Presenter |

|

Simon Harris |

|

Carl O'Rourke |

|

|

Overview

When seeking the cheapest stocks, simple value ratios should come with a “health warning” due to their tendency to favor lower quality stocks with the poorest growth prospects. In the GMO Equity Dislocation Strategy, we take a different approach to invest in stocks that are cheap, even after we account for their growth and value characteristics, using our Price to Fair Value model. By building growth expectations directly into our model we are giving higher growth, less capital-intensive businesses a better chance to look attractively valued. Our Price to Fair Value approach leads Equity Dislocation to a set of holdings that is differentiated from the passive alternative, notably that the Strategy can hold attractively valued, high quality growth companies on the long side of the portfolio.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- The Price to Fair Value model builds on decades of valuation research at GMO.

- GMO historically used a version of the Price to Fair Value model, but it was relaunched for Equity Dislocation after the completion of extensive Economic Fundamentals research which restates company financials to better reflect economic reality.

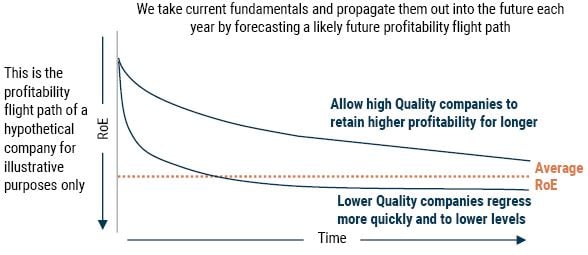

- Forecasting future returns on equity is the anchor around which everything else is built. We incorporate growth and quality by modeling future profitability and reinvestment decisions.

- The Price to Fair Value model is the engine behind Equity Dislocation and is also utilized as part of a broader suite of valuation models in our long-only global equity portfolios.

WE INCORPORATE GROWTH and QUALITY BY MODELING FUTURE PROFITABILITY AND REINVESTMENT DECISIONS

Related Strategies

Please click on the links below to access strategies related to this event.

Related Research

Please click on the links below to access research related to this event.