Key Takeaways

- India has seen foreigners leaving the market for most of 2025.

- For this and other reasons, India has become one of the bigger shorts in our Systematic Global Macro Strategy’s equity portfolio.

- However, in recent weeks there has been a positive turn in foreign flows.

- We will begin by looking at why foreign flows are important, then discuss why we believe the recent turn in flows may not be a sign for optimism.

Foreign Flows from India

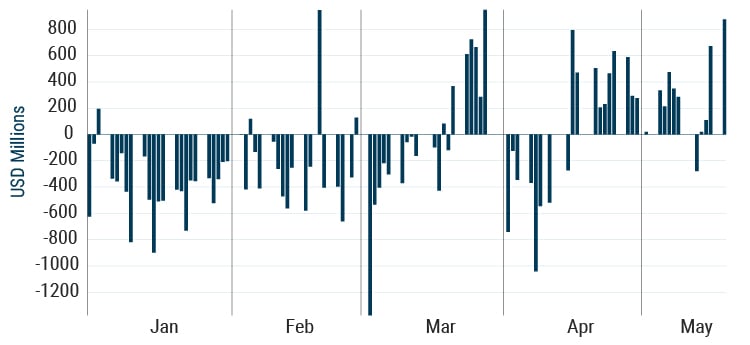

For some time now, foreigners have been pulling money out of the Indian equity market. In Exhibit 1, we can see that daily foreign flows have been generally negative in 2025 as fears of low growth, geopolitical tensions, and high valuations have all driven foreign investors away.

However, we can also see a short-term reversal in foreign flows around 20 March, followed by a more persistent turn in April. So, what caused the change in sentiment?

Exhibit 1: Net Foreign Portfolio Investments (Daily)

As of 5/31/2025 | Source: Bloomberg

The Drivers of Foreign Flows

Many academic studies have reviewed the drivers of international flows into emerging markets. Such flows are often viewed in a push or pull framework – that is, driven by either attractive local opportunities that “pull” money into emerging markets or lacklustre opportunities in developed countries that “push” money into emerging markets (Fernandez-Arias 1996). There are also a variety of indicators that can help predict foreign flows.

For example, studies have shown that risk levels are generally a major driver of flows, with higher risk levels leading to foreign outflows as investor risk appetite decreases (Neir 2015). On the fundamental side, cheaper valuations abroad, higher growth, and a strengthening U.S. dollar can all lead to emerging market inflows, whereas issues such as higher inflation and geopolitical uncertainty in emerging countries can lead to outflows.

A Change in Sentiment

When foreign flows changed in 2025, there were economic and risk issues present that no doubt would have helped drive a reversal in foreign flows on both the push and pull sides. The most obvious was the Trump administration’s mid-April delaying of tariffs, which came with an accompanying decrease in market risk.

The VIX Index reached a high of 52 in April – at the height of the uncertainty – and subsequently retreated with the calming of geopolitical tensions. In conjunction with lower risk levels, we had some positive economic news: February and March CPI numbers came in ahead of expectations. Perhaps going against this were ongoing concerns about future corporate profitability.

It’s clear that these factors contributed to the change in foreign positioning; the bigger question is whether the shift is sustainable and if it indicates a change in sentiment. But let’s first address what flows can tell us, and why they are worth monitoring to begin with.

Why Do Flows Matter?

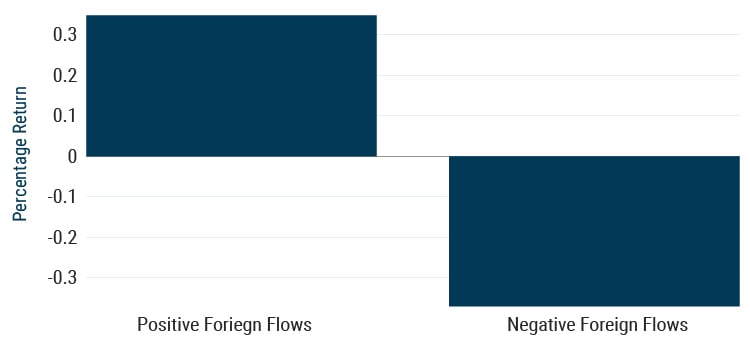

One of the most important reasons to monitor foreign flows is their ability to move the market . For example, there is a notable difference between returns on the days when foreign flows are positive vs. the days when foreign flows are negative. 1 This, in turn, could potentially be used as an indicator for future market directions.

Exhibit 2: Average Returns by Foreign Flows

As of 5/31/2025 | Source: Bloomberg, GMO

So Why Aren’t We More Excited About India?

One might think that the return of foreigners to the Indian equity market would be a positive signal for India, if the trend is sustainable. But has the current market environment historically been attractive to foreigners, or does the current turn seem more of an anomaly?

Delving a bit deeper, let’s look at foreign flows to India in conjunction with local market conditions. To do this, we split the history of the Nifty 50 Index into four segments based on our two main investment concepts – Value and Sentiment – as shown below.

| Value |

Forward P/E > Median → Indian equities are expensive Forward P/E < Median → Indian equities are cheap |

| Sentiment |

12-Month Momentum > Median → Momentum is strong 12-Month Momentum < Median → Momentum is weak |

Each daily foreign flow is assigned to a market segment according to market conditions, and flows within each segment are summed. 2 This allows us to see which local market environments are more likely to attract (deter) foreign investors.

Exhibit 3: Foreign Flows by Market Conditions

Strong Momentum |

Weak Momentum |

|

| Expensive | 24.1% | 6.9% |

| Cheap | 51.4% | 17.4% |

As of 5/31/2025 | Source: GMO

As Exhibit 3 shows, the level of foreign investment does indeed change significantly based on the concepts of value and sentiment. As one might expect, a cheap market and strong momentum typically “pull” flows in. But neither of these scenarios reflect what we see in India today.

Rather, Indian equities are expensive and lacking momentum. Today’s flows appear to be an exception to the local environment, most likely driven by short-term relief of risk and tariff speculation. Were market risk to rise again in response to, say, renewed trade tensions or other geopolitical issues, flows would likely turn negative yet again.

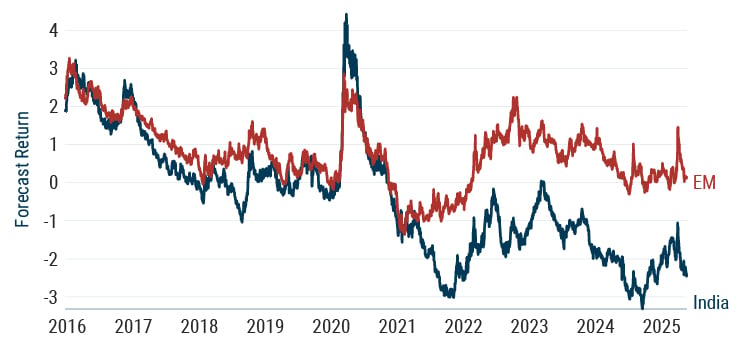

SGM Valuation and India

Based on the long-term valuation models for the SGM portfolios, India has become significantly more expensive than emerging markets in general – indeed, high valuation multiples and stretched margins lead us to forecast that India will generally underperform emerging markets in the longer term (Exhibit 4).

India also does not rate well on our shorter-term sentiment models: though flows are positive, the model is weighed down by concerns about corporate profits. Overall, we don’t see India scoring well on either valuation or sentiment.

Exhibit 4: SGM Long-Term Value Forecast

As of 5/31/2025 | Source: GMO

The chart represents a forecast for the above-named country and not for any GMO fund or strategy. The forecasts above are forward‐looking statements based upon the reasonable beliefs of GMO and are not a guarantee of future performance. Forward‐looking statements speak only as of the date they are made, and GMO assumes no duty to and does not undertake to update forward looking statements. Forward‐looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results may differ materially from the forecasts above.

Conclusion

Investors should be aware that flows have (at least temporarily) returned to India. But this current wave of foreign buying seems to go against the historical value and sentiment trends, which makes their sustainability questionable – especially if we start to see signs of renewed risk.

More importantly, with SGM’s value and sentiment models signalling such poor local market conditions, we’ve positioned our portfolios against the flow. So, while we acknowledge that foreigners have reversed course on India for now, we’ll need to see substantial improvement in valuations and local sentiment before making Indian equities a “buy” in SGM portfolios.

References

Bekaert, Geert, Campbell R. Harvey, and Robin L. Lumsdaine. 2002. “The Dynamics of Emerging Market Equity Flows.” Journal of International Money and Finance 21(3): 295-350.

Fernandez-Arias, Eduardo. 1996. “The New Wave of Private Capital Inflows: Push or Pull?” Journal of Developmental Economics 48(2): 389-418.

Ahmed Hannan, Swarnali. 2018. “Revisiting the Determinants of Capital Flows to Emerging Markets – A Survey of the Evolving Literature,” September. IMF Working Paper No.18/214.

Koepke, Robin. 2015. “What Drives Capital Flows to Emerging Markets? A Survey of the Empirical Literature,” April 23.

Nier, Erlend W. 2015. “What drives capital flows to emerging markets?” World Economic Forum, January 5.

This observation should be taken with caution as both the flows and returns are on average positive.

Foreign flows are adjusted and expressed as a percentage of market cap size to make historical observations comparable to more recent ones.

Disclaimer: The views expressed are the views of Martin Emery through the period ending June 2025 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

This observation should be taken with caution as both the flows and returns are on average positive.

Foreign flows are adjusted and expressed as a percentage of market cap size to make historical observations comparable to more recent ones.