Presenters |

|

Joe Auth |

|

Ben Nabet |

|

Jason Lowry |

Overview

The COVID-19 pandemic and its aftereffects have made a significant impact on the commercial and residential real estate world. In this roundtable, we share our outlook for U.S. real estate in a world with and without COVID-19, the rapidly changing and accelerating trends in the asset class, the potential impacts of inflation, and how GMO seeks unique structural attributes when evaluating the risk/reward tradeoff in the real estate debt market.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- The overall state of the U.S. real estate market is strong. Recovering markets, plentiful capital, and tailwinds from the currently favorable supply/demand relationship have powered performance in the asset class. New real estate sectors (Single Family Rentals, for instance) have become institutionalized given these dynamics.

- Residential real estate markets entered COVID-19 in a good place and remain very strong. Societal changes, such as working from home, are likely to remain in some capacity post COVID-19 and are a long-term tailwind for residential housing. Supply chain issues and lower inventory also provide a constructive outlook over the short and medium term.

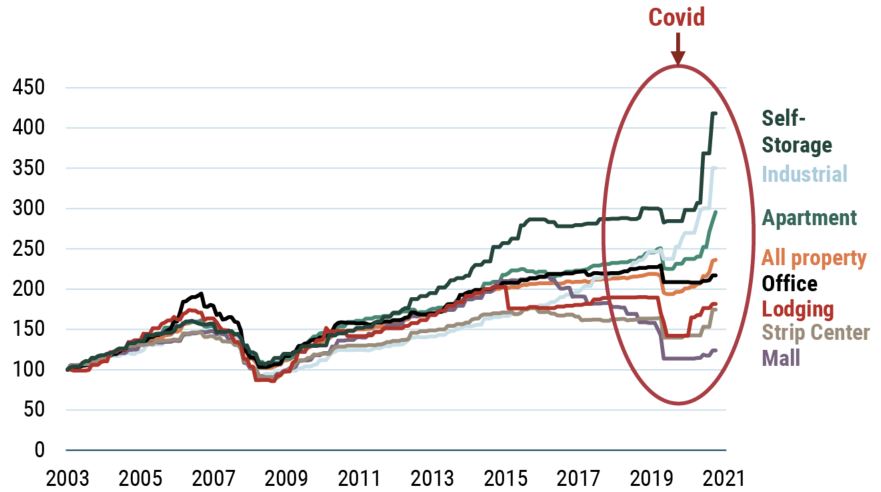

- Commercial real estate has had a bumpier ride. The impact from COVID-19 has led to a significant divergence in performance across underlying commercial property types. The historical relationship between macroeconomic factors and commercial real estate performance has been overridden by changes in the way we use different property types. As a result, historical correlations across property types have broken down.

Recent Price Dispersion Across Commercial Property Types

Commercial Property Price Index

Source: Green Street Advisers

We consider two different scenarios when evaluating winners and losers in this space: one where COVID-19 continues to impact the world and one where COVID-19 is no longer a significant factor. In some cases, pre-COVID trends have shifted demonstrably, while in others, COVID-19 has accelerated these trends. In both scenarios, we believe ESG will be a critical component of real estate investing moving forward.

Real estate has historically been a great inflation hedge during periods when CPI has risen. While we still believe real estate is more attractive than most asset classes during inflationary periods, increasing leverage, potential rate hikes, and less friendly capitalization rate math are all factors we are monitoring as real estate debt investors in an inflationary environment.

When navigating the accelerating trends and divergence across real estate sectors, we look for opportunities as credit investors where winners will offset losers. Two examples of how we achieve this at GMO are through cross collateralization of underlying holdings and by seeking bonds with favorable structural leverage characteristics.

Related Strategies

Please click on the links below to access strategies related to this event.