Executive Summary

While electric vehicles continue to dominate the headlines and garner attention in clean energy circles, biofuels are increasingly becoming an important alternative to carbon-based fuels. Biofuels have a much smaller carbon footprint than oil-based fuels and provide the same or better performance. Importantly, biofuels require little to no infrastructure investment, a far cry from that required to enable mass penetration of electric vehicles. Given these attractive features, we believe this often overlooked industry is poised for tremendous growth over the next decade.

What Are Biofuels?

A biofuel is any fuel that is derived from biomass, such as plants, algae, and animal byproducts. Biomass has much lower carbon content than a traditional fossil fuel, allowing for a dramatic reduction in greenhouse gas (GHG) emissions during combustion. Biofuels is a broad category that includes biodiesel, renewable diesel, sustainable aviation fuel (SAF), and renewable natural gas.1

The Case for Biofuels

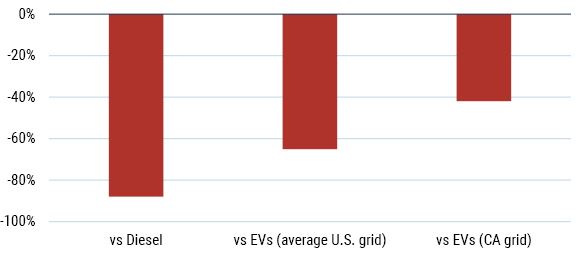

As governments strive to meet aggressive emission reduction targets, biofuels stand out as an effective, low-cost solution. Biodiesel and renewable diesel can have carbon footprints 80-90% smaller than conventional diesel (see Exhibit 1).2 In fact, biofuels are so clean that they can offer more than a 60% reduction in emissions relative to electric vehicles charged by the current U.S. electricity generation mix of coal, natural gas, nuclear, renewables, etc. (and even a 40% reduction for electric vehicles charged by California’s ultra-clean grid!). Making biofuels even more attractive to policymakers, biofuels don’t require a massive infrastructure investment, as most fuels can be distributed through existing tanks and pumps. Compare this to the vast infrastructure investments required to increase renewable generation (solar/wind projects, grid enhancements, energy storage) or electric vehicle penetration (charging infrastructure, increased electricity generation), and one can see why government support has been rapidly growing for biofuels.

EXHIBIT 1: BIOFUEL CARBON DIOXIDE REDUCTION

As of 12/31/2020 | Source: Renewable Energy Group, California Air Resource Board, GMO

Note: EVs is Electric Vehicles. Average U.S. grid represents the average U.S. electricity generation mix. CA grid represents the California electricity generation mix, which is one of the cleanest in the country.

Public Policy Support

State- and country-level policies increasingly require the blending of biofuels or support the transition to them. What started as a trickle has become a flood. Low Carbon Fuel Standards support the growth of biofuel adoption and are already in place in California, Washington, Oregon, and Canada. At least 13 other U.S. states are in the process of considering their own standards, as are Europe and the U.S. federal government. Norway mandated the blending of jet fuel with SAF starting last year, and Sweden is following suit this year. We expect significantly more support to materialize in the years to come.

Interaction with Oil

One of the interesting features of biofuels is that they provide indirect exposure to oil prices yet benefit from clean energy efforts intended to displace oil demand. Renewable diesel, for example, is a direct substitute for diesel, and biodiesel is blended with diesel. When diesel prices rise, renewable diesel and biodiesel producers sell their product at a higher price, but their production costs aren’t affected. On the other hand, if carbon policies discourage conventional diesel consumption, biodiesel and renewable diesel producers stand poised to capitalize. We saw this last year when Covid-19 savaged diesel demand and the price of diesel plummeted. Biofuel prices, on the other hand, rose over the course of 2020 as biofuel demand stayed strong due to the policy incentives mentioned earlier (see Exhibit 2).

EXHIBIT 2: Biofuel Prices Have Remained Remarkably Stable During The Covid Pandemic

As of 12/31/2020 | Source: Bloomberg, OPIS, GMO

Investment Approach

There are a lot of things to like about investing in biofuels. First, the growth prospects are very strong, with growth all but guaranteed if policymakers are to meet their climate commitments. Second, this is a relatively new, poorly understood industry with layers of complexity and uncertainty, all things that create opportunities for those willing to dig deep and take risk. And for many, the allure of investing in companies that are doing good for the world is becoming more and more attractive.

When analyzing companies in the biofuel industry, we carefully evaluate their feedstock agreements. Different types of feedstock (e.g., used cooking oils, greases, animal fats, soybean oil) have different carbon footprints, and we target companies with access to low carbon intensity feedstock.3 Companies with established feedstock agreements or captive feedstock from other business operations (i.e., vertically integrated companies) have significant advantages. We also look for companies working on innovative feedstock solutions, such as algae and waste plastics. As always, we pay close attention to valuations and focus on companies that we feel have been mispriced given their growth prospects and optionality.

Conclusion

We see exciting investment opportunities in the biofuel industry and have substantial exposure across several GMO strategies, including Climate Change, Resources, Resources Long/Short, and Cyclical Focus. We believe biofuels will be critical as the world pushes for decarbonization and that the future is bright for companies that are strategic about their feedstock procurement and possess the requisite logistical expertise.

Download article here.