When the ducks are quacking, feed ‘em

Stock issuance highest ever, as firms and Wall Street know when it’s time to sell

to eager buyers

Source: Federal Reserve.

The title of the chart is a phrase that has been attributed to the head of First Boston’s equities trading desk in May, 1991, but that cannot be confirmed.

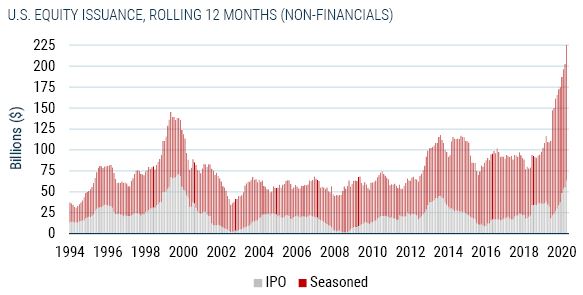

- Dubious new records. Yes, we are witnessing new price records for the S&P 500, NASDAQ, and a host of other markets. That, in isolation, should not be worrisome. What should worry you, though, is that records are being set on the valuation front. By almost any measure – forward or backward looking – we are staring at some of the most expensive valuations in history, especially in growth stocks. But we’ve talked about that inconvenient truth many times before. Here’s a new worry: Stock issuance in 2021 is also setting a new record, blowing away the last high set in the run-up to the Tech Bubble. This is a dubious item to celebrate if history is any guide.

- We’re not just talking SPAC. In past commentaries, we have bemoaned the SPAC (Special Purpose Acquisition Company) phenomenon as yet further evidence of speculative behavior. These “blank check” companies may literally have no business plan, no sales, no earnings – heck, investors don’t even know what industry they’re buying into. Yet SPACs are selling like hotcakes. More SPAC capital has been raised in the first six months of 2021 than in the past 20 years, combined. That is concerning enough. But SPACs are only part of the problem. Record-high stock issuance is also emanating from seasoned companies – in other words, everybody’s getting in on the party. See the chart above.

- Signs, not signals. There is never an unambiguous Batman-style beacon signaling a market top, but record-high stock issuance is an ominous sign that should have Gotham on edge. Wall Street knows an eager, price-insensitive buyer when it sees one. As the cynical expression goes, when the ducks are quacking, it’s time to feed ‘em.

Download article here.