Executive Summary

Most global equity managers today are underweight Japan. They harbor a view that Japan is a slow growth, low profit, and low return place to invest due to demographic headwinds and a paternalistic corporate system. We believe reforms have driven a rise in profitability and a more shareholder-friendly environment in addition to representing important secular tailwinds. While Japan is and will remain cyclical, we believe investors would do well to revisit their biases and acknowledge that substantive change has occurred. This change has led to better fundamentals than most recognize and bodes well for long-term investors.

Japan profit margins and attitudes toward shareholder interests have improved substantially over the last decade. Investor perceptions of Japan, however, have lagged this progress. In this piece, we touch on the key forces behind this improvement, noting where we see room for additional profit gains and shareholder-friendly outcomes.

Key Takeaways

- Long-standing corporate, economic, and cultural beliefs in Japan previously favored a broad group of stakeholders above shareholders.

- Reforms and policies, however, have led to a more shareholder-friendly environment and driven a rise in profitability. These efforts represent important secular tailwinds.

- Hard to implement operational moves like raising prices, cutting costs, and divesting non-core businesses have driven profit margin expansion and thus improvements in return on equity (ROE). Optimizing bloated balance sheets will pave the way to an easier path to continued gains in ROE.

- From a top-down perspective, GMO finds Japanese equities quite attractive. In an expensive world, Japanese Small Cap Value rises to the top of attractive securities to own, as we do across our various GMO Asset Allocation strategies.

- Our Usonian Japan Value portfolios are significantly cheaper than the market yet have stronger balance sheets. We are investing in companies that have both the ability and inclination to increase the distribution of excess capital to shareholders while improving ROE along the way. Active engagement helps the process.

Profitability Has Improved but Remains Cyclical

Japanese companies have been less profitable than their developed market peers for decades. In addition, their balance sheets are bloated with low-yielding cash and low-returning, unproductive assets. As a result, Japan has delivered a relatively meager 3% real return on capital1 vs. about 6% for developed markets for most of the past four decades. The plight of the Japanese market has its origins in long-standing corporate, economic, and cultural beliefs that favored a broad group of stakeholders (employees, customers, suppliers, etc.) above shareholders.

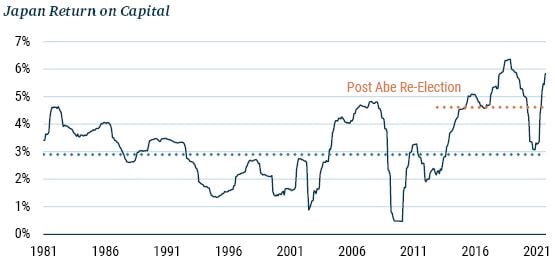

Macro headwinds, however, have forced an evolution in the treatment of shareholders. Faced with an aging society, shrinking workforce, rising pension liabilities, and anemic growth, political leaders implemented policies to make capital more productive and to enhance returns for shareholders. Those policies and efforts by management teams evolved over decades but were certainly intensified with Prime Minister Abe’s re-election in late 2012. As Exhibit 1 indicates, return on capital (ROC) in Japan has improved, moving from its perennially low 3% real level to reach closer to developed market “norms.”

EXHIBIT 1: IS THIS ALL CYCLICAL OR A SIGN OF SECULAR STRENGTH?

As of 11/30/2021 | Source: GMO

Return on capital is after inflation. Universe excludes Financials, Resources, and Trading companies.

Despite secular tailwinds, some of the observed improvement in profitability is cyclical in nature given the Japanese economy’s sensitivity to the global economy. The correlation between the TOPIX index’s ROE and the global economic cycle (proxied by U.S. industrial production lagged 6 months) is about 80%. A longer-term view supports this correlation. Regressing 5-year changes in Japan’s ROC vs. its real effective exchange rate and the global profit cycle (proxied by changes in U.S. ROC) suggests cyclical drivers explain about 40% of the changes in Japan’s long-term profitability. While cyclical forces matter, we believe the remaining 60% of the change in Japan’s ROC is due to secular factors.

Deeply Embedded Secular Drivers Are Behind Japan’s Improving Fundamentals

Management teams in Japan worked hard to shore up their businesses following the bursting of Japan’s economic bubble in the early 1990s. A confluence of secular forces amplified these efforts to improve corporate profitability and elevate the interest of shareholders in the pecking order of corporate mindsets.

Monetary and fiscal policies complemented and accelerated management-led reform efforts. Historically, the Bank of Japan’s (BOJ) monetary policy has had an obvious direct impact on interest rates and foreign exchange rates. The BOJ implemented policies (Quantitative and Qualitative Easing, Negative Interest Rate Policy, and Yield Curve Control) intended to generate inflation and end the deflationary environment that plagued Japan following the bubble burst. In addition, the government has driven a flurry of self-reinforcing policy and regulatory initiatives, the objectives of which are best summarized by the 2014 Ito Review,2 which called for a “shift to capital efficiency-focused management, optimization of the investment chain, and promotion of two-way dialogue between companies and investors.” The Ito Review is complemented by a suite of other policies including Japan’s Corporate Governance and Stewardship Codes. Tax code changes also have been a moderate driver for secular profit improvement.

The private sector and asset owners have played an influential role that has focused on improving shareholder outcomes. The stock exchange itself has driven secular changes consistent with the government initiatives. The Tokyo Stock Exchange, for instance, introduced rules for a minimal level of independent board directors and introduced a new “Prime Exchange” intended to provide incentives for corporate governance improvements. Finally, policy changes have coincided with secular shifts in investor behavior. Most importantly, Japan’s national pension plan has been a proponent and contributor to these policy changes in order to meet growing pension liabilities. Institutional investors have been pushing for various improvements as evidenced by Japan-specific proxy voting policy changes made by ISS and Glass Lewis. The combination of this comprehensive suite of policy initiatives is driving durable, secular transformations that are behind the profit improvements of Japanese companies.

Policies and Reforms Have Led to Higher ROE

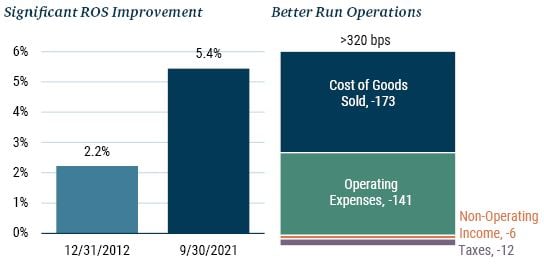

ROE improvement is an explicit and common objective of many of these policy initiatives, which have clearly been successful. ROE has improved markedly over recent years, driven by a rise in return on sales (ROS) as detailed in the Du Pont analysis presented in Exhibit 2.

EXHIBIT 2: WHERE DID ROE IMPROVEMENTS COME FROM?

As of 9/30/2021 | Source: GMO

Leverage is Total Assets/Equity. Universe is TOPIX ex-Financials.

ROS, or net income margin, improved dramatically from 2.2% in 2012, immediately before the re-election of Prime Minister Abe, to 5.4% by the end of the third quarter of 2021. We believe the net income margin likely would have been even better today if not for COVID-19. Decomposing this profit improvement across sectors and income statement line items makes it clear that: 1) the rise in ROS is not due to a mix shift in sector exposures (e.g., toward Information Technology) or within one sector; and 2) profit improvements are evident up and down the income statement. The biggest improvement has been at the gross profit level (i.e., a reduction in cost of goods sold) followed by lower operating expenses as a percent of sales (see Exhibit 3).

EXHIBIT 3: RETURN On SALES IMPROVEMENT DRIVEN BY COST REDUCTION

Source: Worldscope, GMO

Tangible Evidence from our Bottom-Up Research3

As the bar to the right of Exhibit 3 indicates, companies have reduced the costs of goods sold (COGS) by a meaningful 1.7% since 2012. A combination of raising prices, improving procurement, product mix, and other initiatives underlie this decrease in COGS. Management teams’ efforts to pursue these cost-reducing strategies have been supported by the BOJ’s monetary policy. While the BOJ’s aggressive brew of policies has not led to the 2% inflation level the central bank is targeting, it has helped move management teams away from the deflationary mindset that set in following the bursting of Japan’s economic bubble.

Our portfolio offers tangible evidence of the changing perspective toward price increases. In the past, when we encouraged portfolio companies suffering from low margins despite very high market share to raise prices, they often balked based on the tenet that “raising prices would be rude to customers.” This commonly held view was a symptom of the deflationary mindset. Today, management teams are more confident in their ability to boost prices, partially due to the secular push of monetary policy.

More progress has been made below the top line. As an example, Morinaga has been able to boost its gross profit margin from percentages in the high 40s to levels in the low 50s through a combination of price increases on its popular ice cream products and the cutting of unprofitable product lines. The company culled its total offerings from about 500 to fewer than 400 SKUs. Similarly, Honda boosted its gross profit margin by cutting procurement costs by 3% – a material improvement in the low-margin auto business. Honda accomplished this by shifting production to emerging markets and consolidating suppliers.

Companies have also worked diligently to improve ROE by cutting their operating expenses. Since the end of 2012, Japanese companies reduced selling, general, and administrative (SG&A) expenses as a percent of sales by about 140 basis points. Once again, the broad set of external policies working in unison have amplified efforts to improve operating efficiencies through cost-cutting and restructuring. Labor practices also have helped companies improve SG&A ratios.

Maxell presents a good example of these changes. Over the past couple of decades, the company diversified away from cassette tapes and floppy disks but did so to an unhealthy degree. More recently, consistent with policies such as “METI’s4 business transformation” guideline, Maxell restructured its corporate portfolio by: selling its drone lithium-ion battery, massage chair, and water businesses; discontinuing 15 other businesses; raising prices or discontinuing or restructuring 170 loss-making SKUs; and reducing labor costs (through early retirements and other means). Amada offers a similar story. The company reduced operating expenses from 35% in FY2010 to 25% in FY2022 by consolidating and selling factories and cutting labor costs. Amada has returned more than 100% of earnings to shareholders with the stated objective of inclusion in the “JPX 400 ROE index,” a goal of one of the policies implemented in 2014.

Other secular changes have boosted profit below the line. Low interest rates, thanks to the BOJ’s aggressive monetary policy, combined with deleveraging brought corporate interest expenses down significantly. At the same time, policies and geopolitics led Japanese companies to increase investments overseas. Today, Japan ranks as one of the largest overseas investors. For equity investors, this can be quite compelling as these investments can generate attractive below-the-line earnings from affiliates.

MUFG presents a good example of this type of opportunity. Pre-Abenomics, MUFG generated almost no income from equity method5 affiliates. Today, income from affiliates (such as MUFG’s 25% ownership stake in Morgan Stanley) represents approximately one-third of MUFG’s pre-tax profit. Similarly, Honda was generating almost nothing from affiliates pre-Abenomics. Now, one-third of its pre-tax profit comes from overseas affiliates in China and other markets.

Finally, tax policy has benefited net profit in Japan as well. Over the past decade, corporate tax rates have declined from 39.5% to 29.7% across a series of cuts. This is another secular change that is leading to durable improvements in Japan’s corporate profitability.

Hard Work Pays Off

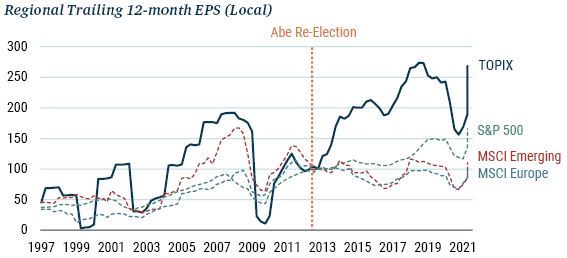

Secular operational and profit improvements have led to better fundamental outcomes for shareholders. While the U.S. has increased earnings per share (EPS) by 66% since late 2012, Japan has done even better. Surprisingly to many, Japanese EPS has grown more than 160% since Abe’s re-election in late 2012 (see Exhibit 4).

EXHIBIT 4: THESE MOVES HAVE PROPELLED EPS

As of 9/30/2021

Rebased to 100 from December 2012.

ROE Improvements Driven by “Hard Stuff,” Leaving “Easy Stuff” for Further Gains

Despite this improvement, there is further room to raise ROE in Japan. Recent ROE gains have come from profit margin expansion. Operational moves like raising prices, cutting costs, divesting non-core businesses, and making process improvements represent the “hard stuff.” While management teams have succeeded by focusing on income statement related ways to enhance ROEs, their efforts to optimize and manage balance sheets (the “easy stuff”) are headed in the wrong direction. While some may see this as bad news, we see it as an opportunity. As Exhibit 2 indicates, asset turnover has worsened while leverage (assets/equity) has declined, meaning companies have become more overcapitalized.

While aggressively levering the capital structure is not prudent, the issue with Japanese balance sheets is the build-up of cash. Robust profit growth caused latent cash balances to more than triple between 1998 and 2020. More than 50% of non-financial companies in the TOPIX index are net cash. Those overcapitalized balance sheets are a drag on ROE. In fairness, aggregate shareholder distributions have improved materially (payout ratios are up from a low of 30% to a high of 50%). Nonetheless, distributions have not kept pace with profit and free cash flow growth, leaving balance sheets more bloated. As company management and outside shareholder interest focuses more on managing balance sheets, we believe significant opportunity remains to improve outcomes for shareholders.

Investors like GMO Usonian continue to engage with management to encourage the distribution of excess capital. Shareholder activism is another secular trend supported by policy changes highlighted earlier, such as the Stewardship Code and proxy voting guidelines. Previously, shareholder activism was unheard of in Japan. Today, Japan is home to the second largest number of companies targeted by activist investors, with the number of annual activist events increasing. The acceptance of such activist efforts has grown materially and should continue to benefit minority shareholders.

Capturing the Opportunity through a High Active-Share Approach

From a top-down perspective, GMO finds Japanese equities, specifically Small Cap Value, quite attractive. Our 7-Year Asset Class Forecasts are helped by attractive valuations (both Value and Small have underperformed for years in Japan) and expectations for continued improvements in profitability. In an expensive world, Japanese Small Value rises to the top of attractive securities to own, and we do across our various GMO Asset Allocation strategies. The exciting thing is that on our data Japan is a market rich with alpha opportunities for active managers, like our Usonian team, to exploit.

Through bottom-up, fundamental research, we can build a portfolio that we believe is more attractive than the broad market. We are targeting 30 to 50 deeply researched Japanese companies that in our view are positioned to do well, generating attractive returns for their shareholders.

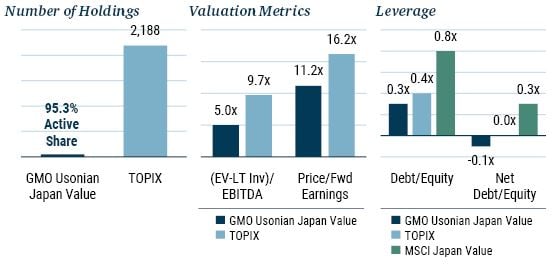

As Exhibit 5 shows, our portfolio is significantly cheaper than the market without leaning into the riskiest segment of the market. To the contrary, our companies have stronger balance sheets than the broad market (they are actually net cash). In addition, our companies’ balance sheets are particularly strong relative to the Value index. Herein lies one opportunity: we are investing in companies that have both the ability and inclination to increase the distribution of excess capital to shareholders and improve ROE along the way.

EXHIBIT 5: CHARACTERISTICS OF GMO USONIAN JAPAN VALUE EQUITY EXPOSURE

As of 9/30/2021 | Source: GMO

Valuation metrics use historical and forward 1-year weighted medians.

The above information is based on a representative account in the Strategy selected because it has the fewest restrictions and best represents the implementation of the Strategy.

Conclusion

We see recent profit improvements in Japanese companies as durable and secular in nature. This stands to benefit minority shareholders. So far, most of the gains have come from the hard stuff – profit improvements. We see increasing opportunity for improvements from the easy stuff – balance sheet management. Based on our observations and deep experience, we believe active investment combined with engaged stewardship is the optimal approach to investing in Japanese equities.

Download article here.