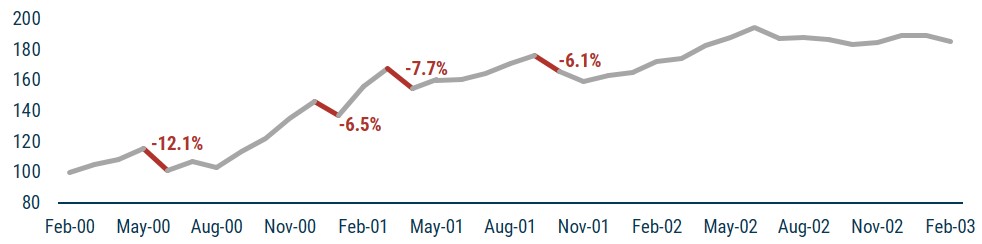

The Best 3-Year Period for Value vs. Growth Also Suffered Some of its Worst Drawdowns

Value vs. Growth: The Best 3-Year Period in History (U.S.), 2000 to 2003: Cumulative Return of 85.6%

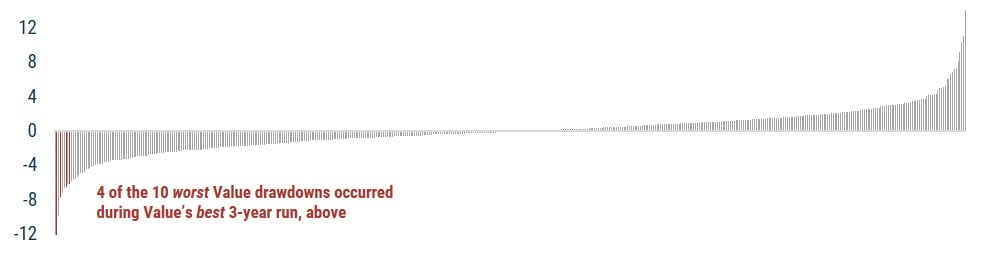

Value vs. Growth: Monthly Returns, Worst to Best, 1979 to 2021

Source: GMO. Value and Growth represented by the Russell 1000 indices respectively.

- The Value vs. Growth reversal, which started in earnest in the late Fall of 2020, generated exciting returns for many of our portfolios through May. In June, however, the reversal did a reversal, with Growth notably beating Value. It was true across the globe but particularly pronounced in the U.S., as the Russell 1000 Value underperformed Growth by 742 bps. Drawdowns like these are unpleasant, but importantly, from an investor’s mental health perspective, they can be unnerving. The second-guessing starts, questions mount about whether Value’s run was short-lived, and an uncomfortable feeling of “is that it?” arises.

- Fear not. These profitable trades never happen in a straight line, as history shows.

- See the first chart above, which shows the historic 3-year reversal of Value vs. Growth from 2000 to 2003. This was the best period in U.S. history. It began for sound reasons, similar to today – the valuation gap between Value and Growth had reached absurd levels by 1999, and mean reversion was inevitable. A long Value/short Growth portfolio would have generated returns of 86% (p.s., it kept being profitable for years afterwards).

- But it was not a straight line. There were uncomfortable, second-guessing-inducing give-backs along the way. In fact, when we look at the entire 40-year history of the Value vs. Growth relationship (the second chart), 4 of the 10 worst drawdowns ironically occurred during this best 3-year run. If any investors had lost their nerve during any one of these drawdowns, they would have also lost out on the trade of a lifetime.

- We are not letting a June give-back weaken our resolve, as it was well within expectations. Our thesis remains intact. Value still deserves to win, by a lot. We’ve only just begun.

Download article here.