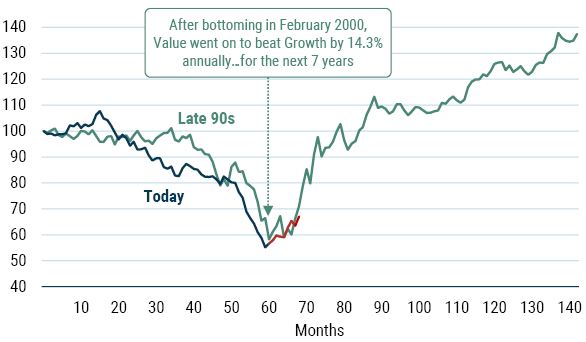

CUMULATIVE Russell 1000 VALUE – Russell 1000 GROWTH

Source: GMO

The “Late 90s” reference is to 5 years ending February 2000; the “Today” reference is to 5 years ending September 2020, and then continues through May 13, 2021.

- There are many eerie parallels between today’s Value/Growth relationship and what we witnessed during the 1999 era. In the late ’90s, Value was suffering from a multi-year period of underperformance. Value managers were getting fired, academic papers were being written about “the death of Value,” and clients of Value managers were losing faith and patience.

- The green line in this chart shows the cumulative performance of the Russell 1000 Value minus the Russell 1000 Growth. During the 5 years leading up to the 1999 period, the line trended down sharply as Value underperformed. The blue line shows the 5 years leading up to today’s environment, a haunting parallel. 2020, in fact, was the worst calendar year in history for Value relative to Growth.

- Now, we acknowledge many differences between today and 1999 (interest rate levels, asset-light companies, etc.), but these can only explain so much. While earnings growth has been basically average for Growth stocks, their price appreciation has been anything but – the last few years have been all about multiple expansion, NOT superior fundamentals growth. We are hearing “it’s different this time” justifications for these high multiples today that rhyme dangerously with what we heard back in 1999.

- Either way, Value’s pain should eventually be rewarded just like it was in the period after 1999, when finally the performance and valuation disparity turned. Fundamentals started mattering and the market began rationally pricing assets. For a 7-year period after 1999, Value went on to trounce Growth by over 14% annually.

- While there is no guarantee that Value will repeat its dominance over Growth today, we believe it is priced to do so (not just in the U.S., by the way, but globally). And the signs are encouraging. See the red line. Since September 2020 through May 13, 2021, Value has beaten Growth by a noteworthy margin. We hope this is a good omen of things to come.

Download article here.