This research is related to the newly launched Nebo platform, a portfolio construction tool that helps RIAs build better portfolios. Nebo bridges the gap between financial planning and asset management, and recently won the WealthManagement.com 2022 Industry Disruptor award.

Learn more about Nebo >

Overview

In this webcast, Ben Inker, James Montier, and Martin Tarlie discuss the genesis of their latest White Paper, "Investing for Retirement III: Understanding and Dealing with Sequence Risk."

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- Sequence of returns risk is a meaningful risk for the vast majority of investment portfolios and there are useful tools that can mitigate its effects.

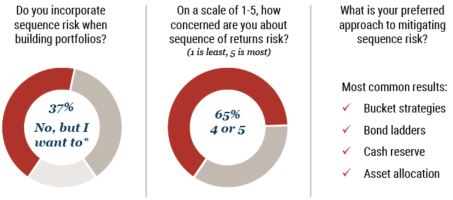

~100 responses to invitation survey

91% response rate–thank you!

*44% replied “Yes”

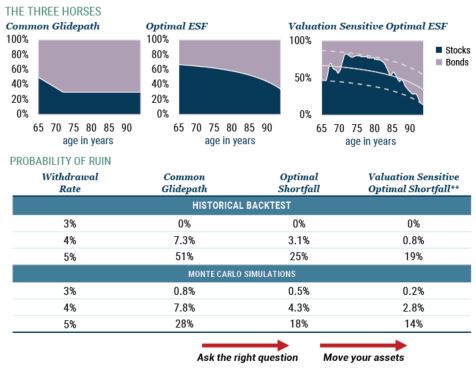

- We believe a multi-period, shortfall optimization framework that considers a client’s total investment horizon, financial needs, and circumstances accounts for sequence of return risk better than any standard single-period optimization.

- By dynamically reallocating portfolios based on valuation, portfolio managers can substantially further improve outcomes for their clients.

- The Nebo platform asks the right questions with respect to risk, takes into account investment horizon, and aligns the financial plan with the portfolio (see www.nebo-gmo.com for more details).

The Derby

Start with $1M at age 65, withdraw $50,000* every year

Source: GMO (charts top); Source: Robert Shiller, GMO (table)

*Withdraw $50,000 in real terms, **The stock weights in the Valuation Sensitive Optimal Shortfall results are constrained to lie between 20-percentage-point bands around the Optimal Shortfall stock weights. For the historical backtests, the results for the unconstrained Valuation Sensitive Optimal Shortfall strategy are 0.7% and 18% for the 4% and 5% withdrawal rates, respectively. For the Monte Carlo simulations, the unconstrained results for the 4% and 5% withdrawal rates are 2.7% and 13%, respectively. Historical backtests use Robert Shiller data from 1926-2018. Monte Carlo results are based on 10,000 simulations.

For additional information, please visit our Nebo website at nebo by GMO (nebo-gmo.com).

Download event highlight here.