Presenters

|

|

Tom Hancock

|

|

Anthony Hene

|

|

James Mendelson

|

Overview

GMO’s Quality team generally seeks to win by investing in great companies under temporary clouds and in companies where the quality is improving in a way the market has not fully appreciated. Today, various reopening stocks with a Covid-19 overhang are examples of the former, and the transformed semiconductor industry provides examples of the latter. In addition, Quality investing with a valuation component wins over the long run by protecting on the downside, and we believe the strategy is well positioned for some of the potential headwinds for equities that exist today.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

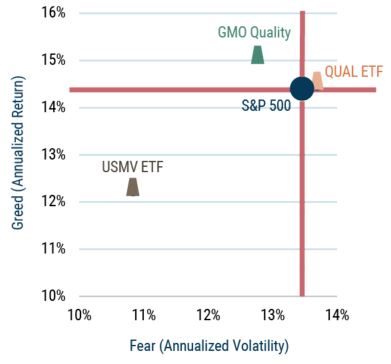

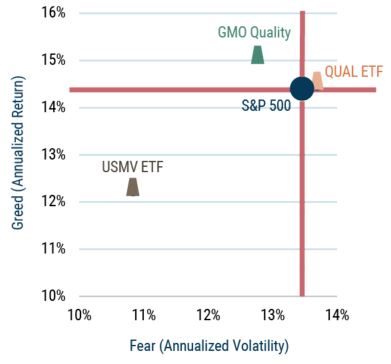

Quality INVESTING FOR GREED AND FEAR

QUAL and USMV are the two largest Quality Factor and Low Volatility equity ETFs. Data is from inception of QUAL ETF in July 2013.

Related Strategies

Please click on the links below to access strategies related to this event.

GMO Quality Strategy

GMO Quality Cyclicals Strategy

GMO Quality Spectrum Strategy

Tom Hancock presented this session at our U.S. Conference on November 3rd. Anthony Hene and James Mendelson presented at our Europe Conference on November 15th.

Disclaimer: Performance data quoted represents past performance and is not predictive of future performance. Net returns are presented after the deduction of a model advisory fee and incentive fee if applicable. These returns include transaction costs, commissions and withholding taxes on foreign income and capital gains and include the reinvestment of dividends and other income, as applicable. Fees paid by accounts within the composite may be higher or lower than the model fees used. A Global Investment Performance Standards (GIPS®) Composite Report is available on GMO.com by clicking the GIPS® Composite Report link in the documents section of the strategy page. GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Actual fees are disclosed in Part 2 of GMO's Form ADV and are also available in each strategy’s Composite Report.

The views expressed are through the period ending November 2021, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2021 by GMO LLC. All rights reserved.