Markets are competitive. Often, the moment someone discovers an edge, it is quickly copied and arbitraged away. Yet one has quietly endured: quality.

According to market theory, persistent outperformance shouldn’t exist. However, companies with high and stable profitability, strong balance sheets, and disciplined capital allocation have demonstrated the ability to deliver superior returns with lower risk over time.

In our view, this durable advantage is precisely why quality deserves a central place in any actively managed portfolio.

A Closer Look at Quality’s Enduring Advantage

Quality companies with strong competitive advantages and robust balance sheets typically exhibit high and stable profitability. These characteristics enable them to deploy capital effectively and compound value over long horizons, allowing them to sustain their fundamental performance across market cycles.

Academics and investment professionals have long studied why the quality advantage persists. Most explanations fall under a broad, behavioral-based thesis: market participants systematically underestimate the future returns of high-quality firms relative to their low-quality peers.

Put more simply, people often overpay for the speculative upside of "lottery ticket” businesses and frequently underprice the more mundane, but powerful, attributes of quality stocks.

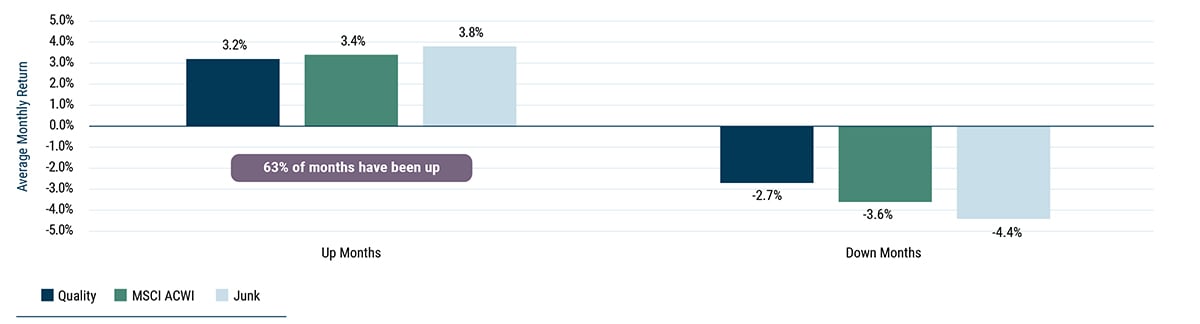

However, we see another important behavioral factor at work — the impact of career risk on investment decision making for managers. Quality tends to lag in strong up markets, even as it has delivered outperformance amid market declines. Over time, this asymmetry contributes to its superior long-term performance.

Yet for investment professionals judged on relative returns each quarter, that long-term track record offers little comfort. In a surging market, allocating to quality can mean trailing the benchmark and disappointing clients. This career risk leads many managers to underweight quality, reinforcing its underpricing.

Exhibit: Why Quality Companies Outperform Over the Long Term

Quality companies slightly trail in up markets, but more than make up for it amid market declines

Data from 1/31/88 to 9/30/25 | Source: MSCI, GMO

GMO defines quality companies as those with high profitability, low profit volatility, and minimal use of leverage. Junk companies are the inverse.

The History of Quality Investing at GMO

The observation that quality stocks offer compelling risk/return characteristics has been at the core of GMO’s equity investing since Jeremy Grantham and his partners founded the firm in the late 1970s. They grappled with a key tension: high-quality businesses often traded at a premium, making them difficult for investors with a value orientation to own. Yet, these same companies consistently outperformed and protected capital in prolonged market downturns.

Through extensive research, GMO identified three financial traits as reliable indicators of quality business models: high profitability, stable profitability, and low leverage. By incorporating these quality factors in GMO’s early quantitative models in the 1980s, GMO was able to identify strong businesses trading at discounts relative to their quality-adjusted intrinsic value. This approach also helped GMO avoid classic value traps that were trading at a discount for a reason.

In 2004, GMO launched a dedicated Quality Strategy with the mandate to own attractively valued stocks within the quality universe. The strategy was the culmination of decades of research into durable business models. While the strategy’s roots date back to GMO’s earliest days, our process continues to evolve to ensure sustained relevance and sharpen our investment edge. In recent years, a deeper emphasis on fundamental analysis with a forward-looking perspective, combined with valuation discipline, has further distinguished our approach from increasingly commoditized “factor” portfolios.

AI and Quality in Today’s Market

While innovation in technology and AI has been a significant driver of recent returns, the recent period of AI-related enthusiasm across markets has stretched expectations, particularly where narratives have overshadowed fundamentals. We see a risk that investors may conflate cyclical surges in capital expenditure with sustainable long-term profit streams. Our approach, therefore, is to participate selectively in this secular opportunity through well-financed, diversified businesses with proven capabilities rather than speculative names.

Opportunities within the quality universe extend well beyond the technology sector. The team at GMO continues to identify compelling ideas in sectors where durable competitive advantages, strong balance sheets, and disciplined capital allocation support long-term compounding, such as healthcare and consumer staples. These businesses may not always command headlines but tend to preserve capital during periods of volatility — dependable franchises that deliver consistent returns and serve as stabilizers when markets turn unsettled.

Diversification remains central to our portfolio construction. By balancing quality growth opportunities with more defensive core holdings and selective cyclical exposures, our strategy aims to participate meaningfully in rising markets while preserving capital when volatility returns.

In short, the opportunity set for quality investors remains compelling. By focusing on financially resilient companies with durable advantages, while maintaining valuation discipline, the GMO Quality Strategy seeks to compound value while preserving capital through changing market conditions.

Quality is the Real Deal

At GMO, we believe that investing in truly high-quality companies at attractive valuations offers investors a powerful combination: protection through the inevitable storms of the short term and superior compounding over the long term.

In an environment marked by uncertainty, elevated valuations, and rapid technological disruption, we believe quality is more relevant than ever. It provides a framework for navigating complexity, avoiding speculative excess, and anchoring portfolios in businesses built to last.