Executive Summary

Emerging countries have been in the midst of a crisis that is not of their own making. A great majority of these countries are navigating the crisis fairly well. Others are struggling, and a few have defaulted on their external bond debt in which our Emerging Debt strategies are invested. Meanwhile, there has been somewhat successful broad-based debt relief for the poorest countries on debt they owe to developed world governments. However, private sector involvement in “blanket” debt relief has proven difficult, due to a number of constraints. Moreover, we know from experience that sovereign debt restructurings are costly to both debtors and creditors. In this paper, we propose a simpler solution than others that are circulating in the market for building in contractual methods to help countries deal with short-term financial distress brought on by a global crisis or a country-specific event. We believe a simple payment-in-kind (PIK) structure borrowed from high yield debt markets could be an effective, simple, low-cost, and self-policing solution. The liquidity relief provided by a PIK option embedded in bond contracts could augment other relief supplied by multilateral and bilateral creditors.

The Context and the Problem

Emerging countries are in the midst of another epic crisis that is not of their own making. These “once-in-a-lifetime” global crises are appearing with higher frequency, seemingly once every 10 to 12 years. The world seems more vulnerable to these crises because of globalization and interconnectedness among peoples and nations. Moreover, crises at the individual country level have become more frequent just as the investable universe for our Emerging Debt strategies has expanded and is approaching 100 sovereigns. These more localized crises are often the result of the age-old reason of poor policymaking, likely made more severe by the ever-increasing threat of climate change.

This latest crisis of global demand, brought on by the lockdown policies designed to fight the coronavirus, has generated familiar calls for debt relief for those emerging countries that have limited resources and weak public health infrastructures to deal with the pandemic. Prior to the crisis, warnings were being sounded about the rising debt load in the emerging world that would reduce policy options for countries if a crisis were to occur.1 As the crisis intensified, some well-known economists called for a blanket debt moratorium for all sovereigns, except those rated triple-A.2 Many others have called for blanket debt relief for poorer countries. The G-20 successfully called for debt relief for the poorest countries on debt they owe to developed world governments (usually concessional lending via export-import banks and the like).3 This plan – the Debt Service Suspension Initiative – which was envisioned to include private sector creditors, including bondholders, required beneficiary countries to seek debt relief from private creditors.

In practice, this “private sector involvement” (often short-handed to PSI) has proven difficult, and the initiative has been all but abandoned due to a number of constraints. These include: 1) institutional constraints, such as the lack of an established “bankruptcy” system4 for internationally-issued sovereign bonds; 2) practical constraints, such as the large and diverse group of bondholders and other private creditors that lend to sovereigns, making collective action very challenging; and 3) reputational constraints, which refers to the “goodwill” and reputation for honoring obligations that many countries have built up over decades with the international financial community. Most countries place a high value upon this goodwill, on display today as many countries, ranging from single-B-rated Honduras, Bahrain, and Egypt, to investment grade-rated Philippines, Mexico, and Chile, with good payment records have been able to partially finance Covid-19 policy responses in the bond markets. In contrast, a handful of other countries with damaged reputations, such as Argentina and Ecuador, have chosen to default again.

Are there any ideas about how to get around the constraints highlighted above? Is there a way for countries to receive debt relief from bond markets when things fall apart?

An Unsatisfying Existing “Solution”

State-contingent obligations (SCOs) are one possible instrument that could help solve the problem.5 These are debt obligations in which payments are uncertain and dependent on some “state of the world.” They can be linked to economic or financial variables, whereby debt service payments, instead of being fixed, are variable and more correlated with a country’s ability to pay. These instruments are not new to sovereign borrowing. The first such bond that we can find was issued by the State of Massachusetts in 1780, called a “Depreciation Note,” indexing the interest payments to a basket of goods. Since then, this concept has made some incremental progress toward linking debt repayments to relevant measurable variables. In the 1970s, Mexico issued several bonds indexed to oil prices. In the 1980s and 1990s, a host of countries including Costa Rica, Bulgaria, and Bosnia and Herzegovina issued GDP-linked warrants, which provide holders with a higher coupon if gross domestic product (GDP) exceeds some threshold level. More recently, Argentina, Greece, and Ukraine have issued similar instruments. In Grenada’s 2015 debt restructuring, a “hurricane clause” was inserted in order to provide debt service relief in the event of another catastrophic weather event, with all the necessary legal provisions detailing exactly how such an event is defined.

We note that the vast majority of these SCOs are issued after a default, generally as a “sweetener” to enhance bondholder participation rates in a debt restructuring. Very few are issued as preventative, and if they are, as in the case of Grenada’s hurricane clause, we observe that they are chasing the last crisis, not necessarily preparing for the next one. In this case, Grenada is partially “hedged” for another devastating hurricane, but not a global pandemic.

The most serious recent attempt to design instruments that can deal with the “next crisis” came from a group of investors, academics, and lawyers, working in affiliation with the Bank of England in 2015 and 2016.6 The group designed bonds with a payment structure linked to a country’s GDP. The higher the GDP, the higher the government’s tax revenue and, therefore, capacity to pay. Had these bonds gained traction, they would have been useful in the current global pandemic. Effectively, countries would have been receiving “debt relief” via lower contractual payments as Covid-19-induced recessions took hold. Some countries may have avoided default as a result.

But these instruments have not gained traction in the market. Why not? We believe it has to do with some combination of low practicality and high complexity. For example, GDP is notoriously difficult to measure, and there is a significant lag in reporting. We know economies are in recession this year, but we will not know the extent of this year’s recessions until well into 2021. However, countries need the debt relief now. This is a timing problem of practicality, but let’s assume this can be fixed somehow. We’d still be left with a problem of complexity. A nominal GDP calculation expressed in local currency terms is a complex process that involves a real output measure and an inflation indicator for an economy, both of which can be manipulated. If a dollar-based measure is required for the GDP-linked bond, then we need to add an exchange rate, which can also be manipulated. The complexity of the instruments makes pricing difficult. Existing GDP warrants in the market are valued using Monte Carlo simulations that must rely on historical data that may have nothing to do with the future. Moreover, preventative clauses such as Grenada’s hurricane provision need to be carefully specified. Does a Category 3 hurricane that moves slowly over the island qualify, or only a Category 4 or above? There are creative ways to deal with these complexities, but in our opinion, they add layers of documentation, calculation, and pay-off uncertainty, reducing the attractiveness of these instruments in the market.

Our Simpler Proposal

Our proposal is to revert to something much simpler, borrowing existing ideas from the high yield market, as well as post-GFC trends in subordinated bank bonds. From the high yield market, we have PIK and “toggle” bonds, which allow for debtors to capitalize coupon payments, usually in return for higher coupon rates in the future. Interestingly, our colleagues from GMO’s High Yield portfolio management team tell us that issuance of these notes has fallen in recent years, perhaps because of low all-in coupons as a result of lower risk-free interest rates, but they also tell us that these notes, similar to our experience with GDP-linked notes in emerging markets, often arise out of debt restructurings. Moreover, their terms tend to be onerous, significantly raising future debt service as a “cost” of using the payment deferral, which tends to keep the entity in financial distress.

In the subordinated bank bond market, we’ve observed the increased issuance of contingent convertible (coco) bonds. These were introduced post-GFC to correct what appeared to be an unfair ex-post burden sharing across taxpayers, debt holders, and equity holders. They are designed to allow banks to skip coupon payments without necessarily having to be in a state of insolvency. In other words, they are more flexible, providing bank management and regulators with more policy options.

How does GMO envision a “sovereign coco” with “PIK/toggle” characteristics? We would design this instrument for maximum simplicity and maximum practicality for both the issuer and the bondholder. It would be a pure PIK, whereby the issuer would have the option to skip two consecutive coupon payments, at its sole discretion, on one occasion during the life of the bond. Other ideas we have seen along this line specify thresholds for when the PIK can be used, such as credit default swap (CDS) spreads, recessions, or natural disasters as measured by specific parameters. We would eliminate all of these, and let the country decide when to use the option. Coupons would be added to principal, and future interest payments would be made on the higher level of principal. Done this way, financial losses to bondholders would be negligible, while the country would receive potentially valuable cash flow relief in the event of a shock.

This option, if broadly used, would be extraordinarily valuable in the current global environment. It would help address the PSI issue and deflect criticism that bondholders are in some way being made whole by debt relief from the official sector. It would prevent countries from incurring the legal and administrative costs of seeking short-term debt relief. The small Central American country of Belize is a case in point. Its government recently capitalized some near-term coupon payments on a bond that is in our EMBI Global Diversified benchmark.7 This required a so-called consent solicitation to obtain the consent of bondholders, which involved the hiring of expensive law firms and financial advisors and many hours of valuable time from government officials and bondholder groups. The provision we propose would eliminate this step. We acknowledge the PIK provision would not be of much help to a country like Lebanon, where debt was clearly unsustainable before the Covid-19 crisis. It would not likely be useful to Argentina either, where willingness to pay is so much in doubt and domestic politics is aligned to view bond markets as adversaries, rather than development partners. But it would be very useful to many countries that simply need short-term debt relief to deal with an unexpected crisis. In the case of Ecuador, it might have provided enough liquidity relief to prevent a default this year.

One potential criticism of our proposal might be that it would be prone to abuse by politicians. Indeed, non-payment of bond coupons might be a creative way to fund an election campaign. We think this is a low risk. Interactions between bond markets and governments is a “repeated game” in game theory parlance. Players “learn” about each other through their actions. Because the capitalization option is available only once over the life of the bond, governments are likely to use it sparingly. Those that abuse it by using it in a year where there is no crisis would reveal themselves as irresponsible stewards of public finance and see their bond spreads rise. We believe this dynamic would be a very effective self-policing mechanism.

In this pure PIK form, which we will label the Capitalization Option, from a net present value perspective, there is no loss for bondholders, assuming no further risky spread discounting is applied, whether the coupons are skipped in, say, Year 1, Year 5, or Year 10. Therefore, such a structure should “cost” the country very little in terms of the added yield it would be required to pay for the initial issuance. But another criticism could be that it is not pure debt relief, only liquidity relief. We can imagine two additional simple forms the model could take that would do so, but cost the issuer in terms of additional yield at issuance:

- Forgiveness Option: At the other end of our spectrum would be a bond in which two consecutive semi-annual coupons could be skipped, with no recovery to bondholders (no PIK). This is pure debt relief, and therefore the most costly to the issuer in terms of the additional yield it would have to pay to entice investors to purchase the bond.

- Deferral Option: Somewhere in the middle of the Capitalization Option and the Forgiveness Option could be a bond that allows the issuer the option to defer coupons for any two consecutive semi-annual periods, to be paid at maturity. This would effectively raise the debt level, as it would be a claim on the sovereign, but interest payments in the interim would not be applied to this added stock, as they would be in the Capitalization Option. This would cost the sovereign issuer less than the Forgiveness Option, but more than the Capitalization Option.

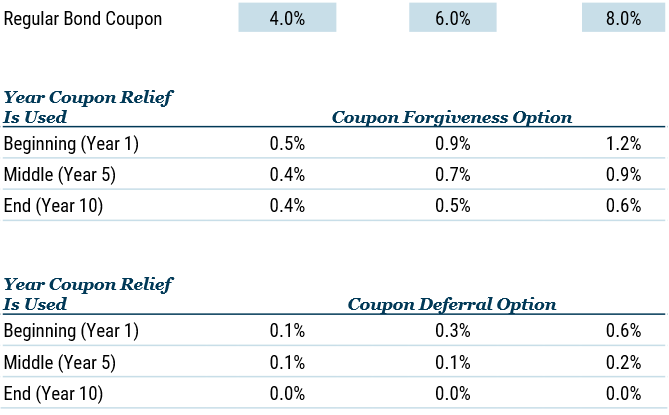

We think of the added yield that countries would have to pay for this optionality as akin to an insurance premium. Table 1 shows how much additional yield (insurance premium) countries may have to pay to make investors indifferent to holding such a bond with a less predictable payment structure or holding a plain vanilla bond.

Table 1: Breakeven Yield Differentials Between Straight Bonds and Debt Relief Options for a Hypothetical 10-Year Bond

Source: GMO

We use a very simple cash flow model to make these calculations, assuming three scenarios (short-, medium-, long-term) for timing of when the coupon relief is used by the country. Investors are likely to demand a premium that drifts to the worst-case scenario, which is immediate usage in Year 1. If that’s the assumption, then the added annual premium the country would have to pay would be from 0.5% per year to 1.2% per year in the Forgiveness Option, and 0.1% per year to 0.6% per year for the Deferral Option. The range depends on the initial creditworthiness of the issuer. For issuers of high credit quality, who can issue at 4.0%, the premium is lower, with the premium growing as initial credit quality falls (initial yields rise).

Would an issuer that can issue sovereign bonds at 4.0% be willing to pay an extra 0.5% per year for the option of skipping two coupons during the life of the bond? We’re not sure. This issuer is likely to be investment grade and can likely “self-insure” against a massive shock like a global pandemic. Would it be willing to pay an extra 0.1% per year for the option to defer some coupons in the event of a natural disaster or fiscal shock? We see this as more likely. We think this option could have been beneficial for a very large number of countries this year, even those with market access.

What about an 8% yield country – as in a single-B sovereign credit? Would it be willing to pay 1.2% on top of its 8% funding yield to be able to skip two coupons? Perhaps. Or an extra 0.6% for the Deferral Option? This is more likely. Even more likely would be the use of the Capitalization Option, which would cost little to nothing in added yield premium.

Conclusions

In this paper we suggest options borrowed from the high yield bond market as a way for issuers and investors to contractually build in some flexibility in the event of a major global crisis such as the one we are all experiencing now, or more isolated crises limited to one or a few countries, such as a natural disaster. We believe our proposal is dramatically simplified relative to other ideas that are circulating. We believe that providing flexibility up front would save valuable time, money, and other resources of both policymakers and bondholders, who these days find themselves hiring lawyers, restructuring advisors, and financial advisors to help manage everything from simple consent solicitations to complex restructurings. These activities could be avoided outright, or at least forestalled, by implementing one of our three options. Finally, we are confident that market forces would prevent all but the most irresponsible of debtors from abusing what are meant to be simple, fair alternatives that can be used to ease short-term financial distress.

Download article here.