The fixed income landscape is very different from what it was a year ago.

Fixed income has historically played a defensive role in multi-asset portfolios, but the sell-off this year is creating some interesting opportunities, particularly in the credit sector. While duration and rates may be areas for some concern, we maintain that now is a time for investors to use the bond market to their advantage – by hedging interest rate and inflation risk with floating rate exposure and harvesting coupons across high yield and distressed credit markets.

Explore our content below and Contact Us or your GMO representative for more information. Intended for accredited investors

Featured Session:

Solutions-based Strategies for a New Fixed Income Landscape

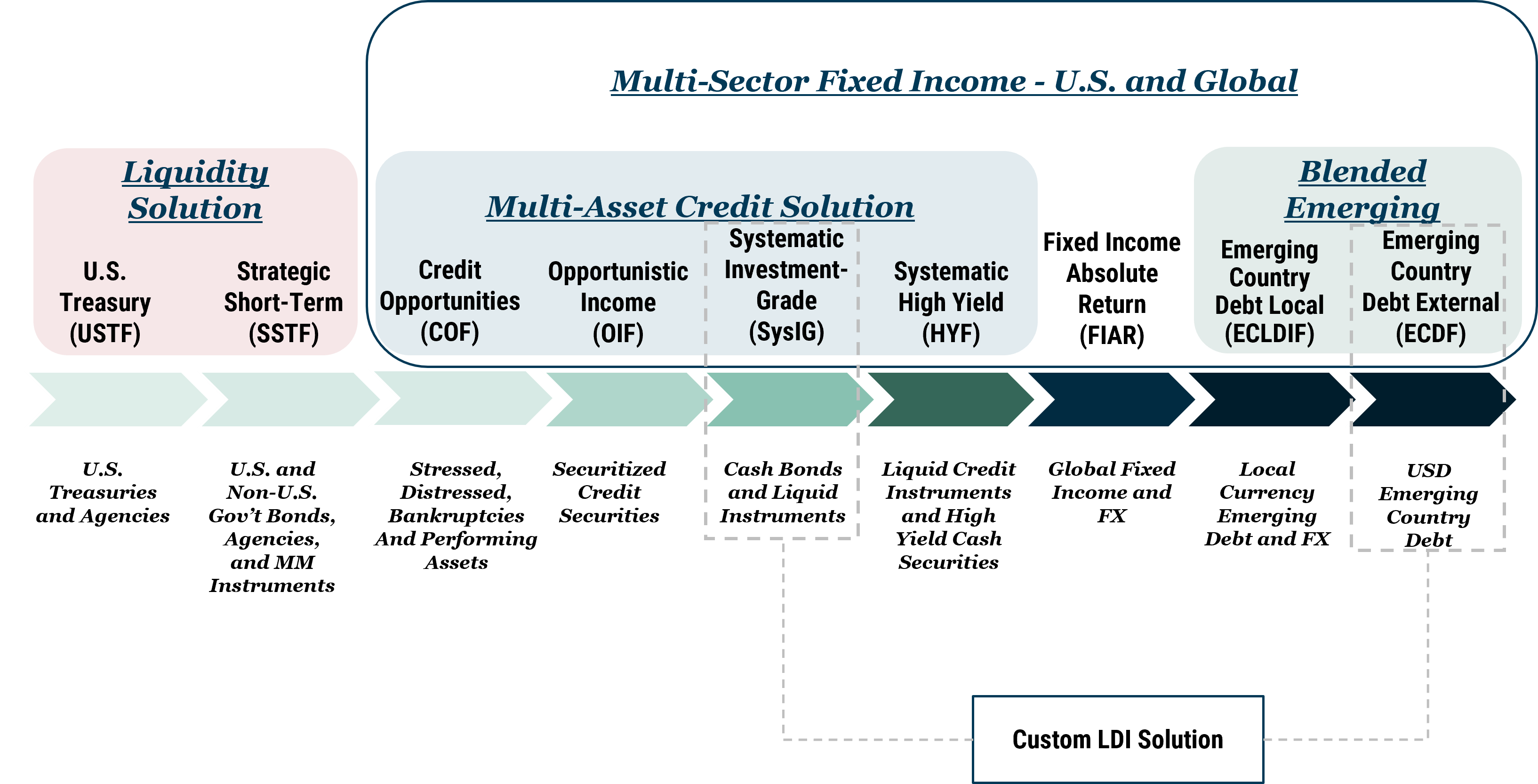

Senior Portfolio Managers Joe Auth, Jason Hotra, Riti Samanta, and Tina Vandersteel offered their various perspectives from across the fixed income spectrum in a discussion about the new fixed income landscape. By combining alpha-based strategies in personalized ways, we can solve investors’ evolving needs for yield, inflation protection, duration, and diversified alpha.

Read more about GMO’s Multi-Sector Fixed Income Solutions.

Making Sense of the Student Debt Drama

The higher education financing system faces serious headwinds. As the second largest category of consumer debt, student loans are an important fixture of the ABS capital markets. In this session, Dmitry Kiselyov discussed the ABS investment implications of the higher education affordability crisis and President Biden’s student debt relief plan.

High Yield Strategy: A Factor-based Approach to Alpha

Brooke Lieberwirth and Rachna Ramachandran, analysts on our High Yield team, discussed the high yield opportunity set and presented our top-down, factor-based approach in GMO’s High Yield Strategy. By taking advantage of structural market inefficiencies in a systematic fashion, our unique process allows for consistent alpha generation over a cycle.