Executive Summary

With global economic and market conditions incrementally improving, third quarter emerging debt returns continued the prior quarter’s recovery, albeit at a more muted pace: +2.3% for EMBIG-D and +0.6% for GBI-EMGD. EMBIG-D spreads fell by 42 bps to 432 bps, while GBI-EMGD’s FX rose by 0.4%, and local bonds by 0.2%. U.S. Treasury yields were virtually unchanged for a second consecutive quarter.

As we enter the fourth quarter, due to the continued rally, our valuation metrics for emerging external debt are less compelling than they were at the beginning of the quarter. However, we view much of this change as being a result of spreads normalizing as transaction and liquidity stresses have been reduced. Valuations continue to remain well within the historical range that we consider attractive, and the fundamentals of a majority of the emerging market asset class remain supportive of positive valuations going forward. Emerging currencies still stand out for their attractiveness. In addition, despite the continued recovery in local interest rates in Q3, real interest rate differentials between emerging and developed markets remain consistent with recent historical norms. In other words, rates rallied nearly everywhere, so relative value did not change much.

In this piece, we update our valuation charts and commentary, with additional detail on our methodology available upon request.1

External Debt Valuation

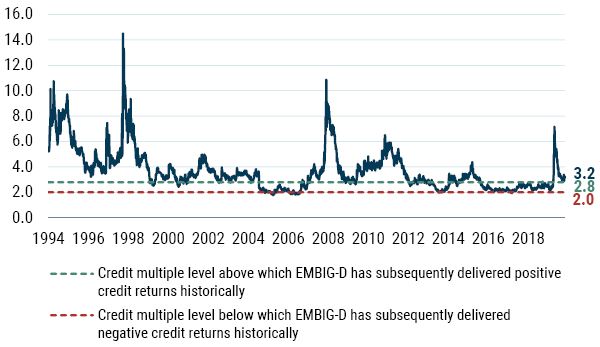

The EMBIG-D benchmark spread tightened by more than 40 bps in Q3. As seen in Exhibit 1, the multiple of the benchmark’s credit spread to the spread that would be required to compensate for credit losses fell slightly over the course of the quarter. That multiple stood at 3.2x on September 30, 2020, down from 3.4x on June 30. This remains well within the range that we would consider attractive, based on the historical experience, but it is significantly less attractive than what prevailed at the end of March (7.2x), right around the peak of the sell-off.

Exhibit 1: Long-Term View of the “Fair Market Multiple” for Emerging External Debt

As of 9/30/20 | Source: GMO calculations based on Bloomberg and J.P. Morgan data

Credit spread tightening was the main reason for the small decrease in the multiple over the quarter, as the multiple’s denominator – the fair value spread or expected credit loss – fell by only 3 bps from 138 bps at the end of June to 135 at the end of September. Regular readers will recall that this fair value spread is a function of the weighted-average credit rating of the benchmark, along with historical sovereign credit transition data and an assumption about recovery values given default. In terms of the third quarter, the fair value spread was influenced by notable S&P upgrades of Argentina and Ecuador given the success of their finalized bond exchanges with creditors following restructuring negotiations. A handful of additional countries, including Belize, Lebanon, Suriname, Zambia, and Venezuela, are either in default or in varying stages of restructuring talks, while Ghana was downgraded from B to B-.

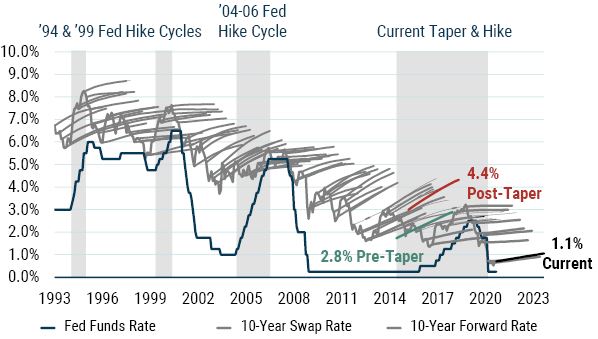

The preceding was a discussion of the level of spreads, or credit cushion. From a total return standpoint, the level and changes of the underlying risk-free rate also matters. In the third quarter, U.S. Treasury yields were basically unchanged, with the 10-year yield rising by 3 bps and having little impact on benchmark returns. We measure the “cushion” in Treasuries by the slope of the forward curve of the 10-year swap rate, depicted by the light-font lines in Exhibit 2. The interest rate “cushion” (which we proxy as the slope of the forward curve) continues to be low by historical standards, meaning a sharp rise in the 10-year Treasury yield would be a surprise to the market. The slope of the 10-year forward curve ended the quarter at 35 bps, higher than the 28 bps of the prior quarter. We would view this as a slight positive relative to the previous quarter.

Exhibit 2: 10-Year U.S. Treasury Swap Curves at Quarterly Intervals

As of 9/30/20 | Source: GMO

Liquidity

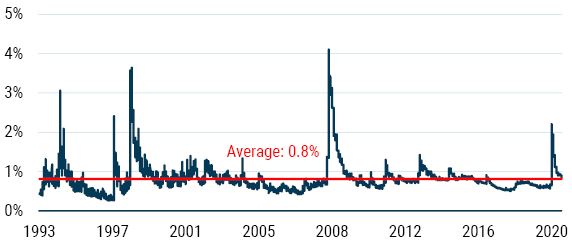

One key feature of emerging markets is liquidity and GMO’s external debt portfolio benefits from and takes exposure to the liquidity premium in emerging markets. Emerging market debt is a risk asset and bid-ask spreads typically widen in times of a crisis. As Exhibit 3 shows, bid-ask spreads came in by nearly 135 bps since the high of 2.2% on March 23, ending Q3 at 0.9%.

Exhibit 3: EMBIG-D Bid-Ask Spread (% of price)

September 2019 – September 2020

As of 9/30/20 | Source: GMO, Haver, J.P. Morgan

It’s important to note that bid-ask spreads tend to revert to a standard level (historically, 0.8%) after widening during times of crisis, and this time appears to be no different. In Exhibit 4 we see how bid-ask spreads behaved during such crises as the Mexican peso crisis (1995), Russian financial crisis (1998), and the Global Financial Crisis (2008), and their following stabilization. From the pinnacle of the Mexican peso crisis in January 1995, it took about six months before bid-ask spreads stabilized, and roughly one year for bid-ask spreads to stabilize following the Russian financial Crisis and the Global Financial Crisis.

We continue to believe that the stabilization of bid-ask spreads following the impact of the Covid-19 pandemic and oil shocks will be quicker relative to prior crises. Our strategy focuses on instrument selection and tends to own securities with a lower liquidity profile than the benchmark. We are long-term oriented investors and liquidity providers in this type of market, and our process is able to identify dislocations and opportunities to pick up attractively priced securities. This approach positions us well for alpha versus the benchmark going forward.

Exhibit 4: EMBIG-D Bid-Ask Spread (% of price), Since December 1993

As of 9/30/20 | Source: GMO

Local Debt Markets Valuation

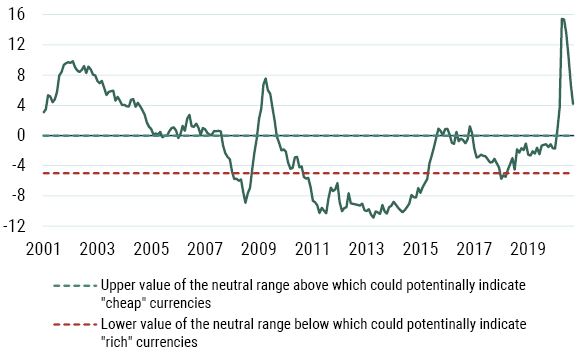

Exhibit 5 provides a time series of our model’s estimate of the GBI-EMGD’s spot FX valuation. Recall that our model analyzes trends in macroeconomic fundamentals such as balance of payments composition and flows, valuation of the currency, and the economic cycle, and uses a regression analysis to produce an estimate of total expected FX returns for each country in the GBI-EMGD benchmark. These are then combined into a single value of a total expected FX return using a market cap weighted average of currencies in the GBI-EMGD. We then deduct the GBI-EMGD weighted carry from the estimated GBI-EMGD weighted value of total FX expected return to get to an expected EM FX spot return. Finally, we estimate a neutral range based on the backtest of the overall model to assess whether EM currencies are cheap, rich, or fairly valued. A value that is higher (lower) than the upper (lower) value of the neutral range could potentially indicate “cheap” (“rich”) currencies. A value that is within the neutral range would be considered “fair.” Based on our framework, EM currencies remain attractively valued relative to the past 10-year average.

Exhibit 5: GBI-EMGD Expected Spot FX Return Given the Fundamentals

As of 9/30/20 | Source: GMO

As a final comment on EM currency valuation, we also consider the current valuation of major DM currencies. This is useful to the extent that EM currencies as a complex often present a high beta trade opportunity vs. DM. While our process is focused on EM relative value by design, we do need to consider the secular valuation of major DM currencies to ensure that a secular move of major DM currencies against EM as a complex does not negatively affect EM relative value currency opportunities. In this regard, when we consider a similar valuation model for EUR and CAD valuation, we find these to be currently in neutral territory. Neither currency is overvalued relative to historic norms, suggesting that a continued focus on EM currency relative valuation is reasonable given current valuations.

As for emerging market local interest rates, we consider differentials in real yields to gauge the relative attractiveness of EM against developed markets (see Exhibit 6, below). In this regard, the story that has been in place for many quarters (years, actually) remains as we can still see a substantial positive gap between EM and developed market real yields. That gap remained unchanged during the third quarter as emerging real yields remained steady at 1.98%. Real yields remained steady in Q3; nominal yields produced subdued gains when compared to the previous quarter’s rally, while inflation forecasts remain low in most emerging market countries given falling global demand. The spread between EM and U.S. real yields has widened during the quarter, to 278 bps. While this spread had been fairly stable for several years running, the 5-year average of this spread rose to 220 bps from 218 bps at the end of Q3. By our calculations, the real yield in the U.S. fell to -0.8% in September from -0.4% in June, and while the European real yield remains firmly in negative territory, the Japanese real yield remained positive for a second consecutive quarter.

Exhibit 6: Inflation-Adjusted Bond Yields

As of 9/30/20 | Source: GMO

Download article here.