Over our decades of involvement in emerging country debt markets, we’ve witnessed many ups and downs. It’s easy to sink into feelings of doom and gloom in the down times, when we’re bombarded with negative headlines and have few places to hide. It is easy to succumb to that feeling of malaise today. Even with the global pandemic waning in intensity, things are not exactly returning to “normal.” Global inflation, a byproduct of trade wars and massive policy stimulus, is at multi-decade highs, necessitating a strong policy response from central banks. And Russia’s invasion of Ukraine has had devastating consequences for the countries directly involved, and significant second-order consequences for those countries that rely on imported food and energy. Doom and gloom commentary abounds, including from those whose job it is to promote stability. 1

What we have observed over many years is that emerging countries are remarkably resilient in the face of shocks. Combine that resiliency with a generalized desire to move up the economic development ladder and improve living standards, and this helps explain why historically sovereign defaults have been relatively rare. It is true that the past few years have seen a spike in sovereign defaults, 2 but we don’t accept the doom and gloom scenario that argues a huge swath of the emerging world is on the brink of a debt crisis.

In support of our thesis, we screened the universe of 70 countries included in the J.P. Morgan EMBI Global Diversified Index (the benchmark for our external debt strategies) through the lens of established debt sustainability arithmetic. 3 Without delving into the math, a country’s debt-to-GDP ratio in the future is a function of four things:

- the debt-to-GDP ratio today;

- the interest rate on the debt (a higher interest rate means higher future debt, all else equal);

- the growth rate of the economy (higher growth means a lower future debt ratio); and

- the budget balance (the bigger the deficit, the higher the future debt ratio).

Herein lies the concern: if interest rates are going higher, global growth is going lower, and existing debt-to-GDP ratios are higher than they were pre-Covid – doesn’t that portend financial disaster for emerging countries? We don’t believe so. Our analysis indicates that the vast majority of the sovereign debt universe has the fiscal space and flexibility to avoid crisis.

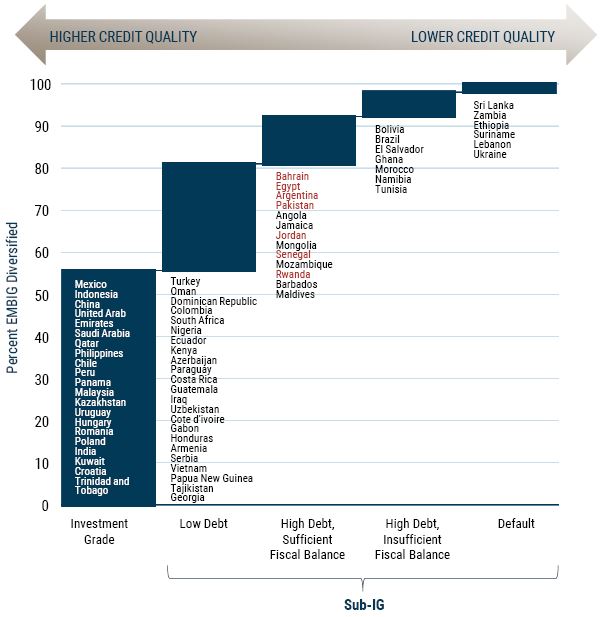

The accompanying exhibit summarizes our results. The cascading bars indicate the combined index weight of the countries listed in each category. The first thing to notice is that over 50% of the index is comprised of investment grade sovereigns that have some combination of sound debt dynamics and diversified funding sources to avoid crisis. These countries are listed in the first column. (Yes, some of them could be downgraded to double-B if we are in a prolonged period of low growth and rising rates, but default risk would remain very low.)

GMO’s Debt Sustainability Assessment of the Countries in the EMBI Global-D, by Market Weight

As of 6/30/2022 | Source: GMO, J.P. Morgan

Countries colored red switch from "High Debt, Sufficient Fiscal Balance" to "High Debt, Insufficient Fiscal Balance" under a stress scenario.

The remaining columns are sub-investment grade, and we divide these countries into four categories within the framework of the debt sustainability arithmetic. We identify the countries in the second column as having a current debt-to-GDP ratio that we believe is low enough to be able to withstand higher debt. This “Low Debt” group accounts for an additional 25% of the benchmark.

The third column is arguably the most interesting. These are countries that have high existing debt but are running fiscal balances that will lower their debt ratios over time under a base case interest rate and growth scenario. These are the countries that are vulnerable to an adverse scenario for rates and growth, but most of them are aware of this and many have IMF programs in place to anchor economic policy. The “High Debt, Sufficient Fiscal Balance” group’s combined weight is about 11%.

The fourth column contains countries that, in our view, have a high risk of debt distress: those with high existing debt and insufficient fiscal trajectories to stabilize it. Two of these countries—El Salvador and Tunisia—have bond prices that already factor in a significant debt restructuring “haircut,” though both are current on payments. Brazil stands out as a systemically important country in this category. We place it in this group because the numbers speak for themselves, but the fiscal problem lies in the domestic debt–not the external debt–so the risk of a sovereign debt crisis in Brazil remains low despite its placement in our exhibit. Brazil’s strong external liquidity buffers somewhat anchor their external debt payment capacity, and there are tools available (which Brazil has used in the past) to make sure the domestic debt gets rolled over and serviced. The combined weight of the “High Debt, Insufficient Fiscal Balance” group is less than 5%.

Finally, in the fifth column are countries that are either in default, in debt renegotiations with creditors, or highly likely to default in the coming year. The average bond price of these “Default” countries is just around $40, which we believe is indicative of the market’s fairly bearish recovery assumptions.

Conclusion

We cannot deny that the global backdrop is a challenging one for emerging countries, but we do not see evidence that the bulk of the asset class is headed for severe debt distress. Indeed, we see remarkable resilience among the countries in our investment universe. Most countries will go to great lengths to avoid default because doing so has such a lasting impact on funding costs and reputation—and access to markets is something to be valued if you are a finance minister of an emerging country. 4 Moreover, bond prices and yields in the asset class currently reflect worse default outcomes than we envision. 5

We expect to see most countries navigate the current environment through a combination of fiscal effort (to keep deficits under control), maximizing domestic capital markets (which many countries have successfully nurtured in recent years), and pivoting as much as possible to lower-cost external financing from multilateral lending sources and bilateral (government-to-government) loans. 6 International capital market financing, which has become more costly recently, is likely to be de-emphasized in the near term. But the bond market will be there when markets stabilize for the countries that can keep their houses in order.

If we are correct, we’d expect prospective returns in local and external debt portfolios to be attractive based on our valuation framework (covered in our latest Quarterly Valuation Update). Credit spreads in external debt and interest rate spreads in local debt look particularly attractive and are likely to be the strongest drivers of returns.

Download article here.

See, for example, IMF Managing Director Kristalina Georgieva Urges G20 Leadership to Address ‘Exceptionally Uncertain’ Global Outlook, and World Bank Group President David Malpass’s introductory remarks at a recent State of the Global Economy event organized by the Brookings Institution.

In addition to Venezuela, which has been in default since 2017 (in part due to sanctions imposed by the U.S. Treasury), Argentina, Belize, Ecuador, Lebanon, Suriname, Zambia, and most recently Sri Lanka have defaulted since Covid-19.

Essentially the first three countries to default after the onset of Covid-19 (Argentina, Belize, and Ecuador) had one thing in common—they had all previously defaulted on their debt in the recent past. Therefore, they had limited or no recourse to market financing to address the Covid shock.

For a further analysis of asset class valuations, see our latest Quarterly Valuation Update.

One such example is the recently launched Partnership for Global Infrastructure and Investment.

Disclaimer: The views expressed are the views of Carl Ross and Eamon Aghdasi through the period ending August 2022, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2022 by GMO LLC. All rights reserved.

See, for example, IMF Managing Director Kristalina Georgieva Urges G20 Leadership to Address ‘Exceptionally Uncertain’ Global Outlook, and World Bank Group President David Malpass’s introductory remarks at a recent State of the Global Economy event organized by the Brookings Institution.

In addition to Venezuela, which has been in default since 2017 (in part due to sanctions imposed by the U.S. Treasury), Argentina, Belize, Ecuador, Lebanon, Suriname, Zambia, and most recently Sri Lanka have defaulted since Covid-19.

For technical details, see: Fiscal and Debt Sustainability; Fiscal Analysis and Forecasting Workshop, Bangkok, Thailand, June 16 – 27, 2014, IMF TAOLAM Office

Essentially the first three countries to default after the onset of Covid-19 (Argentina, Belize, and Ecuador) had one thing in common—they had all previously defaulted on their debt in the recent past. Therefore, they had limited or no recourse to market financing to address the Covid shock.

For a further analysis of asset class valuations, see our latest Quarterly Valuation Update.

One such example is the recently launched Partnership for Global Infrastructure and Investment.