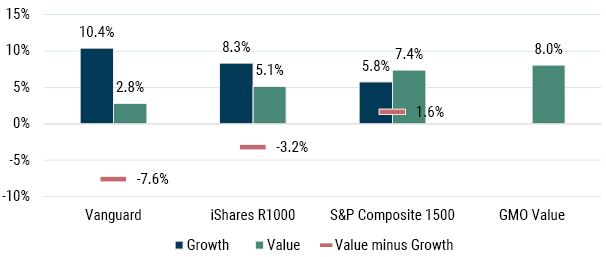

Exhibit 1: Value won. and lost. wait…what?

January 2023 style returns varied widely. 1

Source: Vanguard, iShares, GMO

- After a bruising 2022 for equities globally, Value stocks in the U.S. have become attractive in an absolute sense and worthy of inclusion in one’s portfolio. But the wide range in returns for various Value implementations in January 2023 raises the question, What are “Value” stocks?

- At GMO, we define the Value universe as those stocks that trade at a discount relative to the market based on our assessment of underlying corporate fundamentals. When estimating corporate worth, we

- adjust reported (GAAP) data for metrics like book value and earnings by capitalizing intangible assets and accounting for the impact of share buybacks,

- recognize that higher-quality and faster-growing companies deserve a valuation premium, and

- utilize multiple valuation models to ensure a robust assessment of overall attractiveness.

- Index providers take very different approaches, not just relative to GMO’s approach but also relative to each other. The performance of various indices’ Value implementations in January 2023 (Exhibit 1) makes this abundantly clear. Value either outperformed by 1.6% or underperformed by 7.6%, depending on which index you follow.

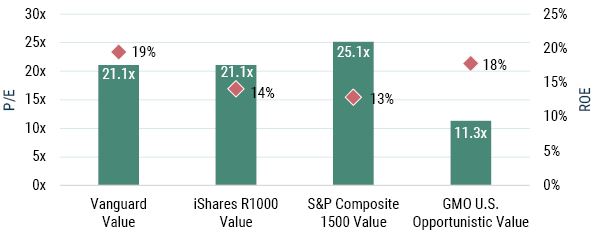

- Or, have a look at the price-to-earnings ratios and return-on-equity levels (Exhibit 2). If you are buying Value passively, you could be paying 21x for a 19.5% ROE group of stocks or 25x for a 13% ROE portfolio.

- Based on a blend of Value metrics that we consider, over 40% of the S&P 1500 Value Index traded at a premium to the market multiple at year end. That’s 40% of a Value index in stocks that look expensive through our valuation lens. 2

- With so many wide-ranging definitions and outcomes, it is crucial for investors seeking Value exposure to choose carefully. To capture the extreme discount of the cheapest quintile of the market, we recommend an active Value implementation. The GMO U.S. Opportunistic Value Strategy dials into this compelling opportunity, trading meaningfully cheaper than index products with similar quality characteristics. Unlike some Value indices, our strategy lives up to its name.

Exhibit 2: Value and Quality Vary Across Methodologies

As of 12/31/2022 | Source: Vanguard, iShares, GMO

Historical 1-year weighted median

Download article here.

As represented by Vanguard Growth Index Fund (VIGAX) and Vanguard Value Index Fund (VVIAX); iShares Russell 1000 Growth ETF (IWF) and iShares Russell 1000 Value ETF (IWD); S&P Composite 1500 Growth Index and S&P Composite 1500 Value Index; and the GMO U.S. Opportunistic Value Strategy, respectively.

Due to S&P’s rebalancing methodology, its version of Value became more “growthy” in 2022, while Growth moved in the opposite direction. The S&P Composite 1500 Index, for instance, saw a big uptick in its energy weight thanks to strong price momentum. Exxon and Chevron are now two of the largest companies in the S&P Composite 1500 Index.

Disclaimer: The views expressed are the views of the Asset Allocation team through the period ending February 2023, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2023 by GMO LLC. All rights reserved.

As represented by Vanguard Growth Index Fund (VIGAX) and Vanguard Value Index Fund (VVIAX); iShares Russell 1000 Growth ETF (IWF) and iShares Russell 1000 Value ETF (IWD); S&P Composite 1500 Growth Index and S&P Composite 1500 Value Index; and the GMO U.S. Opportunistic Value Strategy, respectively.

Due to S&P’s rebalancing methodology, its version of Value became more “growthy” in 2022, while Growth moved in the opposite direction. The S&P Composite 1500 Index, for instance, saw a big uptick in its energy weight thanks to strong price momentum. Exxon and Chevron are now two of the largest companies in the S&P Composite 1500 Index.