In theory, growing a pool of wealth over decades — whether for a family, an endowment, or a pensioner — is a straightforward endeavor.

An advisor or allocator needs to do three things: understand the goals of their client, find different ways to earn returns for taking risks, 1 and then take the right amount of risk to meet those goals. 2

Taking too much risk may expose the client to unacceptable drawdowns, while taking too little risk will likely lead to inadequate returns in the long run.

Historical performance of 60/40 portfolios

The de facto “passive” allocation of 60% equities/40% bonds has proven effective at compounding wealth over time by tapping into two key risk premia: the equity risk premium earned by underwriting the risk of an economic growth shock and an inflation risk premium received for bearing the risk of surprise inflation.

Since 1979, when the Bloomberg U.S. Aggregate Index incepted, a 60/40 portfolio made up of U.S. equities and bonds has delivered returns of 10.2% annualized, 3 outpacing inflation by 6.8% and exceeding the return requirements of most investors.

So, we’re done, right? Should we all just run 60/40 allocations and call it a day?

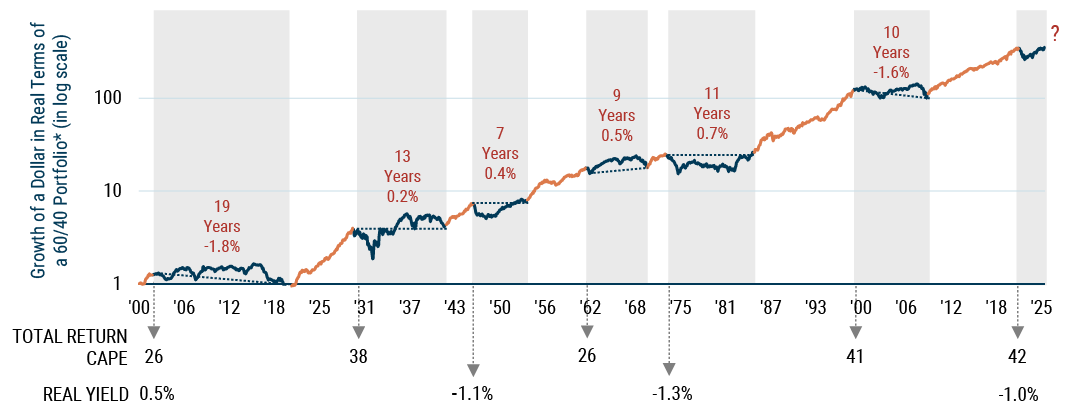

That approach has worked exceptionally well since 1979, and quite nicely over even longer time periods. While the classic disclaimer on investment ads says, “past performance is no indication of future results,” we can take away some lessons from 120 years of results for a 60/40 portfolio. As the exhibit below indicates, a 60/40 portfolio (in this case, U.S. stocks and U.S. bonds) has delivered real return of about 4.7% since 1900 — a couple of points less than the 1979-to-present period, but sufficient for most investors’ needs.

The occurrence of “lost decades”

But this enviable long track record hides the fact that there have been six periods, averaging 11 years each, in which an investor in a 60/40 portfolio would have either broken even relative to inflation or, even worse, lost money in real terms. Those chapters share something in common—they all followed exceptionally strong periods of return for the traditional portfolio and thus began when either or both stocks and bonds were trading at extremely high valuations.

Exhibit: 60/40 – “Lost Decades” Are More Common Than You Think

Most started with high valuations on stocks or bonds

As of 9/30/2025 | Sources: Bloomberg, Global Financial Data (early history), Factset (S&P500 returns and CPI), J.P. Morgan (J.P. Morgan GBI United States Traded), Shiller data, Federal Reserve Bank of Philadelphia (U.S. Treasury Yields and Long-term Inflation Expectations). Real yield is the yield on the 10-Year U.S. Treasury minus Philly Fed Long-Term Inflation Expectations (1992-present) or the 12-month trailing CPI (early history). Current CAPE = 42 and Real Yield = 1.8%.

60% U.S. Equities (S&P 500), 40% U.S. Bonds (U.S. Treasuries) rebalanced monthly.

Recent valuation concerns

In the most recent run-up from early 2009 through the end of 2021, this passively allocated 60/40 portfolio delivered about 9.4% real, about twice the long-run average. These stellar returns were powered by rising equity markets and a decline in interest rates that left the S&P 500 and real bond yields at some of their least attractive valuations in history.

Today, following the fastest rate hike cycle in 30 years, real and nominal yields on government bonds look reasonable. But the yield pickup for taking most credit risk looks unsatisfactory, and some stocks, particularly in the U.S., are trading at excessively high valuations. Against this backdrop, reversion toward longer term valuations would lead to very disappointing medium-term returns for a 60/40 portfolio.

The need for dynamic allocation

This is where diversification, dynamic allocation, and GMO’s Benchmark-Free Allocation Strategy can help.

We are willing to be unconventional when necessary, and we currently have exposures distinct from traditional stock/bond portfolios, offering investors access to alternative assets that may diversify their existing allocations.

We invite you to take a deeper dive into this topic and read the full paper, "A Second Opinion on the 60/40 Default" in its entirety.

In the long run, earning sustainably high returns will require taking risks that counterparties are willing to pay to avoid. If an asset or strategy gives a return that does not have some unpleasant characteristics to it, it is unlikely to deliver substantial returns in the long run. A substantial part of the art of building portfolios for investors is determining what risks the investor is in a position to take on that counterparties are willing to pay for.

The goals for a client include both their goals for returns and their willingness to take risk in service of those return goals. A client who says they need to earn 10% per year and cannot tolerate any losses has demonstrated that their goals are not mutually compatible, and asset allocation will not be able to fix that. Ensuring that a client’s goals are feasible is a necessary precursor to building an appropriate portfolio for that client.

As of 6/30/2025.

Disclaimer: The views expressed are the views of the Asset Allocation team through the period ending October 2025 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Past performance is no guarantee of future results.

Copyright © 2025 by GMO LLC. All rights reserved.

In the long run, earning sustainably high returns will require taking risks that counterparties are willing to pay to avoid. If an asset or strategy gives a return that does not have some unpleasant characteristics to it, it is unlikely to deliver substantial returns in the long run. A substantial part of the art of building portfolios for investors is determining what risks the investor is in a position to take on that counterparties are willing to pay for.

The goals for a client include both their goals for returns and their willingness to take risk in service of those return goals. A client who says they need to earn 10% per year and cannot tolerate any losses has demonstrated that their goals are not mutually compatible, and asset allocation will not be able to fix that. Ensuring that a client’s goals are feasible is a necessary precursor to building an appropriate portfolio for that client.

As of 6/30/2025.