Executive Summary

April 3rd marked the 1-year anniversary of the first investments deployed by GMO’s Quality Cyclicals Strategy,1 within a fortnight of the trough that ended 2020’s quickfire bear market. Those initial portfolios provided very handsome returns to investors over the year. This piece reports on the thinking behind the strategy’s investments in quality cyclicals, its progress over the year, and how the portfolio is positioned.

“From time to time all civilised countries are now exposed to a complete upset of their industrial, commercial, and financial machinery, at the very moment when the great majority…imagine that trade is at its best and that no danger threatens them.”

“Earthquakes, droughts, tidal waves, hurricanes, swarms of locusts, epidemics, have all brought about serious disturbances in trade at different times; and some of the disturbances…have had more than local or temporary effects.“

From H.M. Hyndman’s Commercial Crises of the 19th Century, published in 1902.

What is a quality cyclical business? Our team has managed portfolios of quality businesses since 2004 and we believe that a company’s quality is a reflection of its competitive advantages, the long-term relevance of its business model, and management’s ability to allocate capital well. Whether the company operates in a cyclical environment is a secondary consideration. If it does, it’s a quality cyclical!

Cyclical industries have a bad reputation, and one doesn’t need to plow through Hyndman to understand why. Cycles are hard to manage. Financial history is littered with companies that made excessive investments at the top of the cycle. Industry segments become more cyclical in their last and least exciting phase: railways, consumer electronics, and autos were growth opportunities once. Many cyclical industries e.g., textiles or steel, are largely commoditized and have a tendency to migrate to low labor cost countries, making capital stock obsolete. The majority of the corporate leverage sits with cyclical financials. Put this way, it is not surprising this group has disappointed over the years.

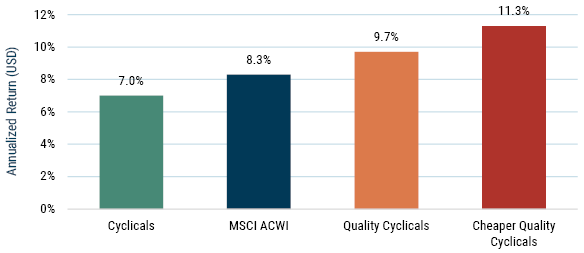

There is a silver lining for quality investors, however. We believe that quality cyclical businesses are inefficiently priced because investors struggle to – or are disinclined to – distinguish between the cyclical and secular elements to their growth and profitability. Cyclical businesses don’t receive the benefit of the doubt. As a result, higher quality cyclicals are structurally underpriced and have delivered market-beating returns in recent decades (see Exhibit 1).

EXHIBIT 1: QUALITY CYCLICALS ARE UNDERAPPRECIATED

As of 3/31/2021

Cyclicals defined as Industrials, Consumer Discretionary, Financials, Real Estate, Energy, and Materials GICS sectors. Quality Cyclicals are defined in this chart using GMO’s quantitative quality metric. Cheap Quality Cyclicals are further defined using GMO’s composite valuation metric. Returns since end of December 1994.

In our strategy, we take a constructive stance and give quality cyclical businesses the benefit of the doubt. Economies grow over time. The future is never clear but quality cyclicals will accrete intrinsic value by taking market share or innovating. Our approach is to spend as much of our time as possible seeking out quality cyclical businesses trading on attractive valuations and little to no time trying to forecast the next downturn or contraction. Downturns will happen and the key is to enter them with a diversified portfolio of strong businesses exposed to different parts of the economy.

Counterintuitively perhaps, downturns, contractions and dislocations are the friend of the long-term investor in quality cyclicals. Logically, quality cyclical businesses are less likely to suffer serious impairment, even when the going gets tough. It’s a different story for their weaker competitors. As a result, the leading cyclical businesses are likely to be able to take share during the period of stress and emerge with a stronger market position. However, because cycles are impossible to analyse with precision, periods of uncertainty can create an opportunity to purchase quality cyclicals at unusually attractive prices, with the quality element bringing reassurance that the companies can hold out for longer than their peers. This is the time for the portfolio to become more concentrated in the areas where alarm bells have been ringing. In short, the investor in quality cyclicals can exploit periods of weakness without having to worry unduly about the specific timing of the healing process.

Last year’s episode was the latest in the long and interesting history of contraction and dislocation. We started with Hyndman’s list from the Victorian world, but in the first two decades of this century alone, we have already seen downward lurches in cyclical businesses relating to financial crisis, sovereign debt, terrorism, resource overinvestment, nuclear accident, and so on. This time the Covid-19 pandemic was to blame and the opportunity to invest in quality cyclical businesses at attractive prices spurred us into action.

In April 2020, we put together a portfolio of leading cyclicals across various risk groupings that had been sold off hard in the bear market. These groupings spanned areas that had taken a direct hit from the closing of the global economy – specifically consumer, financial, travel, and energy – and also those that had taken collateral damage, for example in technology hardware and non-energy resources.

The approach worked out well for our clients. The initial allocations returned 85%2 in the first year as the dust began to settle on the pandemic. This compared favorably with the MSCI ACWI benchmark return of 61% and is all the more striking given the market’s distinct preference for tech stocks over this period. (For the period 4/30/2020, the inception date of the composite, through 3/31/2021 net performance was 55.8% compared with the MSCI ACWI benchmark return of 39.6%.)

Within the portfolio, we increased exposure to the “direct hit” stocks in stages last year, funded by selling some early investments in companies that fared well in the lockdown, e.g., DIY businesses. Today the majority of the portfolio is allocated to consumer, financials, travel, and energy, i.e., positions that we believe should benefit from the continued reopening of economies.

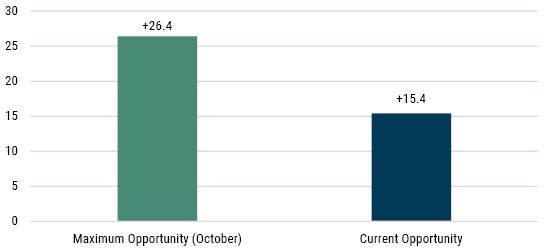

Although these areas have performed well since the first vaccine results in November, we believe that there is plenty more to play for. Exhibit 2 shows our preferred measure of relative potential for the portfolio based on unwinding the Covid era return for the portfolio and its benchmark. At the relative lows in October the return potential was a whopping 26%; returns since then have been strong and the current calculation suggests a catch-up potential of 15% remains. Diverse companies such as Beiersdorf, a newly-minted cyclical due to its exposure to the sun care business amongst other things, and Las Vegas Sands, the now Asia-focused leisure business, still trade well below their pre-Covid levels.

Exhibit 2: Relative Return Potential

As of 3/31/2021 | Source: GMO

Relative return potential is calculated by comparing the impact of reversing returns since 2/14/20 on the holdings of the Cyclical Focus Strategy and the MSCI AC World benchmark daily since the inception of the Cyclical Focus Strategy. The above information is based on a representative account selected because it has the least number of restrictions and best represents the implementation of the Strategy.

A small portion of the portfolio comprises quality companies that were picked up at good prices last year but whose performance we no longer expect to be dominated by the pandemic. Instead, we believe it is their own ability to innovate and take share that will drive returns. Examples here include Neste, the leading player in renewable diesel, and Borgwarner, one of the auto component manufacturers best positioned for the transition to electric vehicles. As the pandemic retreats into the history books, we would expect the portfolio to become more diversified across an array of different cycles, emphasising the leading businesses in each.

To reiterate, investors either struggle to – or are disinclined to – distinguish between the cyclical and secular elements of the fundamentals of quality cyclical businesses. As long as that remains true, we would expect quality cyclicals to be a great pond for investors to fish. For now, we believe that the opportunity in well-managed businesses that will benefit from reopening post-pandemic remains a particularly attractive one.

Download article here.