Executive Summary

Quality investing is an approach well suited to small cap equity. As an asset class, small cap has become notably cheap this year. GMO recently launched a Small Cap Quality Strategy to take advantage of the alignment of attractive long-term small cap quality stock characteristics and compelling short-term valuations. We believe this new Strategy is well positioned to outperform, while offering defensive characteristics especially valuable for investors searching for opportunity in an uncertain market environment.

We believe a moment has arrived when long-term and short-term opportunities in quality small cap equity are finally aligned, when one can invest in high-quality small cap names at attractive valuations. At a time of heightened uncertainty for many risk assets, investors can confidently add small cap quality to their equity portfolios.

The Small Cap Quality Opportunity

Attractive Valuations Today in Small Cap

For most of the past decade, small cap stocks were expensive versus both their own history and their typical multiples against large cap stocks. However, in more recent years, there has been a significant derating of small cap stock valuations, which have fallen 39% from their post-Global Financial Crisis peak versus the broader market. 1 Today, we believe small cap stocks have become notably cheap. Within the U.S., small caps trade at a 21% discount versus their typical relative multiple against the total market.

Exhibit 1: Small Cap Relative Valuations Have Become Attractive

U.S. Small vs. U.S.: Normalized Earnings

Data from December 1976 through September 2022 | Source: Worldscope, GMO

Small cap’s decline in valuation has been driven in part by fears of an economic slowdown. We believe this presents a compelling investment opportunity in quality: small cap quality offers a way to take advantage of attractive small cap valuations while reducing downside risk. Indeed, GMO’s Asset Allocation team recently began allocating capital to U.S. small cap quality in select portfolios.

Higher Return, Lower Risk with Small Cap Quality

On the GMO Focused Equity team, we have experience investing in high-quality stocks – companies that, by our definition, exhibit high margins, high returns on capital, low debt, and stable fundamentals. We have been investing in these companies since 2004 in our Quality Strategy, and we are confident that a portfolio of quality stocks can provide superior returns and lower risk over time.

High-quality small cap companies have delivered stronger returns than the small cap universe, with lower volatility. Since 1976, small cap quality has outperformed the small cap asset class in the U.S. by 1.8% annualized and has also outperformed the all-cap U.S. market by 2.8% annualized (Exhibit 2). These more predictable, long-term winners are very often undervalued by the market, buried under the buzz of stocks long on narrative but short on fundamental stability.

Exhibit 2: Small Cap Quality’s Strong Relative Returns

Data from December 1976 through September 2022 | Source: Worldscope, GMO

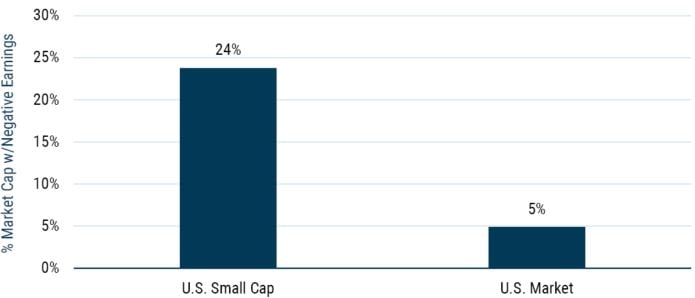

The small cap universe is full of speculative stocks offering more promise than profit and burdened with challenged financials. Chronically underperforming junk companies represent far more of small cap indices than they do of large cap indices. As Exhibit 3 shows, 24% of U.S. small cap stocks by market cap weighting produced negative earnings over the last 12 months, while only 5% of the total U.S. market had negative earnings over the same period. This is not just a current phenomenon: loss-making small caps have made up a high – and slowly rising – proportion of the small cap universe for decades.

Exhibit 3: “Junk” is Common in Small Cap

Negative Earnings Exposure

Data from September 2021 through September 2022 | Source: Worldscope, GMO

As a result, more of the small cap universe is set up to fail, and less of it is set up to succeed. Investors tend to overpay for shares of weaker and more volatile businesses, perhaps lured by overly optimistic projections or lottery-ticket-like chances for sizeable payoffs should these companies succeed. We believe that because of the prevalence of junk companies in small cap, a quality-focused strategy can deliver superior and meaningfully differentiated results against small cap benchmarks.

Of course, investing in small caps involves heightened volatility. However, compared to the small cap universe, applying a quality-oriented approach can mitigate this risk, as Exhibit 4 shows. For small cap quality, the risk premium tends to work in reverse, just as we have seen in larger cap quality. By thoroughly sifting through the junk and focusing on only investing in the best businesses, investors can generally achieve higher returns with lower risk over the long term.

Exhibit 4: Attractive Risk and Reward for Quality vs. Market

Quality for Greed and Fear

Data from January 1980 through September 2022 | Source: Worldscope, GMO

Quality, Small Cap Quality, and U.S. Small Cap are broad investment universes and not Strategy or backtested performance.

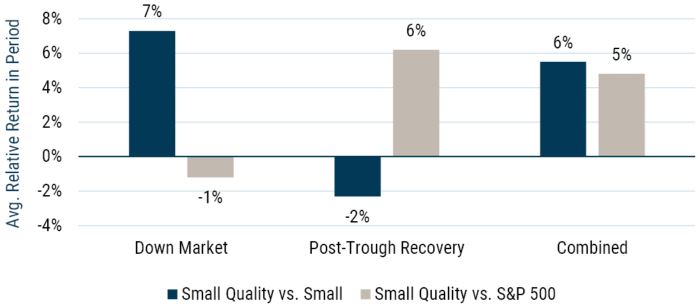

Though we will not prognosticate on the risk of a recession or the duration of the current market downturn, we note that small cap quality has consistently offered attractive investment characteristics through previous down markets. As Exhibit 5 shows, small cap quality strongly outperforms small cap during down markets, while roughly tracking large cap. In the post-downturn recoveries, small cap quality stocks meaningfully outperform large cap stocks and only “give back” a small proportion of their earlier outperformance against small cap stocks.

Exhibit 5: Small Cap Quality in Down Markets 2

Data from January 1995 through December 2020 | Source: Worldscope, GMO

How to Find Quality in Small Cap

Invest in Amazing Businesses That Can Sustain Excellence

When applying our quality investing approach to small cap, the core philosophy remains unchanged – we continue to look for companies led by strong management teams that can sustainably deliver high returns on capital. Small cap differs from large cap in important ways, though.

When seeking quality in our large cap Quality Strategy, we are typically analyzing dominant businesses that have delivered long-term – often decades-long – outperformance. We therefore have ample evidence that we are investing in strong companies, and so the core investment question we must answer is, “Are we paying an attractive price for this amazing business?” Within the small cap universe, companies that screen as high quality tend not to be as dominant in their industries, and they typically have shorter track records of success. Thus, the core investment question shifts to, “Are we confident that this business is, in fact, amazing?”

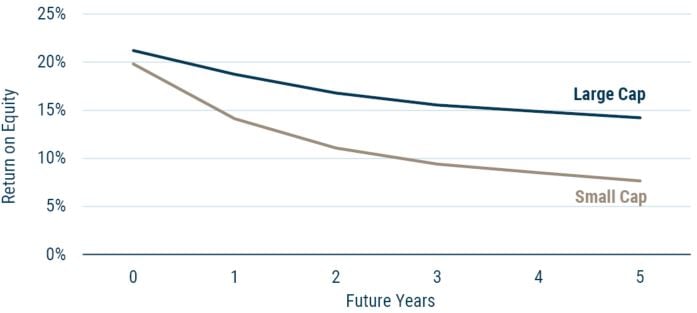

Our research shows that small cap quality companies are, in fact, less likely to sustain their quality characteristics over time than large caps. For instance, as Exhibit 6 shows, both large cap and small cap companies with high return on equity (ROE) face ROE declines over time, but the decline is faster in small cap companies.

Exhibit 6: ROE Decline in High ROE Companies is Faster in Small Cap

Data from December 1980 through September 2022 | Sources: Worldscope, GMO

This rapid small cap quality-decay illustrates an opportunity for fundamental research to add value to systematic quantitative quality investing. By identifying those companies within the quantitatively defined small cap quality universe that can avoid quality-decay, we aim to create a portfolio of companies that will be well positioned to outperform the already-strong returns of our quantitatively defined small cap quality universe. Thus, the key focus of our small cap research is distinguishing which companies have truly sustainable competitive advantages that can support long-term outperformance.

Introducing the GMO Small Cap Quality Strategy

We have recently launched a Small Cap Quality Strategy to exploit the opportunities discussed herein.

Our strategy is highly focused on ensuring that we only invest in companies that can sustain their edge and performance over time, using fundamental research to identify long-term winners within a quantitatively defined quality universe. These longer-term investments also help to minimize trading costs, which can be high in small cap.

Before leveraging fundamental analysis, our portfolio construction process begins with applying our proprietary systematic quality screens to the small cap asset class, reducing our investable universe of 2,800 U.S. stocks by over 90%. Fewer than 200 U.S. small cap names tend to meet our quantitative quality threshold.

Within this remaining universe, we fundamentally examine every name, testing whether each company possesses the sorts of strong competitive advantages that lead to sustained outperformance. As our ROE analysis discussed above would indicate, most companies fail this test. Indeed, only about 80 names currently meet both our fundamental and quantitative quality criteria.

The final GMO Small Cap Quality Strategy is a high-conviction portfolio of about 40 names, selected for their attractive valuations and especially high-quality business models, within a risk management framework designed to avoid excess exposure to any one sector or economic trend.

Our Strategy in Practice

Below are examples of the types of companies we prefer to own within small cap.

Dominant players in niche industries: relatively small businesses with niche dominance that can achieve the economics and defensibility of a scaled incumbent.

- Acushnet, a leading company in the golfing equipment industry, has durable, respected brands and strong distribution channels.

Innovators in high-quality sectors: strong cultures of innovation in industries with solid economic characteristics.

- Globus Medical operates primarily in the spinal surgery market and, alongside larger quality names such as Medtronic, has consistently provided innovative solutions to complex medtech challenges, such as surgical robotics and spinal implants.

- Power Integrations, a semiconductor company in the attractive analog space, leads in high voltage systems, an increasingly important area given secular trends toward electrification for automation and decarbonization.

Essential cogs in a larger supply chain: companies specializing in providing key products that other industry players are reliant on.

- Woodward provides a suite of products deeply entrenched in complex processes in the aerospace and industrial sectors. Customers are reluctant and often unable to swap out Woodward products, as they have satisfied cumbersome regulatory requirements.

Razor/razorblade business models: firms that provide upfront capital equipment at a low cost, while making money on recurring aftermarket sales.

- Kadant produces capital equipment with a focus on the production of paper-related products like packaging and tissue. The company earns roughly two-thirds of its revenue from parts and consumables, such as blades used in the paper production process.

Conclusion

We think GMO’s new Small Cap Quality Strategy is well positioned to deliver exceptional absolute and relative returns. Small caps are attractively valued currently, and small cap quality companies outperform within the small cap universe – and our portfolio holds the best of those small cap quality companies. It is the perfect time for quality in small cap.

Download article here.

For the purposes of this paper, all references relate to the U.S. market. “Small cap” are U.S. companies in the lowest decile of market capitalization of all publicly held U.S. companies. “Quality” are companies in the highest quartile on GMO’s quality metric blending profitability, stability, and leverage, and “Small cap quality” are those companies in the intersection of the two groups.

Down markets are the time periods during which small cap stocks fell more than 10% from peak to trough. Post-trough recovery time periods are the lesser of 12 months and the time to the next bear market. Twelve separate down markets observations were averaged for this analysis.

Disclaimer: The views expressed are the views of Hassan Chowdhry and James Mendelson through the period ending October 2022, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2022 by GMO LLC. All rights reserved.

For the purposes of this paper, all references relate to the U.S. market. “Small cap” are U.S. companies in the lowest decile of market capitalization of all publicly held U.S. companies. “Quality” are companies in the highest quartile on GMO’s quality metric blending profitability, stability, and leverage, and “Small cap quality” are those companies in the intersection of the two groups.

Down markets are the time periods during which small cap stocks fell more than 10% from peak to trough. Post-trough recovery time periods are the lesser of 12 months and the time to the next bear market. Twelve separate down markets observations were averaged for this analysis.