressures for investor representation and have increased the number of independent directors on their boards. As the display on the left of Exhibit 3 suggests, a decade ago most companies had no or limited independent directors, but today almost all companies have at least one-third independent directors. Institutional investors moreover have begun to vote down poison pills and support the growing number of initiatives put forth by activists (see center and right charts of Exhibit 3).

Exhibit 3: Growing voice of institutional investors

Source: TSE, JPX; IR Japan

Labor Market Reforms

Beyond pressing for more efficient capital deployment, the Kishida administration is tackling another structural issue which has weighed on the competitiveness of Japanese companies and capital – a rigid labor market with low productivity. Policymakers are pushing to make Japan’s labor market more liquid and productive to revitalize the country’s economy. The Japanese government has or is in the process of introducing several market reforms such as moving from seniority-based pay to merit-based compensation schemes and by enabling easier hiring and firing practices relative to the entrenched lifetime employment attitude prevalent in Japanese corporate culture. The timing of such policies is right considering Japan’s demographic headwinds and tight labor market.

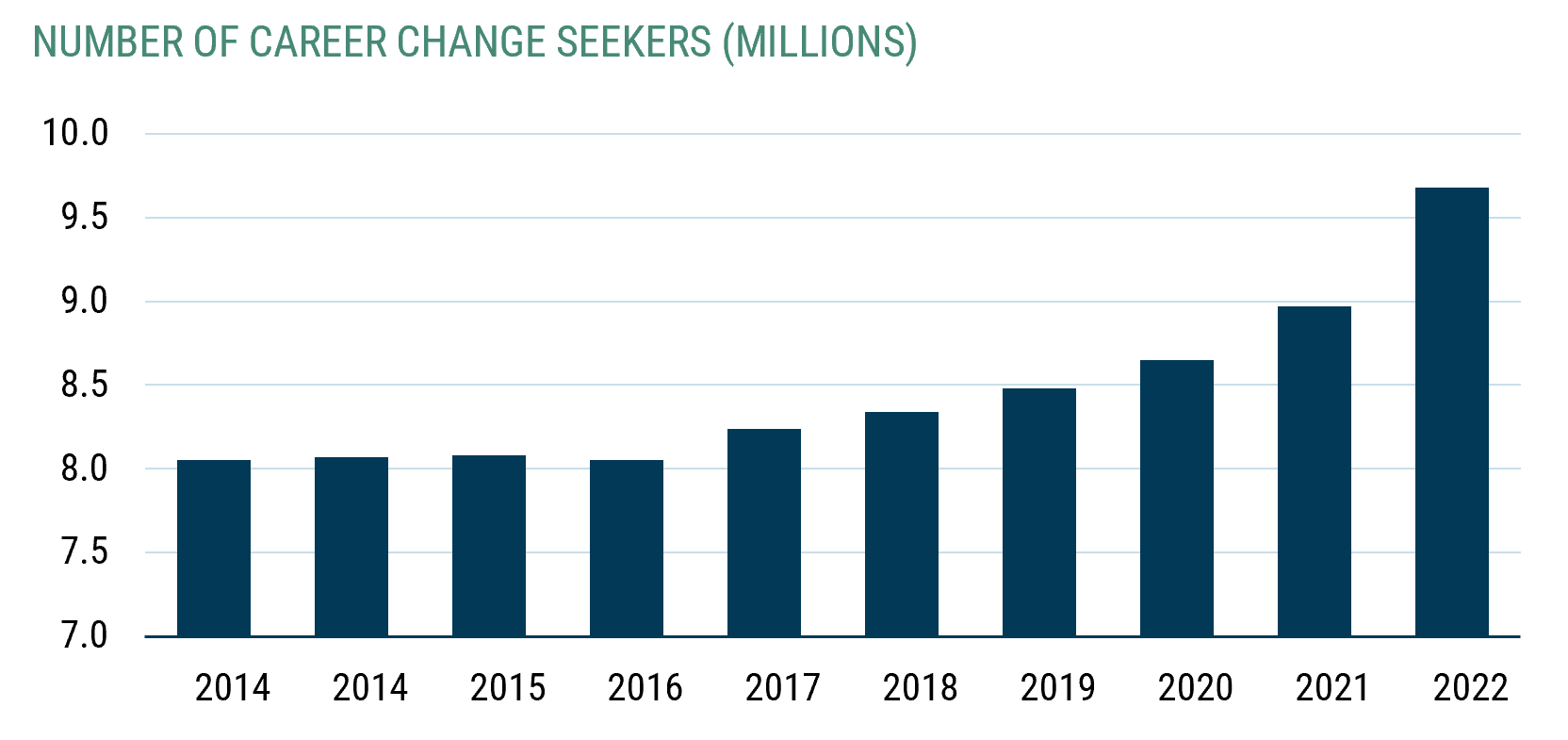

The aforementioned NISA initiative plays an important role in labor market reform with the U.S. experience again being instructive. Prior to the 1970s, large U.S. employers provided pensions designed to make it more difficult for employees to change employers given employees risked losing retirement benefits if they changed firms. When 401k plans broke this constraint by offering portability, labor became more mobile. Japan’s NISA program is intended to accomplish the same. While some regulations are still pending, labor markets have already seen signs of change. The number of employees looking to switch careers is rising quickly as Exhibit 4 suggests. 5

Exhibit 4: Japan is changing labor practices

Source: MIC Statistics Bureau; Nikkei Asia

Consolidation & Market for Corporate Reform

One key goal of the MacArthur-led rebuilding of the Japanese economy post-WWII was to eliminate the monopoly power of the owner-controlled zaibatsu system to foster competition. Perhaps the General’s plan worked too well. Japanese industries are very fragmented with companies aggressively competing, often to a point where it is difficult to generate reasonable returns on capital. Does Japan really need 10 auto makers and 13 printer manufacturers?

Japan’s Ministry of Economy, Trade and Industry (METI), through its recently revised “Fair M&A Guidelines,” is trying to address this issue by encouraging M&A to drive consolidation and to create national champions. Further, METI wants to create a more active market for corporate control by requiring management teams and boards of directors to actively consider bids. Unlike in the United States, Japan does not have a ”Revlon standard” requiring boards to maximize shareholder value in an M&A event. In fact, boards often ignore offers hindering an active and objective market for corporate control, which in turn leads many companies to persistently trade below intrinsic value. Over time, METI’s efforts should benefit shareholders by improving profitability as industries consolidate and by improving value realization (i.e., takeover premia) coming from a more active market for corporate control.

While METI’s revised guidelines have not yet been implemented, their announcement has already had an impact. When Nidec, a Japanese manufacturer of electric motors, launched an unsolicited offer for another listed company, Nidec’s CEO Nagamori specifically pointed to METI’s revised guidelines to justify his hostile approach. Further, the 49 takeover bids/tender offers launched in 2023 (through September) stands at its highest level since the launch of Abenomics in late 2012.

Tokyo Stock Exchange’s 1x Price to Book Initiative

The policy which has captured the most attention in 2023 has been the Tokyo Stock Exchange’s (TSE) new corporate governance reform agenda focused on improving listed company price/book ratios (PBR). At the beginning of the year, over half the companies on the TSE Prime exchange traded below 1x PBR with ROEs <8%, far below developed market norms. The TSE published a request for listed companies to explain and disclose their cost of capital and action plans to generate return of capital above the cost of capital.

The fact that this high-profile policy is coming from the stock exchange and Financial Services Agency regulators is drawing significant interest. Every CEO we have met is aware of this initiative, which is the equivalent of the NYSE and SEC telling U.S. companies to do more to improve their profitability and increase their valuations for shareholders. The TSE's continued pressure on Japanese corporates has been partially responsible for the reduction in the number of companies trading below 1x PBR.

Companies have stepped up their pace of share buybacks and reductions in crossholdings to improve PBRs. According to JP Morgan, 65% of the companies trading with PBR <1 on the TSE Prime exchange announced buybacks and/or dividend raises through mid-November. While the number of companies announcing share buybacks decreased modestly year over year, companies guiding toward higher dividends jumped meaningfully. There have also been a growing number of prominent examples of companies unwinding cross held shares. For instance, the Toyota Group, which has rigidly resisted calls to unwind its web of cross holdings, just announced plans to sell shares of Denso and KDDI. We expect this trend will have a flywheel effect as companies unwind cross held shares to raise capital to repurchase their own shares being sold by Toyota. Furthermore, some companies are beginning to delist rather than deal with growing pressures as a listed company. 6

Small Cap Value Stocks Poised to Benefit

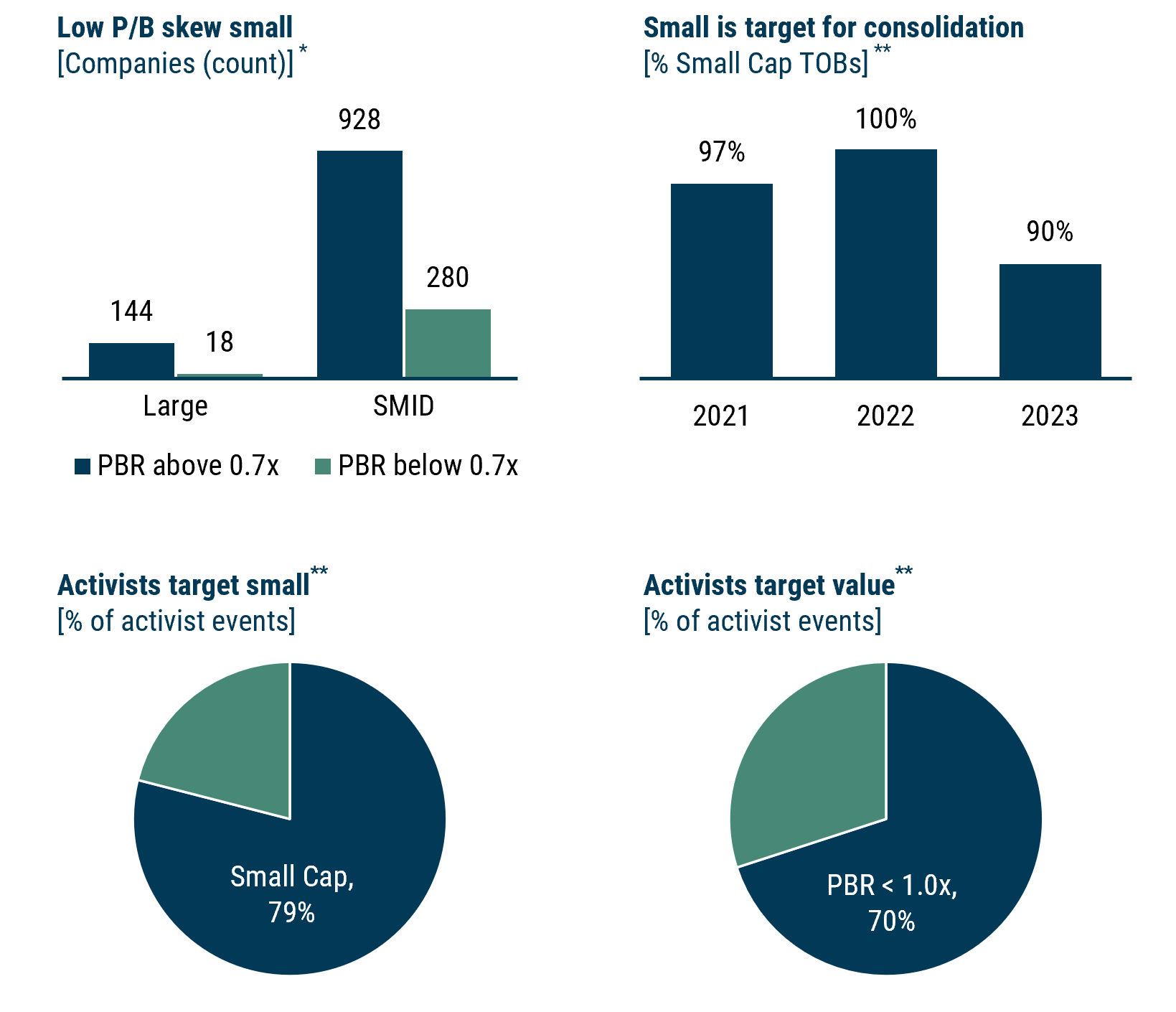

The four initiatives detailed above should provide a tailwind to the broad Japanese equity markets, but they are particularly helpful to the GMO Usonian Japan Equity team’s investment approach. For the past 20 years, we have been leaning into small-mid cap companies, using engagement to influence outcomes. Many of Japan’s policy reforms disproportionately benefit this universe. The TSE’s 1x PBR initiative, for instance, applies most to smaller and mid-cap companies with 280 such companies trading below 0.7x PBR vs. only 18 large cap companies trading that cheaply. Further, METI’s drive to consolidate industries will primarily impact small cap companies given 90% plus of takeover bids for companies below $2 billion in market capitalization. And finally, recent initiatives make the environment more conducive to activists in Japan. Activists largely target small cap companies (80% of activist events are in small caps) as well as value companies (70% of activist events are in companies with PBR <1x.)

Exhibit 5: Policies are a tailwind for small cap value

IR Japan YTD as of Oct 2023 | Source: Bloomberg, Oct 2023; Bloomberg and M&A Online, Oct 2023; Nikkei, Google, Bloomberg; Nikkei 7/7/2023; 2023 AGM

*Universe of TOPIX Index companies with market cap above ¥30 billion: Large Cap includes companies with market cap above ¥1 trillion; SMID includes companies with market cap between ¥30 billion and ¥1 trillion.

**Small Cap = <$2 billion.

4% more from Small Value

As mentioned, we believe the broad Japanese equity market is about fairly valued offering 4% real returns. While value within Japan is trading at a normal discount, the small value cohort remains dislocated. As Exhibit 6 indicates, small value stocks trade at a discount to the market that is at the 15th percentile relative to history. If our forecast methodology, which assumes that discount will revert to its mean over time, proves accurate, small value stocks offer an additional 4% of return above the broad market return. 7

Exhibit 6: The opportunity lies in value and small

As of 9/30/23 | Source: GMO

Price/Scale is based on multiple valuation metrics. Value represents the cheapest half of the market. Small represents the smallest third of the market-by-market capitalization.

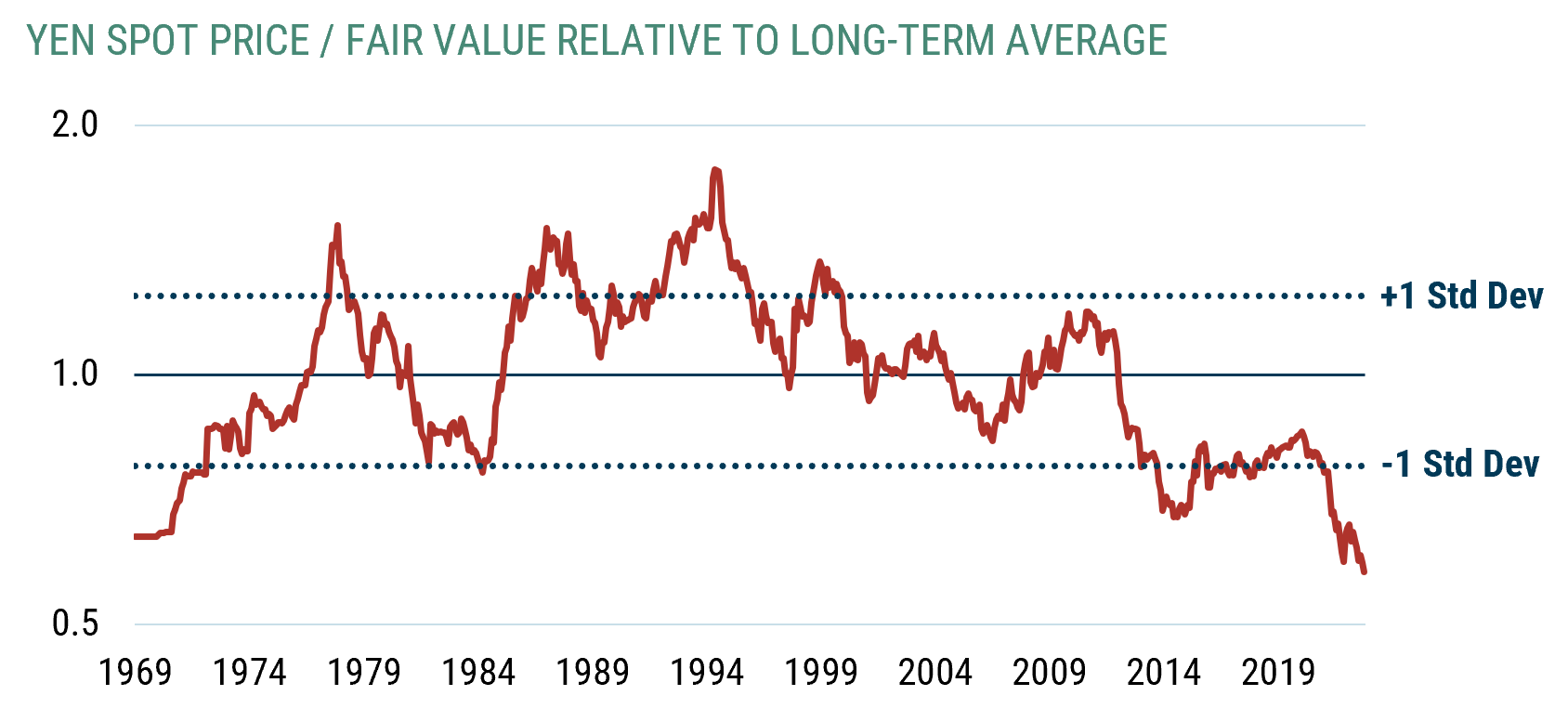

4% Tailwind from the Cheap Yen

Combining our base case real return forecast for Japan of 4% with another 4% of potential alpha from small value leads to an enticing return opportunity of 8% real. That should be an attractive proposition to most domestic Japanese investors given their alternatives are nominal bonds paying about 1% or cash paying essentially nothing. U.S.-based investors, though, should benefit from one additional source of return – the potential appreciation of the yen. Today the yen looks to trade at about a 40% discount to fair value – as cheap as we have seen it in our data that goes back through the 1970s (see Exhibit 7). While this currency weakness has dampened recent Japanese equity returns calculated in dollars, we expect it to provide a tailwind going forward.

Exhibit 7: The yen is more attractively priced than ever

As of 9/30/2023 | Source: GMO

We have written about how cheap currencies tend to lead to strong future equity market performance 8 . Foreign investors in a market with a cheap currency can benefit in two ways: the most obvious is currency appreciation – in this case, if the yen strengthens vs. the dollar; the alternative path is for the currency to remain cheap, giving the companies a competitive cost advantage that leads to faster growth. Data going back to the 1970s supports the point that currency valuation matters in Japan. When the yen has been most expensive, the average 3-year performance of Japanese equities, relative to other large developed markets, has lagged by over 10% a year. But when the yen started cheap, as it is now, Japan outperformed by over 5% a year. Our models forecast an additional 4% of expected return from the cheap yen.

These 4s Really Add Up

In rough numbers, we get a 4% return from the local market, 4% of relative return from small value, and 4% from the yen to arrive at a 12% real return forecast for Japanese small value stocks, measured in dollars. Our forecast for Japanese small value is strong from an absolute perspective and relative to other segments of the global equity universe. The group is among the most attractive assets we observe and why our portfolios hold anywhere from 2x–4x the benchmark weight in Japan. In addition, we believe the 4 policies we highlighted should buttress the long-term improvements in ROCs and corporate governance reforms Japanese companies have already delivered.

Download the article.

Register for full access to GMO's Research

For more information or to watch the replay, please contact us or your GMO representative.

We should note there is considerable upside to this forecast. Our base case forecast that Japan delivers around 4% real from here rests on the assumption that the red ROC line will converge downward toward the green line. Most of the ROC prints from the last 10 years have been well above that path. A better fit of the data is a model that we considered back in 2018, but we rejected as being too bullish. It assumed Japanese ROCs to converge to developed market levels by 2030. If this indeed is the path that ROCs are on, our forecast for Japanese stocks improves to 7% real today, quite an attractive potential return.

See Japan Value – An Island of Potential in a Sea of Expensive Assets (March 2021) and Japan Equities – Entrenched Perceptions Ignore Improving Reality (January 2022).

In their 11/1/23 Japan Equity Strategy Research note, Goldman Sachs further estimates that corporate pensions could buy up to ¥12 trillion based on corporate pension reforms that could be finalized by the end 2023.

A note of caution for investors: While we believe that labor change is very important for Japan’s economy as a whole, it will not be universally positive for all companies. Investors need to carefully navigate which companies are able to pass on higher wages via higher prices vs. commodity-like companies that will suffer from wage inflation-induced margin compression.

Most notably, post-TSE initiative, Benesse Holdings, Taisho Pharmaceuticals and Shidax Corp.

The natural question to ask is whether the lower valuation for this group is warranted by worse fundamentals. Afterall, value stocks in Japan have underperformed the market by 1.2% per year since 2016 when the discount was last at its normal level. Value stocks normally undergrow the market but offer higher yields and outperformance due to rebalancing – selling winners at a premium and buying losers from the rest of the market at a discount. Valuation changes make up the difference in relative returns in any period. Since 2016, growth was modestly worse, but on balance the fundamentals over the last five or so years have been better than the prior period. The drag on performance recently was due to the declining valuations and their impact on the rebalancing return. Without deterioration in relative income or growth, this drag from declining valuations should ultimately prove temporary and eventually reverse.

See 35-Year Highs for the Dollar: Our Currency, Our Problem (September 2022)