U.S. equities experienced a sharp sell-off in early April, hitting a low point on "Liberation Day" when higher-than-expected tariffs intensified recession and inflation concerns.

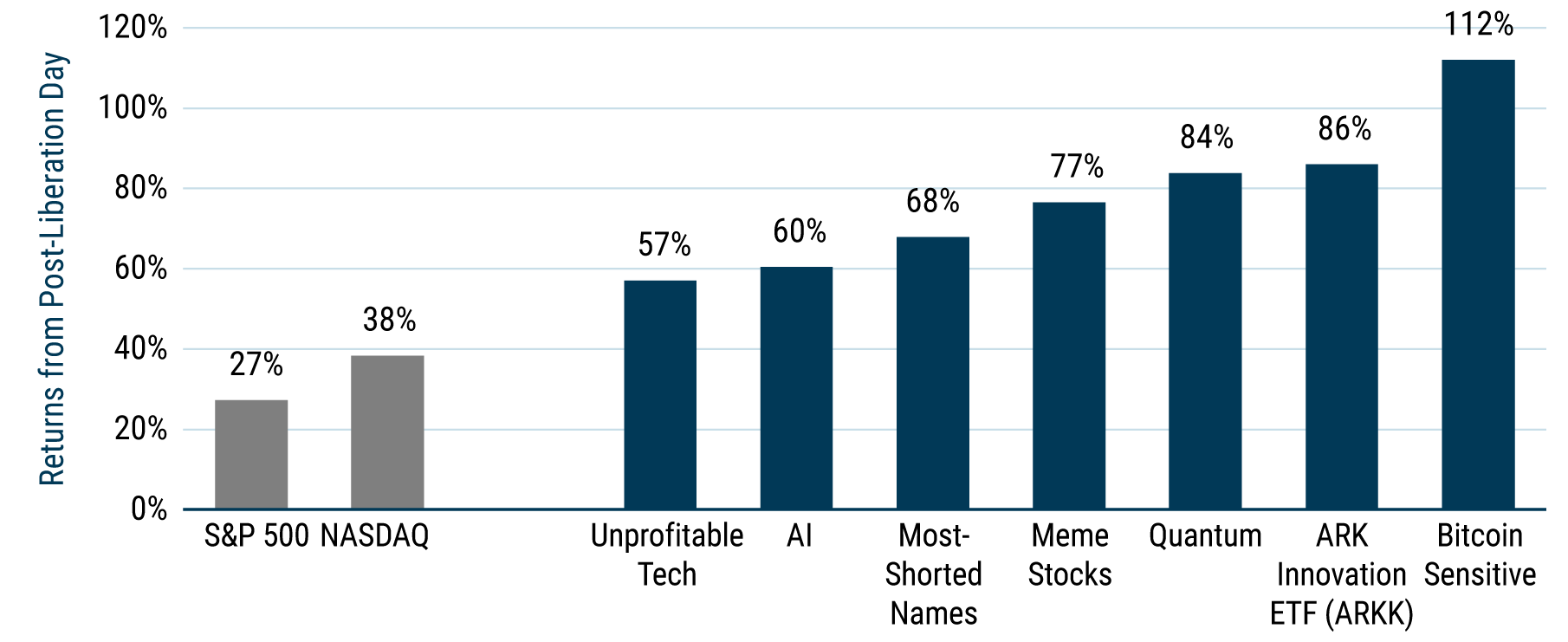

Since bottoming on April 8, sentiment shifted swiftly, and the market staged a remarkable rebound with the S&P 500 rallying an impressive 27% through July 31.

With retail investors aggressively buying the dip, the most speculative sectors didn't just climb the “wall of worry” – they catapulted over it. Unprofitable tech, meme stocks, and bitcoin-sensitive stocks surged approximately 55-115% in just fifteen weeks.

Animal spirits are roaring, and strong momentum has pushed both valuations and signs of speculation to risky levels.

U.S. EQUITIES TURNED SPECULATIVE IN 2Q 2025

High momentum and lower quality groups rallied most following the Liberation Day market lows

Returns for period from 4/8/25 – 7/31/25 | Source: Goldman Sachs 1

What can investors do to protect themselves from this market excess?

1. Exploit it.

GMO Equity Dislocation is designed to profit from extraordinarily wide valuation spreads by taking long positions in the cheapest value stocks and short positions in the most expensive growth stocks. The recent rally leaves a rich group of candidates for short positions. The Equity Dislocation Strategy can provide diversification for a portfolio with meaningful growth exposure, yet minimal net exposure to equities.

For investors who want to retain equity market beta, GMO Quality Spectrum is a long/short equity approach that seeks to compound capital through full market cycles by going long high-quality, fundamentally strong companies and shorting a diversified basket of unstable, overvalued “junk” stocks. With a net long exposure and a structure designed to mitigate drawdowns, the strategy aims to deliver superior risk-adjusted returns while maintaining equity market participation.

2. Be Dynamic.

GMO Benchmark-Free Allocation is a valuation-sensitive, dynamic allocation strategy. The portfolio aims to tilt away from areas of excess toward dislocated and cheap market segments. Today, unsurprisingly, Benchmark-Free Allocation's biggest exposure is a 20% allocation to Equity Dislocation. We also have significant holdings in U.S. and international deep value, Japanese and emerging markets equities, as well as other liquid alternative strategies.

The Unprofitable Tech basket is composed of equities in tech-related industries that did not report a profit in the last 12 months and are not expected to do so in the next 12 months. We attempt to exclude companies exposed to winning themes such as AI, Nuclear, Quantum Computing, and Cryptocurrency, as well as highly shorted companies. AI is the Goldman Sachs U.S. TMT AI Basket (GSTMTAIP), which consists of companies that are pursuing artificial intelligence or can help enable new technologies across software, semiconductors, tech hardware, media, internet, and IT services. The basket is liquidity optimized to trade $500mm in a day at 10% ADV. Most-Shorted Names is the Goldman Sachs Liquid Most Short Index (GSXUMSAL), composed of 70 stocks with the highest short interest relative to equity float, optimized for liquidity and capping Biotech at 10%. Meme Stocks is the Goldman Sachs high retail sentiment basket (GSXUMEME), which consists of U.S.-listed equities that are most popularly mentioned on retail communities. The basket is liquidity optimized but may include stocks with potential borrow constraints. Bitcoin Sensitive is the Goldman Sachs Bitcoin basket (GSCBBTC1), which consists of U.S.-listed TMT stocks that are fundamentally related to bitcoin across various segments (bitcoin mining, digital payment, crypto investment, and blockchain tech). The basket tends to track Bitcoin across cycles and is liquid to trade $100mm at 10% of volume. S&P does not guarantee the accuracy, adequacy, completeness or availability of any data or information and is not responsible for any errors or omissions from the use of such data or information. Reproduction of the data or information in any form is prohibited except with the prior written permission of S&P or its third-party licensors. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.

Disclaimer: The views expressed are the views of the Asset Allocation team through the period ending August 2025 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

The Unprofitable Tech basket is composed of equities in tech-related industries that did not report a profit in the last 12 months and are not expected to do so in the next 12 months. We attempt to exclude companies exposed to winning themes such as AI, Nuclear, Quantum Computing, and Cryptocurrency, as well as highly shorted companies. AI is the Goldman Sachs U.S. TMT AI Basket (GSTMTAIP), which consists of companies that are pursuing artificial intelligence or can help enable new technologies across software, semiconductors, tech hardware, media, internet, and IT services. The basket is liquidity optimized to trade $500mm in a day at 10% ADV. Most-Shorted Names is the Goldman Sachs Liquid Most Short Index (GSXUMSAL), composed of 70 stocks with the highest short interest relative to equity float, optimized for liquidity and capping Biotech at 10%. Meme Stocks is the Goldman Sachs high retail sentiment basket (GSXUMEME), which consists of U.S.-listed equities that are most popularly mentioned on retail communities. The basket is liquidity optimized but may include stocks with potential borrow constraints. Bitcoin Sensitive is the Goldman Sachs Bitcoin basket (GSCBBTC1), which consists of U.S.-listed TMT stocks that are fundamentally related to bitcoin across various segments (bitcoin mining, digital payment, crypto investment, and blockchain tech). The basket tends to track Bitcoin across cycles and is liquid to trade $100mm at 10% of volume. S&P does not guarantee the accuracy, adequacy, completeness or availability of any data or information and is not responsible for any errors or omissions from the use of such data or information. Reproduction of the data or information in any form is prohibited except with the prior written permission of S&P or its third-party licensors. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.