Presenter |

|

Martin Tarlie |

|

|

|

|

Overview

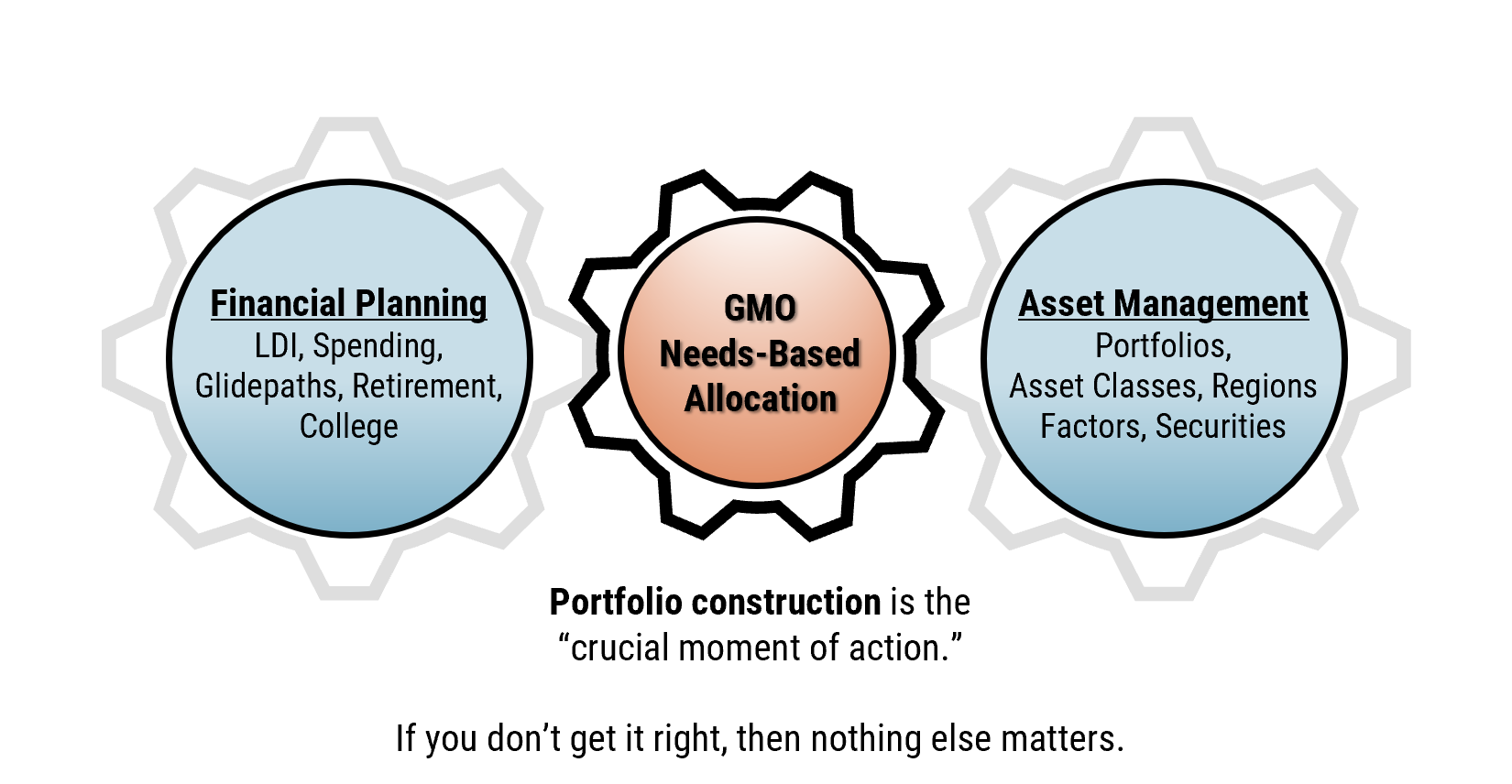

GMO has developed a platform – dubbed “NEBO” – that melds financial planning and asset management. NEBO is built on our Needs-Based Allocation framework, which redefines risk not as volatility but as “not having what you need, when you need it.” Over the past year, we have had the good fortune to work with a handful of innovative financial advisors as design partners, achieving significant usage milestones along the way. At the 2021 GMO Fall Conference, Martin Tarlie demonstrated how NEBO helps advisory firms generate better portfolios for their clients.

Key Points

- Needs-Based Allocation is a new paradigm for portfolio construction. The multi-period shortfall optimization generates target portfolios by determining optimal allocations of the single asset class building blocks, uniquely accounting for the client’s needs and circumstances – what they need and when they need it – and aligning those needs with their portfolios.

- NEBO is a platform that melds financial planning and asset management. We view it as a uniquely custom CIO dashboard and an Investment Policy Statement enhancer. The platform embeds GMO Asset Allocation insights and expertise and is built on almost a decade of deep research to solve the problem of portfolio construction. More broadly, NEBO can be thought of as the cockpit controls that the CIO/PM uses to fly their portfolio construction plane, and as the platform that aligns client portfolios in a way that better balances long-term wealth accumulation versus short-term loss aversion.

- NEBO enhances human intelligence. Our early users have a strong belief that NEBO helps them make better decisions, in part by providing an interactive platform that allows them to answer the fundamental question “what do I need to believe about the markets and my client in order to own this portfolio?” This layered decision-making process helps advisors find the right balance between the art and science of portfolio management – increasing their confidence and decreasing their fear, uncertainty, and doubt.

- NEBO generates better portfolios for your clients. Our research suggests that the combined direct benefits, when measured in annual return units over a full market cycle, are approximately 150-250 basis points per annum. Our research is consistent with numerous studies estimating the economic benefits of (portfolio-related) financial advice, including Morningstar Gamma, Vanguard Advisor Alpha, and Envestnet Capital Sigma.

Financial planning & asset management

Needs-Based Allocation melds financial planning and asset management

Related Strategies

Please click on the links below to access strategies related to this event.

Related Research

Please click on the links below to access research related to this event.

- Investing for Retirement: The Defined Contribution Challenge (Apr 2014)

- Investment Horizon and Portfolio Selection (Mar 2017)