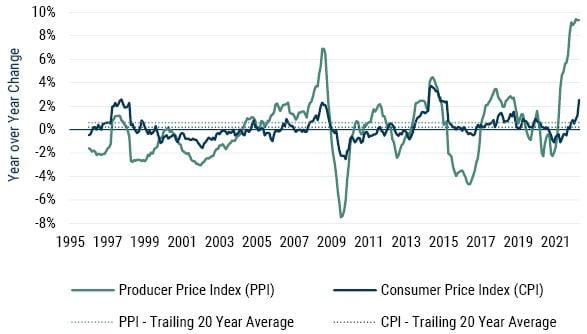

Rising Input Prices Elevated PPI, CPI Likely to Follow

As of 4/29/2022 | Source: GMO, Bloomberg, Bank of Japan

- Japan has been stuck in a low growth, low inflation (and at times, deflationary) environment. While no one cheers unbridled inflation, deflation may be worse because central bankers don’t have effective tools to combat it. Deflation leads companies and consumers to delay investment and put off purchases – why buy something today when it will be a bit cheaper tomorrow? This deflationary mindset has hindered Japan’s productive capacity and growth rate over the past 30 years.

- As a result, Japan has been rooting for higher inflation for years. The Bank of Japan has deployed a series of innovative monetary policies (QE, QQE, and YCC 1 ) designed to spark inflation to a sustainable 2%+ target. The chart above suggests that Japan may finally be getting the inflation it has been seeking.

- Rising input prices due to supply chain constraints stemming from the ongoing impacts of COVID-19, the war in Ukraine, and soaring commodity inflation have pushed producer prices, as measured by PPI, up over 9% to the highest levels seen in 40 years. In the short run, the gap between PPI and CPI will be problematic for many companies. Consumer goods companies will likely face margin squeezes until they can pass higher costs on to consumers through higher prices.

- During the previous few decades, Japanese companies typically absorbed raw material price increases. This time feels different, though. Inflation headlines have become commonplace in Japan, and recent evidence suggests that companies are hiking prices already:

- Tokyo Metro subway fares have gone up ¥10, the first such price increase in 28 years.

- Food and beverage prices are up 12% on average.

- Kyoto City Zoo admission ticket prices have increased 21%.

- Toilet paper prices have risen 10%.

- 7-Eleven lunch bento box prices have increased 15%.

- Ultimately, wage inflation will be the litmus test. We are still early in the process, but evidence indicates that wage inflation might also be taking hold in Japan, especially in labor-intensive service sectors. For example, two companies in the video game industry recently raised base salaries by over 20%. As Japan relaxes the conservative border policy it has had in place to contain COVID-19, lower-wage workers in restaurants, bars, and tourism could demand – and see – wage gains.

- The current bout of inflation could break Japan’s deflationary mindset, spurring consumer spending and investment. Japanese companies have in fact picked up their investments, with the first quarter of 2022 marking the fourth sequential quarter of growth (capex rose 3% year over year).

- The virtuous cycle of corporate investment, productivity growth, higher wages, and increased consumer spending would prove to be quite powerful for Japan’s economy and equity market. Japan could thus become an unexpected, rare place to find inflation acting as a positive force, putting Japanese equities in position to play a valuable role for investors trying to navigate global inflationary pressures.

Download article here.

Quantitative Easing, Quantitative and Qualitative Monetary Easing, and Yield Curve Control

Disclaimer: The views expressed are the views of Drew Edwards and Rick Friedman through June 2022 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2022 by GMO LLC. All rights reserved.

Quantitative Easing, Quantitative and Qualitative Monetary Easing, and Yield Curve Control