Executive Summary

Born of the Global Financial Crisis, additional tier-1 securities were designed to absorb bank losses in times of turbulence and maintain financial safety at no cost to taxpayers. Despite good intentions, we’ve found AT1s to be flawed instruments that are contingently junior to common equity in practice. These complex securities are not only difficult to model relative to their standard issue counterparts, but they create a troublesome principal-agent conflict for quasi-sovereign banks. Despite the optical opportunity presented by these new instruments in the form of higher yields, the hurdles we have applied for investing in AT1 bonds have generally been higher than the market spreads to account for their binary nature and relative unpredictability.

Introduction

During the Global Financial Crisis, taxpayers suffered big losses while the bank bondholders walked away with par claims in their pockets – claims that were funded by taxpayer dollars. Most shareholders walked away unharmed as well. In years since, motivated not to repeat a public bailout of private institutions, regulators have pushed banks to fund their activities with more loss-absorbing instruments. Understanding, however, that true capital is particularly costly in times of turbulence, regulators created a new instrument to correct what appeared to be an unfair distribution of losses across taxpayers, debt holders, equity holders, and depositors. Known as contingent convertible (“coco”) 1 or additional tier-1 (“AT1”) securities, this new class of subordinated bank debt was designed to ensure that junior bondholders would bear at least some financial burden in times of crisis.

These AT1 securities, now roughly $250 billion and $25 billion of notional value in developed and emerging markets, respectively, offered a simple risk/return concept. In exchange for receiving higher interest payments, AT1 investors would take on the risk that the issuing bank, should it run into trouble, may suspend interest payments, convert the bond into equity, or write the bond off altogether. In the event capital was urgently needed, regulators would be spared from tapping into public funds to finance a bailout.

But as AT1s entered the emerging country debt investable universe in 2013 and we began to catalog their features, we found that many of those features were unfriendly to investors. Most importantly, it became clear that in practice, AT1s are contingently junior to equity. This means that AT1 bondholders can incur losses before equity shareholders in many scenarios, and that such scenarios are extremely difficult to predict ex ante. This makes them difficult to model and value relative to standard bond features.

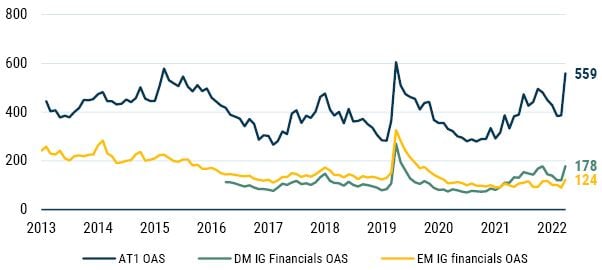

Furthermore, in our market where we focus on quasi-sovereign (i.e., government-owned) issuers, the existence of AT1s creates a potential principal-agent conflict in which the government simultaneously acts as a shareholder, regulator, and fiduciary of public funds. Therefore, despite the optical opportunity presented by these new instruments, we have so far concluded that the yields haven’t been sufficient to cover potential losses. (Exhibit 1 shows the AT1 yield advantage over the years. Notice the substantial price drop and yield rise in the bonds – we believe the market is likely to remain shut to new issuance at these valuations.)

Exhibit 1: AT1 Spreads, Yields, and Bond Prices Since Inception

Option-adjusted spread of AT1s vs. DM and EM investment-grade financials

Source: BofA Global Research, ICE Data Indexes LLC

Weighted-average price of AT1s vs. effective yield

Source: BofA Global Research, ICE Data Indexes LLC

Given the extensive reviews of bond terms and conditions inherent to our bottom-up process, we were not surprised that Credit Suisse’s AT1 bondholders were apparently written down to zero, even as equity shareholders retained some small residual value. But the Credit Suisse event did bring to light the possibility that both developed and emerging market investors in the regulated financial system see ex-ante rules torn up when faced with the ex-post reality of a crisis. We expect similar outcomes for AT1s in the future and therefore continue to set very high hurdles for portfolio inclusion.

The Risk Profile of an AT1 Bond

Having studied the features of these bonds at their inception and through their evolution under various jurisdictions, we have found that AT1s are typically highly complex instruments relative to plain vanilla senior bonds or old-style junior debt, and that they are riddled with significant flaws.

Let’s start with the greatest of these issues – capital impairment risk. Although AT1 bonds rank above equity in solvency, there are many plausible scenarios in which the hierarchy of investors is inverted such that AT1 bondholders incur losses ahead of equity shareholders. The trigger point for AT1 investors to take a loss was moved from the time of resolution (i.e., bankruptcy) to before resolution, so regulators can trigger an AT1 at their discretion without putting the bank under a resolution regime. While this surely benefits broader financial stability, it also eliminates statutory accountability to AT1 investors.

There is also the distribution risk. When a bank breaches its buffer requirements, it faces restrictions on the dividends and coupons it can pay based on a maximum distributable amount that it is required to calculate and observe. However, when an AT1 non-cumulative coupon is skipped, it is directly transferred from bondholders to equity shareholders via retained earnings. The dividends, on the other hand, even if not paid, are still retained for the benefit of the common equity shareholders. So, unpaid dividends are thus built into equity on behalf of the shareholders, while unpaid AT1 coupons represent a pure loss of value for the bondholders, making the latter junior.

As quasi-sovereign investors, a third complication has also stood out to us: the principal-agent conflict. In the case of AT1s issued by a government-owned bank, the government simultaneously acts as a shareholder, a fiduciary of public funds, and the bank’s regulator. If capital is direly needed in a quasi-sovereign bank, it is not inconceivable that the government could prioritize its own finances while raising capital. Rather than respecting the capital structure, a government may “bail in” AT1 holders – that is, cancel the debt that is owed – without diluting shareholders (i.e., itself). AT1 bonds were designed to prevent private losses from being cured by public coffers. But, in the case of government-owned banks, it is the public’s losses that would be cured by AT1 private investors – an unintended (but probable) consequence.

A Quasi-Sovereign Investor’s Approach to Assessing Bank AT1 Risk

It is for these reasons that the hurdles we have applied for investing in AT1 bonds have generally been higher than the market spreads, especially in the last few yield-starved years. With the recent Credit Suisse bondholder experience in mind, the question we have asked ourselves is, did we have the proper process in place to analyze the risks associated with AT1s? Our short answer is yes.

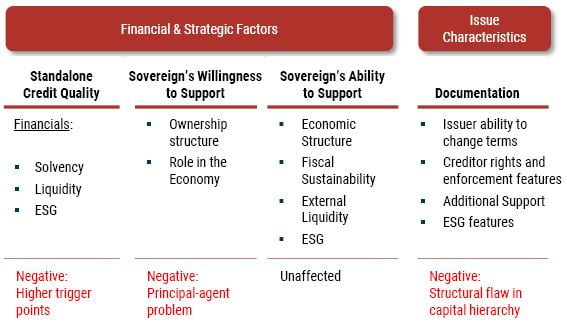

Exhibit 2: The Impact of AT1 Bonds on GMO’s Investment Pillars

As Exhibit 2 shows, when assessing a bank’s relative creditworthiness, we analyze the bank’s stand-alone credit quality as well as the sovereign’s incentives and ability to provide support in times of stress. As a final step, we review issue characteristics to capture and account for the variation in bond documentation. 2

Let us start with stand-alone credit quality analysis, a process where we deep-dive into the bank’s fundamentals. This step rewards strong credits while penalizing the weak. It does so by quantifying the distance between a bank’s current financial position and a trigger point where a loss is apportioned. When a bank issues an AT1, it increases its total loss-absorbing cushion. This simultaneously reduces the bank’s likelihood of entering a resolution where senior unsecured bonds are forced to take a loss. From this we conclude that, all else being equal, an AT1 issuance makes senior unsecured bondholders safer.

The second pillar in our model aims to measure the sovereign’s incentives to support a quasi-sovereign bank in times of elevated stress. With enough incentives, governments can bail out their companies to prevent a costlier alternative. As we explained earlier, AT1 bonds are designed to avoid costly taxpayer-funded bailouts. Therefore, from this we conclude that AT1 bonds will get no extraordinary government support under any circumstances, making these bonds riskier.

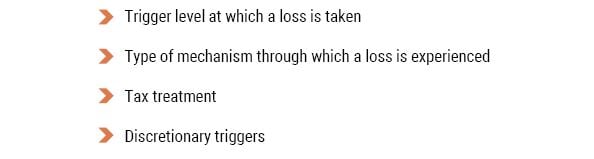

Exhibit 3: Main AT1 Documentation Differences

Studying issue characteristics takes an increased importance in AT1 analysis because, as highlighted in Exhibit 3, we have observed a high degree of design heterogeneity among existing AT1 debt stock, making these bonds riskier and thus requiring a deeper dive into bond documentation to evaluate our rights as investors. Consider the following examples from our investment universe, which show the lack of uniformity among AT1 designs:

For starters, capital adequacy levels at which the bond triggers a loss (also known as the point of non-viability or “PONV”) can vary between 2.5% on the low end and 5.5% on the high end. This number is critical because it tells investors at which point an AT1 security will be apportioned with losses, and the variance is large.

Second, even if a trigger event is a certainty, the type of mechanism through which a loss is taken is not. Some AT1 designs force a permanent write-down on AT1 principal whereas others force the entire principal to convert into bank equity.

The third difference stems from tax treatment. Some regulators recognize AT1 bonds as debt and allow banks to deduct interest payments from their income, reducing the bank’s overall tax bill. Others see AT1 bonds as equity and may even categorize them that way (e.g., as “preferred shares” in North America), hence coupons are treated as dividends and no tax deductions are granted.

Lastly, AT1 designs entail discretionary triggers where regulators can arbitrarily decide to force losses on a case-by-case basis, regardless of a bank’s capital level.

So, a decade after our initial analysis, we continue to believe that to purchase an AT1 instrument, investors must put faith in the issuing bank’s respective government officials, regulators, and management team. With AT1 capital qualifying as total loss-absorbing equity in the eyes of international (Basel) and national banking regulators, it has proven to be a popular tool among the quasi-sovereign banks in our universe. But even as the first ever subordinated bank bond entered our benchmark in 2016, we maintained that there were safer ways to increase portfolio yields and therefore continue to steer clear of AT1s at current valuations in our emerging debt portfolios.

Download article here.

Not to be confused with the sovereign contingent bonds we most recently discussed in “Sovereign Contingent Bonds: Two Years Later, Still a Useful Idea” (Ross and Ulukan 2022). We first proposed sovereign contingent bonds in August 2020 as a way for countries to structure bond agreements that allow for more flexible policy options in the face of a crisis. The idea was to combine features from post-GFC contingent convertible bonds and high-yield style payment-in-kind/toggle bonds, essentially creating a sovereign coco with PIK/toggle characteristics. Notably, the bonds we proposed would be designed with simplicity and maximum practicality for both issuer and bondholder in mind, serving as an effective, simple, low-cost and self-policing solution in times of global or isolated crises.

To learn more about our investment pillars and corporate credit investment process, see “EM Corporate Debt ESG Integration: An Alpha-Oriented Approach” (Sobolev and Ulukan 2022).

Disclaimer: The views expressed are the views of Mustafa Ulukan through the period ending April 11, 2023, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2023 by GMO LLC. All rights reserved.

Not to be confused with the sovereign contingent bonds we most recently discussed in “Sovereign Contingent Bonds: Two Years Later, Still a Useful Idea” (Ross and Ulukan 2022). We first proposed sovereign contingent bonds in August 2020 as a way for countries to structure bond agreements that allow for more flexible policy options in the face of a crisis. The idea was to combine features from post-GFC contingent convertible bonds and high-yield style payment-in-kind/toggle bonds, essentially creating a sovereign coco with PIK/toggle characteristics. Notably, the bonds we proposed would be designed with simplicity and maximum practicality for both issuer and bondholder in mind, serving as an effective, simple, low-cost and self-policing solution in times of global or isolated crises.

To learn more about our investment pillars and corporate credit investment process, see “EM Corporate Debt ESG Integration: An Alpha-Oriented Approach” (Sobolev and Ulukan 2022).