Presenters |

|

Catherine LeGraw |

|

John Pease |

|

|

Overview

The GMO asset class forecasts are grounded in valuation, and therefore equilibrium expectations are critical. We have long recognized the possibility of a permanent shift in interest rates. Consequently, for the past seven years, we have created two sets of forecasts: one assuming assets revert to an equilibrium aligned with historic norms, and the other assuming that equilibrium interest rates and the cost of equity capital have shifted permanently lower. In this session, we revisit the plausible regimes for equilibrium interest rates, we introduce a new scenario that we are considering, and we examine the implications for our forecasts and ultimately for our investment decisions.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

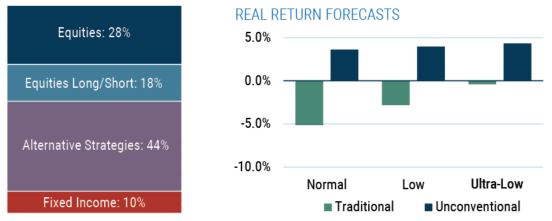

- There are three plausible interest rate regimes: normal, low, and ultra-low with equilibrium real cash rates of 1.25%, 0.00%, and -1.00%, respectively.

- Secular forces such as longer life expectancy post-retirement, higher inequality, lower population growth, and higher corporate monopoly power have been pushing rates to ultra-low levels and may cause them to remain there.

- Current conditions like labor shortages, changing inflation policy, increasing dependency ratios, and the transition to clean energy may move rates back closer to historic norms.

- We build asset class forecasts under each plausible regime and seek to design robust portfolios across all relevant states for interest rates.

- Relative views (e.g., preferring value to growth equity styles) are indifferent to the interest rate regime and thus remain steady across all plausible scenarios.

- A traditional 60/40 stock-bond portfolio has a negative forecasted real return across plausible interest rate regimes.

- An unconventional portfolio that emphasizes relative value positions is robust with roughly 4% forecasted real return across all three plausible regimes.

Seek Robust Portfolios

As of 10/22/2021 | Source: GMO

The above information is based on a representative account in the Strategy selected because it has the fewest restrictions and best represents the implementation of the Strategy. Weightings are as of the date indicated and are subject to change. The groups indicated above represent exposures determined pursuant to proprietary methodologies and are subject to change over time. Totals may vary due to rounding.

Related Strategies

Please click on the links below to access strategies related to this event.

- GMO Benchmark-Free Allocation Strategy

- GMO Global Asset Allocation Strategy

- GMO Equity Dislocation Strategy