Last year we invested in selected companies that we judged would benefit from the reopening of the global economy, so we are on the look-out for ways of tracking progress out of lockdowns around the world. Bloomberg has obtained an interesting data set from Pret-A-Manger, one of the world’s leading sandwich purveyors. The light this data sheds on the land of the sandwich, and the glimpse of a post-pandemic world, is intriguing.

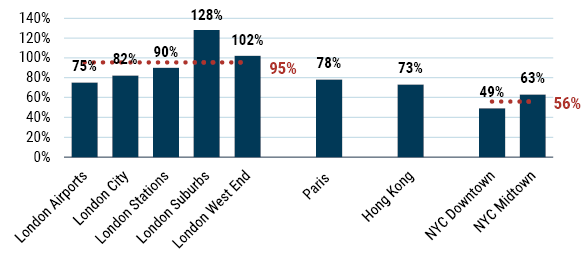

This week, sandwich volumes in London’s West End, historically home to a vibrant mix of shopping, nightlife, and commerce, regained pre-pandemic levels for the first time. Across the various London sandwich-buying demographics, Pret-A-Manger’s volumes are running at a simple average of 95% of January 2020 levels. Sandwich-buying has been edging up in Paris and New York too, but London is ahead of the pack. And yet, Covid-19 caseloads in the UK are currently amongst the world’s worst. The UK currently has the highest per capita rate of weekly new Covid cases across the two dozen countries that we track closely – the UK rate is twice that of the US, eight times the level of France, and several hundred times higher than the rate in Hong Kong.

News from the Land of the Sandwich

London is reopening much faster than New York. This chart shows volumes for the week of 7 October 2021 at Pret-A-Manger’s stores relative to their weekly average in January 2020.

Source: Pret-A-Manger, Bloomberg.

What is going on here? When we invested in “reopening” stocks, we posited that the world would get over Covid by one of three routes: treatment, vaccination, or learning to live with the virus. It turns out that the answer lay in a blend of all three. The UK has made strides in treatment, and the country made a notably fine start on vaccination, albeit subsequently upstaged by others. Achieving herd immunity via vaccination now seems to be a pipe dream, given the infectiousness of the Delta variant. But having afforded decent protection to the vast majority of vulnerable citizens, the UK has moved faster on learning to live with the virus than many (developed) countries.

The trade-offs required are unpleasant – but Her Majesty’s government has apparently decided that the economic, educational, social, and non-Covid medical benefits of reopening are worth the very real health-related costs. Incidentally, the UK’s weekly covid death rate is currently running at a similar level to the rest of the developed world – about one thousandth of a percent of the population – largely because the cases are currently heavily weighted to the young as schools are running at full steam once more.

The UK’s approach has been cack-handed in a multitude of ways, but we suspect that rich countries, all in the process of vaccinating their populaces, will ultimately follow the UK in terms of living with the virus. The political cost of imposing constraints on democracies is simply too high for that not to be the case. Progress in dealing with the virus will necessarily be bumpy and non-linear, but each quarter marks a quarter closer to the time when the pandemic ceases to have a bearing on capital markets. We believe that our investments in carefully selected reopening beneficiaries remain attractively positioned today.

Download article here.

Disclaimer: The views expressed are the views of the GMO Focused Equity team through the period ending October 2021 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2021 by GMO LLC. All rights reserved.