Why Dynamic Allocation in Credit Matters

- Allocators increasingly seek flexible credit strategies that can adapt quickly to an environment of shorter and more frequent market dislocations.

- Many investors lack the infrastructure to underwrite each credit sector or react quickly to market changes.

- GMO’s nimbleness and focus on margin of safety allow us to capitalize on short-lived dislocations.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Overview

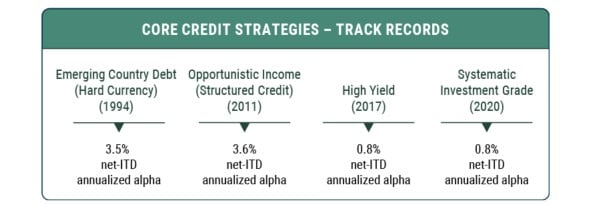

GMO’s Multi-Asset Credit Strategy launched on May 21, 2025, and builds on the strengths of GMO’s longstanding core credit capabilities, benefits from GMO’s investment style diversification, and enables a more agile and comprehensive approach to investing in credit.

Anchored by our valuation-driven philosophy, the GMO Multi-Asset Credit Strategy dynamically allocates across fixed income markets including emerging debt, structured products, high yield and investment grade credit, loans, and mortgages.

Distinctive Attributes

- GMO’s investment philosophy emphasizes agility, high conviction, and an unconventional value-driven approach to investing in core credit asset classes.

- GMO’s 30-year track record in emerging debt investing adds diversification beyond typical U.S.-centric credit risks.

- A top-down, bottom-up allocation framework integrates proprietary models, with both quantitative and fundamental analysis to guide portfolio construction.

Multi-Asset Credit’s Core Alpha Engines

As of 5/30/2025

Alpha Diversification

Low to negative correlation between alpha engines

GMO

|

GMO

|

GMO

|

GMO

|

|

| GMO Emerging Country Debt | 1.0 | 0.3 | -0.1 | 0.6 |

| GMO Opportunistic Income | 0.3 | 1.0 | -0.1 | -0.3 |

| GMO High Yield | -0.1 | -0.1 | 1.0 | 0.1 |

| GMO Systematic IG Credit | 0.6 | -0.3 | 0.1 | 1.0 |

Data from inception to 5/30/2025

Net of fees alpha vs respective strategy benchmarks: GMO Emerging Country Debt vs JPM EMBI Global Diversified +; GMO Opportunistic Income vs Bloomberg US Securitized; GMO High Yield vs Markit iBoxx USD Liquid High Yield; GMO Systematic Investment Grade Credit vs. Bloomberg US Corporate.