Presenters |

|

Drew Edwards |

|

Rick Friedman |

Overview

Despite lackluster returns over the last few years, Japanese equities have garnered more attention recently. Investors are attracted to rising profitability, attractive valuations, and a more shareholder-friendly environment. Global institutional investors, however, remain underweight Japan on concerns that recent profit improvements are simply a cyclical “head fake.” Indeed, Japan’s response to Covid-19, handling of the Olympics, and lag in reopening have reinforced the view that Japan is a low-return-on-capital market. But we believe this market, now showing signs of shareholder-friendly change following a decade of surprisingly strong fundamentals, is worth a closer look.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- Japan’s profit improvement represents a durable, secular transformation. While Japan is and will remain a cyclical economy geared toward what happens beyond its borders, profitability improvements have been driven by a confluence of secular forces and management efforts that should continue to reap rewards for long-term investors. The combination of a swath of government policies aimed at improving Japanese competitiveness and profitability, accommodating monetary policy, shareholder-friendly listing requirements instituted by the Tokyo Stock Exchange, and a more active stance by asset owners underlies this thesis.

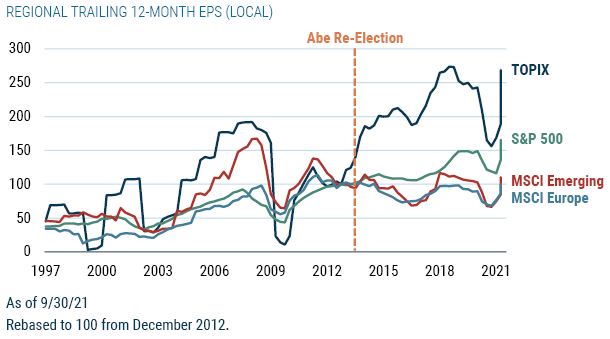

These moves have propelled EPS…

Japanese EPS growth has exceeded EPS growth in the U.S.

- Ample opportunity to enhance shareholder returns exists. Ironically, Japanese management teams have focused on the “hard stuff” to enhance return on equity. They have improved return on sales by raising prices, improving procurement, and cutting operating expenses. Company balance sheets, however, remain over-capitalized with excess cash and unproductive assets. Management teams can more easily increase ROE by optimizing their balance sheets.

- An active and engaged approach is best suited for the Japanese equity market. Despite being the world’s second largest equity market by market capitalization, the Japanese equity market is relatively inefficient due to limited analyst coverage (especially for small and mid-sized companies), as well as language and cultural barriers. Further, the combination of over-capitalized balance sheets and increasing support for outside voices means investors can add value and affect outcomes through constructive engagement.

- A comprehensive suite of policy initiatives in Japan is driving durable, secular transformations behind profit improvements. From an investment perspective, we believe there is plenty of room for additional (and easily attainable) ROE improvements, especially in small cap value Japanese equities, which currently represent GMO’s strongest asset class forecast.

Related Strategies

Please click on the links below to access strategies related to this event.