Overview

In this webcast, we review the 2022 investment landscape and its impact on GMO Asset Allocation portfolios. We then show how the 2022 downturn informs our Asset Allocation views going forward. Importantly, we highlight the biggest opportunities we see across public markets and how GMO is exploiting them for your benefit.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- A significant rise in interest rates, on the back of persistently high inflation, led asset prices (especially for the most speculative areas) to sell off in 2022. Valuation-sensitive portfolios, particularly those that leaned into uncorrelated alternatives, shielded much of the downdraft.

- As the sell-off improved the opportunity set, we added risk across most portfolios – the combination has led to higher expected returns.

- Value is still quite attractive, despite outperforming Growth last year. We seek to benefit from the still wide valuation gap between the most expensive and cheapest equities globally via our Equity Dislocation portfolio.

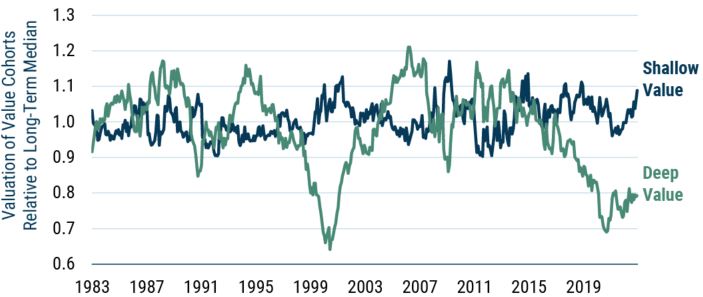

- Further, we noted an unusual phenomenon in the performance of U.S. Value equities: the cheapest quintile of the market (“Deep Value”) underperformed the rest of Value. Normally, Deep Value outperforms when Value wins. This left the cheapest part of the market trading at an unusually wide discount. To take advantage of this anomaly, we launched U.S. Opportunistic Value, a portfolio invested in Deep Value, a group which turns out not to be particularly junky today.

Valuation of Deep and Shallow Value in U.S.

Data from January 1983 – December 2022 | Source: GMO

Deep value is cheapest 20% on GMO’s price/scale, shallow value is next 30%, both within top 1,000 U.S. stocks by market capitalization. Valuation is normalized for whole period median relative valuation of each group.

- Many other opportunities also look attractive. The team explains why GMO prefers non-U.S. over U.S. equities, sees an improved opportunity in credit markets thanks to higher yields and lower prices, and added exposures to Small Cap Quality and Resource equities.

Download event highlight here.