As enthusiasm for artificial intelligence and its potential to reshape business models and deliver extraordinary profits accelerates, we worry that rational, disciplined investing is taking a back seat. Many investors appear to be abandoning fundamental analysis and prudent valuation in favor of paying any price to own the hottest stocks.

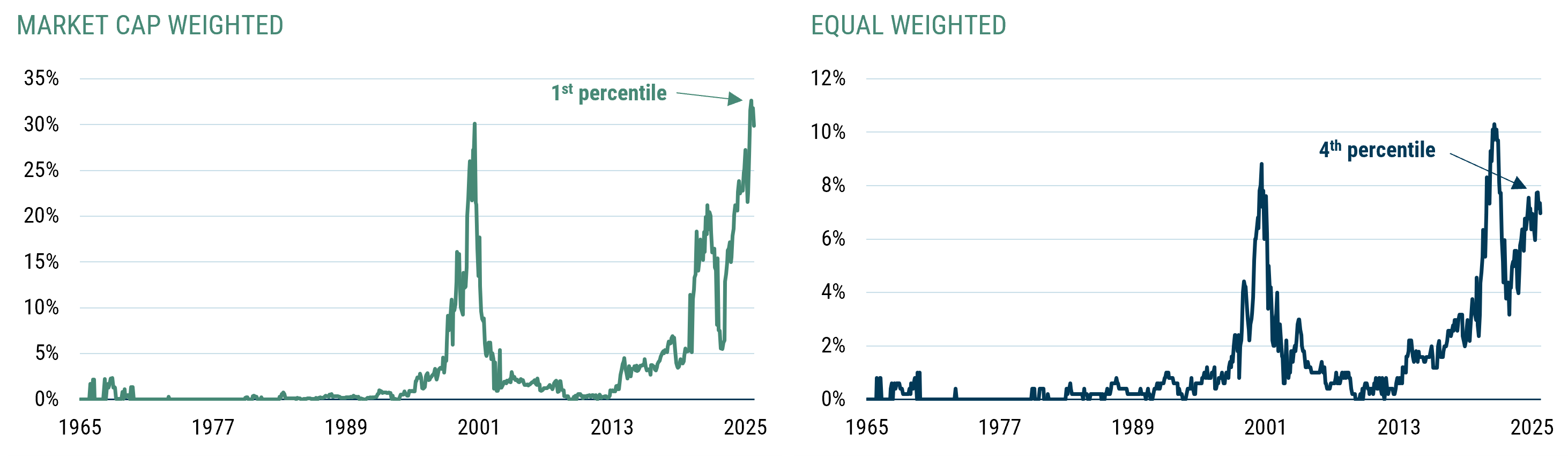

One striking sign of this euphoria: more than 30% of U.S. market capitalization now trades above 10x sales, a level reminiscent of the tech bubble. Five of the “Magnificent 7” companies exceed this threshold, which explains much of the surge in aggregate valuations on a cap-weighted basis.

S&P 500 once again concentrated in expensive names

% stocks with Price/Sales > 10x is at an extreme even after adjusting for select number of mega-caps

As of 10/31/2025 | Source: GMO

Some argue these multiples are justified by the Mag 7’s dominant business models and exceptional growth—but we see several problems with that logic:

- Even great companies can disappoint when expectations are sky-high.

- Speculation has inflated valuations for many firms without the market power or fundamentals of the top-tier leaders.

- Equal-weight perspective reveals the breadth of excess. Roughly 8% of all U.S. stocks trade above 10x sales, approaching the 2000 peak and not far from the 2020 growth bubble.

In short, today’s market reflects more than optimism—it reflects risk. History suggests such extremes rarely persist without painful corrections.