Executive Summary

Game theory is a useful framework for modeling aspects of sovereign debt recoveries, given that it models the interactions among debtors and creditors in the lending/borrowing “game.” While there is a long-established set of precedents for Paris Club (U.S. & European) and multilateral (IMF, etc) creditors’ actions, we still have little available information about how China will act in debt negotiations. The increasing presence of China as a single large bilateral creditor in our markets, therefore, is worth modeling to see what kind of postures they might take. As commercial lenders alongside sovereign and multi-lateral lenders, we and our investors have a stake in the possible answers provided.

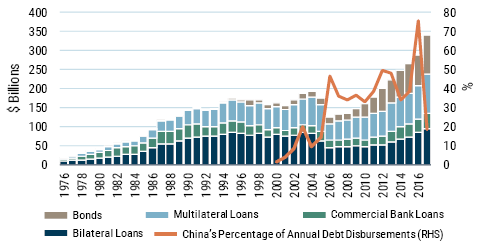

Since the inception of GMO’s Emerging Country Debt strategies in 1994, there have been many big structural shifts in the marketplace. One is the very emergence of the bond market itself, to which GMO has borne witness all along the way. In 1994, bonds accounted for about 15% of the external debt of emerging countries. In 2017, this figure was 44%. Over the ensuing years, bonds have essentially replaced bilateral (country-to-country) loans, while loans from multilateral organizations (such as the World Bank, IMF, and others) have remained at 20-25% of the total. A second big structural shift is the emergence of China as a creditor to other emerging countries, a process that has accelerated in recent years as a result of the Belt and Road Initiative. Opacity in the data prevents a fully accurate accounting, but by some estimates China (via its state policy banks and other entities) accounts for about 30% of the public sector external debt of Sub-Saharan Africa, for example. This is corroborated by the line in Exhibit 1 showing that China has been the source of about 40% of disbursements of external debt to Africa in the past 10 years.1 This level of exposure means that China will be an important “player” in some future debt restructurings. In this piece, we employ simple techniques from game theory to model how China might change, for better or worse, recovery outcomes for bondholders.

Exhibit 1: Public Sector External Debt of Sub-Saharan Africa, by Creditor

Source: World Bank, Johns Hopkins SAIS China-Africa Research Initiative, and GMO calculations

Thankfully, sovereign debt is an asset class with a relatively low observed incidence of default.2 When defaults occur, recovery values are essentially a function of two things: 1) the sovereign’s ability to pay (as governed by the economic and public finance realities); and 2) the strategic interaction among the “players,” in this case sovereign debtors and their creditors, which takes into account relative attitudes toward debt relief, economic adjustment, and strategic goodwill. The primary determinant of recovery value is the former, but the latter can also influence the outcome, positively or negatively. Moreover, recovery values in sovereign restructurings show wide variation over historical periods, ranging from 30% of face value on the low end to 90% on the high end. We already have an in-house model for estimating recovery based on the economic fundamentals. By understanding the strategic interaction among players a little better, we might be able to narrow the range of uncertainty around these estimates.

The Set-up of the “Game”

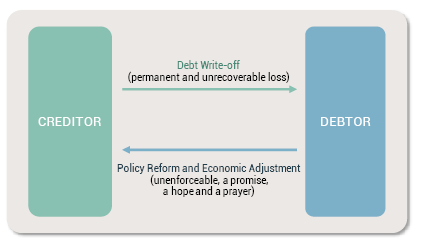

So, how might we model this strategic interaction? This is where game theory techniques can be useful.3 Imagine a simple interaction between debtor and creditor in which the debtor can offer economic policy reforms (PR) that will benefit the creditor (because it reduces country risk over time), while the creditor can offer debt write-off (DW) that will benefit the debtor.

The Give and Take of debt restructuring

Assume that the debtor receives negative utility (disutility) from PR, because those are often politically difficult and can be painful in the short term, and we know that politicians have very myopic horizons. Assume that the debtor receives positive utility from DW because of the favorable fiscal space it opens. Finally, we can also consider a “goodwill” or “reputational” element by which the debtor receives negative utility if the restructuring deal is too overly tilted in its favor. It knows, for example, that if it forces terms that are too harsh relative to the effort it makes on economic reforms, it will suffer reputational damage and need to pay permanently higher spreads on future borrowing. (Ecuador is a current example of such a country.)

Conversely, the creditor receives positive utility from PR implemented by the country, disutility from DW, and disutility from a deal that is too tilted in its favor, given it is aware of, and sensitive to, the humanitarian costs of a country remaining in a debt trap (and, frankly, doesn’t want to be back at the negotiating table in a few years’ time).

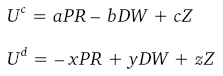

Simple utility functions for the creditor (c) and debtor (d) can therefore be specified as a function of PR, DW, and goodwill or reputation (Z) as follows:4

The preferences of creditors and debtors can be defined by the relative size of the coefficients a, b, and c, and x, y, and z. We constrain each utility function’s coefficients to sum to unity, again for simplicity. We specify high (3), medium (2), and low (1) to PR and DW, while Z can be expressed as a function of PR and DW, because it is meant to proxy the relative effort of creditor and debtor.

One of the many activities that bondholder groups and debtors undertake in the cat-and-mouse game of debt renegotiation is an effort to gauge and calibrate the other player’s utility function. For example, in the former era in which money-center banks were the primary private sector lenders to emerging countries, the banks received a high disutility from DW, because loans were booked at par and not necessarily “marked-to-market,” and these LDC loans often represented a large share of banks’ capital. This would be specified in our equations as a higher “b” coefficient. The “tension” in the game derives from these coefficients. If you have a creditor group that derives a lot of disutility from DW but a debtor that derives a lot of positive utility from DW and negative utility from PR, then you are likely to have a suboptimal outcome. Bondholders seek to determine, through past actions, policy statements, domestic political conditions, and other observations, whether a debtor is “good” or “bad,” which provides useful information in the strategic interaction game.

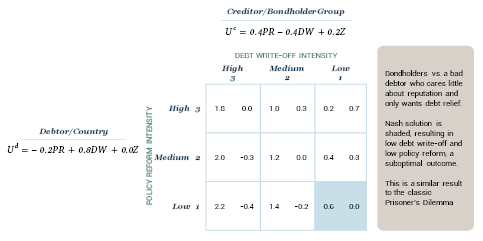

Sample Debt Negotiation Game Between a Bondholder Group and a “Bad” Debtor

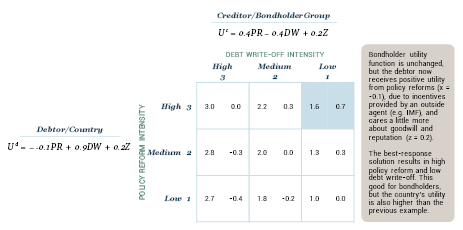

Let’s take an example. Exhibit 2 shows a plausible pay-off matrix in a game between a bondholder group and a bad debtor. I define a bad debtor as one that places high positive utility on DW (y = 0.8), because this is the “easy way out,” and cares not at all about reputation/goodwill (z = 0.0). The bondholder or creditor places equal weight on PR and DW (a = b = 0.4) and some weight on reputation/goodwill, despite the recalcitrant debtor on the other side of the table. Each ordered pair in the matrix represents first, the debtor’s utility, and second, the creditor’s utility, under differing combinations of policy reform effort and write-off intensity.

Exhibit 2: Debt Renegotiation Game Between a Bad Debtor and a Creditor Group

The “best response strategy” solution, or Nash solution, is shaded. This is the outcome of strategic interaction between these players, as it is the only solution in which neither player has an incentive to move, given the stance of the other.5 This is a sub-optimal equilibrium because it results in little effort or concession from either side, and a Pareto-improving solution6 is available by moving diagonally (northwest) in the matrix. But, alas, these superior solutions are not stable equilibria in the game theory sense, without some outside agent to force the parties to those better solutions. This game set-up results in an equilibrium akin to the classic “Prisoner’s Dilemma.”

Exhibit 3 presents a corollary scenario to the game presented in Exhibit 2. How might an outside agent, such as the International Monetary Fund (IMF), promote a better solution? The IMF can work with countries to reduce the disutility of a PR program, by providing, in exchange for PR, additional lending resources that can be used for social support. I model this by specifying coefficient “x” as -0.1 (disutility of PR gets converted to modest positive utility) with the residual weight getting added to the reputation variable. In this version of the game, the payoff matrix yields the result that is shaded, with the country agreeing to high-intensity PR while receiving low DW (the Ukraine restructuring of 2015 might be a good recent example, in which Ukraine received substantial financial support from various sources, including the IMF, and agreed to a relatively mild restructuring of debt).

Exhibit 3: Debt Renegotiation Aided by Outside Agent(s)

Various other equilibria (not shown) emerge from this framework, depending on the parameterization of the utility functions of the players.

How Do We Incorporate China as a Major Creditor into the Framework?

We can use the game theory framework to help us model the increasingly large presence of China as a bilateral creditor country in the modern market. In previous periods, bilateral (government) creditors to emerging countries banded together in the form of the “Paris Club”7 and presented a unified front in debt restructurings. Represented by Ministries of Finance of mostly developed countries, the Paris Club had considerable clout to determine debt relief, and then impose “comparability of treatment” terms on private sector creditors such as global banks and bondholders. During the era of the Paris Club, which operated in cooperation with the multilateral lending institutions to impose restructuring terms on the commercial bank lenders, the game theory model may have been less relevant, given the process was less of strategic interaction and more of imposition and moral suasion. Fast-forward to the present day when, for many countries, China as a lone bilateral creditor has replaced the Paris Club group, and bonds have replaced commercial banks, and maybe the game theory model is again relevant.

Today’s China-influenced era can be modeled as a two-stage game in which a country in debt distress, after analyzing the structure of its debt, determines that its best strategy is to first make an appeal to its largest creditor: China. After it has negotiated debt relief with China, it may negotiate debt relief with bondholders, which are a more disparate group whose claims are generally domiciled in foreign jurisdictions such as New York and London.8

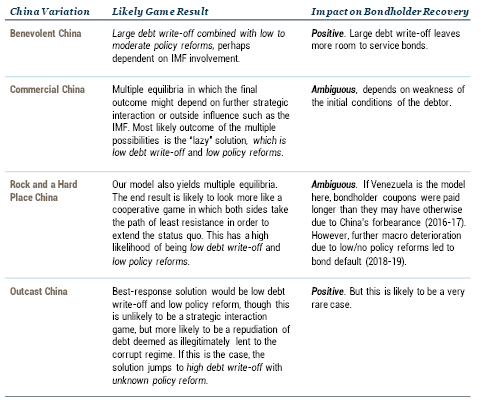

Before determining the effect of China’s presence on bondholder recoveries, we first need to model this first stage in which the debtor negotiates debt relief with China. Moreover, we need to identify which “China” we are talking about in order to determine utility function parameters. I consider four variations of China, the first two of which comprise the vast majority of scenarios:

- Benevolent China – China is an aid provider and seeks to win friends as part of its strategy of emergence as a future great power. I model this as China placing a high weight on goodwill, and low weight (meaning low disutility) on DW.

- Commercial China – China acts more like a commercial creditor, as most of its combined exposure is made of up loans on commercial terms, perhaps for bona fide investment and infrastructure projects. I model this as China placing higher weight on DW, meaning its commercial exposure is significant and a DW would hurt financially. I also assume goodwill has a relatively high weight in both the debtor’s and China’s utility function.

- Rock and a Hard Place China – I doubt China would ever intentionally partner with a rogue, illegitimate regime, but from time to time it might find itself in that position as a result of an existing relationship gone rogue. A current example would be Venezuela. Both are incentivized to maintain a status quo, because regime change could be embarrassing for China and result in imprisonment for the rogue regime insiders, for example. In this case, both China and the rogue regime have similarly parameterized utility functions.

- Outcast China – This might be a (also rare) scenario that would follow regime change, in which China is deemed to have been (willingly or unwittingly) in cahoots with the previous rogue regime. Reputation and goodwill collapse to zero, and this is unlikely to be a best-response-strategy game, but rather an outright debt repudiation by the new regime, depending on how it values future economic and political engagement with China. This latter calculation may be a function of the country’s perceived future engagement with the United States and Europe. Again, I am thinking of post-regime-change Venezuela here.

Without showing all the payoff matrices of the above games between a debtor and the four variations of China, Exhibit 4 shows the results based on our model parameters that are briefly described in the numbered points above.

Exhibit 4: Debt Restructuring Games Between a Hypothetical Debt Country and Four Variations of “China Inc.”

Conclusions and Implications

- There remains a lot of uncertainty in predicting sovereign default recovery values. However, this analysis can help us frame future thinking about restructuring outcomes when China is a major creditor. When used in conjunction with our existing quantitative recovery model, we may be able to narrow our range of recovery estimates, and then compare them to market prices in order to identify alpha opportunities.

- Under most scenarios describing China’s relationships with debtors, the fact that China tends to “go first” in terms of awarding debt relief tends to benefit bondholders via the country either avoiding bond default (there have been many cases of this), or via higher recoveries in a subsequent bond default.

- The previous conclusion should be tempered by the fact that the debtor may have arrived at a point of debt distress because of the Chinese lending.

- Going forward, in our normal interactions with countries’ policymakers, we intend to question countries much more rigorously regarding the size and nature of their Chinese loans, much like we have elevated our inquiry regarding environmental, social, and governance (ESG) issues in recent years.

- In understanding the size and nature of the Chinese loans, we can, with higher confidence, parameterize the utility functions of the “players.”

- Finally, we are constantly trying to parameterize the utility functions of countries in terms of their interactions with the global bond market. We can never achieve full certainty of specification, and governments change, but it is a core component of our sovereign research activity.

Download article here.