The traditional 60/40 portfolio (60% equities, 40% bonds) has long been a standard for investors. Its limitations, especially during "lost decades," suggest the need for a fresh perspective.

Investing in a static 60/40 allocation relies heavily on the herd’s view of valuation or, more accurately, whatever way the wind of investor sentiment is blowing. The 60% passively allocated to equities buys more of whatever has the largest market cap, while the 40% invested in bonds leads to increased exposure to borrowers that issue more debt than others in the index.

Even in an industry where “being different” can be difficult, doesn’t it make sense to get a second opinion from someone who is prepared to genuinely look at valuations relative to underlying fundamentals?

Avoiding bubbles and capitalizing on dislocations

Risk premia change as valuations change, so an asset allocation strategy should only hold assets that are priced to deliver satisfactory returns at any given time. Valuation-sensitive multi-asset class strategies such as GMO’s Benchmark-Free Allocation Strategy, which shifts allocations significantly during extreme valuation environments, can help a portfolio both avoid bubbles and capitalize on dislocations.

The following examples of dynamically shifting and expanding beyond traditional risk premia are ways Benchmark-Free has been able to help diversify risks and enhance returns:

- Timing – Playing Defense

As valuations reached dizzying heights across all asset classes in 2007 and 2008, we reduced equity exposures in Benchmark-Free to 25%, which we allocated to quality stocks in the U.S., and preferred a position in a long quality/short junk strategy.

The defensive posture of the portfolio helped protect capital during the GFC drawdown: Benchmark-Free fell 19.3% (net) from the end of October 2007 through February 2009, while the 60/40 MSCI ACWI/Bloomberg U.S. Aggregate portfolio fell 35.7% in the same period. Importantly, as global equities bottomed (down 55%), our valuation signals lit up green. Jeremy Grantham famously penned Reinvesting When Terrified in March 2009 as we were ramping up our equity exposure. - Timing – Playing Offense

Another way to enhance asset allocation strategies is to use traditional assets in a less conventional way, perhaps through targeted or thematic strategies. For example, the equity market selloff induced by Covid lockdowns in early 2020 presented an opportunity to invest in the highest quality businesses in cyclical sectors that were hit particularly and, crucially, indiscriminately hard.

In a similar fashion, we currently believe that an exposure to Japan small cap value equity could prove very rewarding due to improving fundamentals and corporate reform efforts, favorable valuations, and an extremely cheap yen. A traditional 60/40 portfolio, holding about two- thirds of its equity exposure in expensive U.S. equities, picks up little of this opportunity. - Expanding the Toolkit

Finally, by expanding beyond traditional risk premia, investors can tap into other ways to get paid that help diversify risks and enhance returns. This could simply include broadening fixed income exposures to allow investments like high yield, emerging debt, structured/asset-backed securities, and Treasury Inflation-Protected Securities (TIPS), or it could also encompass the use of alternative risk premia.

One example of an alternative approach would be an equity long/short strategy, such as our Equity Dislocation Strategy, which we launched in late 2020 to generate returns from a narrowing of the valuation dislocation between cheap value stocks and egregiously expensive growth stocks. Driven by its risk-aware structure, an unwavering focus on the very cheapest and most expensive stocks, and strong stock selection, Equity Dislocation has generated a cumulative gross return of some 42.6% (28.3% net) as of June 2025. This has far outpaced an index approach of being long MSCI ACWI Value and short MSCI ACWI Growth, which fell 4.0% over the same period, suggesting that much of the opportunity remains intact.

Mitigating large drawdowns

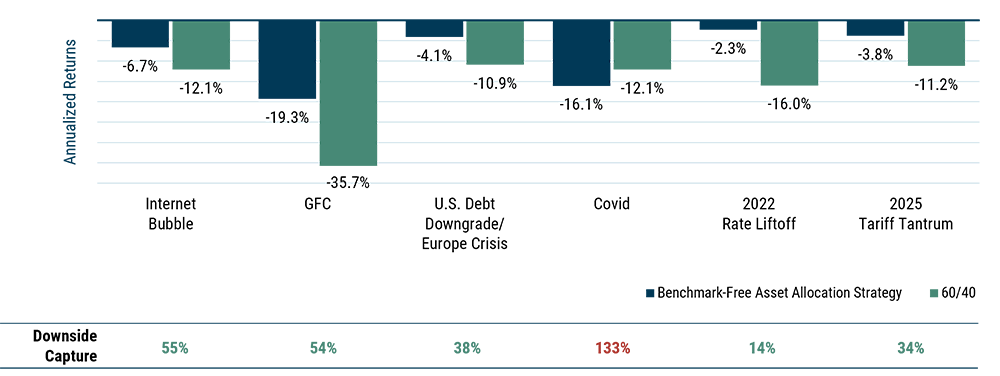

By avoiding expensive assets and capitalizing on undervalued opportunities, Benchmark-Free has helped investors enhance risk-adjusted returns in part by mitigating large drawdowns.

EXHIBIT: VALUATION SENSITIVITY HELPS IN MOST DRAWDOWNS

Benchmark-Free has acted as a helpful diversifier in five of the last large 60/40 declines.

Source: GMO

Internet Bubble: 8/31/01–2/28/03; GFC: 5/31/07–2/27/09; U.S. Debt Downgrade: 4/29/11–9/30/11; Europe Crisis: 12/31/19–3/31/20; Covid: 5/31/21–9/30/22; 2022 Rate Liftoff: 12/31/21–12/31/22; 2025 Tariff Tantrum: 2/19/25–4/8/25.

Read the full paper, "A Second Opinion on the 60/40 Default," to explore this topic in depth.